According to Pearler's Financial Year in Review, I'm a flat white drinker (note: I do prefer Soy, but that wasn't on the menu).

I'm amongst the 20% of Pearler investors who check their investment portfolio less than 5 times per month. "You're chill about checking your portfolio", it says.

To be clear, I feel like the past six months have been anything but chill. To say it hasn't been an easy year for a lot of investors would be an understatement.

The ASX 200 (Aussie shares) and S&P 500 (US / global shares) have been really volatile in 2022. The "fear index", which tracks the sentiment of investors, seems to be stuck on "extreme fear". Uh-oh…

For many of us, I imagine this is the first period of real volatility you have experienced. So checking your portfolio every day (which 30% or more of us do) is to be expected.

How often should I check in?

Two questions I got from a Rask member recently were "How often does the share market fall like this?" followed by "How many of these events turn into bear markets?"

There's a rough rule of thumb that the stock market 'corrects' (i.e. a 10% fall) once every year, and once in every five years, it falls 20% or more (i.e. a bear market).

So, basically, if I plan to be a long-term investor, crashes are to be expected.

What I learned early in my investing journey was that checking my portfolio, or the price of my favourite stock in Google, didn't make a difference.

No matter how many times I logged in, searched for my stock ticker code in Google Finance, or refreshed my browser - nothing changed.

Huh.

While it sounds obvious -- after all, why would anyone but Aussie Broadband care about my constant browser refreshing? -- it's much harder than it sounds to tune out of the noise when your hard-earned money is on the line.

Due to a bias known as loss aversion, we feel the pain of loss twice as much as the joy of gain. Then we have the flight, fight or freeze mentality. And sure enough, each day the news serves us up a fresh dose of confirmation bias with its negative headlines. And recency bias - watching a stock price fall over weeks or months - adds "proof" that "the stock market is like gambling".

Right?

After a few painful years of 'trial by fire', I began to realise all of these 'things' were working against my long-term financial goals. They were causing me to over-trade, invest too much at the wrong times, and give me false confidence.

What can be automated, will be automated

Eventually, this led me to discover that one of the best things I could do for my future self was to automate the things that are good for my goals and add friction to the things that detract from my goals.

Much like Apple Pay on my Watch, it makes life easier to have a brokerage app on my phone. However, that would only increase my desire to trade shares or ETFs more often. So, I deleted the brokerage app.

I also deleted any sports betting and shopping apps, and disabled notifications in my iPhone settings (this has many other benefits besides giving us traction towards our investing goals).

Bye-bye, distraction. Hello, traction…

Conversely, I wanted to make the good things easier. I wanted to put a rocket under the tools and strategies that helped me build my wealth consistently because I knew from school (and Albert Einstein's famous quote about the eighth wonder of the world) that compounding is the easiest way to get rich. But it takes 10-20 years to kick in, which seems like an eternity when the headline writers are screaming at us to "sell now".

This is why I think Autoinvest from Pearler is a literal "no-brainer". Including Pearler Micro (which I can only guess would bring down the average), a typical monthly deposit by Pearler investors is around $603.

This is a great achievement because it tells me investors are prioritising saving to invest, regardless of what the market is doing. My guess is the automation feature nudges them to look past the short-term pain.

For example, if you asked me to "save and invest $600 a month when the stock market is falling" I'd probably put every mental block in front of the idea I could. "I don't like saving", "it seems like a lot of money", "but I heard the stock market is about to fall"… and so on.

Automating something that seems hard -- but I know is important to my financial goals -- would make the task so much easier.

"99% of long-term investing is doing nothing; the other 1% changes your life" - Morgan Housel

The reality is the finance industry is also a stitch-up. And we're the patsy at the poker table.

"Don't just stand there, do something!" scream the headlines at the most trusted news outlets. But here's another cold, hard reality: in general, the less you do, the more you get.

When I worked for Australia's top investment research firm, we found that the professional investors who made fewer investment decisions did better. I think that comes down to the quality of their decision-making. Warren Buffett says we should treat investing as if we could only make 20 investment decisions in our life.

Then there is research that shows investors in managed funds underperform the funds they're invested in because they buy and sell at the wrong times. That can only be explained by their behaviour.

And finally, while it may be equal part furphy and fact, there's a famous study from the USA which found the best-performing investor accounts were held by those who were dead (because they couldn't trade!). So much for timing the market.

Little bits, lots of times

My Australian Finance Podcast co-host, Kate Campbell, and I are huge fans of saying "little bits, lots of times". This is because good investing is all about forming good habits with money. Whether it's budgeting or investing, studies show it might only take eight weeks for the behaviour to become automatic.

But you can hack yourself by automating just about everything. You can start where your money touches down: your bank account.

