NOTE: we do our best to share general resources so you can do your own research. When it comes to tax, this is personal to your investing and financial position. We are not a tax advisor, and don't have any information about your personal situation. When investing, there may be tax implications and you should get advice from a licensed tax adviser.

This article was first written for the November Issue of Equity, the Australian Shareholders' Association's monthly magazine. This second version is just a more web-friendly version of its print predecessor.

The irony of investing is that it pays to be lazy.

The fewer trades we make, the less we spend on brokerage and the better our long-term returns.

And that’s before accounting for the extra time, money and energy we spend researching, transacting, monitoring and reporting on it all.

Now don’t get me wrong, we still need to invest, and the more we invest, the better off we will be.

BUT the stats clearly show that the more passive our investing strategies are, the better our long-term returns on whatever money we do invest.

There are literally hundreds of reports which show this, with my favourites being the S&P Indicies versus Active reports.

Hopefully though, you don't need any more convincing and you're already looking for the simplest, laziest option.

With that in mind, I've written this article for three types of investors:

- Passive investors

- Active investors looking to simplify

- Active investors who’d like to encourage their loved ones to invest

If you fall outside these three categories, this article probably isn’t for you.

But for those inside these categories, welcome! You're in for a treat:

- If you’re a passive investor, I’m preaching to the choir – this article hopes to help you become an even lazier investor.

- If you’re an active investor and you are looking to simplify, you’ve found the right place – this article will help you spend less time, money and energy investing.

- And if you’re an active investor who’d like to get their loved ones to start investing, I’ve got a proven, straight-forward framework for you – Financial Independence.

All of the knowledge you'll need to simpli-FI your investment strategy is below, specifically:

- The stats show…

- Dispelling the 'passive investing is a bubble' myth with one picture

- The Financial Independence movement | An Intro

- How to simpli-FI

- At the end of the day

The stats show…

I’m sure you’ve heard it before, but to be thorough, here are the stats:

- In Australia, 84% of active funds were outperformed by the S&P/ASX 200 Index over the last 15 years.

- This outperformance decreases for small- and mid-cap funds, though remains above 50%, and increases for international funds.

- The table below from the latest S&P Indicies versus Active (SPIVA) report illustrates these data points, as well as some more granular detail.

In summary, professional investors, whose job it is to analyse and evaluate investments, consistently underperform index and exchange-traded funds (ETFs), on average.

So, if the vast majority of professionals underperform the index, what hope do retail investors have?

Very little, according to value-investing superstars like Warren Buffet, Peter Lynch and Benjamin Graham.

They've each stated that retail investors would perform better if they shunned active investment strategies.

In fact, in Berkshire Hathaway’s 2005 Chairman's Letter Warren Buffet went so far as to propose a ‘Fourth Law of Motion’: For investors as a whole, returns decrease as motion increases.

He estimates that the 'friction' or costs of investing amount to a staggering 20% of business earnings.

It is also widely known that Buffet has also directed that 90% of his wife’s estate be invested in a low-cost S&P 500 Index fund.

For me, a reformed active investor, deciding to adopt a mostly passive strategy boiled down to one question:

Do my returns justify the additional time, money and energy I spend investing in any way other than the laziest way possible?

I calculated my portfolio total return and compared it to the All Ords Accumulation Index. My 5-year annualised return was ~0.25% pa above the index (in hindsight, I just got lucky).

Considering the size of my portfolio though, that was nowhere near enough to justify the 5 – 10 hours per week I was spending. Plus I’d become way too busy to enjoy reading annual reports.

So, I decided my time was better spent working to earn more, relaxing at home, or drinking pina coladas, and I gave it away.

The investment strategy I then adopted was super easy and simple - regularly invest in ETFs.

I later found out that it’s the same strategy used by an online community of self-taught passive retail investors called the Financial Independence (FI) community.

