I find December and January are a great time to reflect.

On your life and where you’re headed. On your habits, and where you can improve. And of course, on your finances.

So let’s take a look at the most common places to put your hard-earned savings. I’ll share my thoughts on each of them and explain where they fit into my plans this year.

To make it more practical, I’ll also suggest which type of people I think are best suited to each option.

Note: Nothing here is a recommendation. As always, please do your own research before making any decisions.

Let’s kick it off with the big daddy of asset classes - the global stock market. Now, it’s tricky to speak about the global market as a whole because it comprises a few moving parts: US, developed, and emerging.

So let’s talk a little about each. Firstly, US shares.

US Shares

Where do we begin? The US stock market has been on an incredible run for a long time, despite the occasional setback.

In fact, since the GFC, the US market has left the rest of the world behind in terms of performance. As I write this in December, the IVV fund page is showing 10 year returns of 15.5% per annum.

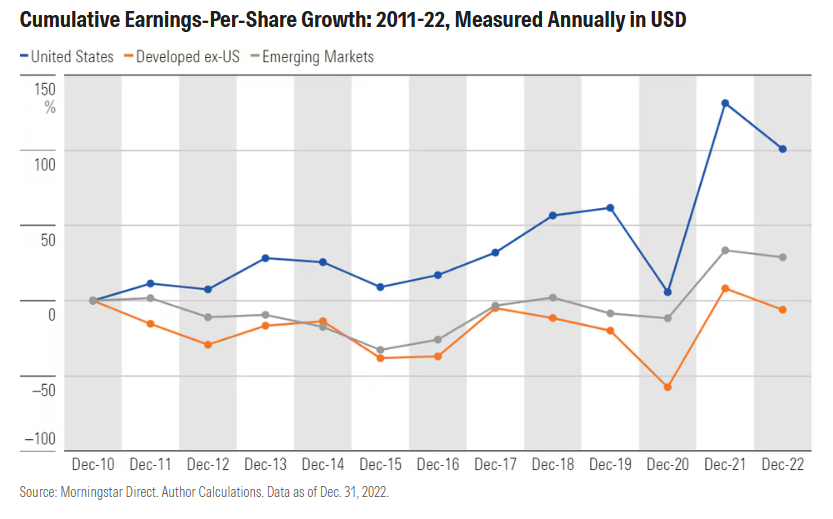

The primary reason for this is the tech boom, driven by the increasing dominance of these companies in our daily lives. And it’s hardly all hype. Earnings have been growing at an impressive pace, year after year - much faster earnings growth than both developed and emerging markets. This article shows it, as does the chart below, and it’s continued strongly since 2022.

Now yes, valuations have increased faster than earnings, making US companies more ‘expensive’. That’s based on the expectation of continued high earnings growth. Will that turn out to be accurate? I’m not sure. I do think the growth will continue, but the speed is debatable, which is why valuations (and the market) will zig zag around.

The outperformance versus the rest of the world could go on for many more years. But it does seem unlikely to be never-ending. Plus, at some point, we’ll have a truly nasty downturn and recession like 2008, and a slow recovery - not the V-shaped bounce-backs people are getting used to. So performance overall will definitely take a hit (recent returns have been way above average)

People argue US stocks - tech specifically - are in a wildly inflated bubble that’s going to implode at some point, just like in 2000. Others say they’re the greatest companies the world has seen and the US market will keep outperforming, finding new ways to grow earnings at a fast pace. I’m not sold on either argument - though the second one does seem more likely.

What I’m doing:

Overall, I’m continuing to invest in US companies for the long run and not overthink valuations too much. But I’ll do it via my global fund VGS, while also holding Aussie shares, so I’m not totally reliant on one market.

Probably best suited to:

Long-term investors who believe the US has a bright future, understand that recent returns have been unusually strong, and can tolerate the idea that the next decade might be less exciting than the last (AKA underperformance is possible).

Non-US Developed and Emerging Markets

To be clear, non-US developed markets are essentially Europe, Japan, Canada and the UK.

These markets are basically seen as unexciting and many investors would even think, why bother? Those who hold developed market stocks usually do so within a global index fund like VGS or BGBL (like I do), which also covers the US market.

Currently, VGS/BGBL comprise about 70-75% US stocks, with the remainder being the countries mentioned. Now sure, these other countries do provide some diversification. But for the most part, they’re often seen as window dressing, garnish, or maybe even an annoying drag.

