Before you establish how to reach financial Independence, you should define it

First, it’s essential to define what financial independence means for you.

The most common definition of financial independence is when your annual passive income equals your annual expenses. Alternatively, financial independence for you could be when your passive income equals a fraction of, or more than, your annual expenses.

It’s also important to think about whether your expenses today are reflective of what you expect your expenses to be in the future. If you expect to have a family in the future, then it’s crucial to take their additional future living expenses into account too!

Let’s say you’ve sat down and worked out exactly how much this is, and the annual expense number you’ve arrived at is $50,000 per year. To reach financial independence, this would mean earning at least this amount in passive income.

So, how do we achieve this by investing?

Choose your investments

When you invest in shares, you can earn dividends from the shares. This is the easiest way to earn passive income from share investing. However, some shares pay higher dividends than others, and some shares pay more consistent dividends than others.

The most common shares that our community invests in to achieve financial independence are exchange-traded funds (ETFs). In fact, over 90% of our community invests in them. Most ETFs pay dividends, and those that do pay dividends are typically very consistent.

When it comes to investing in ETFs to achieve financial independence, there are typically two strategies:

- Invest in a single, extremely diversified ETF

- Invest in multiple ETFs that result in a highly diversified portfolio

The main benefits of option #1 are:

- it’s simpler to set up, and

- it removes the temptation to tweak your portfolio mix (this temptation becomes stronger than you expect in volatile markets).

The main benefits of option #2 are that the underlying ETF management fees are slightly lower and you have greater control over your exact investment mix.

Both are great options, although most people start with option #1 - it’s impossible to mess up! You can always change later by choosing the option #2 approach. You don’t need to sell or trade your existing holdings - you can simply add to them.

If you go with option #1 - Invest in a single, extremely diversified ETF - then you’re going to want to choose a Diversified ETF.

Two of the most popular Diversified ETFs on Pearler are Vanguard Diversified High Growth Index ETF and Betashares Diversified All Growth ETF (ASX: DHFF).

Define your financial independence number

Now that you’ve selected your ETF(s), it’s time to work out how much you need to accumulate to reach financial independence.

You can rely on earning a passive income of 4% from your share investments. This is known as the 4% rule. Globally, this is typically achieved through a mix of dividends and selling small parcels of shares each year. In Australia, we have the good fortune of having much higher dividend rates than the rest of the world, so 4% is often achievable through dividends alone.

