It's been a huge year for Pearler's community of long term wealth builders. That's why we'd like to take a moment to reflect on their saving, planning, and investing habits over the past 12 months.

At Pearler, we're all about those FIRE (Financial Independence Retire Early) goals. We've also always argued that one of the key ways to reach FIRE is to form regular investing habits.

That's why we've classified your investing frequency by…fire types. Yes, we love finance jokes, memes, and puns.

As much as we celebrate regular investing, our community isn't in competition with anyone. So whether an investor is a Spark or a Bonfire, we're here to help.

This year, the news has buffeted us with warnings about market crashes. But in the face of this buffeting, our community have channeled a different Buffett (that would be Warren, and we promise that's our last finance joke) and kept investing.

As 2022 finishes, the buy-to-sell ratio within the Pearler community still sits at 90/10. Moreover, the number of investors applying the principles of dollar-cost averaging has remained steady.

Far from making news-provoked panic sells, the Pearler community are proving themselves to be steady-handed long term investors.

This is the type of behaviour you'd expect to see from time-tested market veterans, right? Not so fast…

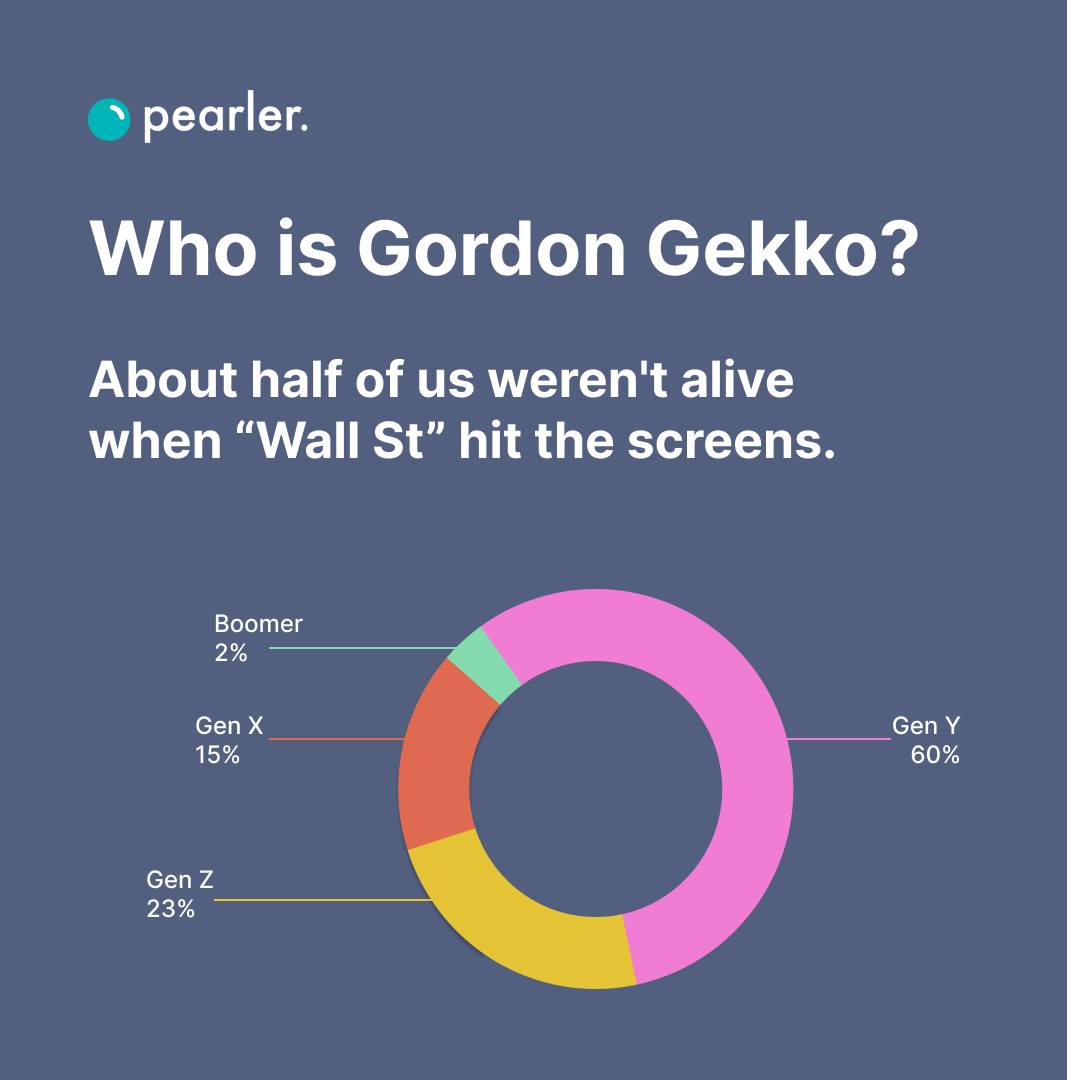

If you needed to google "Gordon Gekko" or "Wall St film", you're not alone. That's because over half of Pearler investors weren't old enough to watch an M-rated movie in the '80s.

We're super proud that - from Gen X to Gen Z - we're building something inclusive. We'll get to the Boomers eventually…if Facebook can, then we can too!

To keep the Wall St theme going, our community also isn't dominated by the stereotypical boys club of '80s high times.

They are part of a diverse group of people as unique as Australia - whether it's gender, income, or geography. But importantly, we all share a common idea of what sensible investing is.

By looking at these figures, we can learn that:

- a growing number of young Aussies care about financial independence

- that same group are forming habits that are conducive to long term investing, instead of speculative trading

- and they don't just invest when stocks are going up…

Pearler investors have kept a global perspective, and mainly use ASX listed ETFs to do it.

In fact, between global and US indexes, over half of our community's investments sit beyond our shores.

And one of our favourite stats is that a whopping 86% of us invest ONLY in Aussie and US ETFs and LICs. Who said diversification was out of style?

That said, we're proud that 14% is invested directly into Aussie and US listed stocks. As much as we celebrate ETFs, there is no one right way to compose your portfolio.

From looking at the data, though, it's clear to see they aren't putting all their eggs in one basket (or their friend's hot stock tip).

We've covered the "what" and the "when", but the most important is the "how". The majority of Pearler's community make a habit of regularly depositing into their Pearler accounts. In doing so, they ensure their investing is proactive, rather than reactive.

In terms of frequent habits, it doesn't stop with depositing. No fewer than 52% of Pearler investors are autoinvesting through the holiday season. This is despite the costs of holiday gifts, family trips, and gestures around life in 2022.

It goes to show that while the Pearler community are diverse, they're united in their focus on long term investing.

Are you a Pearler investor? Check out your personal Year in Review below!