You’re investing for the long term. You’ve got your head around

dollar-cost averaging

. And you’ve automated your investing strategy. You’re nailing it.

But there’s one thing that’s spoiling your perfectly automated system.

Dividends.

They get paid and then they don’t feed directly into the automated investing strategy you’ve set up, for one reason or another.

This article is here to help you fix that.

Ultimately, you have two options:

- Set up Dividend Reinvestment Plans through your share registry

- Set up an investment automation with your broker for dividends

We dive into each approach and their pros & cons below.

What are dividend reinvestment plans?

A Dividend Reinvestment Plan (DRP) exchanges your dividends for additional shares when dividends are paid. This gives you additional shares on payment, typically with no brokerage cost and sometimes at a discount. It’s a convenient way to automatically accelerate investment compounding if ever and whenever dividends are paid.

Here's how the process generally works:

1. Dividend payment:

When a company declares a dividend, you have the option to receive the dividend in cash or to reinvest it through the DRP. If you opt for the DRP, the cash dividend is instead used to purchase additional shares in the company.

2. Automatic reinvestment:

Once enrolled in the DRP, the process becomes automatic. The company, share registry, or brokerage handling the DRP uses the dividend payment to buy new shares.

3. Purchase price and discounts:

The new shares are typically purchased at the market price around the time the dividend is paid. Some companies may offer shares at a discount, providing an added incentive to participate in the DRP. The discount rate, if offered, varies by company and is usually a small percentage.

4. No brokerage fees: One of the main benefits of DRPs is that they generally come with no brokerage fees or transaction costs, making it a cost-effective way to accumulate shares over time.

5. Tax considerations:

Dividends in Australia are taxable, and participating in a DRP does not change this. You must still declare the dividend income on your tax return, even though you did not receive the cash. If your investment is domiciled in Australia, you may receive

franking credits

with your dividends which can offset the tax liability. These credits are based on the tax already paid by the company and can reduce the overall tax payable by the shareholder. (

NOTE:

this information is general in nature, and doesn't take your circumstances into account. For personalised tax advice, speak to a registered tax accountant.)

6. Flexibility and control: You can choose to opt in or out of the DRP at any time. You can also decide to reinvest all or part of your dividends, providing flexibility to align your investment goals however you choose.

You can set up a DRP in two different ways. Let's dive into the different options.

How to set up a dividend reinvestment plan through a share registry

To set up dividend reinvestment plans you need to go to the organisation that manages the registry of shareholders for your investment, the share registry.

The registry has the following responsibilities:

- Recording changes in share ownership

- Issuing shareholding statements

- Manages dividend payments, bonuses, and rights issues.

You can identify the share registry for each of your investments on the ASX website by searching for your investment by code or name using the search bar. The Share registry information can then be found at the bottom-right of the page. The three main share registries in Australia are Computershare , Link Market Services and BoardRoom .

Alternatively, if you’re a Pearler investor you can find the responsible registry for a particular holding by clicking on it from your Dashboard under the Dividend reinvestment section as shown below.

You will need to do this for each of your investments. Whenever your investments have a different registry, you will need to create a new account and update your settings. If you only invest in ETFs of a specific ETF manager, all of their ETFs will typically be held with the same registry. Most registries allow you to set defaults and/or apply settings across all existing investments too. That way, if you have a relatively simple share portfolio, the process should be relatively straightforward to execute.

It may take up to 2 weeks for the initial investment into a new stock to be registered at the share registry level.

You can read more about share registries here:

What is a share registry and how do I find which one manages a company or ETF?

How to reinvest dividends using Pearler's automate feature

An investment automation is when you invest in a portfolio of one or more shares according to rules you’ve set. Many long-term brokers, such as Pearler, offer this.

