Exchange-traded funds (ETFs) can be a fantastic investment category. They typically offer low cost, high diversification, and low effort. They also make it easy and accessible to invest.

For this reason, more and more Australians are choosing to invest in them. In fact, this past year has seen a record level of investment flowing into ETFs - despite the share market volatility. But how to choose the right ETF for you?

As with all investments, it depends on your circumstances. However, specific ETF types tend to typically complement a specific set of investment circumstances. Additionally, once you have chosen an ETF type you’d like to invest in, there are clear criteria you can use to make the decision between two ETFs of the same type.

What are the types of ETFs?

ETFs are typically passive and split by asset class and/or geography. For example, there are ETFs that only invest in a specific set of companies, loans, or commodities. Similarly, there are ETFs that only invest in a specific country or region.

Additionally, there are “diversified” and “target-date” ETFs. Diversified ETFs contain multiple ETFs that are split by asset class and geography to form a complete portfolio within one ETF. Target-date ETFs do the same thing, however their percentage split between underlying ETFs is systematically changed over time. This provides a diversified investment portfolio that becomes more conservative as the target date approaches.

Finally, “active”, “thematic”, and “synthetic” ETFs also exist. These three categories typically don’t follow the standard low-cost, high-diversification principles of the other ETF categories, so be wary of that. Usually, investors who invest in these have an investing thesis. This could be: "the manager of this fund is brilliant", "this industry is going to triple in size", or "the market is going to crash, and I want to bet against it".

Passive (asset class &/or geography) ETFs

These are ETFs that invest in a certain asset class and/or geography profile. It's these ETFs that built the reputation for this investment category: high diversification and low cost.

Some passive ETFs focus on a specific asset class. For example, there are ETFs that only invest in commodities, companies, or loans.

Other passive ETFs focus on a specific geography. For example, there are ETFs that only invest in a specific nation.

And then there are ETFs that focus on a specific asset within a specific geography. For example, you can invest in Australian Bonds, Global Shares, Physical Gold, and more.

