NOTE from Pearler: we do our best to share general resources so you can do your own research. When it comes to tax, this is personal to your investing and financial position. We are not a tax advisor, and don't have any information about your personal situation. When investing, there may be tax implications and you should get advice from a licensed tax adviser.

In Part One, we explored why timing the market is a fundamentally flawed idea. I encourage you to go and read that article, because it fits nicely with what we’ll cover in this post.

Specifically, we’ll explore a couple of strategies for timing the market, I’ll explain the challenges and mental hurdles involved, how it’s not as easy as it first seems, and why you should keep investing regularly for your long term goals.

Timing the market in practice

If we’ve decided to play this market timing game, the first thing is we need to decide how we’re going to do that. No, you can’t wing it! Will you wait for a big crash and go ‘all-in’ at a specific point? Or will you drip feed your money in as the market falls?

Let’s consider the ‘all-in’ approach first:

With this method, you need to decide at which ‘threshold’ you’ll invest the cash you’ve been building up. When the market falls 20%? 30%? Or maybe 50%?

Let’s say your chosen threshold is 35%. That’s around the same decline experienced during the corona crash of 2020, but not as bad as the GFC collapse of 50%. So, the plan is if the market falls 35%, you're ‘all in’. Sounds good. But what if shares only fall 30%? Is that close enough, or will you keep waiting?

As you might imagine, this is where it gets tricky. Whatever threshold you choose, the decision-making process is the same. How do you know how far the market is going to fall? You don’t. And that’s the problem with this all-in approach. You only have one shot at it, and so it can feel like an incredibly important and stressful choice to make.

For this reason, the more common option for timing the market is to steadily invest this extra cash at different intervals as the market goes down. We’ll call this the drip feed approach.

Drip feeding as the market falls

You’ve got your small stockpile of cash. Instead of the above, you decide to add more to your portfolio for each 10% the market falls. When it drops 10%, you put in a bit. At 20%, you put in more, and more again after a 30% fall. Then, if the market gets to a 40% drop, you’ll put every dollar in.

This sounds a lot more sensible than the lump sum approach, which is essentially hoping you go all-in at the bottom of the market. Yeah… good luck with that! But the drip feed approach is still just as tricky to apply.

Let’s say the market falls 13% over a couple of months. You put in your first chunk of cash. The market falls further, it exceeds a 20% decline, so you invest your next chunk. and is now down 28%. You invest extra at 20%. “Sweet, I knew this was a good idea.” Prices decline further and now shares are down 28%. Now you’re not sure. A 28% fall is pretty damn close to 30% – is that close enough? Do you break your own rule? If yes, how about 27%, or 26%?

Maybe you wait. The market starts going back up. Then, you wonder, “is this it?” Have you missed your shot? You’ve still got extra cash and you didn't get to invest very much. Prices are still cheaper than before. Do you invest the remainder or not?

If the market falls 20%, how do you know it won’t fall another 20%? And if it falls 40%, couldn’t it fall further? Instead, the market could fall 15%, recover, and then rise for the next 5 years. All are possibilities, and by playing this game we can’t help but try and figure out which one it is. Unfortunately, there’s no rule for how far the market will or won’t fall.

Sharp downturns in reality

Let’s say you stick with your investing plan. The market drops more than 30% and you tip a third chunk of cash into the market. News stories feed the negativity the market falls further, now down 40%.

You start getting worried. It feels scarier than you imagined. There’s talk of company bankruptcies and political tensions are worsening. Unemployment rises, some of your friends lose their jobs and are struggling to find work.

Everything suggests worse times are ahead, and your own job may be less than certain. So you decide to keep your cash pile for now and reassess in a few months. While you might object to my scenarios, this is a worthwhile thought experiment because you’ll have to make these decisions in real time.

It won’t be easy. You’ll probably want to wait for some ‘green shoots’ of positive news before tipping money into the market. But remember this: the best time to buy will likely be the scariest time to buy. When everything inside you says don’t do it, the economy is in the toilet and shares fall further every week.

The dust never settles

After the GFC, there was non-stop talk of the global economy not recovering, and instead falling into a deeper recession. It was expected to be the Great Depression all over again.

Then for years the European debt crisis was going to cause the global recovery to end. After that, there have been ongoing fears of China’s economy slowing, dragging Australia down with it.

Then we worried about Brexit, and a world with Trump as President. Then Aussie housing was going to ‘collapse’ – isn’t it always? Later came trade wars, followed by coronavirus, and now rapid interest rate rises and yet another predicted recession and housing collapse.

Waiting for the dust to settle? Never gonna happen. It’s like this every year, every decade. If you decide whether to invest based on the prevailing stories at the time, you’ll simply never invest. And then you miss out on the chance to compound your money and build lifelong wealth.