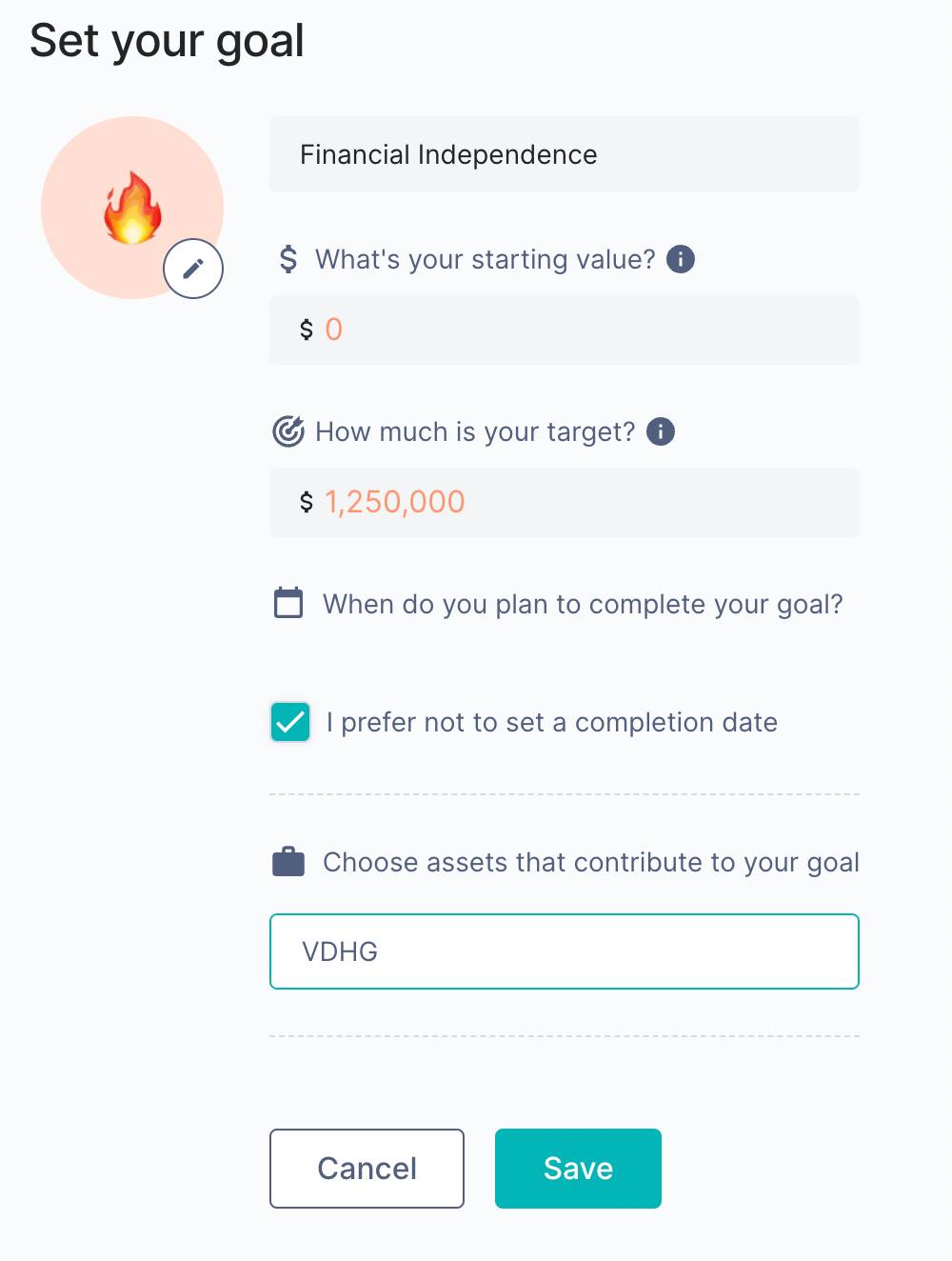

To get your financial independence number, simply divide the passive income you need to earn by 4%. In this example, that’s $50,000 per year divided by 4%, which is $1.25m.

$1.25m is a large sum, but you’d be surprised how quickly you can accumulate a significant investment portfolio. Compound interest on sharemarket returns means that investment portfolios grow quickly over time, especially if you’re regularly investing (see below).

Experiment with Pearler’s calculators

The most challenging thing about investing is understanding how what you do today is likely to affect your outcomes in 10 or 20 years’ time - and then making a decision on what to do today.

To help with this, we’ve created a suite of calculators.

Want to know how much you should invest to reach a goal within a certain amount of time? Try our Investing Amount Calculator.

Keen to learn how long you will need to invest for to reach a goal with a set amount to invest each week or month? Try our Investing Duration Calculator.

Care to understand how much your investments will grow after investing a set amount over a set amount of time? Try our Compound Interest Calculator.

Want to put it all together to decide on your financial independence goal? Try our Financial Independence Calculator.

After you’ve spent some time with these calculators, you should have a good understanding of the trade-offs you’re willing to make, and ultimately how much you’re willing to invest every time you get paid.

The key takeaway from these calculators is that the more you’re able to invest early, the more your investments will compound in value, and therefore the faster you’re able to accumulate wealth. Or, looking from the other side of the coin: the longer your investment time horizon is, the more wealth you’ll be able to accumulate (and the rate of accumulation significantly increases in the latter years).

