With 2025 flying along, it’s time to share a personal update.

If you’ve been following these, you probably know I mentioned that we’d sell an investment property this year.

Well, we’ve just done that, with settlement happening at the start of August!

In this update, I’ll explain how that went and give you an overview of the following…

– How our investments have been going

– Current wealth breakdown + dividend income

– Review of property and share markets

– What I’m doing right now + future plans

By the way, my last portfolio update was back in December, which you can read

here.

As usual, these posts are simply to share, because I know how valuable and interesting it is to read about what others are doing with their own money.

So, nothing here is a recommendation; please do your own research before investing in anything. That being said, I hope you enjoy the article 🙂

Property sale

As part of our transition from property to shares, we sold another rental. This one was a three-bedroom villa in Perth, about 12km from the city. Funnily enough, our remaining two properties are also basically the same as this!

The sale went incredibly smoothly, with a couple of lowball offers, followed by some more reasonable ones, finally getting us to within 2-3% of our goal price – good enough for me!

The property itself performed very well over the last five years, but fairly average over the whole 13 years of ownership. This one was owned in my name, leaving me with a likely decent-sized CGT bill (depending on my personal income for the year).

So what’s the plan?

Well, given I’ve been out of the workforce, I haven’t had a single dollar added to super for the last eight years. That means I’d be able to add five years worth of ‘catch up’ super contributions and claim it as a tax deduction. And although I’d MUCH rather keep access to the money, I estimate this may save me something like $35,000 in tax. So that’s something I’ll be doing shortly.

The only reason I’m doing it this way is that we don't technically need access to all the proceeds from these final property sales, since our wealth has grown nicely after reaching FI. If that wasn’t the case, I’d happily pay more tax to retain access to the money.

With the rest of the proceeds, I plan to add a chunk to our share portfolio, which I’m doing immediately. And the remaining chunk will likely be put into Mrs SMA’s super in 2026. Reason being, we’ll be selling a rental she owns early next year, yet we probably won't receive the proceeds until after June 30 (leaving us unable to add those funds to super in time to claim the deduction). So, this money is on ‘stand by’ for now.

Current wealth breakdown

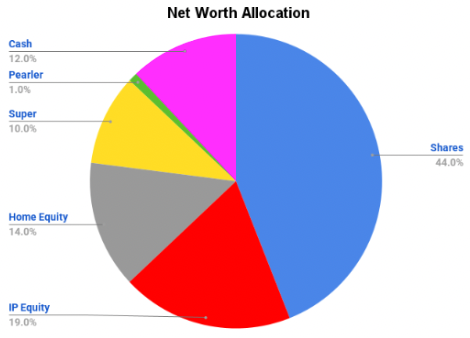

Okay, onto the portfolio. Here’s the breakdown of our wealth and where it’s all sitting right now (in percentages rather than numbers for privacy)...

The main difference here is the big boost in cash from 1% to 12%, and the drop in investment property equity, from 28% to 19%.

That cash won’t last though – I’ll be adding to the shares immediately and to super pretty soon. We’ll be back to low cash levels soon enough – I just prefer being pretty much fully invested.

In the next few updates, the shares and super portions will expand their piece of the pie. I also plan to ‘get rid’ of some of that home equity by borrowing more to invest, but I’ll explain that more in a later update.

Let’s now take a look at markets.

Share market update

Given my last update was in December, let’s take a look at how shares have performed since the beginning of the year.

As I write this, here are the returns since January 1, 2025:

– ASX 300 as measured by

VAS

is up around 7% (plus dividends and franking)

– S&P 500 as measured by

IVV

is up around 4.7% (plus dividends)

Most readers will remember we also had a

small market tantrum

in Feb/March where the US market fell 15% and the ASX dropped by 10%.

It felt scary at the time, and I was getting lots of questions from nervous readers for my thoughts on what might happen. But the markets have fully recovered since then.

At the time I wrote the sheer uncertainty involved in anticipating how things would play out. I said: “Maybe the market has another 25% fall. Or maybe it reaches new highs by the end of 2025.”

That second line felt strange to write at the time. But amazingly, both the US and ASX have hit new highs. Whether that’s sustained for the remainder of the year is anyone’s guess!

Property update

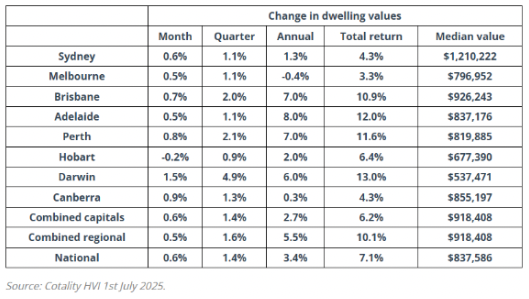

So how have property markets fared so far this year?

Well, despite the usual endless talk of mortgage stress, unaffordability, and global turmoil supposedly going to send ‘shockwaves’ through Aussie property, it seems prices held up pretty damn well.

Solid growth from Adelaide, Perth, Brisbane continues – and now Darwin has joined the party too! Which makes sense, given how cheap it is relative to the other capitals.

The above figures use ‘dwelling values’ but the difference in ‘house prices’ is even bigger. I’m fairly sure it’s now been around the same level for a dozen years or so

–

it reminds me of Perth’s situation around 2020.

