In Australia, the terms "ETFs" and "index funds" are often used interchangeably. When someone mentions an index fund, it's possible they're actually referring to an ETF. For the purposes of this article, though, we'll be sticking to the official definitions for both.

When deciding between exchange-traded funds (ETFs) vs index funds, the choice isn’t always so clear-cut. Some of us might heed the advice of the great Warren Buffett, who believes “a low-cost index fund is the most sensible equity investment for the great majority of investors”. And while we agree there’s merit to this statement, ETFs are also a suitable investment for most investors.

ETFs and index funds are very similar, which is why many investors have a difficult time deciding between the two.

So we don’t rehash old news, you can head here to check out our article on ETFs vs mutual funds (hint: index funds are a type of mutual fund).

Before delving into the differences, let's assess: when comparing ETFs vs index funds, how are they similar? Well, both are low cost investment options with diversification benefits. They also track a specific index and aim to match the performance of that index. For example, an index fund that tracks the ASX200 will invest in the same shares listed on the ASX200. Therefore, the returns generated by that index fund will look like that of the ASX200.

Both ETFs and index funds also provide a risk-averse, and generally simple, way to invest for the long term.

However, there are a few key differences to note when considering the debate of ETFs vs index funds.

Key differences between ETFs vs index funds

The main difference between ETFs and index funds is how they are bought and sold. ETFs are bought and sold like other shares listed on an exchange. This can happen at any time during the market trading day.

Meanwhile, index funds can only be bought and sold at the net asset value (NAV) price when the market closes.

Plus, though ETFs can track a particular index, you can also find ETFs aligned to specific industries (technology) or values (sustainability).

Pros and cons of ETFs and index funds

Exploring the advantages and disadvantages of ETFs vs index funds is the best way to help you figure out your preference.

Here are the pros and cons of investing in ETFs:

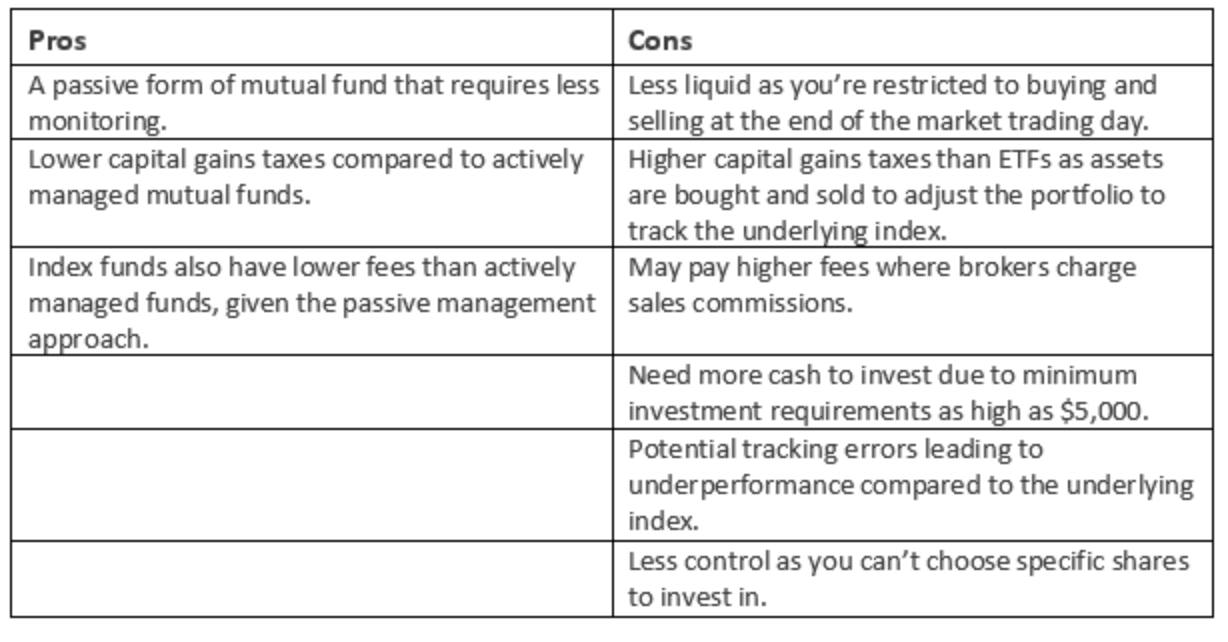

For index funds:

ETFs vs index funds: which one should I choose?

Both ETFs and index funds provide simple ways to easily access the diversification benefits of investing. This can help you manage risks and reduce the impact of big market swings compared to holding direct shares.

The passive management styles of ETFs and index funds make both suitable investment options for long term investors. In saying that, there’s no “perfect” choice. As a long term investor , we encourage you to spend time researching both options and choose the one that’s right for you.