The other thing that’s implied by these calculators is that you’re dollar-cost averaging. This means that you’re spreading out your investment purchases, buying at regular intervals and in roughly equal amounts. This is especially powerful in a bear market, as it allows you to “buy the dips.”

Or, to put it differently, you’re purchasing stock at low points when most investors are too afraid to buy. Committing to this strategy means that you will be investing when the market or a stock is down, which is often the best time to buy.

Set a SMART investing goal

The above calculators can give you a firm idea of what should happen over the long-term (10+ years). With that said, they should serve as an indicator only, as results will vary! Generally speaking, sharemarket returns are quite consistent over the long term. However, any given year could experience a bear market. That’s why it’s important to have flexibility around when you expect to reach your financial independence number, and your plans for once you get there.

This means that the daily measure of our investing success shouldn’t be our portfolio value, as sharemarket returns are beyond our control.

SMART is a goal-setting framework. It really complements share investing well when applied correctly, but is often poorly applied.

SMART stands for Specific, Measurable, Achievable, Relevant and Time-Bound.

A SMART goal is a goal we control (Achievable). Therefore, the best goal to apply to investing is centred on the amount you invest, not the amount you accumulate.

As above, since sharemarket returns change from year to year. For this reason, aiming for a precisely-sized investment portfolio at the end of a given period is not realistic. However, precisely investing an amount is.

As such, you should centre your goal on how much you invest every week, fortnight, or month (we recommend choosing the same frequency as your pay cycle for simplicity) and measure your success based on this. This is key.

How much should you invest? That’s completely up to you. It will also depend on your personal circumstances, your high-level goal, and how quickly you want to achieve financial independence.

That said, most people who actively pursue financial independence via shares regularly invest 20% of their income into their portfolio. For instance, if you earn $60,000 after tax each year, you would invest $1,000 per month.

Extending this to our SMART goal framework, one SMART goal could be to invest $1,000 per month for the next 20 years ($240,000 total invested). It’s specific - you know you need to invest $1,000 each month. It’s measurable - $1,000! It could be achievable - is investing 20% of your paycheck each month realistic? It’s relevant - achieving this goal will bring you closer to achieving financial independence. And it’s time-bound - 10 years!

Rather than choosing a specific monthly amount to invest, you could consider investing a specific percentage of your after-tax income. This way, you have the benefit of increasing your investment amounts as your wage increases over time. Alternatively, if you take a career change or break, there's a greater chance you’re able to meet your goal. The difficulty with this option is that it does take a little more maintenance.

Choose what works for you and make sure to measure your progress!

Set up Automate

Once you’ve worked out how much you want to invest and how often, you can automate everything!

Firstly, select how you would like to invest. For amounts of $1,000 and more, option #1 is the most common with our community. For amounts of less than $1,000, option #2 is most common.

