When you start your investing journey, you can’t know everything. In fact, chances are you’re starting with only a little bit of knowledge. And that’s totally fine - it’s the same for most of us.

Luckily, you’re not alone. One secret weapon in your arsenal is the ability to learn from others' mistakes. And that’s exactly what this article is about. I’ve pieced together some great lessons from the Pearler community, which was shared right here on the Pearler Exchange.

The power in learning as you go

Getting your financial snowball started and learning as you go is the most practical and sensible thing to do. Otherwise, you end up in a state of analysis paralysis, where you never feel smart enough to take action, and the fear of making a mistake stops you from even starting!

As you can imagine, that makes your goal of financial independence damn near impossible to achieve. But when you accept that mistakes are inevitable, and decide to take action anyway, that’s when things take off. It liberates you to begin right now and keep moving forward, instead of putting it off for another 12 months. Imperfect action will always beat perfect procrastination.

With that said, avoiding mistakes can also speed up your progress. So, let’s walk through some of the wisdom from the Pearler community on what they wish they had known sooner and done differently.

Not investing sooner

One thing many investors will happily admit to is that they wish they began investing sooner. That’s certainly true for Nadya and Carmen…

In both of these cases, they had experienced the famous analysis paralysis that I just mentioned. If I had to guess, I’d say about 90% of us go through this at some point!

Both can reflect now with the benefit of hindsight and see that they were probably overthinking it in the beginning. And it’s not their fault - investing is just one of those fields (perhaps like health and fitness) where there is just so much information, countless different approaches, and no one-size-fits-all for everyone.

Now, you still shouldn’t dive in before you’re ready. Definitely spend some time researching what kind of strategy and investments are right for you. But the lesson here is that the sooner you start investing, the sooner you become an investor. It then forms part of your identity, and becomes a priority in your life, which is powerful in itself.

The earlier you begin investing, the sooner you start earning passive dividends income and get your money compounding for the long term. The problem with waiting for the right time to invest? It never feels like the right time. The problem with waiting until you’ve got enough knowledge? It never feels like you’ve got enough knowledge.

Taking stock tips when you're just starting out

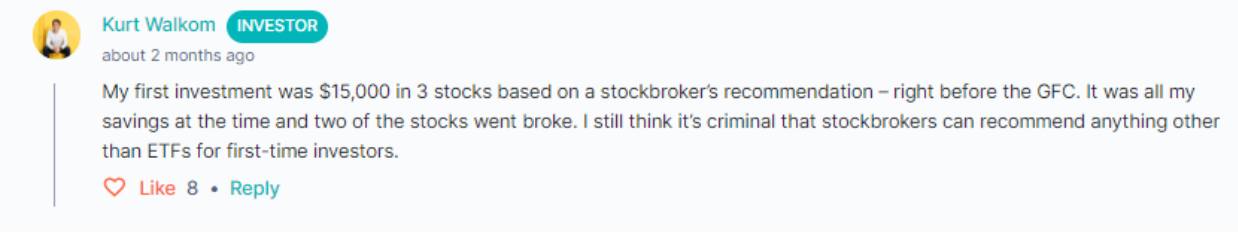

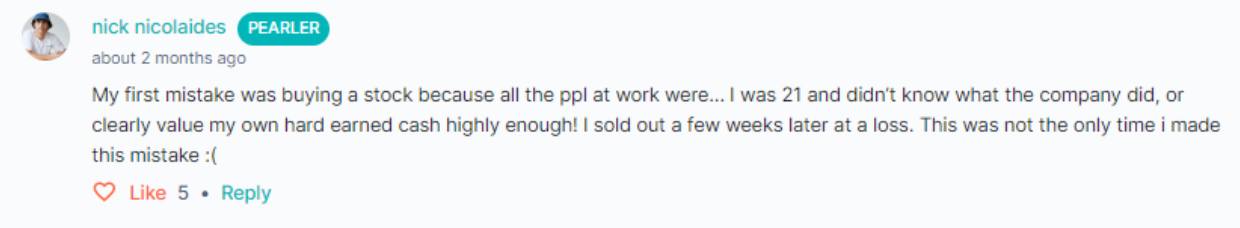

Many times, new investors will enter the world of shares and go straight into individual stocks rather than diversified investing. Here’s Kurt and Nick sharing their experience…

Sometimes new investors go for individual stocks because they simply aren’t aware of things like index funds. Other times, they’re following random tips of stories heard from friends or colleagues.