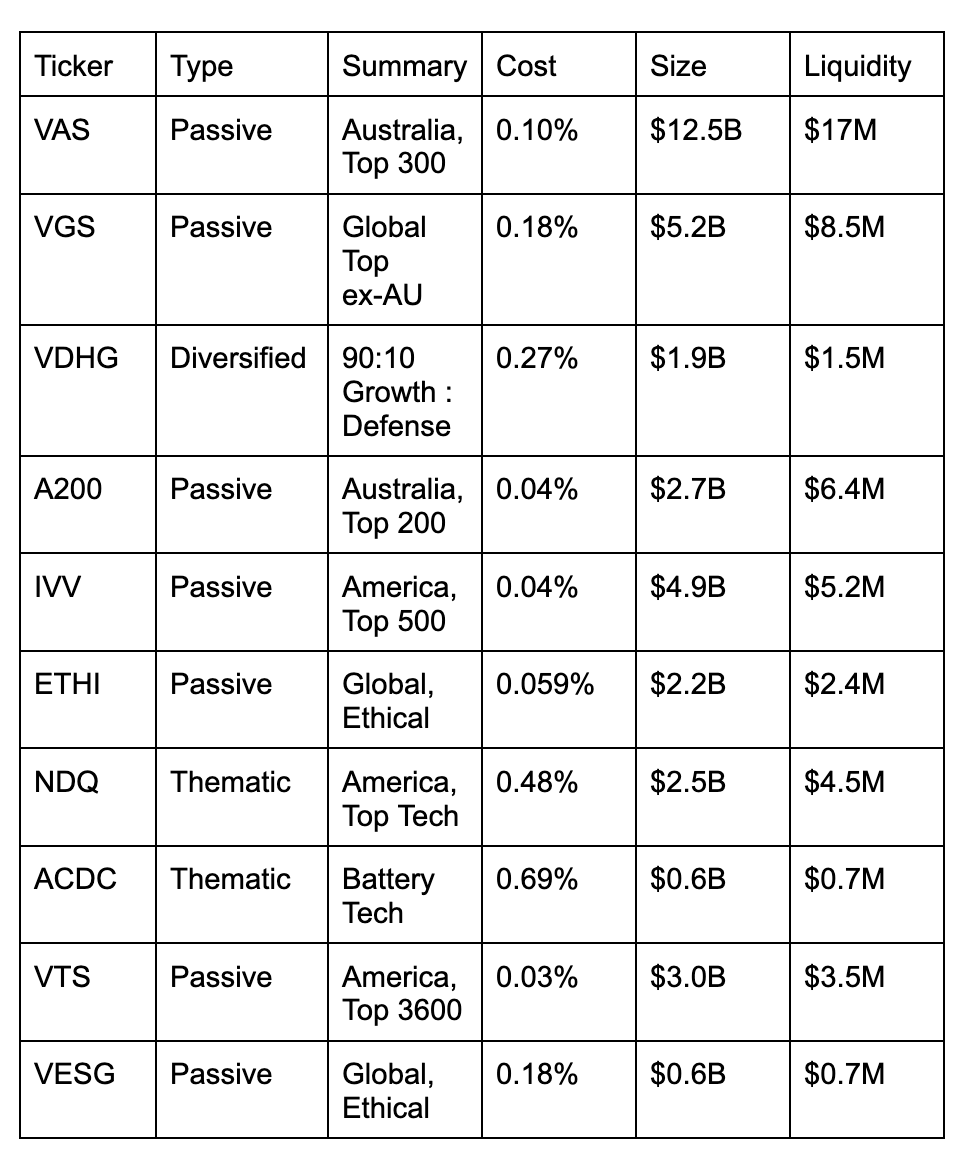

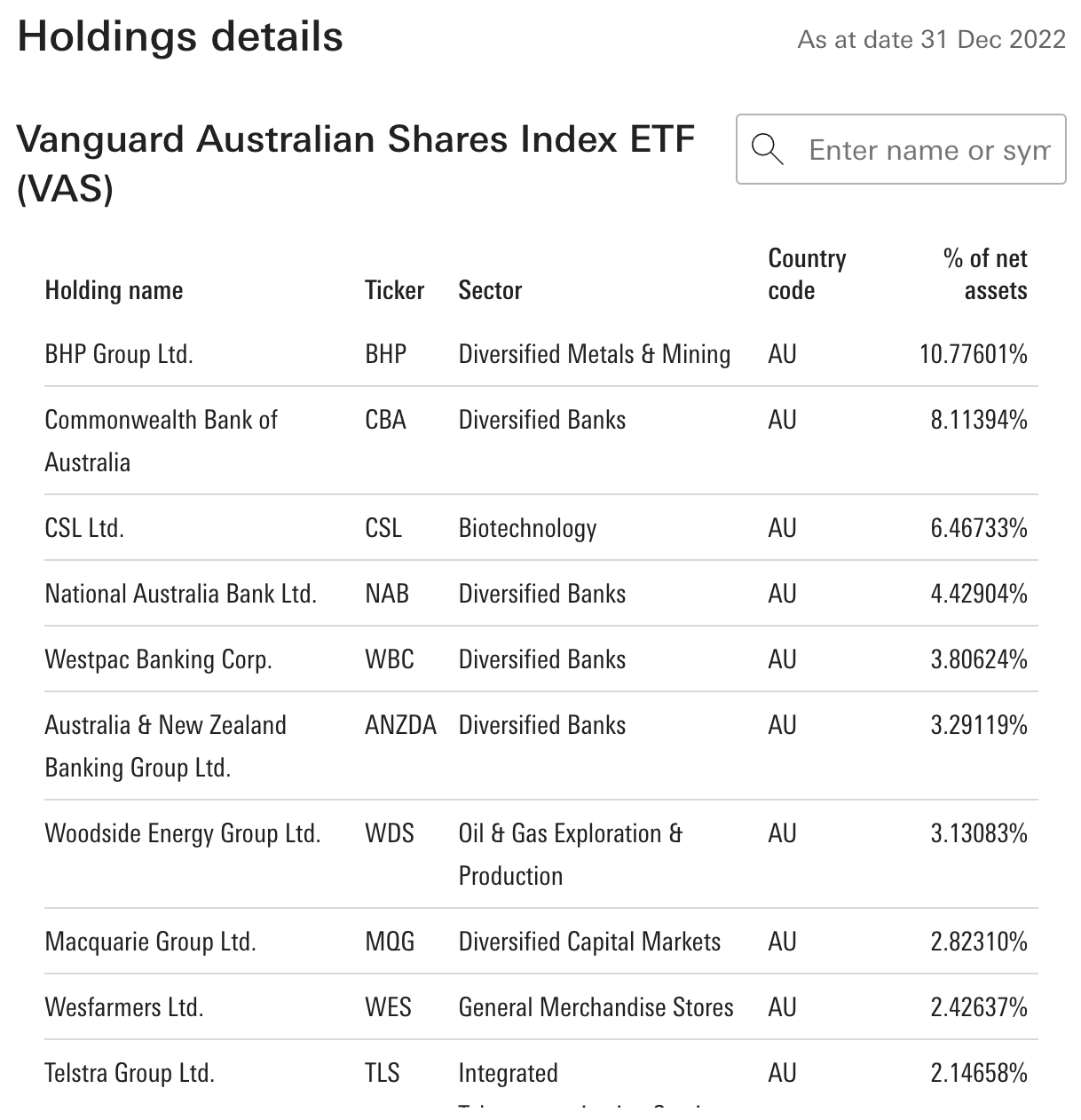

The most popular ETF in Australia is Vanguard Australia Shares Index ETF (VAS). This is a passive ETF that invests specifically in the 300 largest Australian companies. The top 10 are shown below:

