Long term investing can sometimes be harder than it sounds.

On the surface, it’s incredibly easy. But when you consider all the ways we can stray off course, and our instinctive desire for safety, it can become challenging to think in terms of decades.

In this article, we’ll do a little exercise. We’re going to plot out where the sharemarket might be in the future. Not like those lame 6 or 12 month forecasts that are hilariously specific and end up being totally wrong. Those are a waste of time.

Instead, I’m talking about something much bigger, much longer, and far more meaningful. While obviously no-one can predict the future, we can look to the past and present to draw certain conclusions. In this way, we can form an educated opinion around where the share market may be during our lifetime.

Why it matters to know where the sharemarket will be in the future

Having a rough idea of what the future could look like can help us stay on track with our investing plans. It expands our mind to think bigger than the next week or month. And in my opinion, it gives us that all-important perspective which is, well, non-existent in mainstream financial media.

Here’s how I personally think about it: the purpose of my investments is to create wealth. From here, they can provide an income stream throughout my life to sustain my financial independence. Since I’m 33 years old right now, my investing timeframe is (hopefully) 50-70 years. It could be even longer, depending on how powerful modern medicine and our knowledge around longevity and health become. But let’s run with this for now.

You may be younger or older than this. It doesn’t matter. Either way, you can apply the upcoming examples to your own situation. So, with this in mind, let’s flesh out where certain markets might be during this timeframe.

Where will the Aussie sharemarket be in the future?

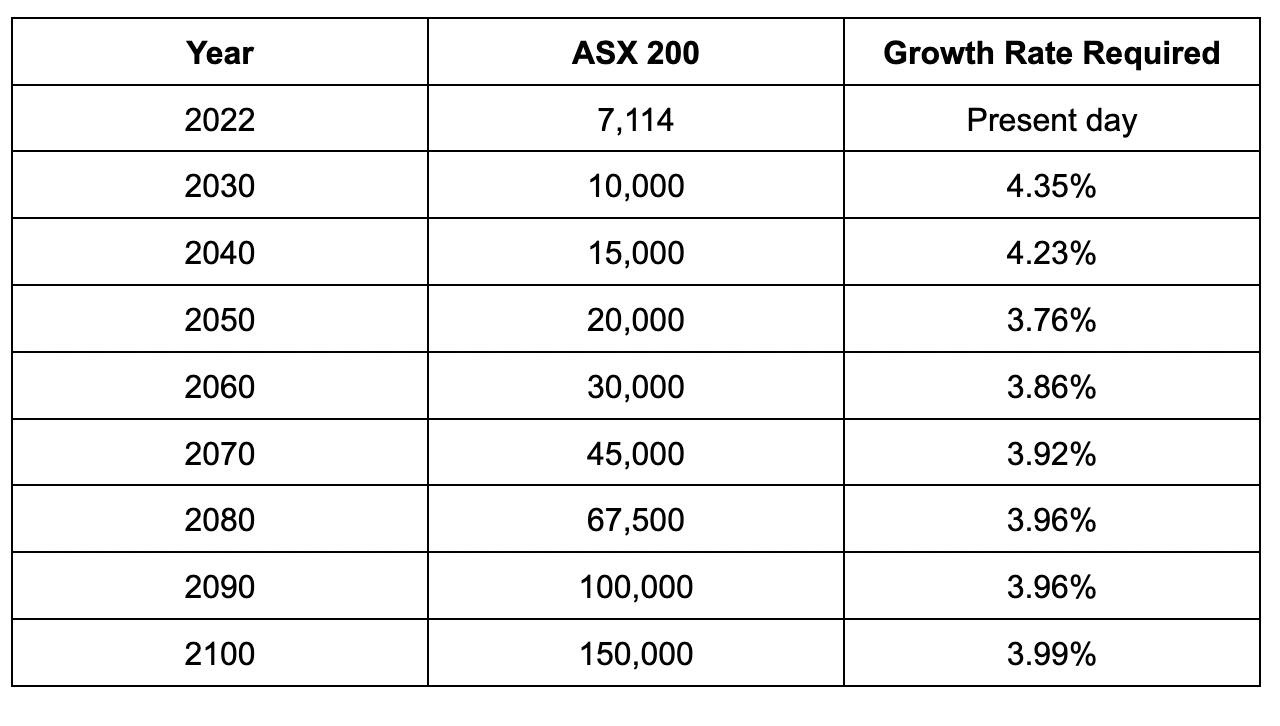

As I write this article, the ASX 200 sits at a level of 7,114 points.

If we assume company earnings grow at a rate of around 4% per annum (not unrealistic), and prices follow earnings over the long run (they generally do), the ASX 200 could end up at the below levels in the future.

By the way, for both examples, we’re using completely made-up numbers and a hypothetical return of 8% per annum. Feel free to conduct the exercise yourself using a different figure, using a compound interest calculator. The overall perspective is what matters.

That’s some impressive growth, no? Those future price levels make today’s market look like an absolute bargain. And that’s kind of the point. The market is likely to end up far, far higher than it is today. Just like what has happened over the last 100+ years.

Assets like shares and property always look unbelievably cheap in hindsight, yet prices probably didn’t seem cheap at the time. Unfortunately, not all of us will be alive to see those last few columns. However, many of us will surely get close! And if you plan to leave wealth to your kids, grandkids or charities, this timeframe is even more relevant.

Okay, let’s go overseas now.

Where will the US sharemarket be in the future?