Before I get into FI though, there’s one thing I have to do first…

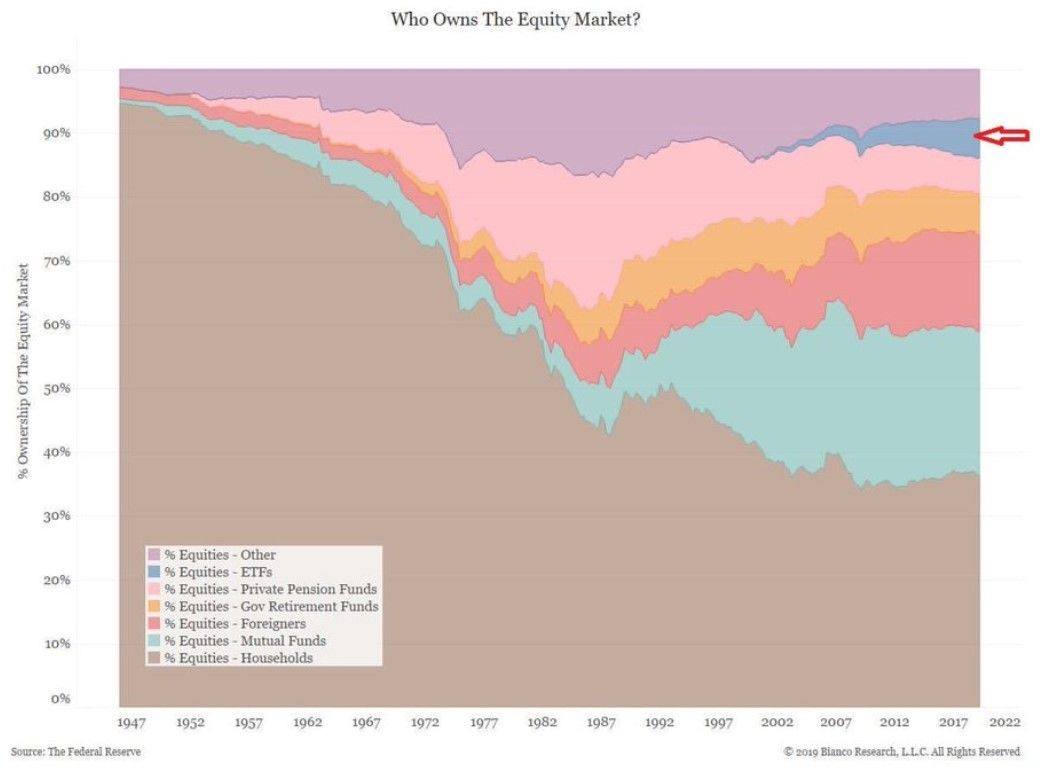

Dispelling the ‘passive investing is a bubble’ myth with one picture

Passive investing has received a fair bit of negative press recently. Notably, this press has originated from active managers who are incentivised to prop-up their stagnating industry.

The truth is, while Index funds represent about 15% of shares in US public companies, and about 5% globally, managed funds still own 2 to 3 times that and set the price of securities on the market.

As you can see in the chart below (compare 'ETFs' with 'Mutual Funds').

The notion that passive investing can create a bubble is a contradiction.

Fundamentally it doesn’t make sense because bubbles come from price speculation and passive investment strategies are price agnostic - they can’t co-exist.

Indeed, any equity market bubble, whether it happens today or in twenty years, will be due to the decisions made by active investors – passive investors are just along for the ride.

If you’d like to read more on this, here are two light but thorough reads I really enjoyed - Debunking the Silly Passive is a Bubble Myth and The Real Bubble Has Always Been in Active Management.

The Financial Independence movement | An intro

Financial Independence (FI) a.k.a. Financial Independence Retire Early (FIRE) is a growing global community of hundreds of thousands (soon to be millions) of people who are teaching themselves to become confident, capable investors with limited financial background or literacy.

Their goal is to generate enough passive income from their investments to cover their annual expenses and be financially free.

From there, they do what they want to do. If they want to retire, they retire; if they want to try a more fulfilling career, they change careers; and if they love work, they keep working.

It’s all about having the freedom to spend their lives doing what they love. And Australia has a particularly strong FI community.

An event held in Sydney this August hosted the largest FI community gathering outside of the United States to date, with close to 300 people attending.

It seems Aussie values and the FI ethos are a great match…

How to simpli-FI

The most powerful part about the FI community is the simplicity of their investing strategy.

The simplicity is powerful because it allows everyday people to overcome the massive hurdles to 'getting started'.

By making investing easier, FI has the ability to truly democratise investing for the everyday person.

And that's the bit I love.

The investing process generally follows these three steps:

- Identify risk tolerance based on future cash and psychological needs (read how to here)

- Identify a target portfolio of one or more low-cost, broad-based ETFs (read how to here)

- Invest the same amount periodically into the target portfolio, known as dollar-cost averaging (read how to here)

By following this strategy long-term, FI investors have outperformed over 80% of professional investors with minimal effort.

So when it comes to investing, it really does pay to be lazy…

At the end of the day

FI is a community as much as it is an investing strategy.

Both elements are useful on their own, but together they are a force that has transformed thousands of everyday peoples' lives and will likely transform thousands more.

Still, whether you become part of the community or not, here are a few hacks FI investors use that will help you simplify your passive investing strategy, no matter who you are:

- Select ETFs using Stockspot’s latest Australian ETF research report

- Optimise how often to invest using Pearler’s Investing Frequency Calculator

- Simplify tax and reporting by using Sharesight.

And for those individual shares you already own, remember, you don’t need to worry about going to AGMs and stressing about the mountain of NOM paperwork – sign ASA up to be your proxy.

What’s the moral of the story? Invest lazily but save diligently.

Happy FI-ing 🔥

Kurt

At Pearler, we pride ourselves on the quality of the general financial advice we give. Please note though, that this advice has not been tailored for you. You have unique financial goals, circumstances and needs which may make this advice inappropriate, and it is important that you know whether it applies to you. If you are unsure we urge you to speak to someone you trust who is competent with money and understands your individual needs, whether they be a trusted friend or accredited professional.