Investing in the stock market can be an effective way to build wealth over the long term. Among the range of investment options, Exchange-Traded Funds (ETFs) stand out for their ease of use, diversification, and cost-effectiveness. Two popular choices for investors interested in owning a share of the Australian market are the Vanguard Australian Shares ETF (VAS) and the BetaShares Australia 200 ETF (A200). Both offer unique pathways to investing in Australia's top companies, but how do you choose the one that's right for you?

Let's delve into what VAS and A200 offer and compare them side by side. We’ll also look at why investors struggle to choose which to invest in, and what to consider to help you decide.

Why invest in Australian shares ETFs?

Before we get to the specifics of VAS and A200, let’s consider what makes Australian shares ETFs a compelling option for long-term investors. Firstly, unlike when you invest in a direct ASX share, ETFs offer instant diversification across various companies and sectors, reducing risk. The Australian stock market has also historically delivered strong long-term growth and provides potential for dividends. This can make investing in Australian shares ETFs an enticing option for investors looking to grow their portfolio or generate income. Lastly, the convenience and lower costs associated with ETFs can make them a great choice for both seasoned and beginner investors.

Both VAS and A200 offer popular gateways to investing in Australia's thriving market. Now, let’s take a closer look at each ETF.

Vanguard Australian Shares ETF (VAS): An overview

VAS is a favoured choice in the realm of Australian ETFs, offering investors exposure to the largest publicly listed companies in Australia. This ETF was established in 2009 by global investment company Vanguard. It tracks the performance of the ASX 300 Index, made up of around 300 of the country's top shares. This wide net aims to give investors gain broad exposure to Australia's economic sectors, from banking to mining and beyond. Companies VAS invests in include the Commonwealth Bank of Australia, BHP Group, and Telstra Corporation.

If there’s anything to take away from this overview of VAS, it’s these key features:

- Diversification: With its broader index, VAS provides a diversified investment, spreading risk across many companies.

- Low costs: Vanguard is known for its low-cost investment options, and VAS is no exception, with a competitive management fee.

- Track record: Vanguard's long-standing reputation and experience in managing ETFs can offer investors a sense of stability. It’s also the largest ETF currently trading on the ASX.

BetaShares Australia 200 ETF (A200): An overview

On the other side of the Australian shares ETF ring, we have A200. This ETF aims to offer investors a slice of Australia's top shares in 200 companies by market cap. The A200 ETF was established in 2018 by its parent company, BetaShares, and tracks the Solactive Australia 200 Index. It has a slightly narrower focus compared to VAS, but still captures the essence of Australia's largest and most influential companies. Companies A200 invests in include Westpac Banking Corporation, Woolworths Group and Fortescue Mentals Group.

The key features to note about A200 are:

- Focused exposure: By concentrating on the top 200 companies, A200 offers a focused entry point into the Australian market, which some investors might prefer.

- Cost efficiency: Currently, A200 is one of the lowest cost Australian ETFs on the market, making it an attractive option for cost-conscious investors.

- Simplicity: A200's straightforward approach to tracking the top 200 companies requires little knowledge of stocks or financial markets. This makes it easy to grasp for newcomers to the stock market.

Comparing VAS and A200

Now that we've seen the cliff notes on both VAS and A200, let’s look at the two ETFs side by side. To help you understand the key differences between the ETFs, the table below compares the main characteristics of each:

|

Feature |

Vanguard Australian Shares ETF (VAS) |

BetaShares Australia 200 ETF (A200) |

|

Index tracked |

ASX 300 Index |

Solactive Australia 200 Index |

|

Number of ASX share holdings |

Invested in the top 300 Australian companies (including 100 small cap companies) |

Invested in the top 200 Australian companies |

|

Sector exposure |

Broad, across all sectors Represents around 84-87% of Australia's stock market |

Mainly top sectors, more focused Represents around 80% of Australia’s stock market |

|

Management fee |

Slightly higher than A200 |

Currently one of the lowest in the market |

|

Fund size |

Larger, potentially indicating stability and liquidity |

Smaller compared to VAS, but still significant |

|

Provider |

Vanguard, known for reliability and track record |

BetaShares, known for innovation and cost efficiency |

This comparison provides useful information on both ETFs. But without going deeper, it’s hard to choose based on this information alone. That can leave many investors scratching their heads about which one to invest in.

