Summary points

- Short-term traders face huge challenges that long term investors don’t have to worry about.

- Even if you can ‘beat the market by trading’, taxes mean you might still be behind.

- Traders need to continually make good decisions to sustain their returns. Long term investors get to sit back and relax!

- Short-term traders have terrible odds of beating the market because most stocks underperform the market.

- Being a diversified long term investor is historically the best way to guarantee you own the greatest companies of the future.

- For most everyday people, the best way to grow your portfolio faster is by adding to your portfolio, not adding to your returns.

- Long term investors have money working for them, whereas traders have turned investing into a job.

In the last article, we spoke about what to focus on as a long term investor. But what about making money in the short term? Why can’t we make a few trades and benefit from short term spikes in the price of certain shares?

In other words, what’s so special about long term investing when - and I think we’d all agree here - it would be far better to generate returns as quickly as possible?

This post dives into the numerous benefits of taking a long term approach, even though it’s not quite as exciting (okay, some would say boring). Some of these benefits you will have heard before, but there are others you likely haven’t considered.

Taxes

The most immediate difference between investing and trading is the taxes involved.

Traders have to pay capital gains tax (CGT) each time they sell a share for a profit. Long term investors pay no capital gains tax whatsoever if they simply buy and hold their investments.

And just to be clear, this is no small factor. For example, let’s say the share market delivers a long term return of 7% per annum. Now consider a trader who tries to take advantage of short-term moves in share prices. We’ll assume their average holding period is 6 months and their tax rate is 30%.

Because all their profits are classed as ‘short term gains’ given the shares are held for less than 12 months, they do not receive the benefit of the capital gains discount. This means all profits are taxed on each sale - in this case at 30%.

So, even if this trader is clever enough to beat the market and earn returns of 10% per year, this becomes 7% after tax…the same as our long term investor following a buy-and-hold approach.

Decisions, time and effort

Part of the challenge of trading is the need to continually make savvy decisions. You might be able to pick a couple of good companies that do really well and produce outsized gains. But to consistently beat the market over time you need to keep repeating this trick again and again.

Now, this might sound like a fun game to play, and it probably will be at first. But it also becomes a responsibility that can start nagging at you. When you’re making all the decisions with your portfolio of shares - especially as a short-term trader - there are no days off, mentally speaking. You'll be watching prices, reading announcements, listening to industry news, and considering all the possible events that might unfold.

In this sense, short-term trading is really a job, not a game. Plus, given the potential rewards involved, some of the smartest people are devoted to short-term trading. To beat this crowd, our decision-making would need to be more informed than theirs. In short, trading requires a large time investment and continual effort.

A long term investor, on the other hand, can simply sit back and continually increase their holdings in a few diversified funds. A few good decisions up front and the hard work is done.

Long term investing calls for very little ongoing effort (which sounds crazy, but it’s true!) and only an initial investment in learning the basic principles of building a sensible long term portfolio. They can completely tune out the noise and simply focus on their long term goals.

Higher odds of success

Because of the above factors, long term investing has a much higher likelihood of success than short term trading. But there’s another very important point to consider. The fact is, most individual stocks underperform the market and stock market indexes are driven higher by a small percentage of massive long term winners.

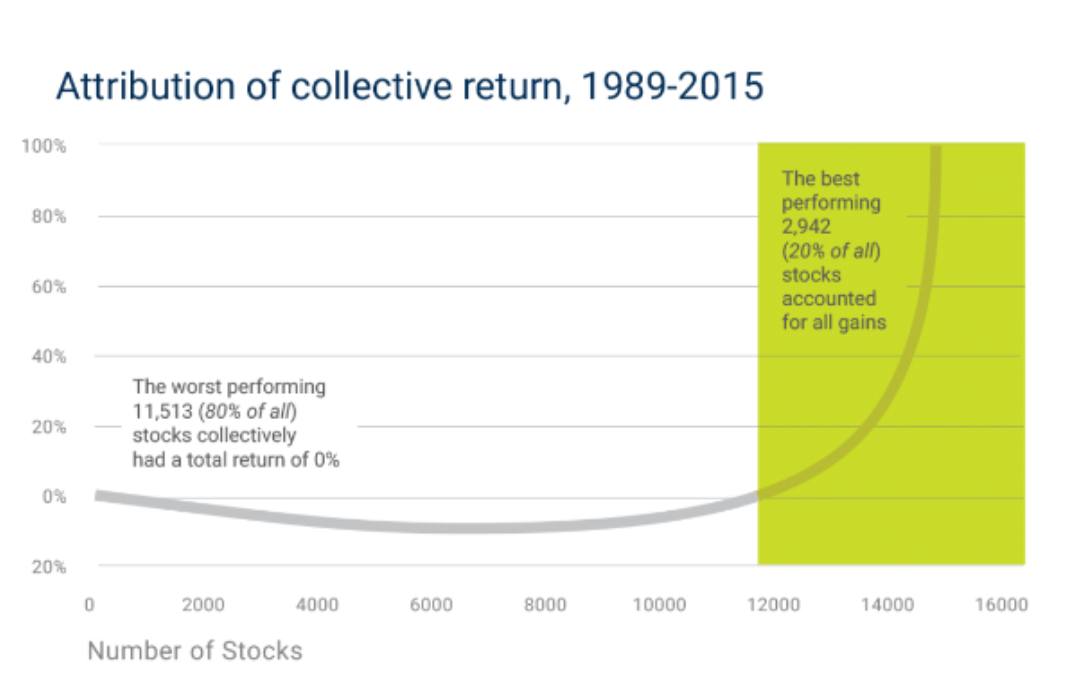

In practice, this means a short term trader who is picking stocks is narrowing their focus and the number of stocks in their portfolio. This has the effect of increasing the likelihood that they miss out on the biggest long term winners, which account for most of the market’s gains.