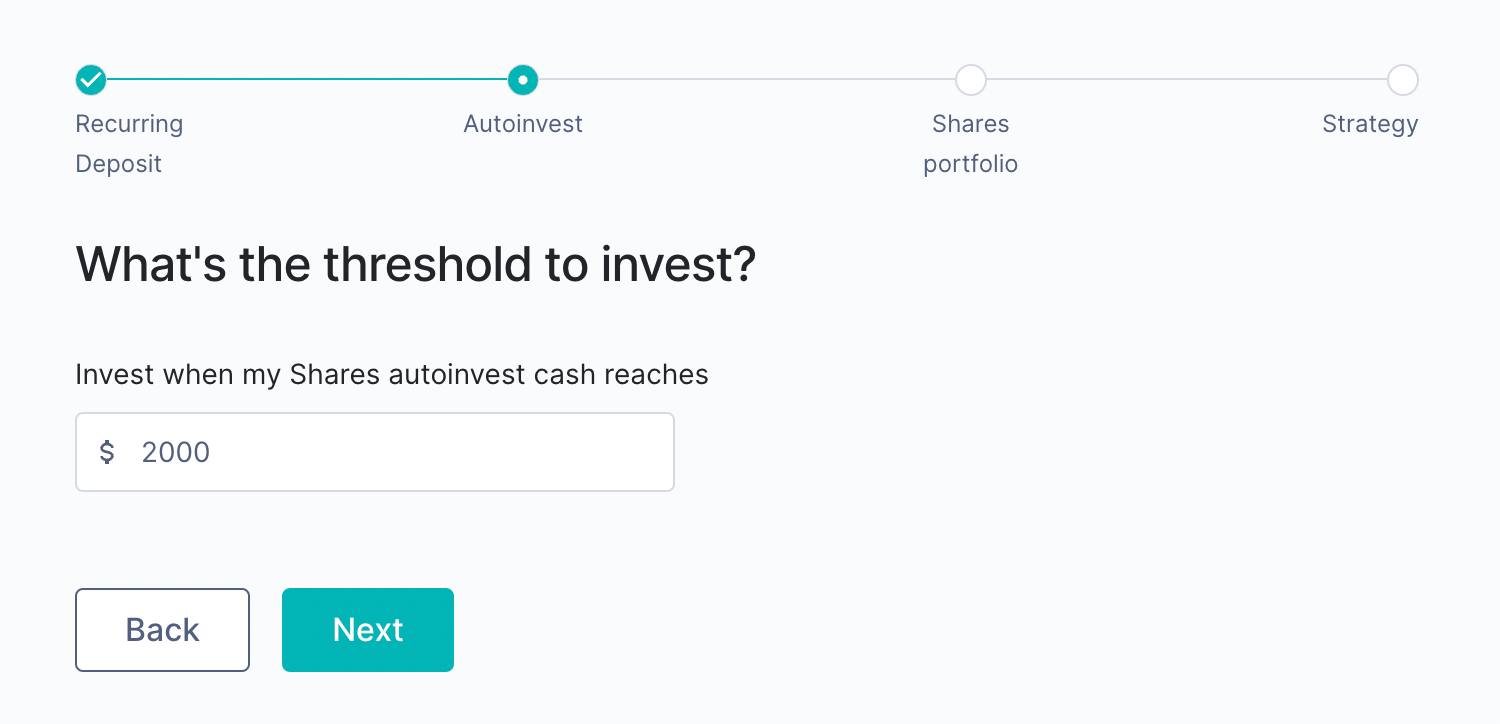

If you want to go deeper on the exact investment schedule you should set, check out our Optimal Investing Frequency Calculator.