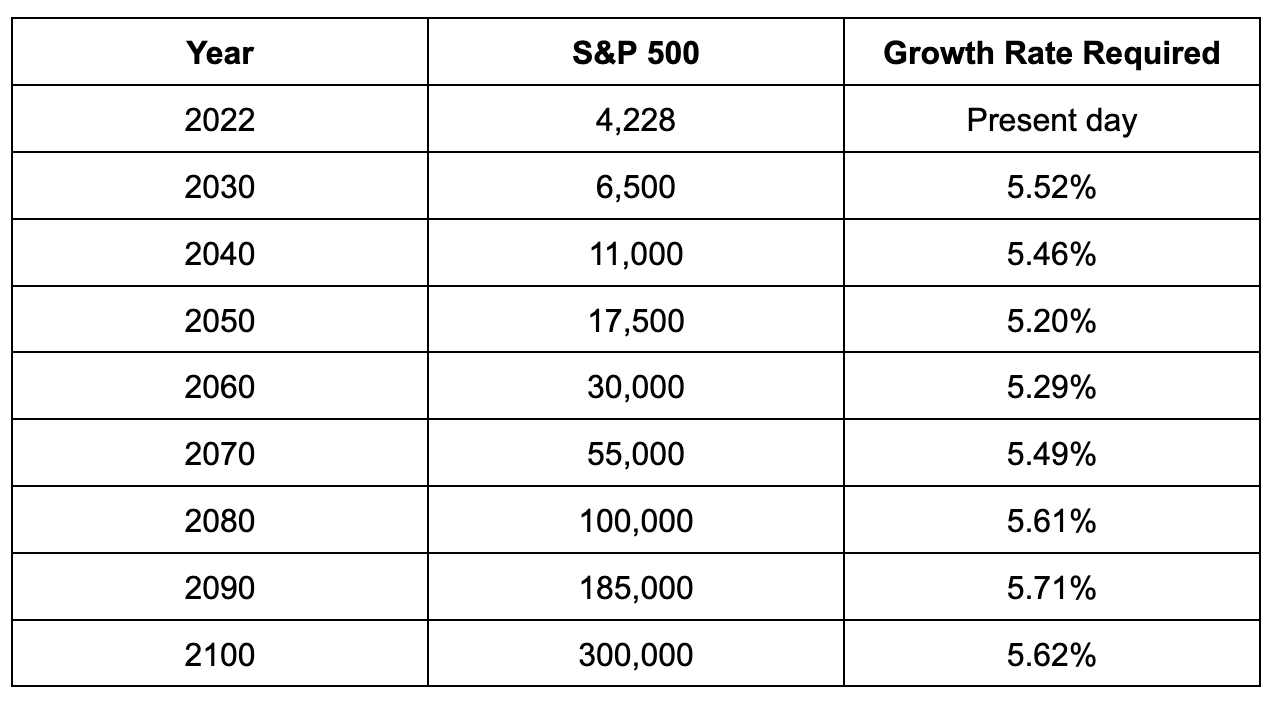

As I write this, the S&P 500 sits at a price level of 4,228 points. For this calculation, we’ll assume a higher growth rate than for the ASX 200.

Why? Because US companies pay lower dividends, and instead use money for share buybacks. This has the effect of reducing the number of shares outstanding, which increases earnings per-share at a faster rate.

So, let’s assume the S&P 500 continues to pay low dividends and has a higher growth rate of, say, 5-6% per annum. Here’s what the future could look like…

Holy moly! In this example, the S&P 500 has far overtaken the ASX 200 despite starting from a lower number. That’s thanks to the higher growth rate.

Wait, does this mean the US is the better investment? Well, not necessarily. Remember, these tables are only looking at price. We’ve completely ignored the higher dividends (and franking credits) paid by the ASX over that time, which could have been reinvested every year by the investor.

Multiplying your money

The hypothetical returns above take us from the present day to 78 years in the future.

It shows us that we have the opportunity to multiply our money many times over, quite simply, by stretching out our timeframe and broadening our perspective. In short, if we add a zero to our time horizon - say, from 5 years to 50 years - we can add many zeroes to the end result.

The fact is, even with a modest growth rate, many of us will be able to multiply our money by 10x, 25x, or even 50-100x in some cases. We just have to hold long enough.

Don’t believe me? Well, $10,000 becomes $1,000,000 in 60 years, assuming a return of 8% per annum. If returns are only 6.8%, it takes 70 years. It’s still mind blowing. Yes, there’s inflation, so future dollars aren’t worth as much as today’s dollars. But that’s all the more reason to get invested, so our money can grow faster than inflation.

Another aspect we haven’t covered is income. Share markets increase over time thanks to companies growing their profits, thereby making them more valuable. As these profits grow, shareholders are rewarded with larger dividends.

So, as the market compounds over time and our money multiplies, so does the amount of passive income we receive. A portfolio that becomes 10x bigger will produce 10x more dividend income.

With dedication and time, our piddly little stream of dividends at the beginning turns into a glorious and majestic waterfall, showering us with cash year after year. That’s another exciting way to think about our long term investments.

Final thoughts

Yes, this was a number-heavy post, which isn’t for everyone.

Now, you might think this whole exercise is absurd. And in some ways, it is. Sadly, the market doesn’t care about our future plans. It’ll do whatever it’s going to do. But I think it’s a valuable thought experiment.

Looking at the markets this way helps put all the short-term price movements into perspective. We can’t help but recognise the awesome power of compounding, and we then see the news for what it really is - absolute noise. And we can crystallise in our minds how much the short-term stuff matters. It doesn’t!

Mastering the art of happily multiplying our money over time requires (at least) three personal traits: patience, dedication, and perspective. Those who get distracted or disheartened and give up are usually lacking in one of these traits.

If we can keep these future scenarios in mind, especially when shares are falling, it’s much easier to maintain the right perspective, stay on track and stick with our plan.

Until next time, happy LONG term investing!