Dollar-cost averaging is the strategy of spreading out your investment purchases, buying at regular intervals and in roughly equal amounts. When done properly, it can have significant benefits for your portfolio.

This is because dollar-cost averaging “smooths” your purchase price over time and helps ensure that you’re not dumping all your money in at a high point for prices.

Dollar-cost averaging can be especially powerful in a bear market, allowing you to “buy the dips,” or purchase stock at low points when most investors are too afraid to buy. Committing to this strategy means that you will be investing when the market or a stock is down, which is often the best time to buy.

Key Takeaways

Dollar-cost averaging is when you make a series of small investments over a longer period of time, rather than investing assets in a lump sum all at once.

The key benefits of dollar-cost averaging are:

- Above-market returns without timing the market

- Removes emotion from the investing process

- Reduces the amount of time spent during the investing process

The key downsides are:

- More transaction costs

- Market rises over time (for pre-saved lump sums)

The best shares to buy using dollar-cost averaging are ETFs and/or LICs. Pearler’s Autoinvest feature can be used to automate your dollar-cost averaging strategy.

What is dollar-cost averaging?

Dollar-cost averaging is a strategy investors can use to build savings and wealth over a long period of time. It is also a way for investors to mitigate short-term volatility in the broader share market.

Dollar-cost averaging involves periodically investing a set amount of money regardless of the market price of the shares being purchased.

It is often associated with passive investing strategies in which the investor wants to minimise the time they spend on administration for their portfolio, while also ensuring they achieve satisfactory returns.

A great example of dollar-cost averaging is its use in superannuation accounts, in which regular purchases are made regardless of the price of any given investment within the account.

In Australia, when you get paid as a full-time, part-time or casual employee, a portion of your salary gets paid to your superannuation fund. Your superannuation fund then invests this money on your behalf into your superannuation account, which is typically a very broad mix of shares, property and infrastructure investments. Each time you get paid, your superannuation fund invests this money into the same mix of investments, regardless of the price of the investments at the time.

Dollar-cost averaging can also be used outside of superannuation accounts, and is commonly used when investing in listed funds such as exchange-traded funds (ETFs) and listed investment companies (LICs).

Additionally, dividend reinvestment plans are another form of dollar-cost averaging because dividends are paid on a regular cycle, and investors who opt into them have effectively made the decision to reinvest their dividends into the company, regardless of the market price at the time.

What are the advantages of dollar-cost averaging?

Above-market returns without timing the market

By investing a set dollar amount (or proportion of your pay) every fortnight/month/quarter, you buy more shares when the market is low and fewer when the market is high.

This results in a lower average cost of your investments. This means you get above-market returns without trying to time the market - and there are very few people who can do that consistently!

Below is an illustration of how this works using a $417/month investment.

As you can see, with a fixed investment amount you buy more shares when the market is low and less when the market is high, and therefore “outperform” the market without spending any mental effort trying to time it (which is statistically doomed to fail anyway).

To be clear, dollar-cost averaging is not definitively better than lump sum investing (we'll get to that later). But when choosing between dollar-cost averaging and timing the market, we believe dollar-cost averaging wins every time.

Dollar-cost averaging can be broadly applied to any single asset or portfolio of assets with sufficient liquidity. This makes investing in a portfolio of shares, particularly ETFs and/or LICs, a perfect fit.

Removes emotion from the investing process

Another advantage in favour of dollar-cost averaging is that by investing mechanically, you will take the emotional component out of your decision-making. You will continue on a preset course of buying a certain dollar amount of your preferred investment irrespective of how wildly the price swings. This way, you will not bail out of your investment when the price goes down in a wild swing, and also not buy too much when the price is rising rapidly.

Dollar-cost averaging helps shift investors’ mindsets towards seeing sharemarket volatility for what it really is - short-term swings in market prices driven by the emotions of others.

Reduces the amount of time spent during the investing process

There's one final advantage of dollar-cost averaging that’s worth calling out. By setting a strict investment schedule, you don’t need to spend time analysing the market and trying to “pick” when is a good time to invest. This analysis takes a significant amount of time (and stress!) and is almost always done poorly, with inconsistent results, regardless of how much time is spent during the process.

By dollar-cost averaging, you don’t need to spend any time or effort trying to deduce when is the perfect time to buy, you just invest according to your schedule! Set-and-forget is a beautiful thing. You can even automate the investment process completely on some platforms (such as Pearler - check out Automate!)

What are the disadvantages of dollar-cost averaging?

