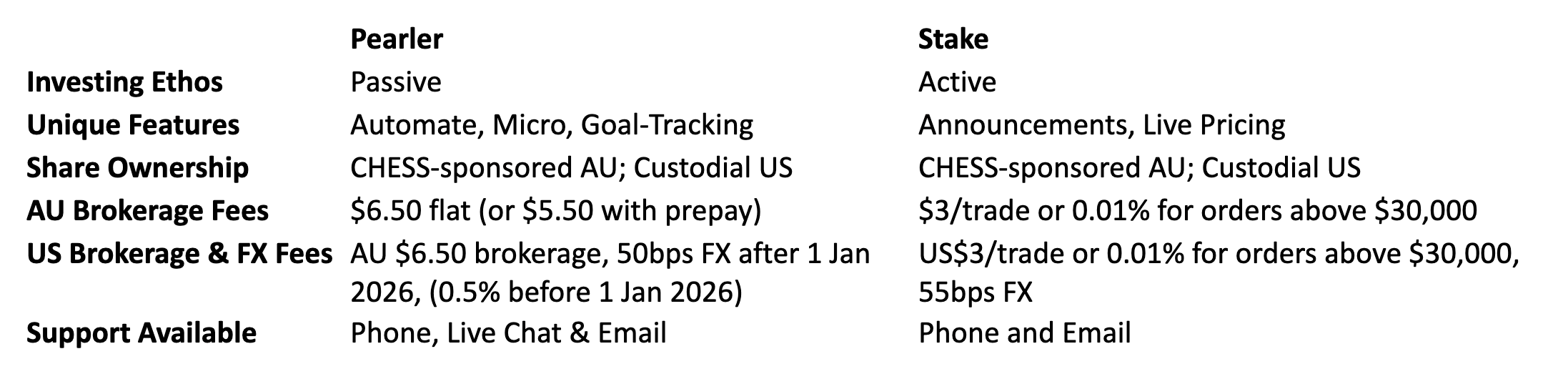

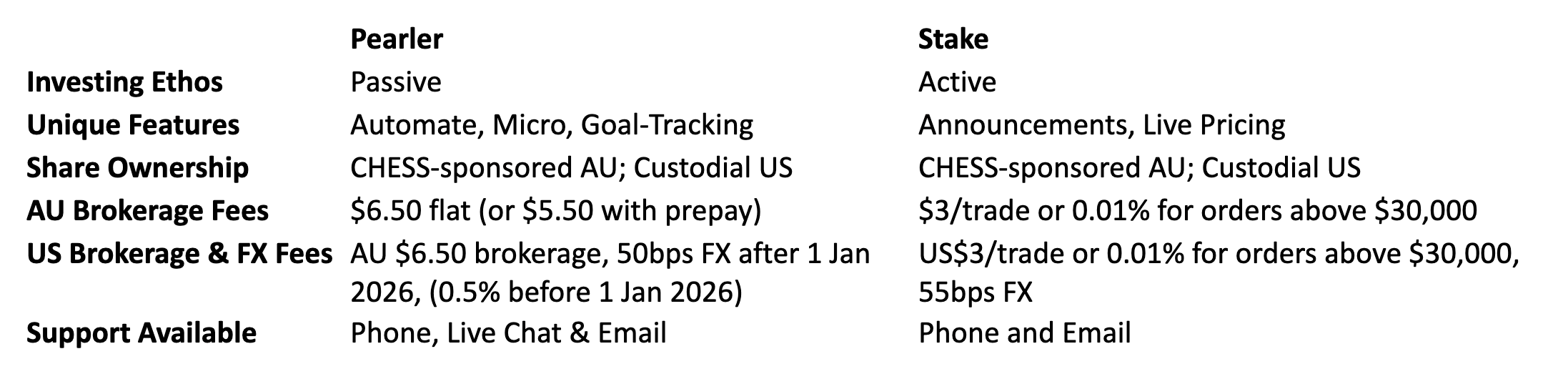

Let’s begin with a bird’s eye view fees, features, and philosophy. We’ll then dive into the specifics lower in the article.