Diversified ETFs

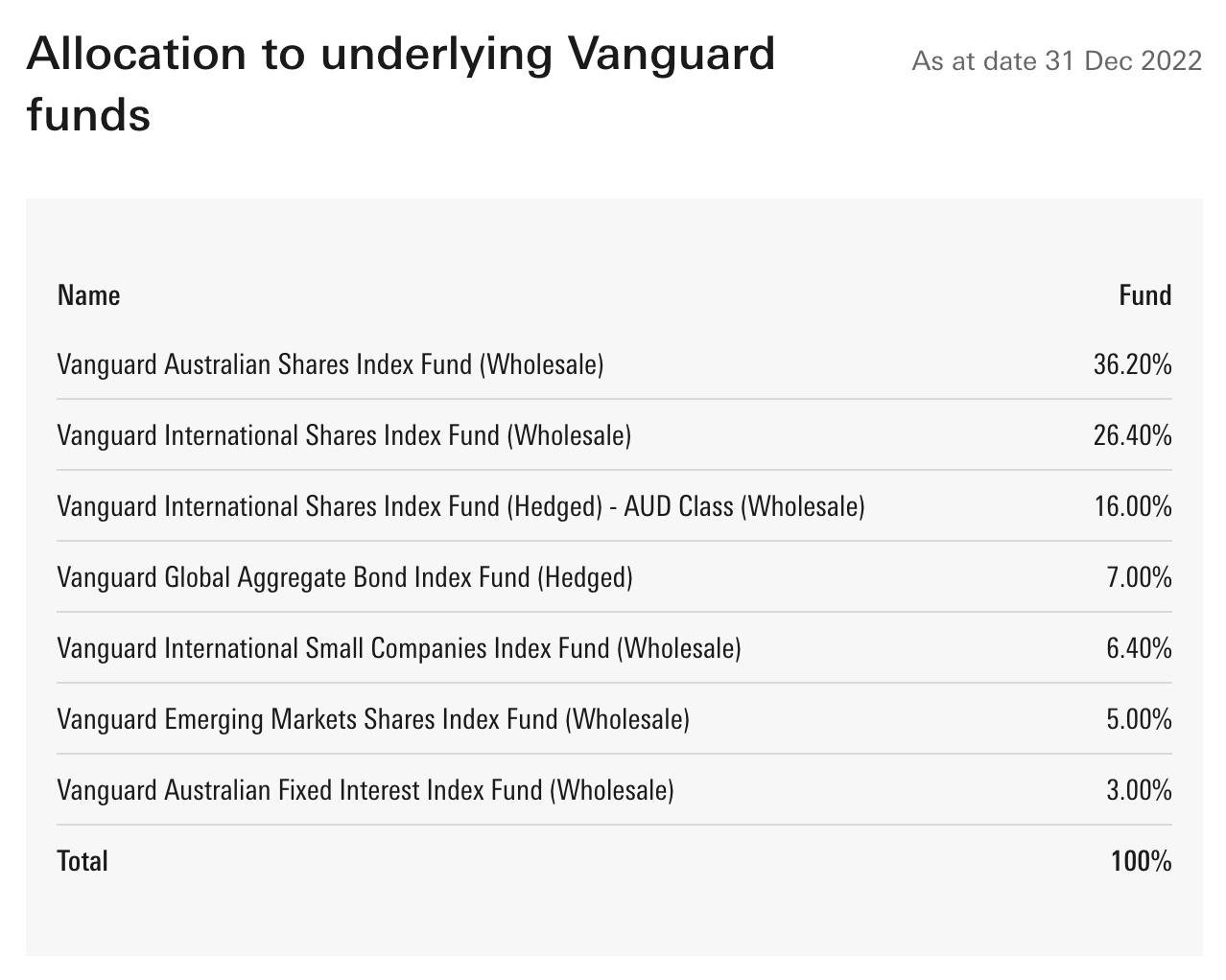

Diversified ETFs are a combination of multiple passive ETFs. When you invest in a Diversified ETF, your investment then flows through into the underlying ETFs - typically more than five!

