Two out of three Sydney residents think renting is dead money, but over 60 percent of Sydney home buyers would have been better off investing their money in the share market and renting their home over the past 25 years EY’s Safe as Houses Report shows. This is before accounting for the recent 14 percent fall in Sydney house prices (with a total drop of 25 percent expected).

Perhaps it’s time to re-think the Australian Dream. Now let's dive into why you might want to reconsider buying property, specifically:

- The details

- The results

- Kicker #1: Buying property has significantly more timing risk

- Kicker #2: Australian homes will not continue to perform as well

- Kicker #3: Saving a deposit takes a stupidly long time to accumulate

- Kicker #4: Buying shares is significantly more diversified

- It's OK to buy a house!

- So, how can you actually invest like this?

- My biggest hope?

The details

EY compared how much it would cost someone to buy and pay off an average house in each suburb of Sydney versus renting that same house in which the money used for the deposit and mortgage payments is invested in Australia’s share market between 1994 and 2017.

Or, as EY said it:

In our model we gave two home seekers the same starting capital, equal to 20% of the average unit price at the time. One invested in homeownership (taking out an 80 per cent loan-to-value ratio (LVR) for a unit). The other rented a similar dwelling in the same location and instead purchased an ASX200 index fund (purchased with a margin loan at 50 per cent LVR). The renter then continued to place the ongoing savings in housing costs compared to the buyer (i.e. the difference between the rent and the sum of interest, principal, and other housing costs the buyer faced) in the ASX200 (including dividends). We then compare the performance of their combined housing and investment choices over time. We then analyse the net wealth position of the joint investment and housing strategies for the two individuals 10 years later, comparing 43 local government areas in Sydney between 1994 and 2017.

The results

62 percent of the time renters outperformed buyers.

Or, as EY said it:

We found that in 62 percent of each equivalent 10-year comparison, people were better off renting and maintaining a leveraged investment in the ASX200, compared to owning a unit in the same area. It is important to note, that in this model the renter is taking on a risk profile that is perhaps higher than most are likely to take and put in place a savings framework that is more stringent that most would want. When we remove the ability for the lender to be able to leverage their ASX200 investment, the results shift in favour of the homeowner.

Kicker #1: Buying property has significantly more timing risk

When buying property, prices are ‘locked in’ at the agreed price tag. Whether the market is at a peak or a trough (and you can never really know), that is how much you end up paying. End of story.

Since share market prices fluctuate, you actually end up buying more shares when the market is low and less when the market is high (because you are investing the same dollar amount every month). In the investing world, this concept is known as Dollar-Cost Averaging.

This means that the worst-case scenario of investing in property at the wrong time tends to result in far worse outcomes than investing in shares at the wrong time, as is highlighted in this report:

While homebuyers in Woollahra buying in 2007 and selling in 2017 yielded biggest gains to buyers, coming out $303,771 ahead of renters. Those who bought in 1998 and sold in 2008, lost out to renting by a whopping $608,032.

The same story holds for other suburbs, take Mosman, a home buyer in 2007 would have ended up $275,924 better off than a renter making a leveraged investment in the share market. At the same time, a 1998 apartment buyer, in 2008 would have been $460,585 behind their renting peers.

The story also holds true in suburbs such as Marrickville. A suburb in which over our appraisal period the buyer has done particularly well, especially the 2007 buyer — who was more than 200k better off than their renting counterpart. However, a 2004 buyer, selling in 2014 was still $115,396 worse off than a renter, while maintaining a leveraged position in the share market.

Most people will be surprised to hear (and possibly won’t believe) that investing in the share market can be less risky than investing in property. Let me be clear — fluctuations only benefit investors when they adhere to a strict investment plan, like that of a mortgage. The issue is, far too few people invest like this.

Kicker #2: Australian homes will not continue to perform as well

Over the analysis period (1994–2017) returns from Australian homes were amongst the highest in the world, as shown in the chart below. Returns well above global averages (and advanced economy averages) are unsustainable over the long term and I think future studies will show that it is even more favourable to rent than buy.

Keep in mind that since this study ended in 2017 Australian property prices have fallen by 14% in Sydney (and a total drop of 25% is expected)]. If this study encompassed 2018 and 2019, I think the comparison would be fairer.