Last reviewed 31 January 2023.

Investing ethos of Pearler vs Stake

Pearler is an investing platform built to support long term, passive investing. The platform is for beginner to experienced investors who share a desire for “boring investing for the long term”. In other words, the aim is to build wealth slowly over time. Pearler makes investing simple, automatable, and low touch whilst providing sustainable returns long term.

Pearler enables investors to build their wealth using diversified portfolios, providing access to listed investment companies (LICs) and exchange-traded funds (ETFs). Shares in individual companies are also accessible on the platform, however Pearler investors typically channel only a small allocation of their portfolios to direct shares. Pearler is fit for investors with long term investment goals - around five to 20+ years - who prefer a buy and hold strategy and minimal managing and monitoring of their investments.

In comparison, Stake is an active investing platform for both short and long term investors. Its primary focus is to help investors research, compare, and select shares that will outperform the market over varying time horizons. These investors believe they can outperform the market, and Stake gives them detailed company research and financial information in an effort to enable them to do so.

Stake is built for investors who want to invest most of their wealth in individual companies, and actively research, monitor, and manage each of their investments on a regular basis. Stake makes it easier to research and learn about individual companies, their operations and their finances. Stake also enables investors to own shares in ETFs & LICs. However, these typically account for a small percentage of each portfolio compared to individual companies.

Stake is built for investors who have a mix of short and long term investment horizons (i.e. one day to 20+ years) and who enjoy spending hours each week researching, evaluating, and trading shares.

Unique features

Pearler and Stake have unique features that reflect their underlying investing ethos.

Pearler’s distinctive features are Goal-Tracking, Automate, and Pearler Micro. Used together, these features empower investors to fully embrace passive investing, where the focus is on investing consistently over the long term rather than monitoring daily share price movements.

With Pearler’s Goal-Tracking, investors can set an investment goal and track their progress toward it. This encourages investors to focus on their goal, track their journey, and celebrate milestones on the way. This feature drives investors to adopt long-term investing habits to accomplish their goals.