This is why you should ignore anyone who implies that certain markets are always superior and will continually outperform. It doesn’t work like that. While some markets may have stronger longer-term fundamentals, every market suffers flat periods and downturns, and every market eventually gets too cheap and experiences a boom.

With one rate cut delivered and others expected over the coming year, I expect property prices to continue trending upwards. There still doesn’t seem to be enough supply coming to keep up with ongoing population growth.

While Perth has had a great run, I don’t see the market changing much over the next year or so. That means it should still be a decent time to sell our remaining properties in 2026 :)

Investment income and share portfolio

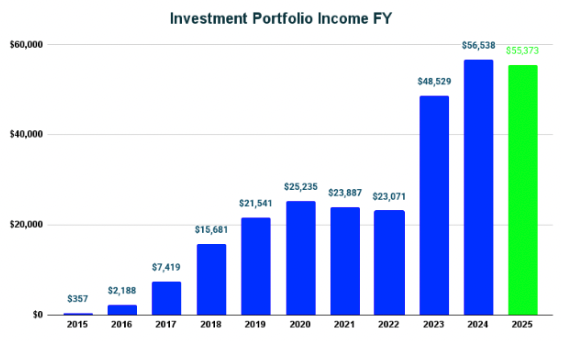

One of my favourite things to do each year is browse over my dividend info for the year and update the below chart.

By the way, this is all dividends received from our share portfolio, and includes franking credits. I don’t include rental income because of expenses and mortgages, plus these are being offloaded, so they aren’t part of the passive income cash machine :)

It’s nice to be over the $50k mark again. But as I flagged might happen, we made no progress on this front due to all our mortgage rates going from 2.3% to over 6% in August 2024.

In fact, I just checked, and we haven’t been able to invest for roughly a year! All our cash has been put towards servicing expensive P&I mortgages. After this property sale, we’ll now have a monthly surplus so we can finally start investing again.

Explainer on our dividend history: Why the big spike in 2023? Well, 2022 would have been much higher, but we sold a huge chunk of shares during that year to buy our house. We then sold an investment property and transferred the loan to our current home, giving us a huge pile of cash to invest. This is a strategy called security substitution which I wrote about here. At the same time, we also decided to become ‘fully invested’ and invest the remaining cash in our offset account, whereas we were drip-feeding the money in before, which I wrote about here.

So with our dividend income running at $55k, this is pretty damn close to our

annual expenses of $60k

. So our ‘coverage ratio’ is rapidly approaching 100%.

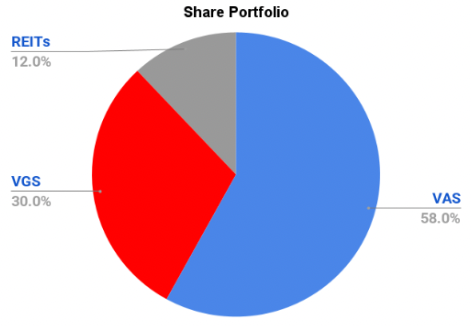

As for our share portfolio, here’s the current breakdown below…

Basically, no change from last time. As regular readers will know, I’ve been mentioning that I’ll offload the two real estate trusts at some point to simplify. These have been the strongest performers this year by quite a bit, which is nice. I’m not sure if that will continue or not, but I’ll take it.

Okay let’s move onto some more exciting stuff: actions and plans!

Current actions and future plans

The first thing that’s happening is investing a chunk of cash from the property sale.

This will be going into VAS and VGS – likely an even split – as I slowly continue increasing my allocation to international shares.

Another exciting change is with our mortgages. After many painful years of paying aggressive principal & interest loans, we’re now finally in a position to refinance. That’s due to a nice combination of factors

–

growing dividend income, lower debt, higher rental income, and consistent part-time income.

So what’s the plan? I want to put our remaining three loans all on interest-only. This will give us a huge improvement in monthly cashflow, allowing us to invest more.

Yes, that includes the mortgage on our own home. This one is debt recycled and I’d rather just keep the debt as is, while optimising cashflow and maximising investments.

A third change in the works is with super. Some of you might have seen that

Pearler has rolled out something new in the superannuation space

. And while on the surface it doesn’t look cheap compared to an indexed option with an industry fund, there’s a bit more to it than that. But I’ll do a full article with numbers showing you exactly what I mean and why I’m making the switch.

Final thoughts

This update has been one of the more exciting ones for me!

We sold a property. We have a lump of cash to invest. We’re refinancing our mortgages. And we can finally get back to monthly investing again.

All that means being able to feed our share portfolio, increase our passive income, and brings us closer to the end of our transition strategy.

So, how am I approaching investing my lump sum given the market has recovered so strongly? Will I hold off since it seems ‘high’ or wait for a pullback?

No. I’m going to follow my normal philosophy: invest as much as I can, as soon as I can. I’m going to continue relentlessly buying assets whenever I can afford to. If the market goes down

–

great, I’ll buy more whenever cash is available.

If the market keeps going up, I’ll get richer. If it goes down, that offers a nice opportunity to keep growing my holdings at lower prices. I really do look at it like that.

Anyway, that's it for this update. As always, make sure to do your own research before making financial decisions. I hope your investment plans are coming to life in 2025.

Until next time, happy long-term investing!

Dave’s best-selling book Strong Money Australia is available on

Amazon.

Listen to the audiobook on

Spotify

or

Audible.