As a long-term investor, one of the most important things you can do is strengthen your investing mindset.

Without the right mindset, even the best investment strategy can fall apart.

It’s vital you learn to adopt a set of principles – some practical, some mental – that will ensure your long-term success as an investor.

That’s the best way to improve your odds and get the outcome you want.

So let’s run through a few of the most important lessons I’ve found to be useful on my own journey.

This isn’t the usual “choose low fees, invest regularly” line you’ll read in every article about investing. Sure, those things are important. But in my opinion, there are larger, more essential factors at play. Let’s explore some of those now.

Future Planning

The best place to start is by figuring out where you want to be in the future.

Let me take a wild guess and assume you want to be a lot wealthier in 30 years than you are today. So, let’s think about that for a minute.

What does the financial picture look like for ‘future-you’? What assets do you own? How big is the portfolio? Is it spread around, or concentrated? Imagine this version of yourself, and what their life is like.

Now turn your attention to the assets. What will they be worth? Where will the share market be in 30 years? What will the average property be worth?

Both of these exercises are extremely important. They can help you remember a couple of things:

- If ‘future you’ wants to own a large portfolio of assets, ‘current you’ better start accumulating as much as possible. The greatest hope you have is by getting the snowball rolling sooner, piling on as many flakes of snow as you can.

- Asset prices in the future are likely to be much, much higher than they are today. When we look back in 30 years, I believe we’re going to be amazed at how ‘low’ prices were. Just like we’re amazed today at prices from 30 years ago, and 30 years before that.

If you’re like me, when you look back at property and sharemarket levels from decades ago, you think: “I would’ve bought as much as I could get my hands on”. My bet is we’ll think the same looking back many decades from now.

It’s best to not overthink the price movements from day-to-day, month-to-month, year-to-year. It causes you to second-guess yourself, holds back your progress, and in all likelihood, is a giant waste of time considering where prices will likely be in the future.