Increases transaction costs

The main disadvantage of dollar-cost averaging is that you will be investing more frequently and therefore incur more brokerage (i.e. transaction) costs than you otherwise would have if you saved up and invested a lump sum. However, with brokerages charging ever less to invest, this expense is typically insignificant - many brokerages in Australia are now charging less than $10 per investment (including Pearler). Moreover, if you’re investing longer-term, fees should become very small relative to your overall portfolio. You’re buying for the long haul, not trading in and out of the market.

If you’re interested in calculating your optimal investing frequency, take a look at our free investing frequency calculator!

Market rises over time (for pre-saved lump sums)

The other disadvantage of dollar-cost averaging only really applies if you’ve already saved up a lump sum and are wondering whether to invest it all immediately, or break it out into chunks.

Since the market tends to go up over time, if you invest a lump sum all at once you are statistically likely to do better than if you were to invest a series of smaller amounts over a period of time. But, this outcome is volatile. Sometimes, you will actually end up much worse, statistically speaking - so it’s worth weighing up your risk appetite, and how much avoiding the extra stress is worth to you. If you’re currently weighing up the pros and cons, we recommend you read up on how to invest a lump sum.

To be clear, if you haven’t already saved up a lump sum, then this is not an issue for you. In fact, this is the very reason you should be investing as early as possible. You’re statistically far more likely to outperform via incrementally dollar-cost averaging than by saving a lump sum and trying to time the market (see above).

What is an example of dollar-cost averaging?

An example of dollar-cost averaging would be investing $1,000 per month in an ETF that tracks the performance of a broad market index, such as the ASX 200. In some months, the index will be priced high, meaning fewer shares would be purchased for the $1,000 investment. In other months, when the index is low, $1,000 would purchase a greater number of shares.

In the long run, however, investors who use a dollar-cost averaging strategy are trusting that the simplicity of the strategy, combined with the fact that it protects them from the temptation of buying high and selling low, will ultimately lead to better results than trying to time the market on each purchase.

More examples of dollar-cost averaging – DCA vs lump-sum purchase

Dollar-cost averaging is often compared to lump sum investing – i.e. where you invest a certain amount in one go and try to time the market to get the most value for your investment.

The clear advantage of dollar-cost investing is that you don’t need to determine the best time to invest. Because you’re investing consistent amounts at regular intervals, the cost and value of your investment will effectively average out.

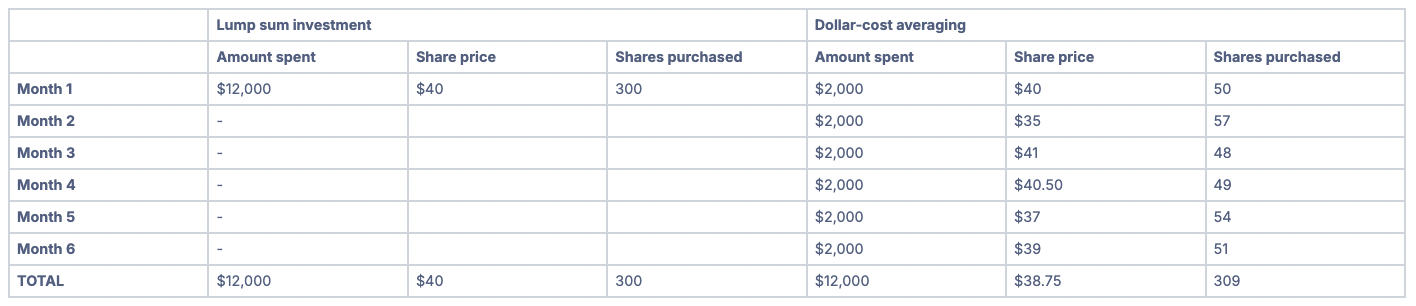

To give you an idea of how this could look, here’s an example of dollar-cost averaging vs investing with a lump sum.

Let’s say you’ve saved up a large sum of $12,000 and want to invest in stocks that are currently priced at $40 apiece. If you invested that $12,000 as a lump sum, you’d be able to purchase around 300 shares.

Now, let’s look at how that could pan out via a dollar-cost averaging strategy spread out as six periodic investments over six months.

In month 1, you spend $2,000 when the share price is $40, netting you 50 shares.

In month 2, you spend another $2,000 when the share price has dipped slightly to $35. In this month, you’re able to purchase 57 shares.

Then, in month 3, the share price takes a bit of a hike to $41 and you’re able to secure 48 shares.

At first glance, you might be thinking that month 3 isn’t as rewarding. You’ve spent more per share and netted fewer stocks than you otherwise would have if you’d gone with a lump sum investment.

But this is where dollar-cost averaging truly shines. In month 2, you actually spent significantly less per share and secured more of them. And, when averaged out with month 3, you’re still coming out on top.