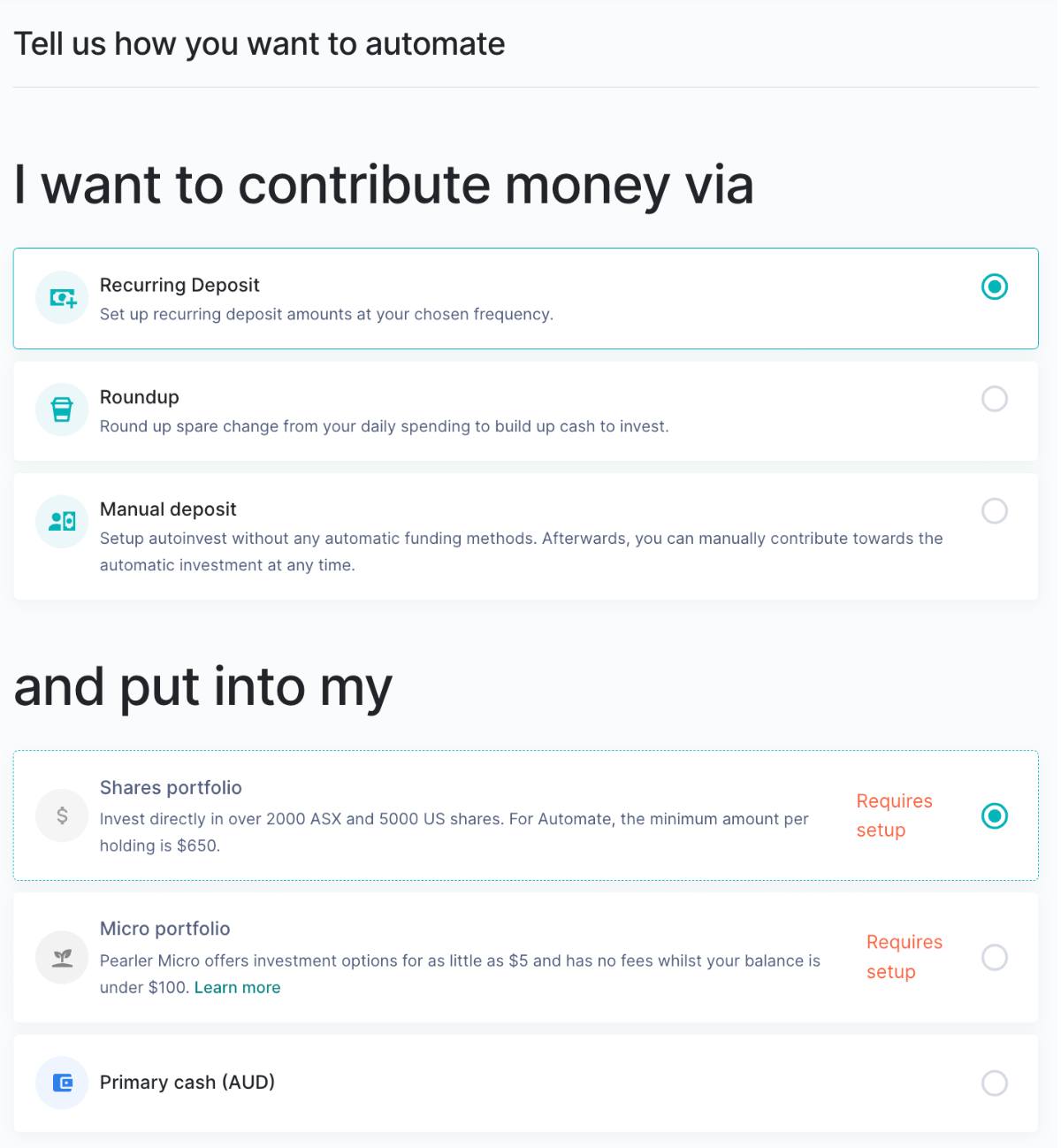

Pearler’s Automate feature allows investors to streamline their investing strategy through automation. It’s a low touch option that enables investors to schedule automatic deposits in Cash and investments in Shares and Micro; easily link multiple bank accounts; and round up extra change into Shares or Micro.