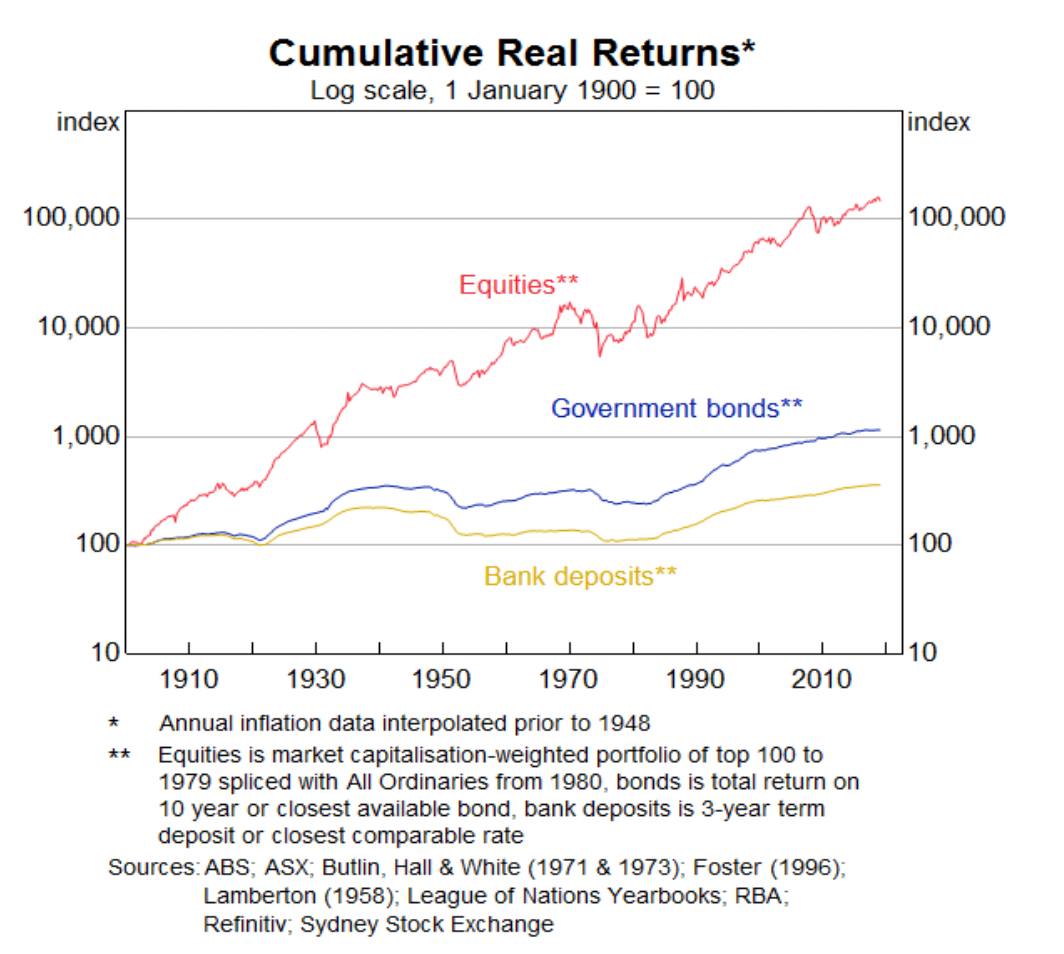

Interesting stat: since 1900, Australian shares have provided a return of over 1,000x after inflation.

As I pointed out in the article "Where will the sharemarket be in the future?", it’s entirely possible that young investors today will see markets at 10x the level they are today. So, if a market index falls from 7,000 to 5,000 on its way to 50,000, does it really matter?

The mindset of a market timer

What’s often forgotten about is the human emotions behind the investor. It sounds easy to invest when the market crashes, but not so in real life. We worry about further losses, and whether our personal finances are strong enough to withstand a recession.

Maybe efforts to stimulate the economy won’t work. Maybe company earnings and dividends will be hit hard. The uncertainty of all this can create fear and inaction. As we’ve discovered, the all-in approach, and the interval approach could both prove difficult to follow. But there’s another complication.

The longer we wait, and the more cash we have, the bigger the decision feels. This creates anxiety around getting the timing right. That can cause us to wait longer for a larger fall, because there’s more emotion (and dollars) invested in the outcome. We’ve made the choice and we want to make sure it was worthwhile.

So in a strange way, we want a real horror crash to justify our approach. Otherwise it just won’t feel worth it. Consider the situation where, after a 15% drop, the market recovers and steadily rises to new highs. As time goes on, our market-timer isn’t sure what to do.

He was convinced a big downturn was coming. He could feel it in his bones. And the well-meaning experts confirmed his view. But it doesn’t eventuate. This is the seduction of market-timing. It feels cautious, even prudent. But numbers aside, the difficulty in managing our emotions and getting it right is astounding.

In contrast, consider a blissfully ignorant investor, who continues to pour money into the market (seemingly down the drain when the market is falling). She stops checking her portfolio, and focuses on what she can control: saving, investing and reinvesting her dividends. Meanwhile, while the market-timer’s cash sits in a crusty old bank account collecting dust, with the rats of tax and inflation gnawing away at its value with each year that passes.

As the market slowly recovers, the regular investor is rewarded with a bigger portfolio and increasing dividends once again. The market timer grows ever-more resentful of these seemingly ‘careless’ investors, and the desire to be right festers on itself. He stops investing and starts thinking the market is a big bubble. But he quietly wonders whether he’s made a mistake.

At the end of the day, the regular investor is likely to end up far wealthier than the market timer, based on two simple things: most years the market provides positive returns, and she’s continually adding to her portfolio. Timing the market is a bit like trading stocks - it’s possible to come out ahead and beat the market average, but the odds of doing so are low.

Final thoughts on timing the market

While reading these two articles, I hope it has become clear that timing the market successfully is the financial equivalent of Mount Everest. For most of us, we’re far better served ignoring the concept altogether.

Here’s a few key points worth remembering:

- By trying to time the market, you’re effectively betting against the market. The odds of coming out ahead are not good.

- Our overall goal is to reach a point where we have a large portfolio of income-producing assets. And we only get there through investing regularly over many years…not by watching and waiting.

- If you wait for the bad news to subside, you’ll never invest, because it never does. We move from one ‘crisis’ to another, year after year. Despite this, the wheels of business keep turning and investors are rewarded over time.

The truth is, we’ll only ever know the ‘best’ time to invest by looking back later. Or, as Warren Buffett put it: “In the business world, the rearview mirror is always clearer than the windshield.”

Until next time, happy (consistent) investing!