Wanting to start your inevstment journey but don't know how? There are a few ways you can invest your money and reach a favourable investment return. One of them is earning through compound interest. When people talk about compound interest, they're referring to the total interest on a deposit, investment, or loan based on both the original principal and the combined interest from previous intervals. It means the interest you earn on your initial deposit earns interest too, resulting in a greater overall return. Sounds complicated? Let's break this down into key terms.

When you invest or loan, you start with a principal. Principal refers to the original sum of money you deposit for an investment. The money you earn increases overtime with interest. This way, you're relying on simple interest , typically based on an annual rate. This is more common for beginners who are interested in short term investing but aren't expecting their ROI to grow faster. Compounding interest, however, opens you to the possibility of much higher returns.

What is compound interest?

"Compound interest is the eighth wonder of the world. He who understands it, earns it... he who doesn't... pays it." — Albert Einstein.

So what differentiates compound interest from simple interest ? The answer's simpler than you think. With simple interest, your interest rate remains constant. With compound interest, as the name suggests, your interest is compounding; it's interest on interest. That means your ROI could reach exponential growth! The interest rate compounds based on time, usually at an annual rate for long term investments.

How does compound interest work?

Compound Interest = Interest on Principal + Compounded Interest at Regular Intervals

You calculate the compound interest based on regular intervals - annually, quarterly, or monthly. And instead of basing the interest rate on the fixed principal, you have a new interest rate per interval that's based on the interest earned from the previous interval.

To understand the difference between simple interest and compound interest, let's try to solve for both using the same values.

Let's say you invest $10,000 in the bank with an annual interest of 5% for a period of three years.

Simple interest

With simple interest, you are earning an annual rate of 5% from your initial deposit of $10,000. Since you have a constant simple interest rate of 5% annually, you earn a constant interest of $500 per year. In three years, you would earn $1,500 in simple interest.

Compound interest

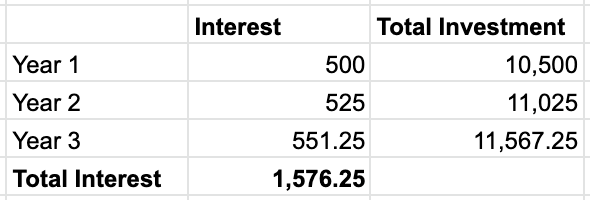

Compounding interest bases the interest rate from the total amount of your investment in the previous year. With the same values, we know that you earn an additional $500 from the money you invest in the first year, resulting in a total of $1,500 with the principal included.

In the second year, your interest rate will be based on the final amount of the previous one. This means that, instead of basing the interest rate on just the principal and the interest earned so far, you now calculate the interest based on $10,500. Applying the interest rate of 5% on $10,500, your interest for the second year is $525. Added to the principal, this gives you a total amount of $11,025.

Applying the same formula to calculate for the third year's interest, you'll find that the interest is compounding. The interest rate of 5% is now based on $11,025, which gives us $551.25 interest. Together with the previous year's total amount in investment of $11,025, you end up with a total of 11,567.25 in three years.

In three years, your interest was able to compound to $1,576.25. This is higher than the calculated simple interest of $1,500. With compound interest, you're saving $76.25 more with the same principal in the same amount of time!

You can follow the same method for interest compounded monthly or daily. You can also find a compound interest calculator easily online. Try Pearler's handy compound interest calculator !

Compounding Interest: The rule of 72

The rule of 72 is a buzzword in the finance world that helps investors easily figure out how long it would take for their principal to double through compound interest. It's most convenient when you don't have a compound interest calculator nearby.

Simply divide 72 by the annual interest rate to calculate for the years needed to double your money. As an example, let's calculate with an annual compound interest rate of 5%. 72 divided by five gives us 14.4 years to double the principal. Keep in mind that this only works if you want to calculate with a 100% ROI in mind.

What is the Compound Annual Growth Rate (CAGR)?

Calculating for the compound annual growth rate is useful for investors who want to know how much the money they invest has grown when it reaches the expected amount. To calculate the CAGR, you just need the beginning balance, the ending balance, and the number of years it took to reach the ending balance.

Let's say you invest $10,000 and your investment grew to $72,500 in five years. Calculating with the formula can be complicated, but a handy CAGR calculator will tell you that your money grew by 48.62%.

Investors like to compare the performance of different investments using a CAGR calculator. When comparing two or more investment opportunities, you would want to invest in something with a higher CAGR. However, the CAGR formula works under the assumption that the annual growth rate is constant throughout the years. It's a representational figure, but is a reliable basis for decision-making before you continue to invest.

What are the risks of compounding interest in long term investing?

There are several benefits to compounding interest, especially when compared to simple interest. This is one of the many ways you can invest while saving money for future use. But before you make that initial deposit, you should be aware of the potential risks associated with compound interest.

- High inflation rate : You're at a loss if inflation is higher than your compounding interest rate. Worst case scenario, the compounding interest won't keep up with the cost of living due to inflation.

- Market fluctuations : When the market fluctuates, so do stock values. You can expect the money you invest to grow some days, and go negative in other days. If you're willing to stick to your investment through the years, though, the potential for great returns is still very much possible with compound interest. However, when it comes to future market returns, nobody has a crystal ball.

- Longer time to reach significant growth : Compound interest works best when you want to invest for the long term - and we're talking decades here. Exponential growth most commonly occurs once your investment reaches about three decades. That's a lot of time.

- Reinvestment risks : With compound interest, you're basically reinvesting the interest that you earn on your deposit over a long period of time. That's money you should be alright with not spending for now. Furthermore, compound interest on borrowings or on debt can lead to huge financial loss when left unchecked.

Compound interest is a great avenue for saving for your long term goals and generating wealth for the future. However, it's important to calculate and monitor the money you invest to manage risks and expectations. This is true for any financial decision. Diversifying your investments, investing long term, and seeking professional advice can help you make informed investment decisions. A great place to start is the Pearler blog !

Make compounding interest work for you with Pearler

The great thing about compounding interest is that you can be saving money long term without the fuss. In fact, a lot of people who are saving for that exciting life goal are able to do so with compounding interest. In a sense, you're earning passively, and passive income is always good to have because it works for you!

If you want to apply the principles of compound interest, there are several platforms to choose from - and Pearler makes long term investing easy. Spend minimal time selecting and monitoring investments on Pearler with a simple, automated set of investing tools. Start investing in your financial future your way today!

"Start as early as you can and let compound interest work for you"

— Warren Buffett