NOTE from Pearler: we do our best to share general resources so you can do your own research. When it comes to tax, this is personal to your investing and financial position. We are not a tax advisor, and don't have any information about your personal situation. When investing, there may be tax implications and you should get advice from a licensed tax adviser.

The shine is coming off the sharemarket this year. After a long period of outperformance, global shares (US in particular) are wobbling a bit more than our local companies.

This can cause new share investors to question whether their portfolio is right for the current environment. Does it make sense to own more Aussie shares? Why are so-called ‘growth stocks’ struggling so badly? And should any of this change how we think about diversification?

In this article, we highlight some things to consider around these questions and more. And just so you know, we’ll use the term US shares and global shares interchangeably, given US shares represent a huge portion of global markets.

To be clear, we’re not giving you instructions here. We’re merely sharing insights from our community for the purpose of discussion and, of course, entertainment.

In the Australian Shares vs US Shares debate, Australia is outperforming

As of EOFY 2022, Aussie and US shares have performed as follows:

- Australian shares: -1.6%

- Global shares: -12%

Source: Vanguard. Total returns including dividends, but not including franking credits.

What would cause global shares to start lagging behind Australia? There are a few reasons.

Higher growth companies (like technology), of which the US has plenty, tend to fare worse when inflation and interest rates are higher. That’s because growth stocks are valued more for their future earnings potential, as opposed to their current profits.

Why does this matter? Well, inflation reduces the value of those future earnings. That means those future dollars aren’t worth as much, and therefore, neither is the company. Higher interest rates also make investments which produce greater cashflow today more attractive in comparison.

Aussie shares, on the other hand, tend to be more populated by slower growing, ‘value’ style companies. These are typically companies which produce decent profits, yet their earnings are unlikely to experience strong future growth. Think banks, retailers, infrastructure, manufacturing, real estate.

You could think of the growth/value difference this way: some companies make pretty good money now, while others seem likely to make lots of money later. Just to be clear, both Aussie and global markets contain a mixture of growth and value stocks - so it’s really a spectrum rather than an either/or situation.

By owning a broad market index fund, an investor can own some of each. Not only does this help average out performance over time, it should also reduce the urge to jump from one style to another.

Companies and valuations

It’s the kind of environment where mining and energy companies are doing well. High demand for commodities and energy prices have helped companies in these industries make solid profits in recent times.

In addition, US shares have been trading at more expensive levels than elsewhere (as measured by lots of metrics including the price-to-earnings ratio) for close to a decade now. It’s possible prices simply got too high and reached unjustified levels for many companies.

It’s worth pointing out that share prices often increase in anticipation of improved future results. In this way, the market is always bringing the future forward, on the upside and downside. So when there’s a whiff of the future being different, prices can move rapidly.

Remember when markets were increasing during our covid-induced recession of 2020? It seemed to make no sense at the time, but the market turned out to be exactly right about the economic rebound.

It’s reasonable that markets may simply be ‘re-rating’ to lower levels given we now have higher interest rates on offer elsewhere, making stocks less attractive. While that hurts as it’s happening, it lets us buy-in at cheaper prices and higher dividend yields, giving us better future returns on each new investment.

Now that we understand what’s happening and the likely reasons why, that leaves us with the following question.

Should any of this change how we invest?

A better question to ask may be: “How long am I investing for?” After all, Aussie shares may continue outperforming for the next five years, or not. If you’re investing for the long term, then, one can make the argument that your approach doesn’t need to change.

By the way, if you’re freaking out about the recent falls, you may need to reconsider what you’re invested in and how much risk you are comfortable with.

For long term investors, the current situation is a good reminder of a few things:

- Market environments can change quickly, from optimistic to pessimistic

- Easy gains don’t last forever (like the speculative mania of 2020-21)

