It’s a new year, and we’re back for the 2024 edition of Pearler’s Top ETFs!

Last year was massive for us all. We kicked things off by crossing the $1 billion threshold (that is, over $1 billion invested through Pearler), and by the end of 2024, the Pearler community smashed through $1.8 billion.

So, as we all grow, this list becomes a more powerful snapshot of how young workers in Australia are building their futures.

Why do we share this? We believe that seeing how your ambitious community invests is a great way to further your own research and education.

Think of it as just another reference point alongside other forums, blog articles, and podcasts... with one key difference: it's purely hard data, independent and without any biases (other than our love for ETFs in general).

And to remind you – we receive no kickbacks. This isn’t some curated list of recommendations handpicked by a faceless corporation. This is the truth of how the Pearler community is investing for their future selves.

As you'll see, simple, diversified, and low fee ETFs have once again won the day.

Top 10 ETF observations

We love a good musing, so here are our key takeaways from this list:

- Young Aussies are moving more money to global ETFs... but are simply doing it via the ASX

- USA! USA! USA! IVV is the biggest mover, from #4 to #2

- Have people been moving from broader ETFs like VGS (0.18% p.a.) or VDHG (0.27% p.a.) to combine narrower ETFs like IVV (0.04% p.a.)?

- VAS reigns supreme at #1. A200 is still strong, but fell back one spot

- DHHF joins the top 10 for the first time ever. Is DHHF going to catch up to VDHG ?

- Investors holding top 10 ETFs are, on average, two years older than the overall community, which averages an age of 34. Do people simplify their investing as they grow older?

- VESG dropped out of the top 10 and down to #14

How does 2024 compare to the previous year?

2024 brought some changes to the list. s we highlighted above, the biggest mover was IVV, jumping from #4 to #2, overtaking VGS and VDHG.

Yes, investors continue to back the US markets, with NDQ also jumping in popularity, pushing A200 down a spot to #6.

Two other big changes:

DHHF entered the top 10 for the first time ever. The Pearler community is showing a rising preference for all-in-one, low-cost funds designed for simplicity. Historically, VDHG has been the go-to, but perhaps we're seeing a changing of the guard?

VESG, which held strong in previous years, fell out of the top 10 to #14 — a notable exit, leaving ETHI as the only ESG rated ETF in the list.

But as always, there is no right or wrong. And you absolutely shouldn’t invest just because of an email, or because something is at the top of a list. But if this email has inspired you do some additional research click the link below.

