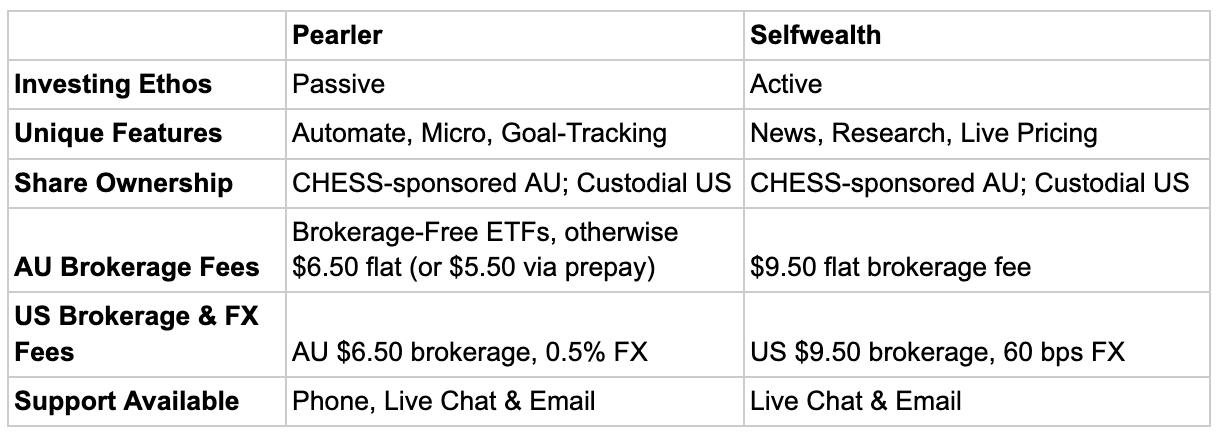

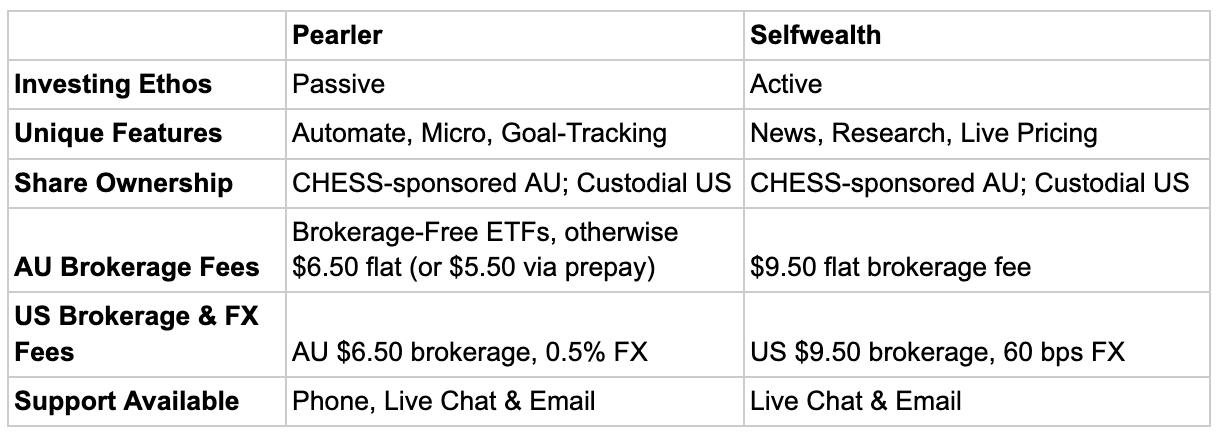

Pearler vs Selfwealth - comparison of features

Pearler is a long term passive investing platform. It’s been purpose-built for everyday investors whose main investing focus is investing regularly in diversified portfolios for the long term. These investors want a simple, streamlined, and stress-free investing experience that doesn’t compromise on long term returns, and that’s exactly what Pearler delivers.

Pearler is built for investors who want to invest most of their wealth in listed funds such as exchange-traded funds (ETFs) and listed investment companies (LICs). Pearler also enables investors to own shares in individual companies, although these typically account for a small percentage of each portfolio compared to ETFs and LICs. Pearler is built for investors who have long investment horizons - typically 5 to 20+ years - and want to minimise the amount of time spent researching, monitoring and managing their investments.

Selfwealth is an investment platform which makes it easier to research and learn about individual companies, their operations, and their finances. In addition to individual shares, Selfwealth also enables investors to own shares in ETFs & LICs.

