"Hi Dave, can you give us a quick intro?"

Hello, and welcome to my first interview over here at Pearler HQ! For those who don’t know me, I’m Dave from the blog Strong Money Australia.

What am I doing here? The main reason I created this Strong Money Australia is to share the lessons I learned from my own FI journey, as well as what I’d do differently starting again today. And to help people build a strong financial position, to live a life with more free time and less stress.

Now, you might wonder why I bother, since technically I could sit on the beach all day or laze around watching TV with beer-in-hand. Well, after ‘retiring’ from our regular jobs, we still need meaningful work to do. That’s what humans thrive on, and it’s a key ingredient to a happy life.

So after unwinding for a few months and settling into a new, slower-paced way of life, I decided to start this website. At first, it was just a blog to share my thoughts and see if I enjoyed writing. Today, I share updates on what’s happening behind the scenes with my own finances.

Obviously, nothing you’ll read here is financial advice and I’m not recommending you do anything… except, hopefully, enjoy the interview!

"Dave, what's your current wealth breakdown looking like?"

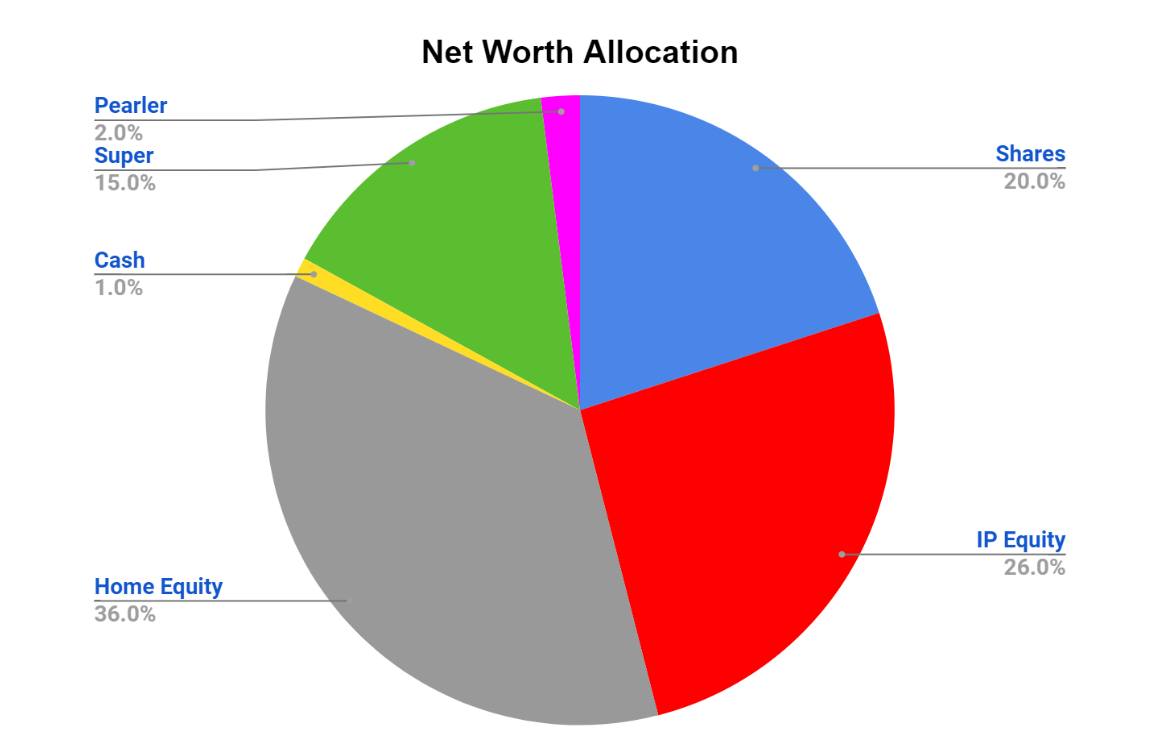

Right now, here’s where the Strong Money household’s net worth is located. I don’t share the actual numbers for privacy reasons, but hopefully this gives you a good financial picture of what’s happening.

What’s changed from last time? All our cash is gone and the home purchase has been completed. Our investment properties (IPs) have gone up a bit and our shares/super have both gone down. And if this is your first time reading one of my updates, yes I’m a very small shareholder in Pearler.

So, at the moment we have a paid-off house. Which is pretty cool, and I've thought about leaving it as is. But at this stage, I feel a larger share portfolio is more useful for us, given it’s likely to be the most profitable long term approach. So this net worth allocation is actually due to change in the next month.