Long term investors often frame diversified ETFs as a one-stop shop. They are typically used by investors who like to streamline their investing as much as possible. With these ETFs, investors simply need to select their risk/return appetite: Defensive to Aggressive (or "Conservative to Growth").

The most popular Diversified ETF in Australia is Vanguard Diversifed High Growth Inxed ETF (VHDG). VDHG has a 90% allocation to growth assets and a 10% allocation to defensive assets. The full underlying asset breakdown of VDHG is visible below.

Target-date ETFs

Target-date ETFs are structured to provide a diversified portfolio that becomes more conservative as the target date approaches. For instance, a target-date ETF with a target date of 2050 might start out with a high allocation to stocks. As the target date approaches, it would then gradually shift towards bonds and other fixed-income investments. Through this approach, investors may aim to prepare themselves for retirement.

Target-date ETFs typically have a year in their name that corresponds to the target date. Examples include the iShares 2050 Target Date ETF (TZV), the Vanguard Target Retirement 2050 Fund (VFIFX), or the Schwab Target 2050 Fund (SWYHX). The purpose of this date is to align with the date investors are planning to retire.

Target-date ETFs are a relatively new ETF category that's not yet available on the ASX.

Active ETFs

Active ETFs are ETFs that are managed by an investment manager. As the name suggests, the manager uses a hands-on, active approach to construct and manage the fund's portfolio. This differs from traditional passive ETFs that track an index and generally have lower fees.

Active ETFs typically aim to outperform the market or a specific benchmark. To this end, their portfolio managers use a variety of investment strategies, such as stock-picking, market timing, or sector rotation. Unlike mutual funds, which only disclose their holdings quarterly. active ETFs typically disclose their portfolio holdings daily.

One advantage of active ETFs is the potential for higher returns compared to passive ETFs. This stems from the fact that the manager can make investment decisions based on market conditions and the fund's objectives. However, active ETFs also usually come with higher fees than passive ETFs. There is also no guarantee of outperformance. In fact, most active ETFs underperform their passive counterparts.

Overall, active ETFs are more similar to a mutual/managed fund than a traditional passive ETF. When you invest in active ETFs, you're making a bet that the manager outperforms the market.

Thematic ETFs

These ETFs invest in companies or industries that aim to benefit from a specific trend or theme. These themes can range from emerging technologies like blockchain and artificial intelligence; to social trends like clean energy or gender diversity; to geopolitical events such as the rise of emerging markets.

Thematic ETFs use a rules-based approach to select companies that are expected to benefit from the chosen theme or trend. For example, a clean energy ETF might invest in companies that produce solar panels or wind turbines. By contrast, a robotics and artificial intelligence ETF might invest in companies that develop robotics technology and AI software.

In summary, thematic ETFs are designed to expose investors to a specific theme that they believe will grow. An investment in a thematic ETF is ultimately a bet that this theme will outperform the broader market over a given time frame. These ETFs are higher risk than traditional ETFs as they are often more volatile due to the concentrated exposure. However, for someone who wants to invest in a particular theme, these ETFs can often be the best way to do so.

Synthetic ETFs

These investments use derivatives - such as swaps, options, or futures contracts - to replicate the returns of an asset or index. Unlike traditional ETFs, which hold physical securities in their portfolio, synthetic ETFs use these derivatives to replicate the performance of their underlying assets.

Synthetic ETFs typically provide exposure to hard-to-reach or illiquid markets, such as emerging markets or commodities. In these spaces, it may be otherwise difficult or expensive to buy and hold physical securities. They can also provide investors with leveraged or inverse exposure to an underlying asset or index.

In the advantage column, synthetic ETFs can often be more cost-effective than traditional ETFs. This is because they do not require the purchase and custody of physical securities. They can also offer greater flexibility in terms of exposure and risk management.