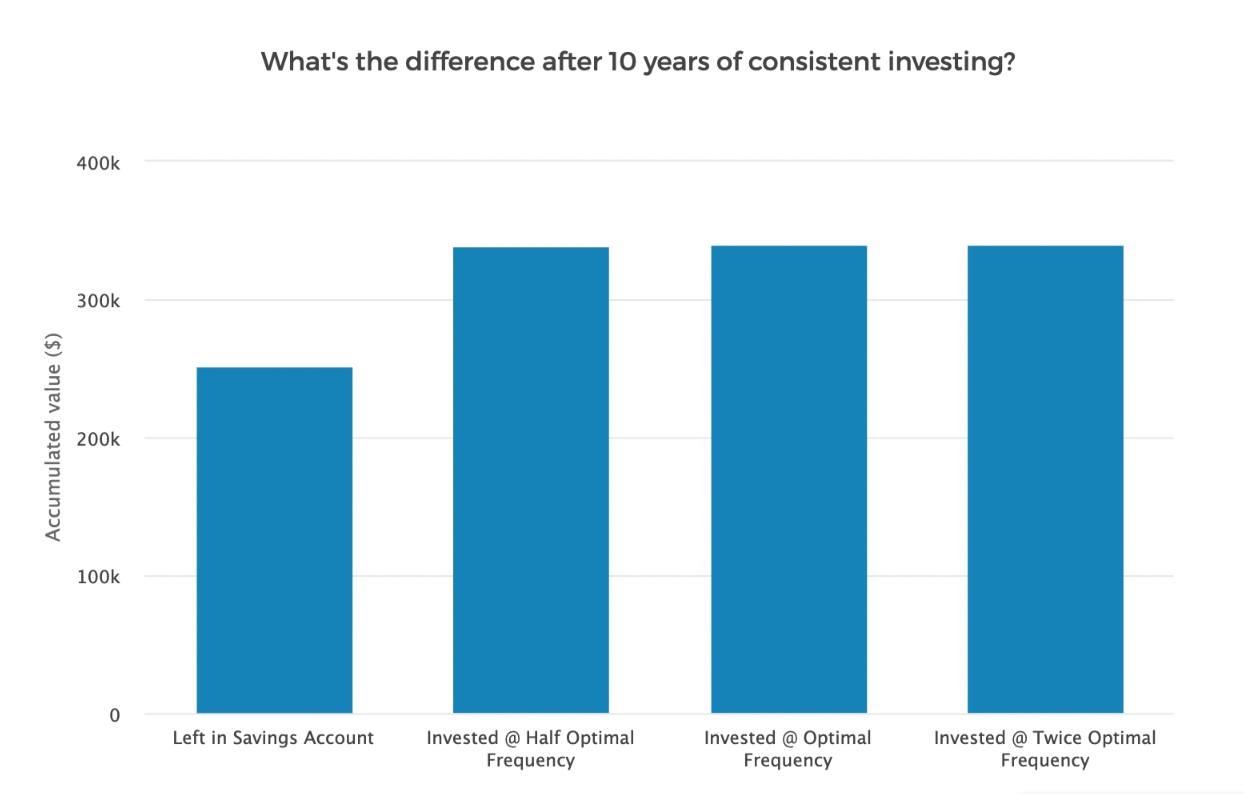

It’s worth noting that whether you invest half or twice as often as “optimal”, the difference is relatively small. In the example below, after 10 years of investing $2,000 every month, the difference is less than $1,000. The most important thing is actually investing your savings rather than leaving them in a savings account!