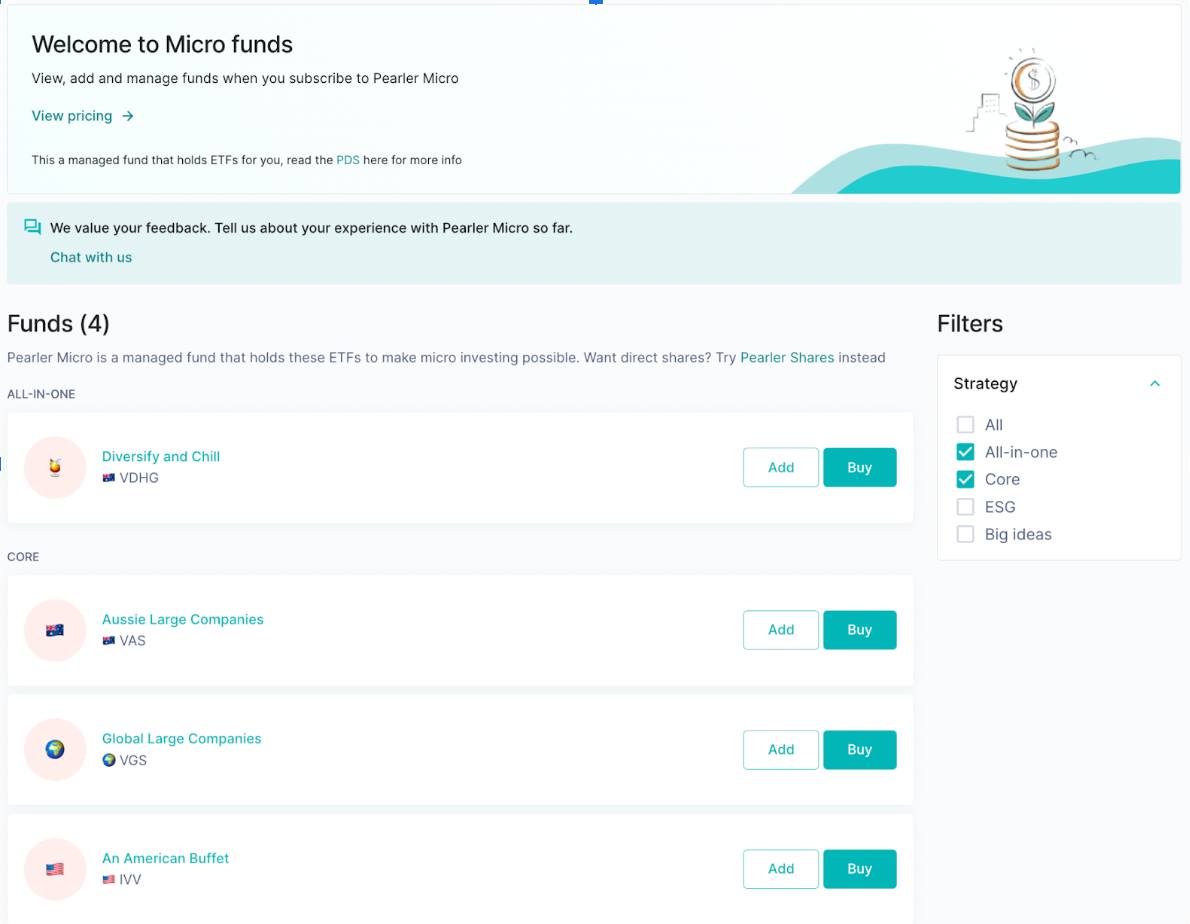

Pearler Micro enables investors to round up spare change and invest these small amounts without a second thought. This works well for beginner investors who want to take small steps into investing. It also serves more experienced investors who use this strategy to invest towards an additional investing goal such as buying a car, starting a business, or travelling overseas.