The challenge in choosing between VAS and A200

For many investors, especially those new to the Australian stock market, deciding between VAS and A200 can seem daunting. It’s common knowledge that the two ETFs are direct competitors, with market participants contributing to the A200 vs VAS debate. This difficulty can stem from the subtle yet significant differences between the two, which may not be immediately obvious. Yes, both ETFs offer low-cost access to top Australian companies. But their different nuances cater to slightly different investor needs and preferences, making the choice between them less straightforward.

One reason investors find this choice challenging is their similar primary offerings – both provide exposure to the top tier of Australian companies. However, VAS offers a broader exposure with its focus on the top 300 companies. On the other hand, A200 concentrates on the top 200. This difference in scope means that VAS might appeal more to investors seeking wider market coverage. Meanwhile, A200 might attract investors looking for more narrow exposure to the highest-cap companies in Australia.

Another complicating factor is the cost. While both ETFs are celebrated for their low fees, A200 often emerges as the more cost-efficient option by a slim margin. For cost-conscious investors, this slight difference can be a deciding factor. Others may still struggle to decide as they weigh it against other considerations such as the fund size, track record, and diversification.

The reputations of Vanguard and BetaShares as investment managers add another layer to the decision-making process. Vanguard's long-standing history and strong track record in fund management might sway investors looking for established reliability. In contrast, BetaShares' innovative approach and commitment to cost efficiency can appeal to investors prioritising modern fund management strategies and lower costs.

How to choose between VAS and A200

Making the right choice between VAS and A200 comes down to understanding what matters most to you in your investing journey. Consider your investment goals, risk tolerance, and the kind of exposure you want in the Australian market.

Here are a few considerations to help you choose:

- Investment goals: Clarify your long-term investment objectives. Are you seeking broader exposure to the market in Australia (VAS)? Or do you want a more concentrated investment in its largest companies (A200)? Your goals will influence which ETF aligns better with your investment strategy. This choice can impact your portfolio's diversity and exposure.

- Risk tolerance: Consider how much market volatility you are comfortable with. VAS's broader diversification might offer a slightly more balanced risk profile, given its wider range of companies. On the flip side, the more focused exposure of A200 could mean more frequent movements in the ETF’s price.

- Cost sensitivity: How important are management fees in your investment decision? Although both ETFs are known for their low fees, there are differences. A200 often has slightly lower management fees than VAS. If cost is a crucial factor for you, this might tip the scales. So compare the fees of VAS and A200 closely, as even small differences can add up over time.

- Investment philosophy: Do you value the track record and reputation of the ETF provider? Research and consider the reputation of Vanguard and BetaShares. Vanguard is known for its stability and long-standing history, while BetaShares is recognised for its innovative and cost-efficient approaches. Your preference for a fund manager's philosophy and track record might influence your decision.

- Performance history: We know that past performance is not a reliable indicator of future returns. However, understanding how each ETF has performed under different market conditions can provide insights into its management and resilience.

- Dividend yield: For some investors, the dividend yield is an important factor. Compare the historical dividend yields of VAS and A200 to see which aligns with your income objectives. Remember that ETF dividends can fluctuate based on shifts in the market and company performance.

- Ease of understanding: Consider how straightforward each ETF is to understand and manage within your portfolio. If simplicity and ease of management are important to you, A200's focused approach might appeal more than VAS’s broader strategy.