Kicker #3: Saving a deposit takes a stupidly long time to accumulate

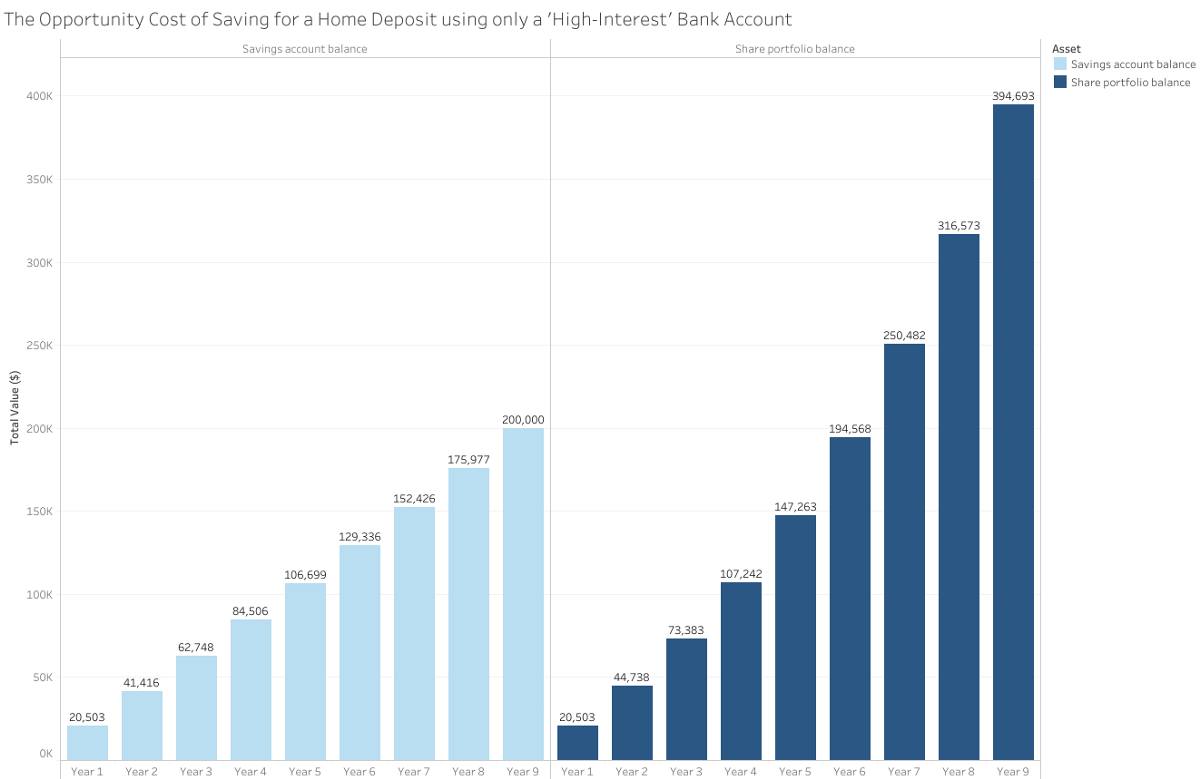

While the housing market has cooled significantly, affordability is still at an all-time low — the average house in Sydney costs 10.9 times the average NSW income. These house prices mean the buyer of an average Sydney home needs to save for over 9 years, or 7 years for those buying an apartment, to make the 20 percent deposit required by most banks. On the other hand, to start investing in shares, the minimum requirements are negligible (from $0 — $500 on most platforms).

So, while new entrants from the housing market are locked out, how far ahead do early share investors get?

Well, a median home in Sydney costs ~$1 million. To save a $200,000 deposit in 9 years using the typical savings account approach, we need ~$20,500 per year (assuming 2% p.a. interest). What if these savings were invested in shares instead?

By the time the new homeowner buys their property after 9 years of saving in a bank, the non-homeowner has a ‘starting’ investment amount that’s roughly twice as large ($395,000 vs $200,000). Or, if someone wanted to buy a home, they could also use the sharemarket as a tool to save the deposit faster. As shown, savings accounts would take ~3 years more to accumulate the $200,000 deposit than investing in the share market.

Kicker #4: Buying shares is significantly more diversified

Lastly, this analysis assumed that homebuyers secured average prices within each suburb. But when it comes to the sharemarket, investors have the benefit of being able to invest across the whole market, homebuyers don’t have this luxury. Home buyers must choose single houses and the truth is, we are about as good at picking houses in a suburb as they are backing horses, throwing darts, or picking stocks (spoiler: we suck — leave it to the professionals).

It’s OK to buy a house!

Owning a house gives much more value than financial return. Stability, security, a sense of achievement, and somewhere to call home. Our home is our Castle, after all…

Just don’t use ‘financial return’ or ‘making money’ as the main reason to justify buying a house, please!

So, how can you actually invest like this?

You might’ve realised that this study modelled investing in an ASX200 index fund purchased with a margin loan at 50 percent LVR. What this means in simple terms is, to get these returns you need to borrow money to invest in shares just like you do when you buy a house.

While it is relatively easy for retail investors to find and invest in an ASX200 index fund, investing with a 50 percent LVR (or any type of LVR) is much more difficult to do.

In my next blog I’m going to dig into the available options to highlight the pros and cons of what’s in the market today. I’m planning on covering:

- Purchasing index funds with a margin loan (as used in this study)

- Purchasing internally geared ETFs (like Betashares’ GEAR)

- Using loan-to-invest products (like NAB’s Equity Builder)

- Any other leveraged investment product that I come across in the discovery process

My biggest hope?

That everyday Aussies start challenging Australia’s biggest myth and realise that everyone doesn’t need to aspire to buy property. Property is not always a great investment, and, in fact, shares are usually better.

With the myth of financial returns out of the way, I hope Australians start to feel more empowered to not even aspire to own a home if they don’t want to.

This would give us the power to weigh up the mobility benefits of renting vs the stability benefits of buying with a clearer perspective on what matters. It might also change what we perceive as affordable and help reduce the significant mortgage stress that many Australians feel today.

So, you do you. It’s time to dream anew.

Happy FI-ing,

Kurt.

At Pearler, we pride ourselves on the quality of the general financial advice we give. Please note though, that this advice has not been tailored for you. You have unique financial goals, circumstances and needs which may make this advice inappropriate, and it is important that you know whether it applies to you. If you are unsure we urge you to speak to someone you trust who is competent with money and understands your individual needs, whether they be a trusted friend or accredited professional.