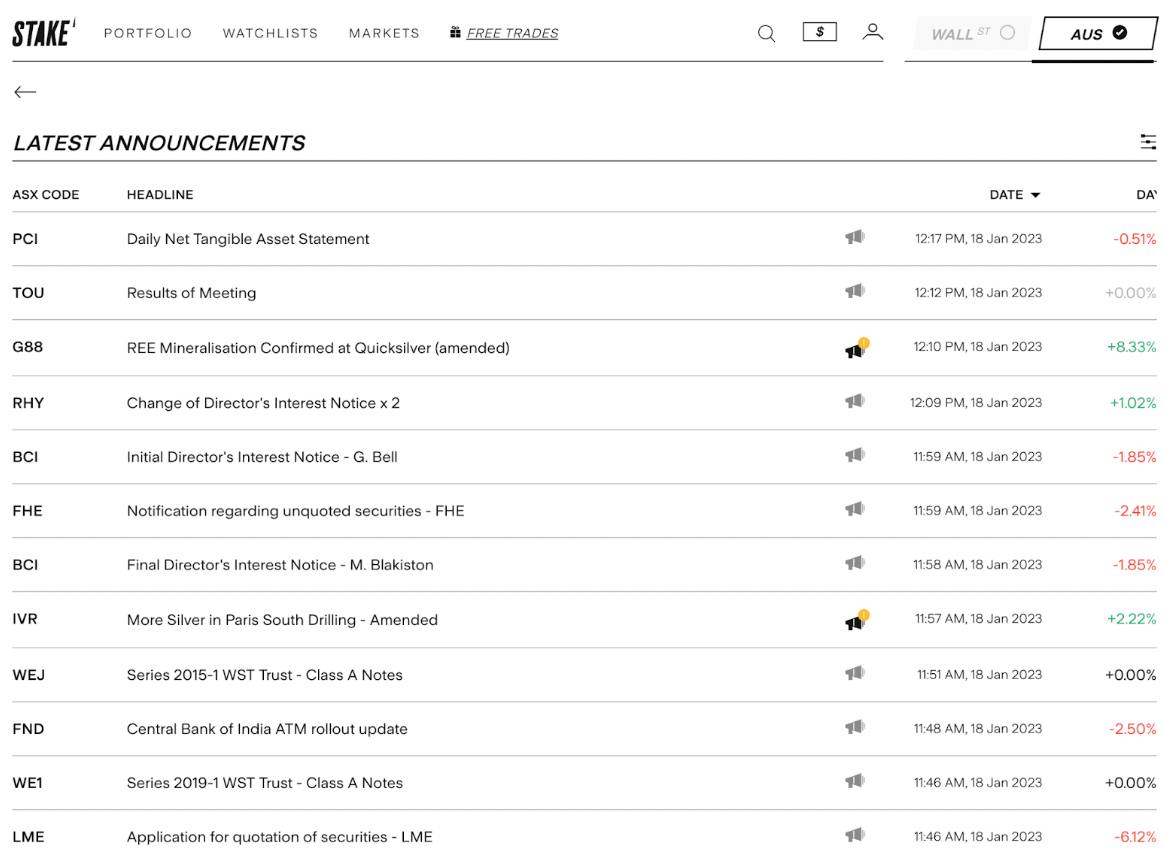

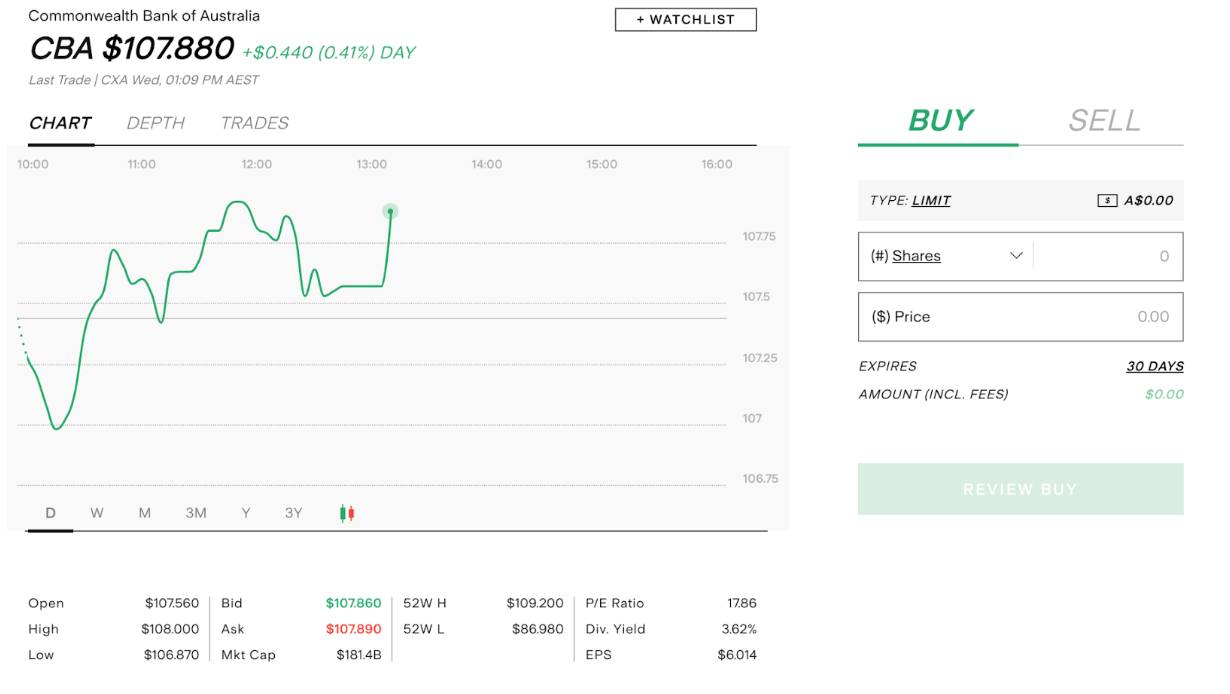

Stake has two key features - Announcements and Live Pricing - that support active investing. Using these features, investors can proactively research, monitor, and manage each individual investment frequently to keep a close eye on their portfolio.

Stake’s Announcements enables investors to regularly watch movements in the market by the minute. With this tool, investors are kept informed of market events. This way, they stay updated on impacts to the individual companies they are interested in or currently invested in.

Stake’s Live Pricing enables investors to view the real-time price of shares on their platform. This allows day traders to make more accurate decisions on when to buy and sell. It is therefore used by active investors when taking actions such as limit and stop-loss orders.

Share ownership structure for Pearler vs Stake

Pearler and Stake have the same share ownership structure for direct ASX share investing.

They both use the CHESS-sponsored model, which means ASX investors own their shares directly. This means shares held with either platform are as safe as safe as the other - and also as safe as shares held with Commsec, NABtrade, or any other big Australian broker.

Read more on Pearler, or on Stake.

For US shares, both Pearler and Stake use the custodial model. This means that shares are indirectly owned by the investor. This ownership model, while imperfect, is the only available option for retail investors who want to own US shares.

Australian (ASX) brokerage fees

Pearler and Stake both charge low, flat brokerage fees for ASX share trades.

Pearler’s standard ASX brokerage fee is $6.50 for all buy and sell transactions. Investors also have the option to lower brokerage fees to $5.50 by prepaying. In addition, Pearler offers brokerage-free ETFs when you invest in some ETFs for longer than one year.

Stake’s ASX brokerage fee is $3.00 for all buy and sell transactions.

American (NASDAQ & NYSE) brokerage fees