On some occasions, they actually do know about diversified options but want to try their hand at stock picking anyway. This normally happens because they’re excited by the idea of ultra-high returns. “Why aim for 7% in a year, when you could get lucky and get that return in a single week?” Or so the thinking goes. In the past, we've covered the challenges of trading stocks, and why long term investing is typically the smarter play.

Regardless of whether you want to own individual stocks in your portfolio, historically speaking, most beginner investors have been better off investing in diversified funds like ETFs. While it might be hard to resist the hype around a stock you keep hearing about, understand something. When a stock has attracted a lot of hype, and its share price keeps surging each week, it’s more likely to be overpriced, and therefore more likely to fall.

Timing the market, watching prices, and not investing regularly

We’ll lump these lessons in together because they’re all related, and very common…

Perhaps the most alluring of the investing traps for beginners is that of trying to time the market. For some reason, we think/hope/trust/pray there is a way to predict what the market will do next. We learn the hard way, though, that this isn’t a very clever idea!

In general, the smarter we think we’re being, the worse our decisions usually are. That’s because choosing to time the market or follow an elaborate (AKA not boring) strategy makes us feel sophisticated. But as many long-time investors will tell you, the fundamentals of good investing don’t change. Genuinely smart investing feels boring and slow.

Committing to a regular investing plan gives you much greater peace of mind. It’s strange that committing to something can give you relief and freedom, but it really does. You no longer have to watch prices, or twist your mind into a pretzel to guess the market’s future behaviour. It doesn’t even matter, because you’ll be investing anyway!

And then your view of the sharemarket changes from what most people view it as - a casino - into the long term wealth generating machine that it is.

Spending too much time on investments

Even if you beat analysis paralysis, and aren’t seduced by timing the market, you’re not out of the woods!

The next trap is spending all your time looking for outperforming investments. Sometimes, you may simply simply overcomplicate things because you think, somehow, it will lead to a better outcome. But Nam, and myself, would caution you against that…

The share market is a pretty strange place. By that, I mean it’s one of the only areas in life where we can put in less effort and expect a better result. Pretty odd, right?

There’s something about this fact which just doesn’t sound right to the logical part of our brain. Almost everything you can think of works the opposite way: put in more time, more effort, more research…and you’re rewarded with a better outcome.

But in the markets, it doesn’t work this way. We’re all fighting over the same returns. The market (and all the businesses which represent the market) are going to earn what they’re going to earn. And thanks to the hyper-competitive nature of professional investing, the opportunities for excess returns get competed away pretty quickly. This can leave us everyday investors with a microscopic chance of doing any better.

The result? We should keep ourselves pretty humble, have a diversified portfolio, and follow a simple approach. That way, we can spend time on things which will give us a greater payoff.

Final thoughts

To be honest, we’re probably just scratching the surface on the ways we can veer off course as investors. But these are some of the major traps we can fall into when we’re new to the world of investing.

Like I said, making mistakes is part of the game. So if you find yourself wishing you’d done things differently, don’t beat yourself up over it. This is actually a good sign. It means you’ve learned and have become a better investor.

Armed with that knowledge, you can teach friends and family what to look out for and be mindful of. And once they’re sick of you nerding out about investing, you can always hang out on the Pearler Exchange and help the newbies coming through… because you remember what it was like to have a million questions with no-one to ask.

Until next time, happy investing!

Dave