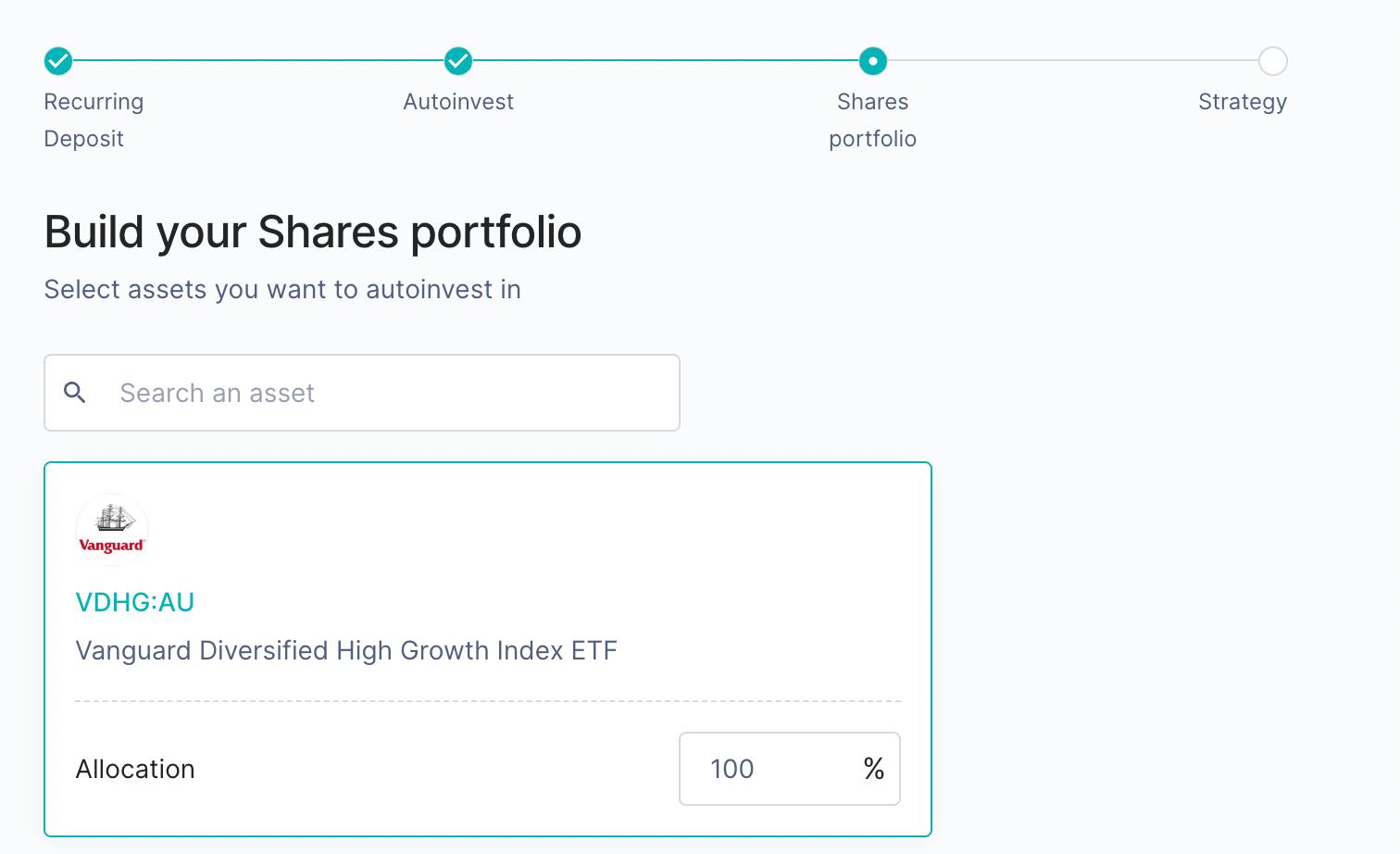

Secondly, double-check that your target portfolio is correct. Following the example above, we’ve chosen a single Diversified ETF, Vanguard Diversified High Growth Index ETF (ASX: VHDG).