As per our home-buying plan, we’re currently selling an investment property. We managed to secure a price around 5% higher than expected, which is great. Settlement is later this month! We’re also utilising a nifty strategy whereby we can transfer the loan from our IP to our home.

Why would we do this? Because then we’ll receive the entire proceeds from the property sale (after costs), allowing us to return our share portfolio to original size, or bigger. This roundabout method was the ideal option for us, given we’re a few years into retirement and had no chance of getting a new loan to fund the house purchase. So we had to sell off a large amount of shares to fund it with cash.

"So how is the current market environment affecting you?"

Since my last update back in March, markets have fallen further. Though not much further, to be fair. The US market is down around 20% since January as I write this. The Aussie market, on the other hand, is only down about 12%. When dividends are included, the Aussie market fares better again.

Regular readers will know I don’t even bother trying to guess where the market is going in the short term. But in the long run, I believe, as do hopefully most people reading this, both the US and Aussie markets will be much higher than they are today.

The short term pain of seeing your wealth decline is real. Everyone feels it. But it’s how we deal with periods like this that determine how wealthy we become in the future.

"How have you been going with your property investing?"

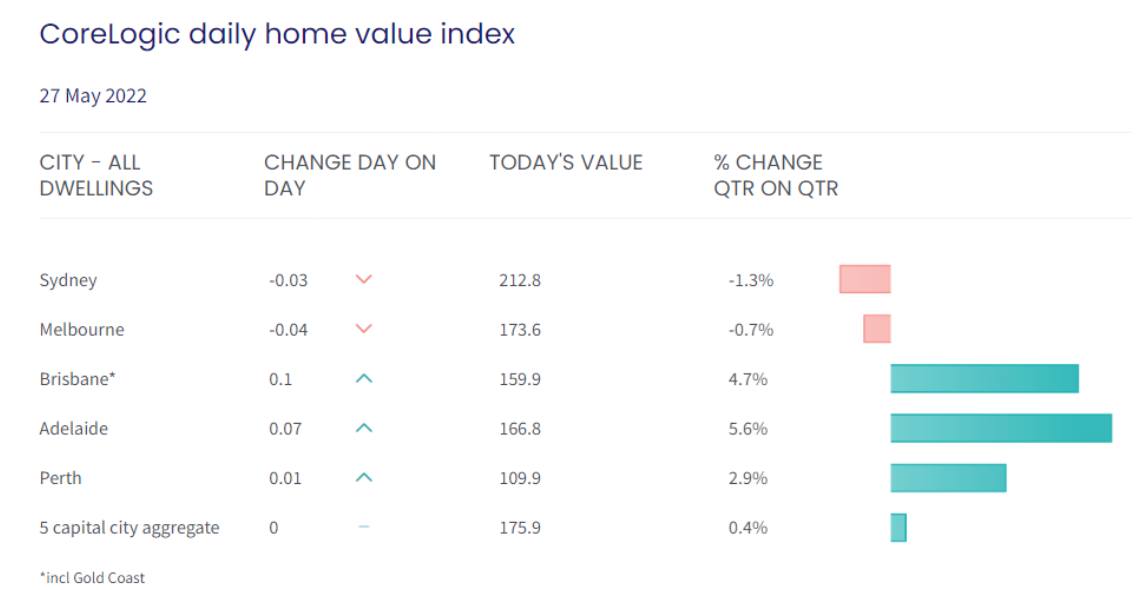

From most accounts, property markets have slowed a little since the first interest rate rise.

The big capitals of Sydney and Melbourne have recorded price declines for the most recent quarter. Other markets, like Adelaide, Brisbane and Perth recorded solid gains.

We have three properties remaining in Perth, so I’m personally rooting for price increases so we can offload these in the future. Overall, Perth property has done poorly over the last 10-15 years, which has been our investment period. Something Sydneysiders and Melbournians can only scratch their head at!

We’ve had a couple of nice rental increases this year, so that's been helpful. Having said that, rents in WA are also basically the same level now as they were 10 years ago.

"What has your portfolio and investment income looked like in 2022 so far?"