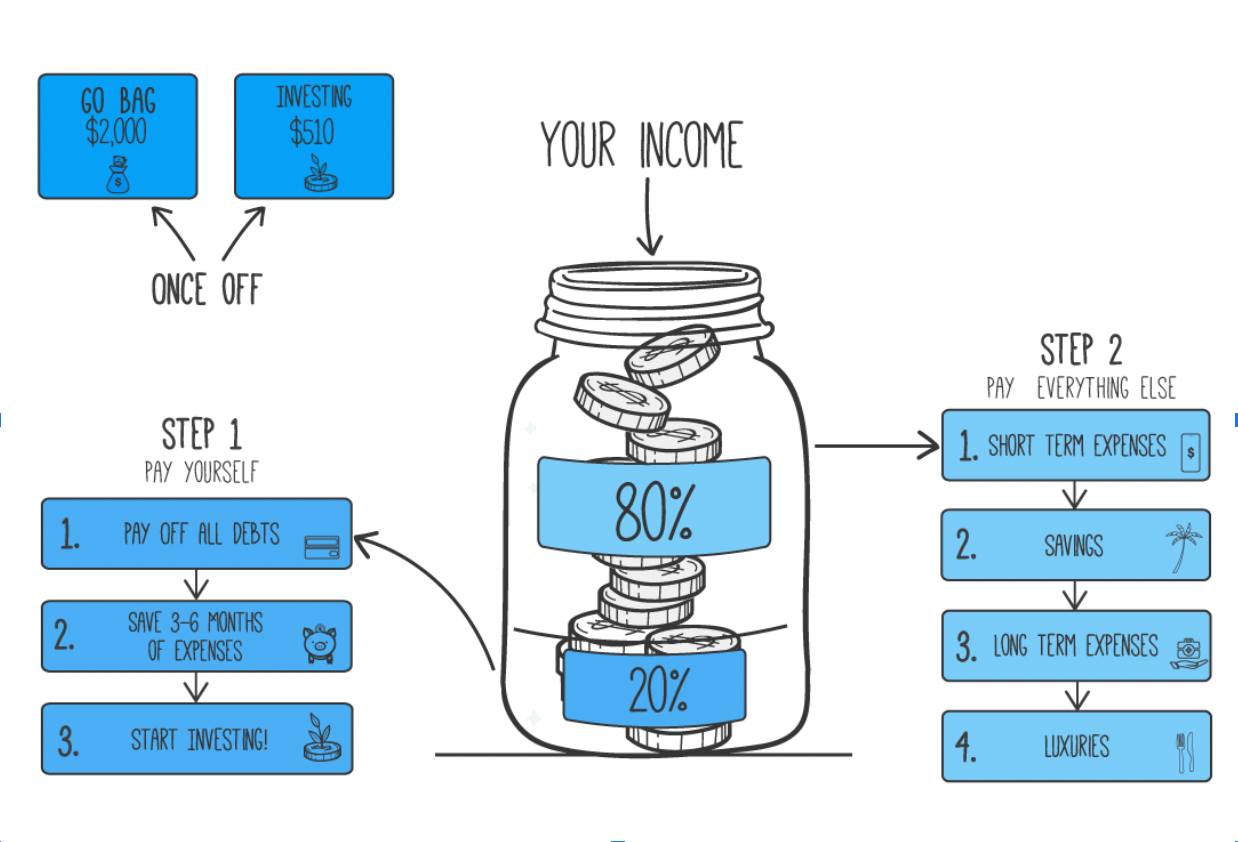

Your bank account makes automation very easy. For example, you could go into the transfers tab of your bank's online portal and create an automation to FIRE inside your bank account every time you get paid. Feel free to use the Rask budget, shown above, as your starting point. From there, make your investing goal a priority and see if you too can reach a $600 monthly target. If you can't save that amount of money, don't sweat it! You can start with a few dollars every month and build your way up. You got this.

5 Key lessons for the new financial year

There's been a lot of ups and downs for investors this past year. But right now is as good a time as any to get started (or keep) investing. With a few simple hacks, dollar-cost averaging has never looked so good.

From here, I truly believe the investors who will be the most successful over the next five years will be those who follow some simple steps.

You will:

1) Automate your regular contributions (it doesn't matter if it's money into Super via Bpay, a house deposit in a high-interest savings account, and/or a brokerage account filled with ETFs and shares);

2) Understand that your greatest advantage as an investor is in understanding your behaviour (The Psychology of Money by Morgan Housel is brilliant);

3) Maintain a diversified but low-cost portfolio, spread across Aussie & global shares, plus some bonds and a healthy splash of cash emergencies;

4) Never invest money in the stock market that you may need in the next 3-5 years (e.g. for a holiday, house deposit, or new car), and

5) Write down your long-term financial goal and stick to it.

After a decade of educating people on money and investing, I've realised that I'm paid a yearly salary to say the same thing 365 different ways -- because the core principles of building wealth never change.

After all, the entire personal finance industry is built on one book written 96 years ago.

Owen Raszkiewicz is the Founder of Rask, a platform helping Aussies invest better. You can free course on Rask Education, or follow Owen on Pearler Profiles, Twitter and Instagram.

This article contains general financial information only, issued by The Rask Group Pty Ltd. The information does not take into account your needs, goals, or objectives, so please speak to a financial adviser before acting on the information. Pearler is a long-term sponsor of Rask's Australian Finance Podcast.