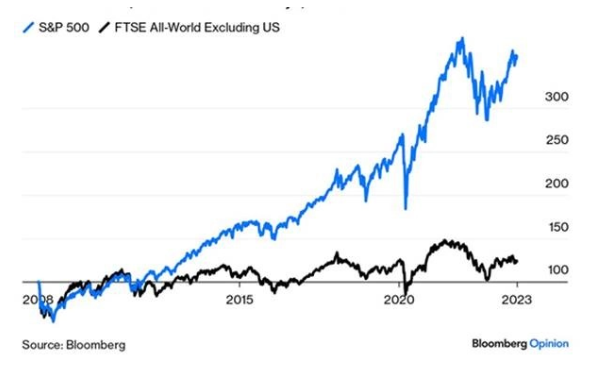

Especially when you look at performance…

Now, this ‘All-World’ index includes emerging markets too, but it highlights the US outperformance versus everywhere else.

However, that’s not the whole picture. When you look at history - and I mean longer term, not just the last 15 years - these markets aren’t as crappy as they might seem.

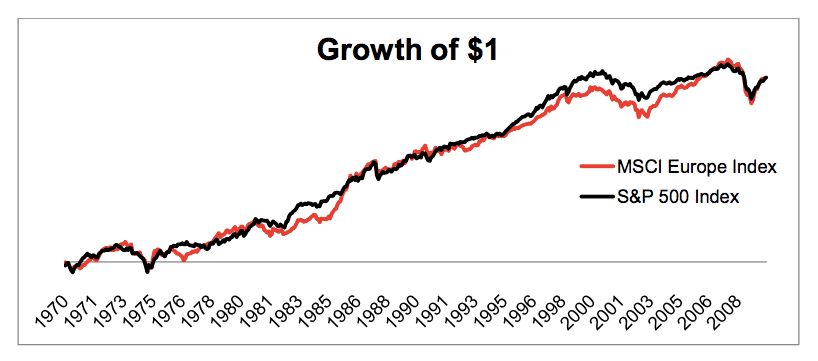

Here are two charts you might find interesting. One for Europe, and one for emerging markets.

Source: Reformed Broker

Source: Reformed Broker

Hmm, they don’t seem so terrible now. It all depends on what timeframe you’re looking at.

European markets seem to have performed neck-and-neck with US stocks until the GFC. Then the divergence began as US tech swallowed the world.

And although the second chart is dated, since inception of the emerging markets index in the late 1980s, it’s done fairly well indeed.

The point is, there are likely going to be times where other parts of the world outperform the US. The 2000s is one such example, where US stocks delivered zero return from about 2000 to 2012.

Diversification can come in handy. Not only to average out performance and help you reach your goals with greater certainty, but also when living off a portfolio to reduce reliance on one market doing well.

There’s a decent argument for emerging markets and/or developed markets outperforming the US over the next decade. Simply based on the recent lacklustre 10-15 years and reversion to the mean, cheaper valuations, and potentially a US tech slowdown (leading to a re-rating of US valuations).

And to be fair, while returns haven’t been great, they also haven’t been horrible for these two options over the last 10 years:

Ex-US developed markets: 9.3% pa (before fees, using

this index

)

Emerging markets: 7.7% pa (after fees, using

this index

)

Just like in property, nothing lasts forever and no single market is a permanent golden outperformer. That’s my view anyway.

What I’m doing:

While I don’t own emerging markets right now, I can see the long term investment case. I deem my simple two-fund portfolio (Aussie + global) good enough at this point in time.

Probably best suited to:

People who like the idea of being globally diversified and/or believe in mean reversion, even if it means owning more boring and unfamiliar companies/markets. And perhaps those who are growing nervous about the US, who don’t want to bet the farm either way.

Aussie Shares

Exciting companies in Australia are few and far between. We do get a few standouts, but for the most part, the ASX is seen as a market full of miners and mortgage providers, with a few other things thrown in there.

That lends itself to slow and steady growth with plenty of cashflow. Lining up with that, our tax system also incentivises that the money gets paid out to shareholders in the form of dividends.

I was looking at the annual returns for Aussie index funds to write this (using

Vanguard’s VAS fact sheet

), and I noticed something interesting. I’m sure you’ll see it too…

3 years: 9.6%

5 years: 9.8%

10 years: 9.4%

Since ETF inception (16 years): 9.2%

That’s a remarkably consistent level of return. Now, this will be part coincidence due to the dates involved. But interesting nonetheless. That doesn’t include franking credits, which would add another 1.2% to 1.5% to the yearly return.

Given Aussie shares aren’t likely to shoot the lights out in terms of growth, you’d expect them to be trading at much cheaper valuations than global (US heavy) shares.

Currently, the price-to-earnings (PE) multiple for the basket of companies in VAS is roughly 21. The price-to-earnings multiple for the companies in VGS is about 24. It’s a similar gap between the forward PE of US stocks and Aussie stocks based on expected earnings in the next 12 months (21 and 18, respectively).