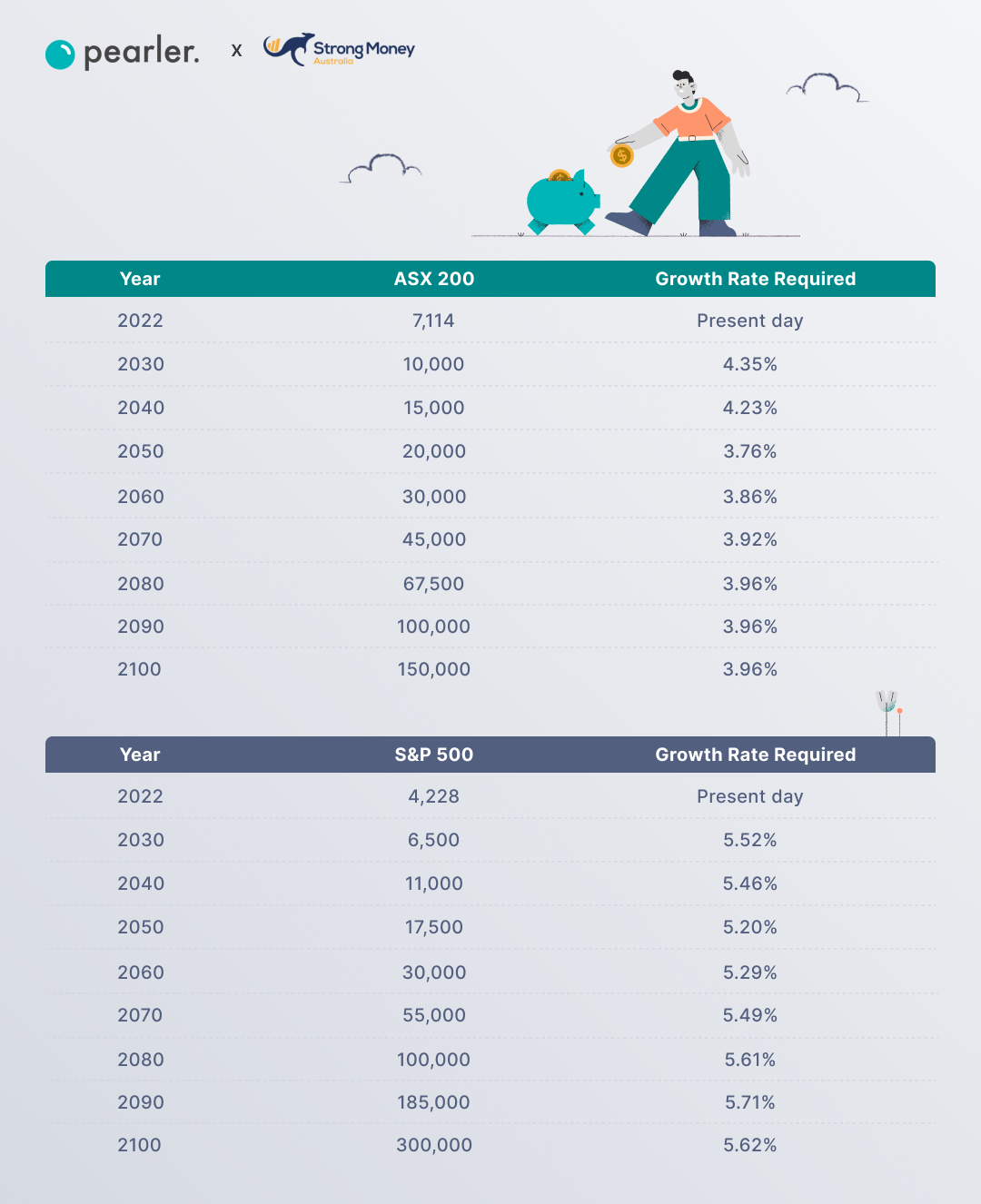

These two charts I shared in a previous article might help explain what I mean. I shared a couple of simple tables explaining where the ASX and S&P could be in the future, based on reasonable growth rates.

I’m secretly hoping the ASX hits 100,000 in 2089 for my 100th birthday. I think that’d be a pretty cool double-celebration!

Be a happy investor

Now, this might seem like a strange one, but hear me out.

I’ve been writing about investing and personal finance for seven years now.

In that time, I’ve seen some investors who are seemingly never happy. While others, facing the exact same situation, are cruising and enjoying each step of the way.

One group focuses on the downside: risk, loss, and problems. The other focuses on the upside: opportunity, progress, and benefits.

Here’s an example of the two main groups of investors. The first group is never happy regardless of what the market is doing:

- Market goes up = “Prices are too high, everything’s overvalued.”

- Market goes down = “Arrgh, I’m losing money!”

- Market goes nowhere = “This sucks, what’s the point of investing?”

On the other hand, the second group of investors is always happy:

- Market goes up = “Nice – I’m a little bit richer than before”

- Market goes down = “Yes, now I can buy even more at lower prices!”

-

Market goes nowhere =

“All good, I’ll just sit back and watch my dividends roll in.”

Which type of investor would you rather be? We can choose to see the negative or the positive. The truth is that investments are unpredictable. We need to accept that.

If everything was breezy and only good things happened, there would be no risk. And if there’s no risk, there’s no reward.

Shares provide higher returns over the long term precisely because of the risk and uncertainty we deal with in the short term.

In other words, we have to

earn

the long-term returns possible in the charts above. And the way we do that is by adopting a healthy mindset through the uncertainty – by being a happy investor.

Master the controllables

I’ve mentioned this before, but it’s worth doubling down on here.

The best way to approach investing (and life for that matter) is to focus on the things we can control. Not only does this make your investing experience more enjoyable and less stressful, but it’s a far more effective use of your energy.

When it comes to investing, there are

no guaranteed outcomes,

so the best you can do is

guarantee your inputs.

So, what are the controllables?

– How much you invest.

Some may like to argue this, but your income and expenses are largely under your control. By that I mean you can greatly influence both of these numbers. So, continuously look for ways to grow your income and trim your spending. In doing so, you create a greater surplus of cash to buy assets with. This will boost your progress more than any investing book you could possibly read. It doesn’t matter how good your investments are if you’re only putting in a few dollars a week.