However, synthetic ETFs are usually more complex than traditional ETFs. They also often carry higher counterparty risk, as they rely on the financial strength and reliability of the derivative counterparty.

Additionally, the use of derivatives can result in higher trading costs. The fund's performance may also deviate from the underlying asset or index due to market fluctuations and the terms of the derivative contract.

Due to these factors, synthetic ETFs are typically not favoured by retail investors. With this in mind, we suggest consulting a professional before investing in these.

Which ETF is right for me?

Many different types of investors use ETFs to reach an array of different investing goals. The most common investing goals within Pearler's community are:

- Financial independence

- Retirement

- Home deposit

- Kids' fund

A common strategy for any of these goals is to invest regularly and repeatedly in a low-cost and diversified share portfolio over a long timeframe (10+ years). If you like this approach, passive and diversified ETFs can meet your needs.

For investors who want the simplest investing experience at a low cost, diversified ETFs work well. You simply need to select the diversified ETF that matches your risk/return appetite - Defensive to Agressive (or Conservative to Growth). From there, continue to invest in that ETF every week/month/quarter. Diversified ETFs typically cost $20 - $50 per year for a $10,000 portfolio.

For investors who want the lowest cost and/or to have slightly more control, passive ETFs can serve your purposes. With these ETFs, you typically want to choose one to five ETFs, then allocate percentages to them. For example, you may want 40% in an Australian Shares ETF; 40% in a Global Shares ETF; 10% in an Australian Bonds ETF; and 10% in a Global Bonds ETF. Or, you may just want 100% in an Australian Shares ETF. It's worth noting that if you invest in multiple ETFs, you are responsible for re-balancing the percentages of your portfolio over time. A portfolio of passive ETFs typically costs $10 - $30 per year for a $10,000 portfolio

Target-date ETFs would also be appropriate for all these goals, and are extremely streamlined. However, since there are no ASX-listed target-date ETFs yet, you need to take on the USD/AUD currency risk if you wish to invest in them. This is not ideal if your investing goal is denominated in AUD, and is something worth taking into account.

How to choose the right ETF for me within a given category

There are many factors you should consider when selecting the right ETFs for you. They include:

- how big the ETF is (fund size)

- how much it trades (liquidity)

- how much it costs (fees and spreads)

- its track record (ETF and index inception)

- success in tracking its index (tracking difference).\`

Cost

Cost refers to the annual fees charged by the ETF manager. These fees are percentage fees that are applied to the total ETF holdings. The fees are often called Management Fees, and they are usually expressed as a percentage called the Management Expense Ration (MER). The higher the MER, the more investors pay in fees. The lower the MER, the fewer fees paid, and the faster the investments grow.

Size

Size is important because ETFs must reach a certain size to become viable. As ETFs gather more assets, it becomes easier for them to cut their expense ratios (fees) to continue attracting more funds. On the other hand, ETFs which haven’t achieved critical mass sometimes shut down and return investor funds or increase their fees to cover their costs.

Liquidity

Liquidity refers to the amount of turnover (or available turnover) in an ETF. We measure it by average daily volume on the ASX. Volume is a measure of market making activity and trading interest, which makes it a reasonable estimate of liquidity.

We should mention, though, that volume may not reflect liquidity in the underlying stocks, which is typically much deeper for broad Australian share ETFs. However, in times of crisis, investors may not be able to rely exclusively on market makers for liquidity. As such, daily volume is a relevant figure.

Tracking Error

Every ETF has a performance benchmark or index that it aims to perform like. For example, Vanguard Australia Shares ETF (VAS) aims to perform like the S&P/ASX 300's Index. Tracking error measures how well an ETF has mirrored its benchmark or index.

For example, over the last 5 years VAS has generated 6.83% p.a. in returns compared to the S&P/ASX 300's 6.85% p.a. Tracking error is rarely zero because there are various factors that prevent an ETF from perfectly mirroring its index including fees. In the case of VAS, the difference roughly equals its fees (~0.10%), which means it’s doing its job right.

Popular ETFs that tick multiple boxes

Let's look at the data from Pearler’s community of over 70,000 investors. Of Pearler's ten most popular ETFs, seven are passive, one is diversified (which is a collection of Passive ETFs), and two are thematic.

All except for one passive ETF have fees of less than 0.2%. Similarly, all except for one passive ETF have more than $1 billion invested.

If you're investing in shares to achieve a long term goal (10+ years), check out the ETFs below.