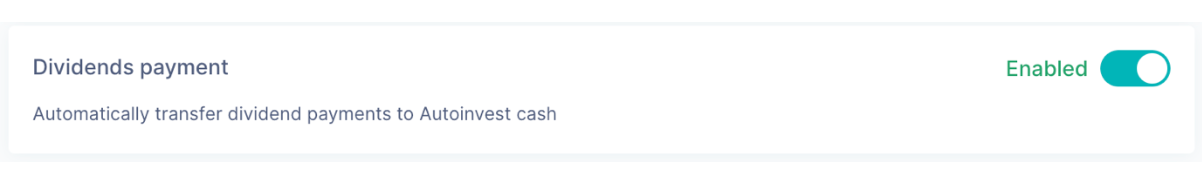

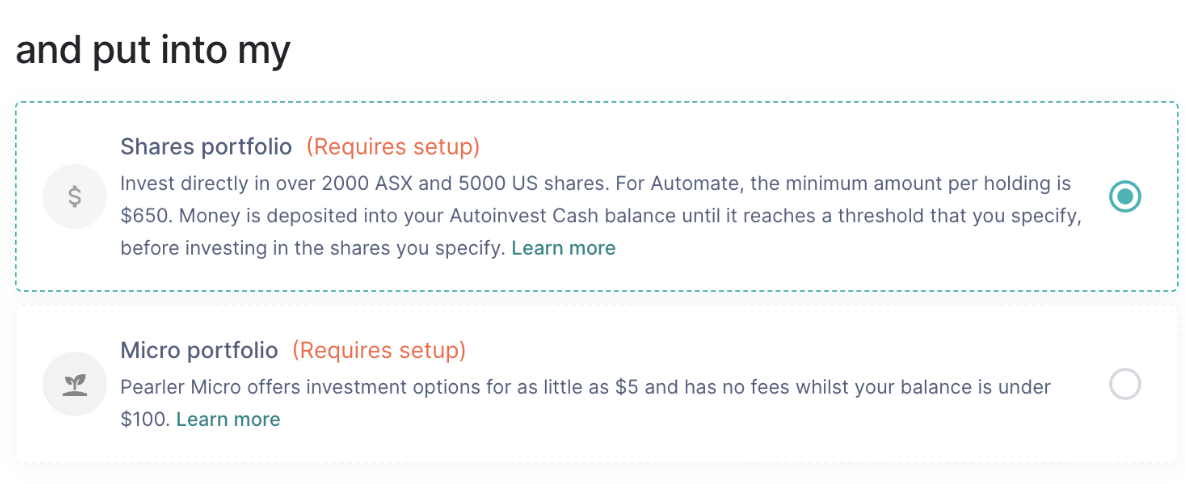

One of the ways you can reinvest your dividends is by having your dividend payments be paid into your Pearler AU cash account. Then, you can set an automatic transfer from the Pearler AU cash account to your Autoinvest cash account. Your Autoinvest cash account is money that will be used to automatically invest (or, in this case, reinvest your dividends) into the share or ETF that you nominate. You can do this via the Settings > Share settings and dividends page.

This works for all existing Pearler Shares Automations . The idea is that your dividends would be paid into your cash account, then included in your next automated investments.

To set up an automation to reinvest dividends, here is one approach you could potentially apply:

1. Select recurring deposits

: Choose an amount you are happy to deposit and the frequency at which you'd like to do so. You don't need to account for your dividends if you have turned on dividends payment, as they would automatically be transferred into your Autoinvest cash account.

2.

Select Threshold

Once your Autoinvest Shares Cash reaches the number you nominate, your cash will be invested (and your dividends reinvested).

For example, let's say you set up a threshold of $1000 to be invested, and you have a occurring deposit of $250 per week. If you have a total of $800 in dividends in your Autoinvest Shares Cash account, your money will be automatically invested in your chosen Shares portfolio.

3. Select Shares portfolio : Assuming you want to reinvest into the same assets that paid the dividends, you need to select the portfolio the dividends are being paid from, e.g. Shares

4. Select your portfolio: Choose your Automate target portfolio in the same percentages as you’d like to reinvest your dividends.

Note that Automate investment costs are the same as other brokerage transactions.

You can read more about investment automations here: Automate

Comparing the two approaches

Thinking critically about both ways to automatically reinvest dividends, the following three primary differences are the most important: cost, effort & flexibility.

Cost

Dividend Reinvestment Plans are cheaper than using an investment automation as they do not incur brokerage fees. However, if you want to have more flexibility in choosing what and when to reinvest your shares, the brokerage fees may be a small cost when it comes to choice.

Effort

Interfacing with share registries can be painful if you hold many shares and ETFs across various regestries. Otherwise, it can be much easier to set up an investment automation, particularly if you have investments across multiple registries, which allows you to track all of them in one place.

Flexibility

Dividend Reinvestment Plans invest the exact amount paid back into the investment that paid it. This can sometimes alter the desired balance of a portfolio and over-weight your investments in one share or ETF. Investment automations give you the option to reinvest dividends in your desired ETF or shares and adjust the percentage allocation as needed.

Summary

What you choose to do with your dividends is a personal choice, however it's worth noting that by reinvesting your dividends you are helping your investments compound. Regardless of if you choose to set up DRP through your share registry or reinvest your dividends through Pearler's automate feature really depends on your prefrences when it comes to simplicity, flexibility and cost..

g.

No matter which you choose, these decisions are not set in stone. It is relatively easy to stop or swap either automation at any time if your circumstances change or if you change your mind.

Happy investing!