– Committed action. As discussed in future planning above, you need to continuously invest to end up with a big portfolio. This means investing as much as you can, as soon as you can afford to. It means ignoring the economy, forgetting about prices, and just focusing on increasing your ownership stake, ensuring that any dividends you receive are also reinvested back into the portfolio. Constant, relentless action.

– Stay focused. Some people do great with their investing plan for the first six months. Then they get bored or distracted, finding new ‘shiny’ investments which seem better. They think these other investments will help them reach their goal faster. It’s almost always a bad move. Six months later they’ll be bored again, looking for ‘the secret’ that’s going to make them rich. If you’ve chosen solid investments in the first place, you can safely ignore everything else. Let the FOMO melt away and stick to your plan.

– Embrace boring.

We all get excited looking at a compound interest chart. It’s amazing to think how much our money might grow over the years. Sometimes this motivates us to keep going. In this sense, it’s like helpful daydreaming. But we also need to remember: the magic of compound interest takes a long time to kick in. In the first five to 10 years, it’s all the boring factors above which matter. So understand that all your efforts, as small and boring as they might seem, are the fuel that’s required to get you where you want to go.

Expect a bumpy ride

As you probably know, markets are volatile. You’ll often see the value of your portfolio drop, and it won’t feel good. The fact is, there’s always a crash coming. We just don’t know when it’s going to be.

The lesson: don’t be surprised when it eventually happens. If anything, you should expect unexpected events to occur. Big crashes (like a 50% fall) are rare, but chances are you will experience one at some point.

The challenge is staying the course. Because when the market is falling, there are endless predictions of how much worse things are going to get.

This happened during the Corona Crash in 2020, every panic before that, and it’ll happen in the future too. In the very beginning, nobody knew what the hell was going on, and markets tanked more than 30% in a single month.

All crashes are built on uncertainty. Mass uncertainty is what causes huge anxiety and the ‘sell first, ask questions later’ attitude. The media asks ‘experts’ for their opinion on what’s happening.

Of course, they don’t know what’s coming next, but they guess anyway. Almost always, they predict bad times ahead. Remember, to the relentlessly negative media, market turmoil is like Christmas, because fear sells. So don’t rely on them to give you anything but emotionally-driven hysteria…certainly not comforting investing advice!

Despite the uncertainty during market falls, the investors who simply keep buying all the way down, and all the way back up (as the market recovers) are typically the biggest winners. Not because they outsmart everyone else, but because they deliberately avoid trying to be too clever, and simply keep investing.

Even during good times, you’ll hear, “markets are set to fall”, “good times are about to end”, and so on. Obviously that’s very unhelpful to everyday investors. My advice? Ignore it.

Look at a long-term stock market chart and you’ll quickly decide that you wish you bought as much as possible, as early as possible, and that market falls are an opportunity.

The 120-year chart below shows how the Aussie market has multiplied more than 500x in price appreciation alone. This doesn’t even include the juicy dividends paid every single year along the way!

Switch your focus from days to decades and you’ll become a more successful (and calmer) long-term investor.By the way, if you’re on the road to Financial Independence, lower share prices are exactly what you want. Experiencing big market falls while you’re building your portfolio can actually boost your progress by quite a lot.If you manage to do plenty of buying when prices are low, this gives you excellent returns as the market eventually recovers. So, when the market is in a slump, ignore the negative news and stick to your plan: accumulate.

Final thoughts

There are many more principles we could have discussed.

You know about the obvious ones already: low fees, diversification, and compound interest to name a few.

Today I tried to point out some less obvious factors that I believe are equally important.

- Thinking about your future self and what you need to do to get there

- Getting clear about what future asset prices could be

- Finding positivity in every market scenario, because there’s always a silver lining

- Mastering what you can control and taking relentless action

- Expecting the waves to hit you, and sailing through it anyway

I hope you find these lessons helpful as you build your portfolio and head towards Financial Independence.

Until next time, happy long-term investing!

Dave