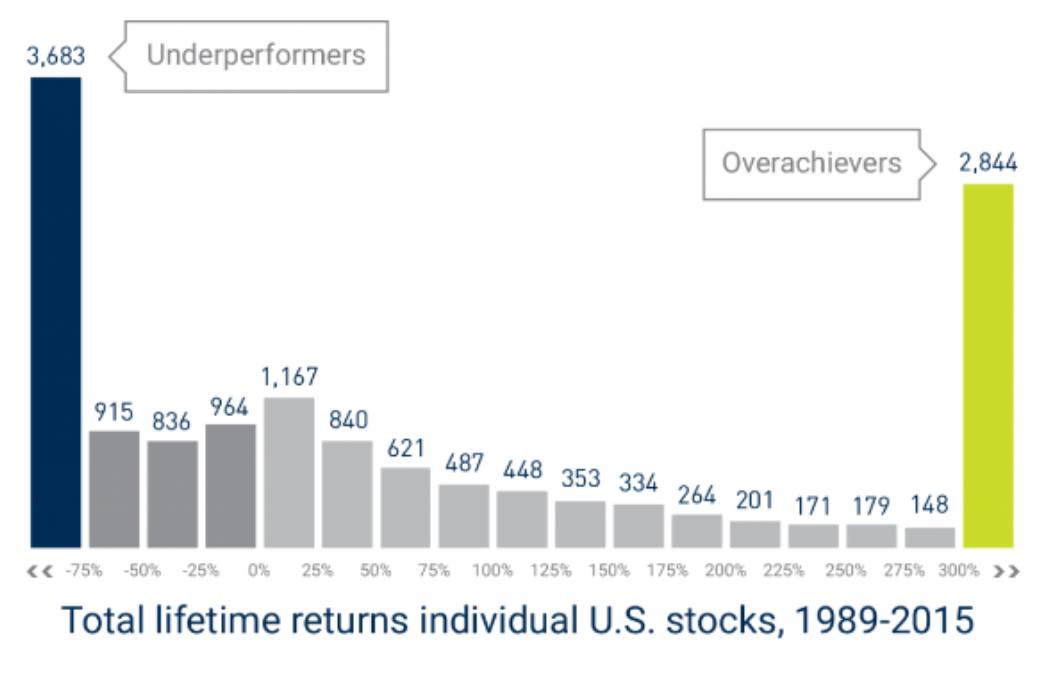

The following two charts are from a US study looking at stock returns over a 26-year period. It shows the huge amount of poorly performing stocks, with an incredible 40% producing a negative return. The second chart shows how important the long term winners are, since they offset so many of the losing stocks.

Source: A Wealth of Common Sense

What’s the takeaway? Well, a diversified long term portfolio has a greater chance of delivering a good return over time. Picking individual stocks comes with odds much worse than 50%. That’s because, as Michael Batnick so eloquently put it: “most stocks suck.” Which is also why investing in index funds is such an effective and popular strategy.

But maybe, for some strange reason, you’re the outlier with incredible foresight who is able to see the future that others can’t. Then is it worth the effort? If we assume that’s true, the answer is still unclear. That’s because you could also focus your efforts on other things which may have a greater payoff.

Higher payoffs elsewhere

Instead of trading stocks to make extra money, what if we put the same time and energy into optimising our expenses? What about applying that effort to increasing our income?

When we think it through, trying to double our long term return from say 8% per year, to 16% per year (and sustaining it) is a wildly unrealistic idea. But by improving our spending and growing our income, we could probably double our monthly savings. Ratcheting up our savings rate from say 20% to 40% is a far more achievable goal.

And remember, if you’re chasing financial independence (FI), cutting your spending has a 25x benefit on how much you need to be FI (since you need $250,000 of investments to produce $10,000 of passive income, using the 4% rule).

But more than that, you could also be devoting energy to your family and friends, other fruitful hobbies, spending time on your health and exercising, being out in nature, and doing a hundred other wonderful things besides spending more time looking at a screen!

Final thoughts

As you can see, long term investors have the upper-hand for so many reasons: less taxes, fewer decisions to make, less effort and mental energy involved, far greater odds of success, and being able to focus their time on more valuable and beneficial activities.

Trading is a bit like swimming upstream when you can instead relax and go with the flow, trusting that the current will take you where you need to go (even if it’s a little choppy sometimes!).

When we zoom out and look at the big picture, we’re of the opinion that the long term investors have got it figured out. Sit back and let your money work for you, rather than the other way round.

Thanks for reading, and happy (long term) investing!