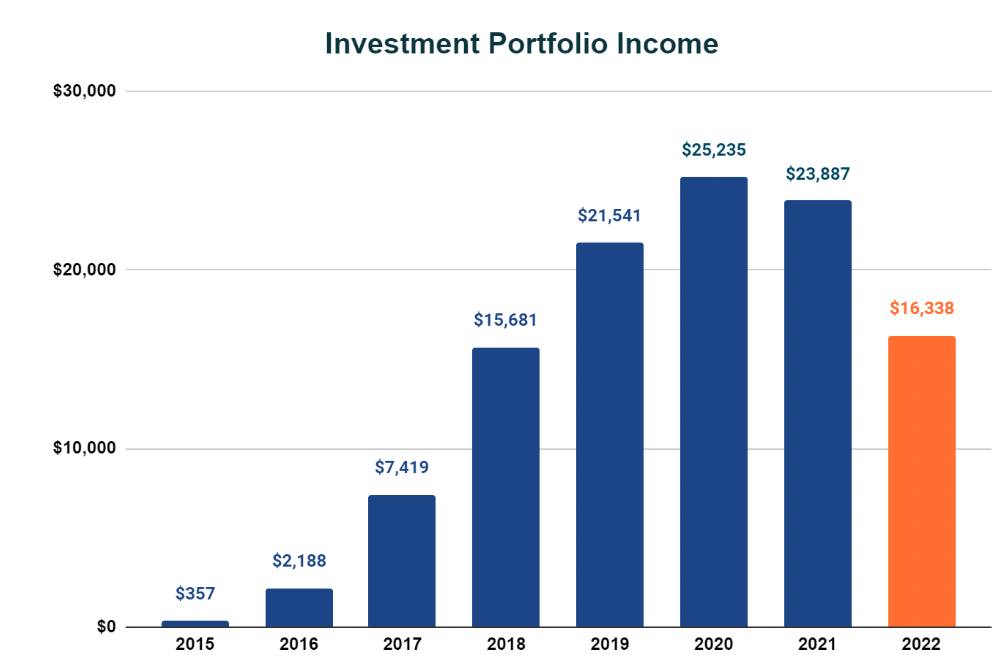

Below you can see the annual dividend income our portfolio has generated. The orange bar indicates the six months to December, since we aren’t finished the current financial half-year yet. I’ll do the full-year update later in 2022.

These numbers will be messy during the next 12 months though, given the sale and later re-purchasing of a large lump of shares. After that, the annual income tally is likely to be much higher than previous years.

For new readers: If you’re wondering how we consider ourselves ‘retired’ if our passive income isn’t higher than our household spending, I explain how that works in this article on how to manage your monthly income.

As you can see in the next chart, most of our portfolio is still Aussie-based investments. I do enjoy the higher income stream from Aussie shares, but I’ll continue increasing our diversification to international shares (VGS) over time.

In the current market selloff, this portfolio has held up better than a more global allocation. But that’s pure luck, of course! And importantly, it hasn’t changed the way I think about global shares or how we plan to build out this portfolio.

Our real estate trusts (REITs) haven’t fared quite as well as our Aussie index fund (VAS). The market is obviously expecting real estate values and earnings to be hurt by rising rates. But the two trusts we own are looking cheap to me, so I’m looking forward to topping up these holdings.

QVE is a value-focused listed investment company, which is holding up better. In this environment, people are shunning speculative stocks and starting to favour boring old earnings and dividends. So the companies QVE owns aren’t cratering like some of the high-flying growth names. All of a sudden, cashflow, profits, and dividends are important. Who would’ve thought?!

"With all that in mind, what are your future plans?"

The frustrating part about our current situation is we haven’t been able to buy any shares for a while. All our available cash went to the house purchase, and lately, renovations (it was truly a dump when we bought it!).

You could argue our renovations are providing returns in the form of an increased property value, and emotional benefits from a nicer home to live in - but still!

We’re now basically just waiting for our IP to sell in a few weeks and we’ll be back to normal, steadily investing each month and continuing our transition from property to shares.

I’d love to be buying during this downturn. But sometimes what’s going on personally trumps everything else and you just have to accept it.

My friend keeps pointing out I’m lucky to have missed some of the market fall since my portfolio is less than half the size it was before. I keep telling him the show isn’t over yet. By the time I reinvest the ‘house’ money, the market could easily be back at all-time highs!

And it’s interesting because usually I’d be nervous about investing a lump sum. But this doesn’t feel scary because most of our lump sum investment will be replenishing money that was taken out recently. So even though it’s a huge amount of money to put in the market, it feels much different because it’s only a bit more than before. My mind is still anchored to the portfolio we had earlier this year.

Given I have no control over this outcome, I’m spending no energy worrying about it - whatever happens, happens.

Anyway, there you have it - the latest on what’s happening with my own investments. I really can't wait to get this property sale completed and replenish the share portfolio. It’s also one less thing to manage, which is nice.

If there’s one thing that aligns with financial independence, it’s having a simpler set of finances. Because complexity, as smart and sophisticated as it seems, isn’t required.

We hope you enjoyed this update from Dave at Strong Money Australia. Dave will be publishing some in-depth articles on the Pearler blog in the coming weeks, so stay tuned!