Confused about the difference between exchange-traded funds (ETFs) and mutual funds? We don’t blame you.

Perhaps you’ve landed on this article, hoping you’ll gain clarity on the difference so you can move forward in your investing journey. We hope this article does that for you.

ETFs and mutual funds are two options that are often thrown into the ring against each other. This is especially so for investors who want to spend fewer hours managing their investment portfolio.

Both investment vehicles offer many similarities, such as diversification, low costs, and access to many options. With all these similarities, it can be hard to pinpoint the differences.

In this article, we aim to highlight those differences and what you need to consider. That way, you can hopefully decide whether ETFs or mutual funds are for you.

What’s an ETF?

An ETF is a basket of assets, usually shares, that can be bought and sold on the sharemarket.

The shares in this basket generally all have something in common. For example, they could all represent a stake in companies in an index like the ASX200 or an industry (for example, agriculture). Or, the shares could all be invested in companies aligned to a theme such as ESG (environmental, social and governance).

Each ETF can contain up to thousands of companies. This makes it easy for an investor to build a diversified portfolio. You can simply choose an ETF that gives you exposure to the index, industry, or theme aligned with your investing strategy.

How can I invest in an ETF?

You can invest in ETFs through a broker or on a platform like Pearler , using an online investment account.

What’s a mutual fund?

A mutual fund is a collection of pooled assets invested in shares, bonds, cash, and other securities. Mutual funds are bought and sold at the end of the trading day at the net asset value (NAV) price. Like ETFs, when you buy a mutual fund, you receive a portion of the fund’s holdings and gain exposure to various assets.

If you prefer to invest in a particular asset class, mutual funds allow you to invest in fixed-income or equity funds. Or, you can choose to invest across multiple asset classes with multi-asset funds.

How can I invest in a mutual fund?

To invest in a mutual fund, you give your money directly to a fund manager or through a broker. In return, the fund manager gives you units in the mutual fund with exposure to the underlying assets.

What’s the difference between an ETF and a mutual fund?

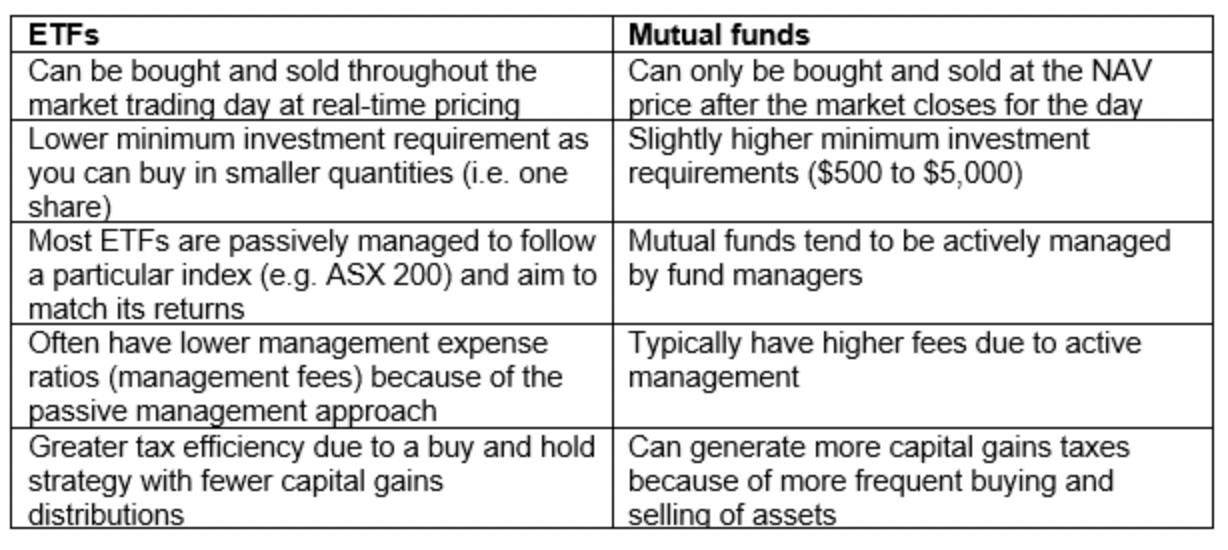

Even with the many similarities between ETFs and mutual funds, there are a few key differences to consider:

So, should I invest in an ETF or a mutual fund?

It depends on your investment goals, how much you want to invest, and the degree of flexibility you desire.

Both ETFs and mutual funds are suitable for the passive investor who wants a hands-off investing approach and a diversified portfolio.

If you want more control over the timing and price when you buy and sell, and don’t have much to start with, ETFs may be for you.

If you’re looking to outperform the index (noting that even for professionals, passive investing has historically outperformed and active ) and are less sensitive to fees, mutual funds are a good option.

Before you invest in an ETF or a mutual fund, we suggest seeking advice from a qualified financial adviser. Also, consider your personal situation and investing strategy by asking:

a) How much do I want to invest?

b) How frequently do I want to invest?

c) How long do I want to invest this money for?

d) Do I want to reinvest my dividends (hint: embrace the magic of compounding)?

Whichever option you choose, we hope this is the beginning of a highly rewarding long term investing journey for you!