- Diversification is helpful

- A long term perspective is crucial

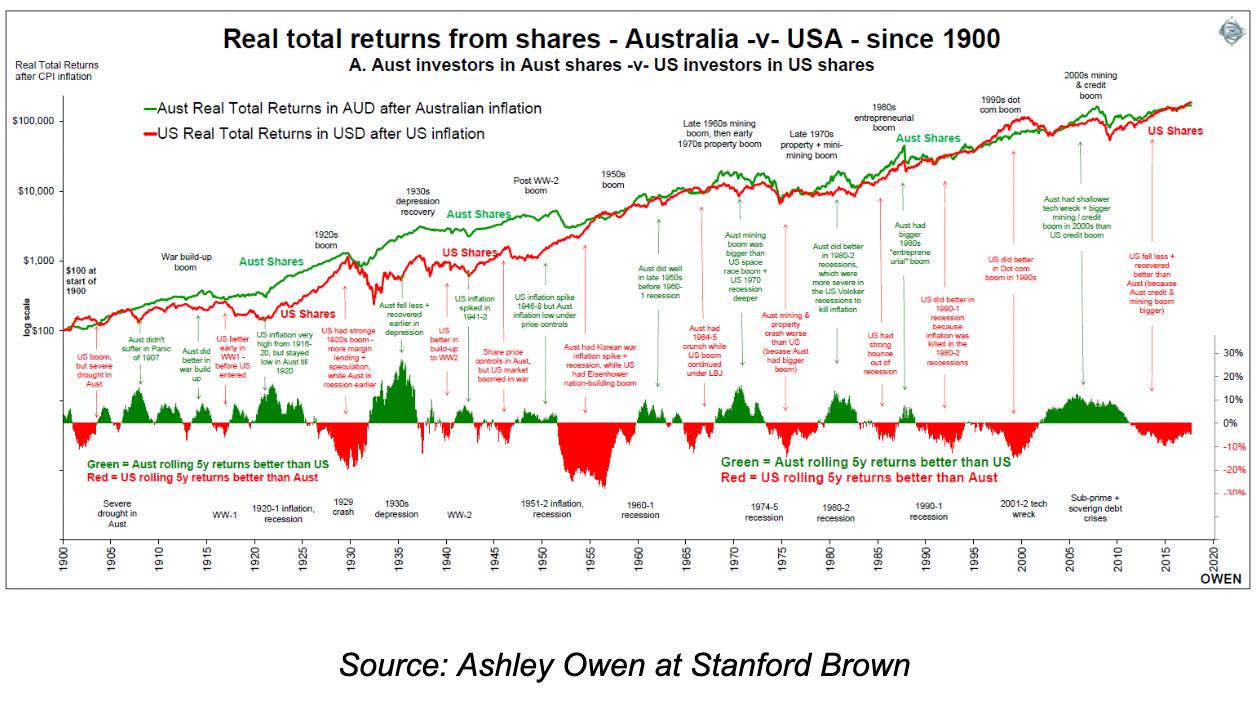

Speaking of long term, let’s zoom out and compare Australian shares and US shares from a broader scale.

As the chart shows, since 1900 Aussie and US shares have produced near-identical returns after inflation. The red and green shading indicates each market outperforming one another at various times.

While this chart is a fascinating look into the last 120 years, there’s no guarantee this process (or these returns) will be repeated into the future. As we’ve seen during the last 3 years, all sorts of crazy and unexpected things can happen in a short space of time.

That’s precisely why diversification is useful. Having exposure to different companies, sectors and even countries, helps us avoid a poor long term outcome by not betting on one thing in particular.

Having said that, even with a diversified share portfolio, we are still making one specific bet: that the global economy will expand over the next 50 years, company profits will grow larger, and humans will continue innovating and becoming more efficient.

After all, that’s what leads to a higher sharemarket over time, and what enables companies to pay increasing dividends to shareholders (and higher wages to employees too!).

Australian Shares vs US Shares: Mix & match

We could debate which market is better. We could even get clever and try to predict what country will perform best in the future based on a variety of factors. But US and Aussie shares will serve us better as friends than competitors - portfolio pals if you will.

The two markets actually compliment each other well. We can see this by comparing the sector breakdown of Aussie shares and global shares.

As you can see, Aussie shares are heavier in financials and materials (for us, that mostly means mining). Global shares, on the other hand, have far more technology companies, along with larger weightings to consumer and healthcare stocks. If we blend the two together, we get the following…

- Financials: 20.7%

- Materials: 14.6%

- Info Tech: 12.8%

- Health Care: 11.3%

- Cons Discretionary: 9%

- Industrials: 8%

- Cons Staples: 6.4%

- Real Estate: 5%

- Energy: 4.3%

- Utilities: 2.3%

Obviously, these numbers change depending on what’s performing well. But this blended breakdown is more balanced than either market by itself.

When combined, there is only one sector larger than 20%, compared to three when viewed separately. Blending the two also results in only sectors with less than a 5% weighting, compared to four ((VGS)) and five ((VAS)) on their own.

Another way Aussie and global shares complement one another is they have different return profiles. Australian shares produce higher dividend income, while global shares typically produce higher capital growth. That’s because our tax system favours the payment of dividends, whereas overseas it’s more efficient to return capital to shareholders by buying back shares.

By owning both, an investor can benefit from the advantages of each.

Final thoughts

Aussie and US shares make quite an attractive couple, each with their own unique characteristics.

Regardless of which is performing better at the time, maintaining a set allocation is usually the simpler, more sensible and less stressful approach. Compared to what? Well, changing our minds every six months based on recent performance or, even worse, ‘expert’ opinions!

We wrote this article because of the understandable questions we’ve received from new investors recently. But when we step back and consider the current situation from a bigger perspective, we see that it’s all a normal and healthy part of the cycle.

The details change, but the overall pattern is the same, leaving many experienced investors rolling their eyes with boredom.

The other group of long term investors - the boring accumulators and wealth builders - can lick their lips at the chance to scoop up extra shares at cheaper prices than before. And that’s exactly how it should be.

Thanks for reading, and happy investing!