Pearler charges a flat brokerage fee plus a foreign exchange fee for US investments.

Pearler’s US brokerage is AUD$6.50 (the same as Pearler’s AU brokerage) and Pearler’s FX fee is 50bps.

Stake’s US brokerage is $3 for orders up to US$30,000, then 0.01% thereafter. Stake’s FX fee is 70bps (which is approximately 1.05%).

For an AUD$10,000 investment in a US company, Pearler’s total cost is ~AUD$56.50 while Stake’s is ~AUD$105.00.

Support available

Pearler offers comprehensive investor support - Phone, Live Chat and Email.

Stake also offers email investor support but does not provide phone or live chat support.

Both Pearler and Stake also have Help Centres that do a good job of explaining the features within each platform and other commonly asked investor questions.

Pearler vs Stake - Which should I choose?

In the end, it depends on your investing style and goals.

Do you want to actively invest and devote hours every week to researching companies, monitoring the market, and executing trades? If this sounds like you, Stake is the more suitable platform.

On the other hand, is your desire to passively invest to build your wealth, and spend minimal time selecting and monitoring investments? If so, Pearler might be for you.

Maybe you sit somewhere in the middle of the passive to active investing spectrum. If so, consider your dominant investing style. For an existing investor, you can figure this out by looking at the proportion of your portfolio in stable long term investments versus actively traded investments.

Again, here’s the summary.

If you’re still trying to figure out whether you want to focus on Active or Passive investing, I’d strongly recommend reading this article: How to SimpliFi your investing stretegy. It compares the performance of professional investors over the last 15 years and shows that even for professionals, passive investing outperformed active.

I hope that helps! If you have any questions let us know, or drop a question in our community. It’s a safe space for all those interested in learning more about long term investing.

Happy investing!