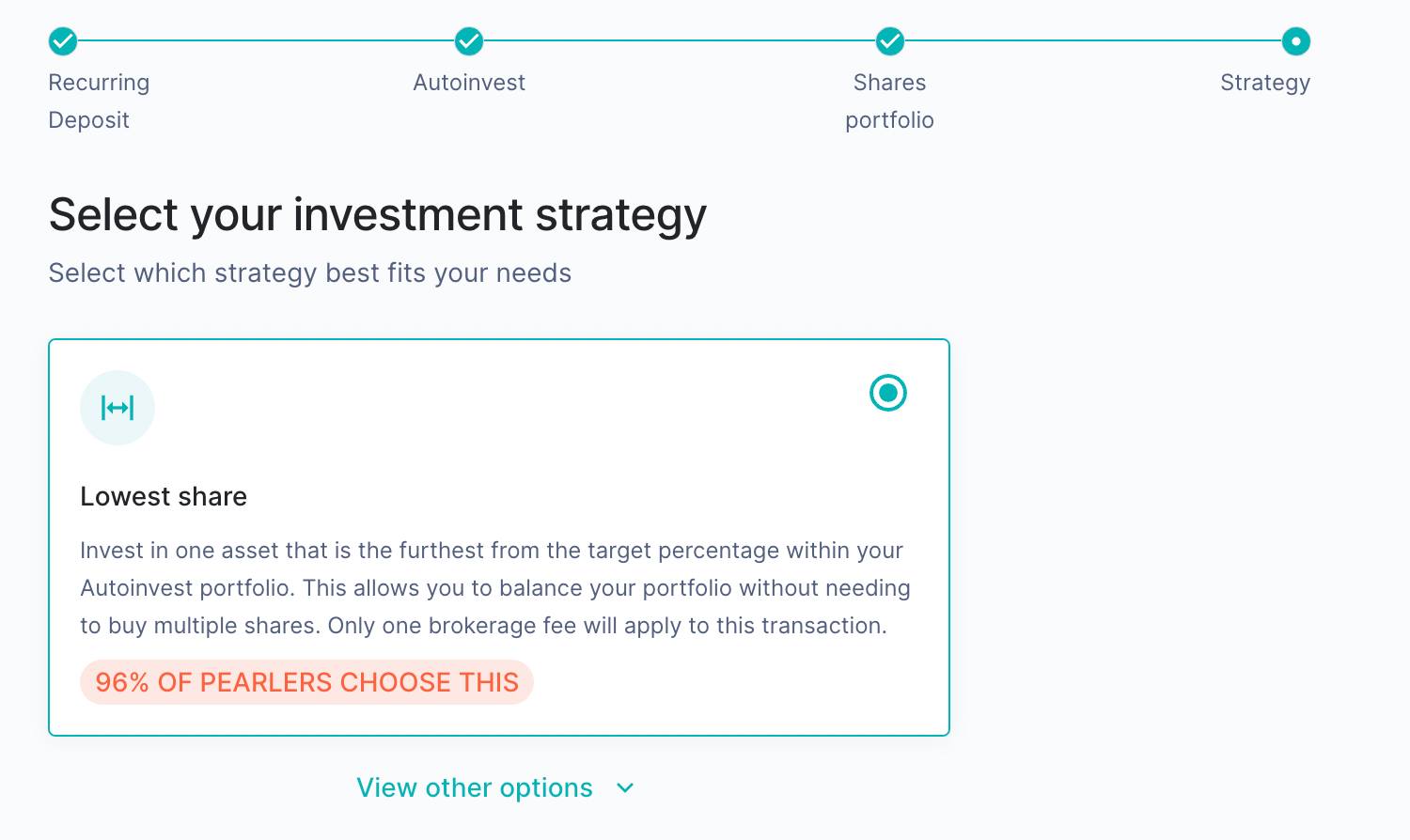

Thirdly, select your investment strategy. In this case, all strategies will result in the same outcome because we’re only investing in one asset. For multiple-asset portfolios the “lowest share” strategy is the most popular because it’s most cost efficient.

Then click "Review" and you’re good to go!

Add a financial independence goal

Having a long-term financial independence number that you track progress towards is fun too. Let’s be honest: it’s what all of us who are pursuing FI are really chasing. And this is why we’ve added the ability to track your progress towards it in Pearler.

Just be aware that you’re going to need to be flexible on your timeline. Even if you do everything perfectly, market returns change.

Sometimes this means you’ll achieve your financial independence number earlier, and other times this means you’ll hit it later. Either way, don’t stress - what really matters is you’re consistently investing, whether that be every week, fortnight, month, or quarter.