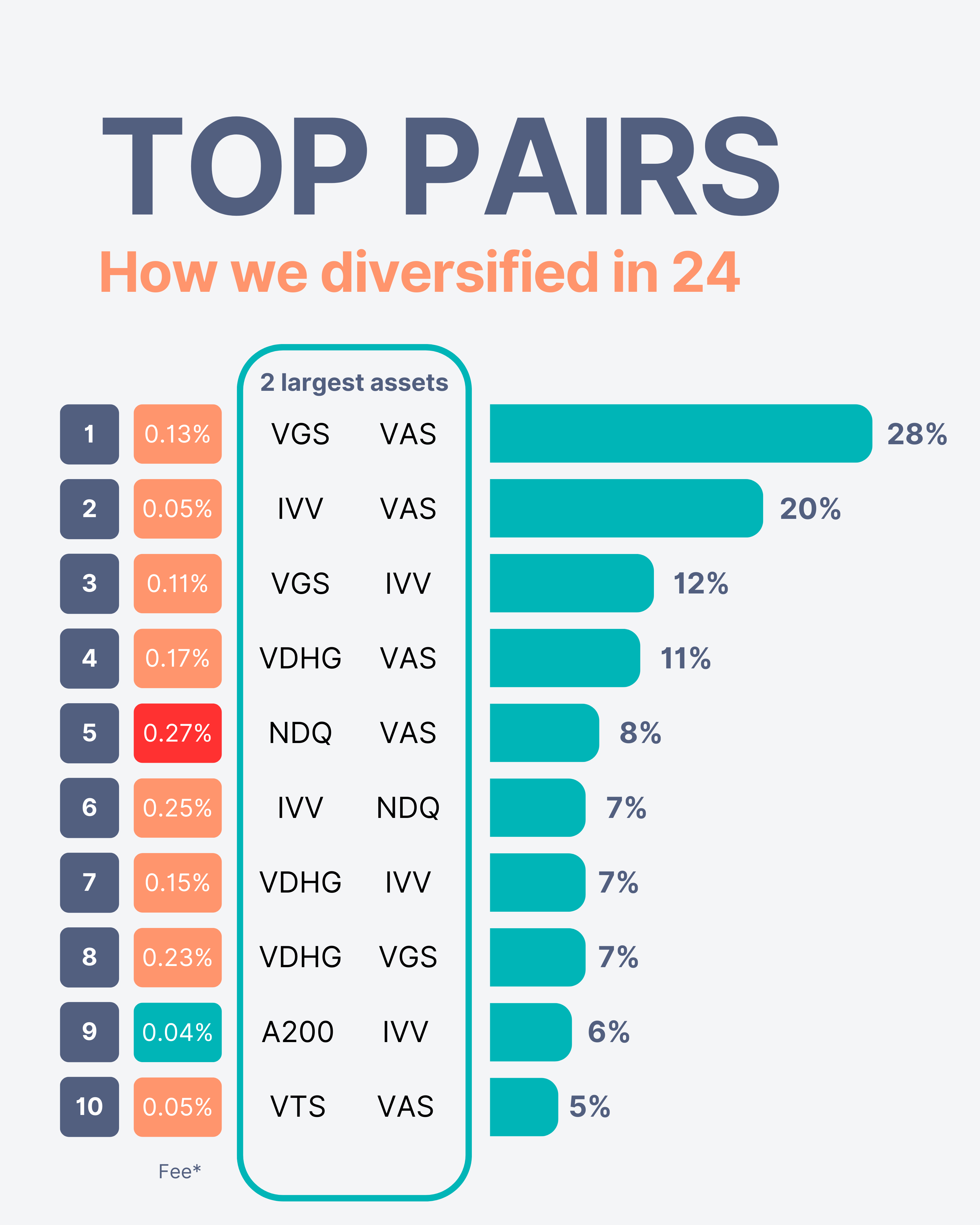

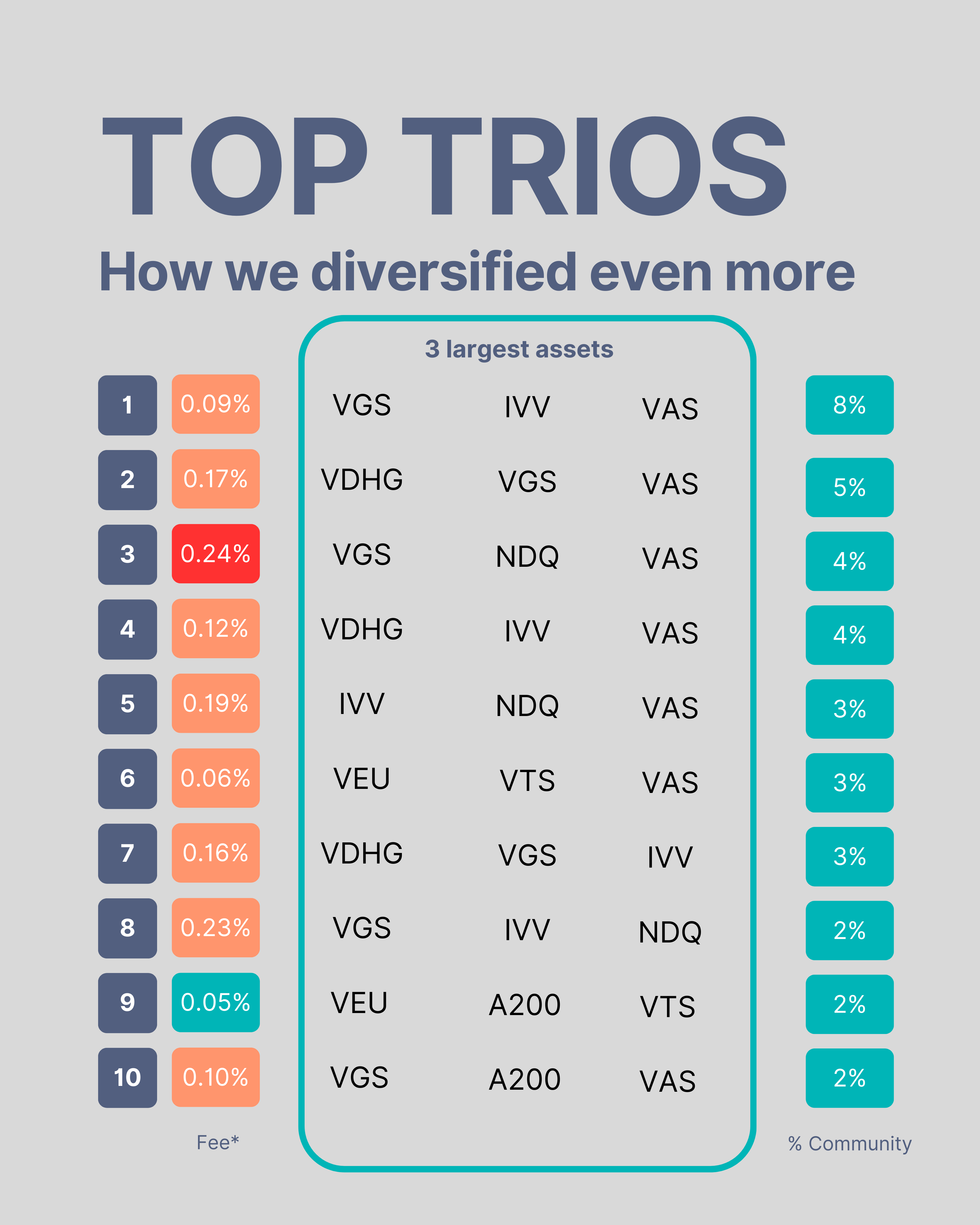

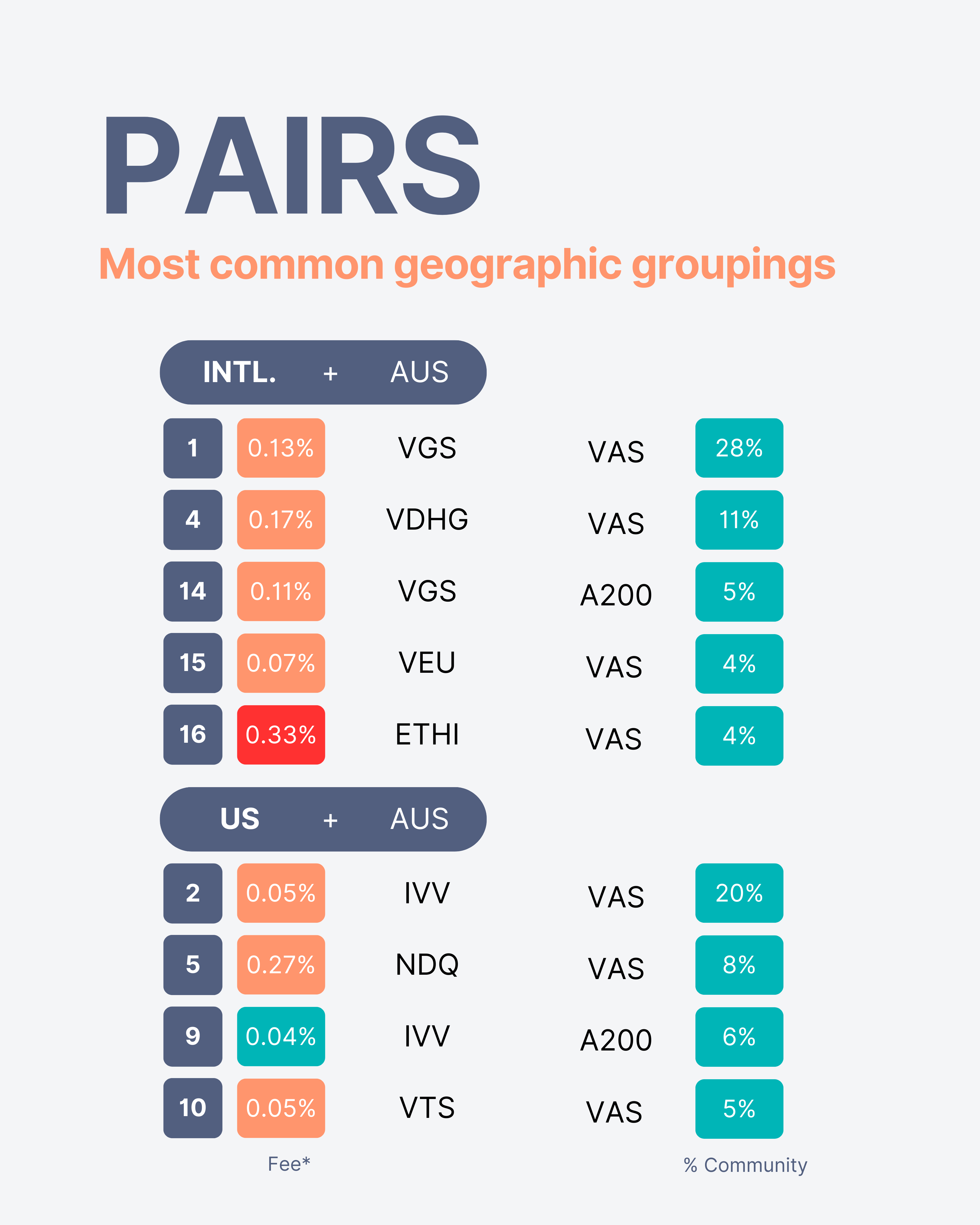

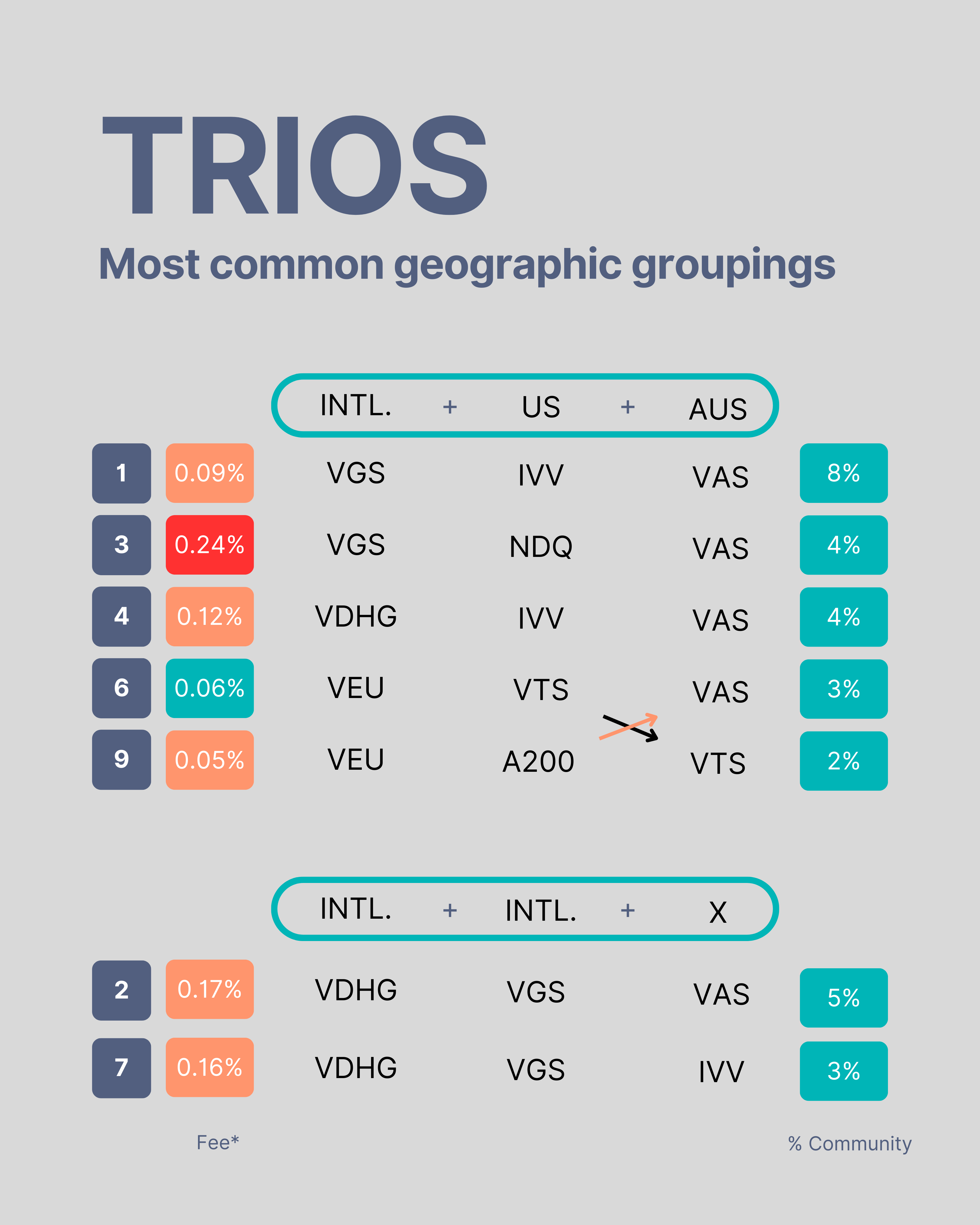

Top ETF pairs and trios

Because we love community data, we didn't want to stop with the most popular single ETFs. That's why we've detailed below Pearler's most popular pairs and trios in 2024, as chosen by our community.

Looking to browse through these ETFs at your leisure? Head on over to our Invest page for a deep dive.

Happy investing, and happy 2025!