Now, there are many other valuation metrics you can look at, which get debated endlessly by people smarter than me. But that’s less of a difference than I’d expect.

Regardless, when it comes to allocation, I’m basically just sticking with my chosen target and assuming the market is smarter than I am when it comes to valuations.

What I’m doing:

I’ll continue investing in Aussie shares, though less than in the past due to my already large holding. For context, my global allocation continues to creep up and now sits at 40% (target is 50%).

Probably best suited to:

People who value dividends, franking credits, and the familiarity of their home market and currency. And those who are happy to pair it with global exposure to get a well-rounded basket of industries and companies.

Property

Every Aussie’s favourite asset class!

There’s little point discussing ‘valuations’ for property - broadly speaking, they aren’t cheap.

I’m also confident in saying people are willing to pay the absolute maximum they need to in order to stop renting and end up with a paid off home one day. Therefore, I think prices will always appear somewhat crazy and irrational - at the upper limits of what people can afford. That appears to be embedded in the system and culture at this point.

Anyway, the below chart is what’s expected from property markets in 2026. Property market forecasts have a habit of being hilariously wrong, but I find SQM is better than most.

This was put out a while back when rate cuts were widely expected. Even though the interest rate outlook is always changing, I wouldn’t expect the outlook to be massively different. Prices look like they’ll probably go up somewhere between a moderate amount and a lot.

If you’re investing and already in the market, it looks like you’ll be banking some gains.

And if you’re looking to offload like I am, the market looks well placed for that too.

As I said in a previous article, if I was looking at buying a rental property, I’d look to the cities/regions which have had the worst performance in the last decade - probably Melbourne and Darwin.

If you happen to get a good part in the cycle, you can make some pretty significant gains thanks to leverage. But that’s far from a given. You could buy in, the market is strong for a year or two, then it stumbles and goes nowhere for half a decade. Not fun when you add in the negative cashflow and transaction costs.

What I’m doing:

I’m still in the process of selling property rather than adding more. While we could afford to keep at least one, I vastly prefer the effortless ownership of shares and having cash hit the bank account with zero expenses or admin. It’s just passive and peaceful.

Probably best suited to:

Investors who are early in their journey, who have a 10+ year timeframe, and don’t mind making a leveraged bet or two in the hopes it creates a better outcome. Assuming you have the borrowing capacity, can afford the cashflow burden, and don’t mind the extra hassle involved.

Cash/Offset

Everyone holds onto different levels of cash. Some need bigger emergency funds due to higher expenses and more liabilities to pay for. Some just feel more comfortable having a beefed up bank account for psychological reasons.

Then there are those of you who like to keep a bit of cash aside for market dips. You effectively ‘under-invest’ so that you can eventually ‘over-invest’ when prices fall.

I’ve spoken about this a lot in the past - like here and here - so I won’t bother repeating that topic here. While it’s not optimal from a probability standpoint, I understand why people do it. And if it helps you stick with your long term plans comfortably and consistently, then I don’t really have a problem with it.

Besides, in the current environment, you’ll be earning something like 4.5% to 5.5% while you wait (tax-free if it’s an offset account). For 100% stability and some optionality, that’s not too bad.

What I’m doing:

I’m not one to keep much cash around. So we’ll likely just hold a few months expenses in our offset account, with the remainder being invested. This ends up being a super small portion of our wealth (less than 1%).

Probably best suited to:

People who sleep better with some ‘dry powder’, have unpredictable incomes, or a more uncertain life situation. And those who know themselves enough to realise they might need to be less invested to stay calm during a market downturn.

Final thoughts

There are plenty of other investment options you might consider, like peer-to-peer lending, crypto, and so on. But hopefully this gives you a nice overview on how I see the most common options, along with what I’m doing.

When writing this, I’m thinking about someone reading who might be new to investing, wondering: “How do I decide what to invest in?”

The biggest factor that drives which of these options makes sense is your personal situation and the following attributes:

Your timeframe, risk tolerance, view of the world, future assumptions, tax rate, knowledge and comfortability with different assets, personality, and priorities.

For new investors, that’s the most frustrating thing in the world to hear. But unfortunately, there’s no substitute for educating yourself on the options and developing your own strategy.

Get ideas and the collective experience from others, sure. But don’t outsource the decision making, otherwise you’ll never build the foundational knowledge required to have real conviction in what you’re doing.

In other words, the goal isn’t to try and find this year’s best performing asset. It’s all about building a mix of investments you’ll still be happy owning ten years from now.

Thanks for reading. I wish you a happy and prosperous 2026!

Dave’s best-selling book Strong Money Australia is available on Amazon. Listen to the audiobook on Spotify or Audible.