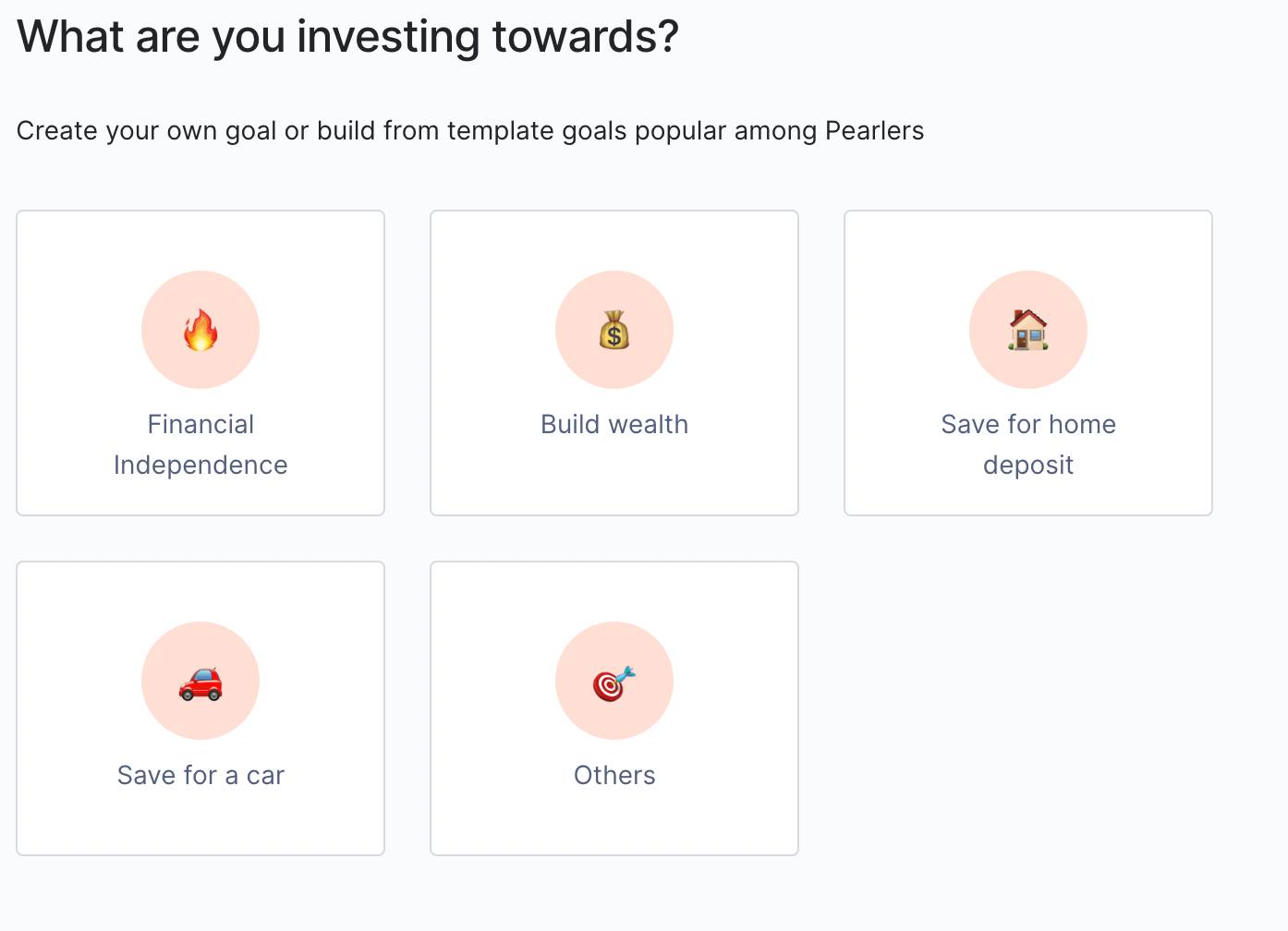

Simply head over to the Goals.

From there, you can set up your goal. Feel free to select an estimated completion date, but also feel free to not either! As above, it’s important to be flexible around when you hit this goal because you can’t control the short-term movements of the sharemarket.

Once you click “Save”, a tile will appear on your Pearler Dashboard. You’ll then be able to track progress towards your high-level financial independence goal each time you log in.

Wrapping up

We’ve now covered the highlight reel on financial independence and how you can achieve it with Pearler.

If you want to dig deeper, we’ve created an eBook that is the ultimate guide to financial independence for Australians. It’s called Aussie FIRE, here’s a link to the introduction (scroll to the bottom to download).

But the truth is that you don’t need to be a personal finance expert to achieve financial independence. You just need a solid foundation (no bad debt and regular savings), and then to invest your savings with consistency and patience.

If you talk to anyone who’s been investing to achieve financial independence for two years or more, they’ll tell you that the most important keys to achieving financial independence are consistency and patience. Automate wherever possible, and your life will be easier.