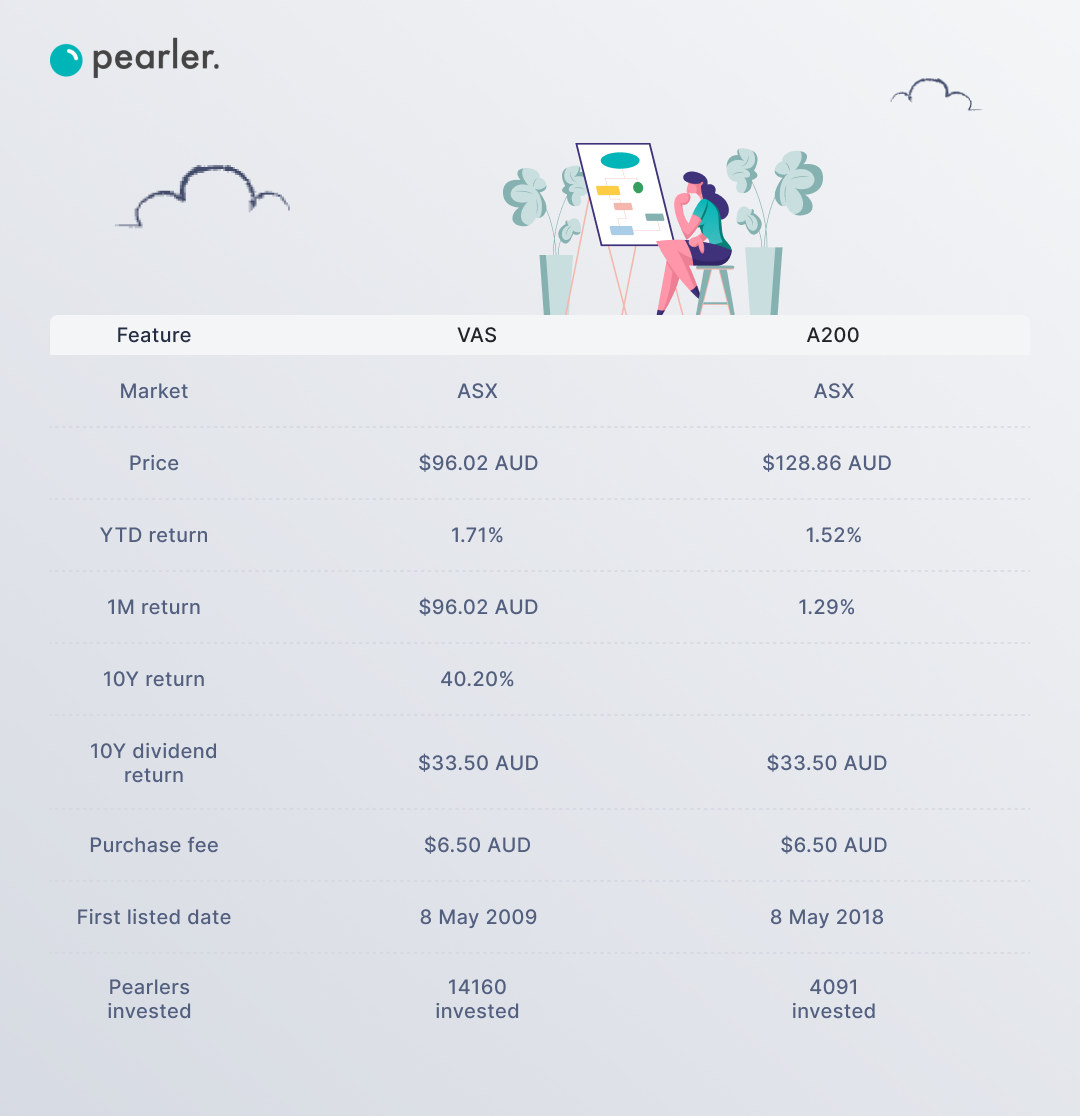

You can also use Pearler's Compare tool to directly compare the two ETFs on features such as price and performance. Here’s an example of the data it extracts, at the date this article was written:

As we mentioned above, keep in mind that past performance doesn’t always indicate future performance. By carefully considering each of the seven criteria listed above, you can make a more informed decision between VAS and A200. The best choice is the one that fits your personal investment strategy, goals, and comfort level with risk. Or, if you prefer a DIY portfolio and have a specific allocation you want to achieve, you may decide to choose both.

Remember, investing is a marathon, not a sprint. Take your time to research and evaluate both options before you invest. You might also consider consulting with a financial adviser to ensure your decision aligns with your overall financial goals.

Embrace the journey, and happy investing!