Across just these three months, the average share price is $38.66 – lower than it was when you made that hypothetical lump sum purchase.

Here’s how your dollar-cost averaging approach could look over the entire six-month investment period compared to a lump sum investment.

As we can see, the dollar-cost averaging strategy has panned out better in this example. The average share price is lower at the end of the investment period and you’ve managed to net an additional nine shares compared to investing with a lump sum.

Of course, this scenario is purely hypothetical. It also doesn’t take into account the brokerage fees associated with each investment.

Plus, it assumes the share price has dipped below $40 enough times to make the dollar-cost averaging investment the more lucrative option. The share price could instead continue to increase – thus pushing up the cost of each investment – and potentially making the lump sum route more profitable.

But, as we learned above when we went through the disadvantages of dollar-cost averaging, this outcome can be volatile.

What are the best shares to buy using dollar-cost averaging?

At Pearler, we recommend investing in diversified portfolios, which means that invested funds are spread across many companies.

Diversification is important, because having all your eggs in one basket can leave you vulnerable to sharper market fluctuations, whereas diverse portfolios spread risk and invest in different types of businesses at the same time.

Diversification can be achieved by investing in many (+20) individual shares, or by investing in a single exchange-traded fund (ETF) or listed investment company (LIC) because they are baskets of shares (meaning you invest in many, usually hundreds, by investing in any ETF or LIC).

Read more here: What is diversification and why is it important?

Alternative strategies to dollar-cost averaging

Lump sum investing

Lump sum investing is exactly as its name suggests: taking a lump sum and investing it all at once.

Those who advocate lump sum investing say it can produce higher returns, especially if you're looking to make a short-term profit. This is because all your money is being invested, rather than waiting on the sidelines to be invested at a future date.

However, it’s generally the more risky option of the two, as there’s also the chance the market could take a dive. Dollar-cost averaging, on the other hand, mitigates that risk because, as we know, you don’t need to try to time the market.

Value averaging

Value averaging looks a little like dollar-cost averaging in that you’re making investments at regular intervals.

The difference is that value averaging involves buying more shares when the price is low and fewer shares when the price is high. Dollar-cost averaging is when investment amounts are split equally.

When you adopt a value averaging strategy, you set a growth target. Then, you modify your regular investments in line with whether your portfolio has grown or fallen in value.

How to start dollar-cost averaging (DCA)

If you’re an Australian with full-time, part-time or casual employment, you are already dollar-cost averaging into your superannuation account, so go you!

A lot of Australians, particularly those who are looking to retire early, also dollar-cost average outside of super. The reason they do this is to accumulate savings and wealth much, much faster than they would be able to in a savings account, with only slightly more effort.

If you’d like to do the same, then all you need to do is open a brokerage account and choose a diversified portfolio to invest in. Then, you invest according to a set schedule.

You’ve got a few options when it comes to investing your money: doing it manually, automating the process or enhancing your existing super contributions.

Manually depositing at each interval

The manual option is fairly straightforward: every time your regular investment date rolls around, you log in to your brokerage platform and make your investment.

This option can certainly work if you’re organised and already in the routine of investing at regular intervals. However, if you’d prefer to ‘set and forget’, you may want to consider automating your investments.

Using Pearler's Automate

This brings us to Pearler's Automate feature.

Automate is designed to make dollar-cost averaging investing super easy. All you need to do is establish your investing frequency, your regular investing amount and where you want your money to be invested, and Pearler does the hard work on your behalf.

The major advantage of using Automate is that you don’t need to keep tabs on the dates of your regular investments. Nor do you have to go to the trouble of logging into your brokerage account every time you want to invest.

Further contributing to your superannuation dollar-cost averaging by setting up voluntary contributions

As we know, your superannuation is already putting the dollar-cost averaging strategy to work.

But, you can actually enhance your super by setting up voluntary contributions. This is where you put extra money into your super through avenues like salary sacrifice; government co-contributions or spouse contributions; or simply by making personal contributions yourself.

In terms of your superannuation investments, one of the advantages of making voluntary contributions is that you’re boosting the amount of money your super fund can use to invest. Over the long term, this could mean a higher super balance come retirement.

You can learn more in our guide to making voluntary super contributions.

And one final trick to add a little extra juice to your dollar-cost averaging. Many shares and listed funds pay dividends, and you can often set up a reinvestment plan to reinvest those dividends automatically. If you’re interested in looking into this further, check out this article on how to reinvest dividends.

Wrapping up

We've covered a lot of detail in this article, so if you'd like the broad strokes version, check out the video below.

Happy investing!

Kurt