Unique features

Pearler and Selfwealth have unique features that reflect their underlying investing ethos.

Three that stand out for Pearler are Automate, Goal-Tracking, and Pearler Micro. Together, these three features encapsulate a passive investing approach, where day-to-day share price movements aren’t significant and what matters most is consistent investing over a long term time horizon.

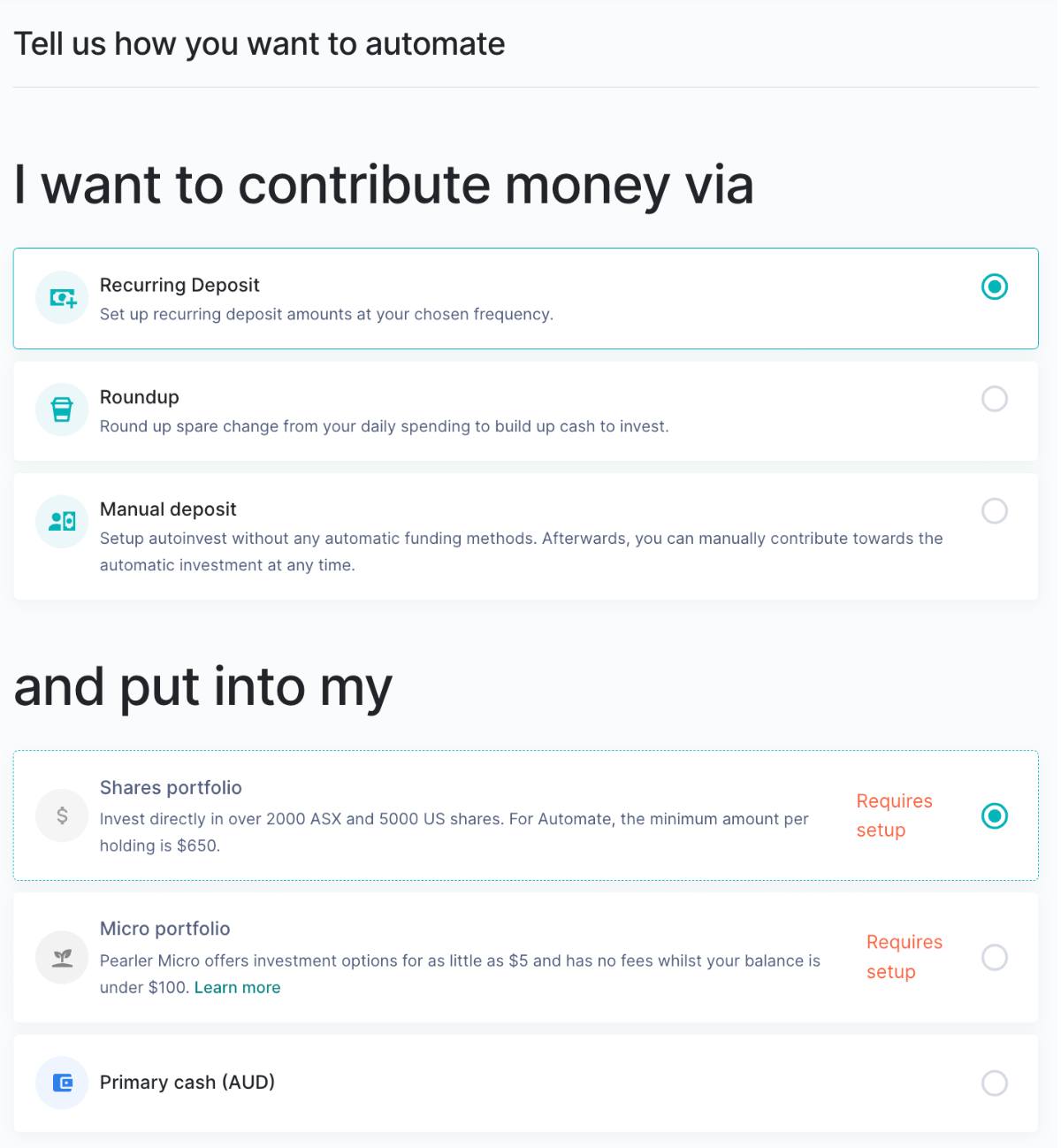

Pearler’s Automate enables investors to completely automate their investing strategy. Investors can spread automatic deposits (and investments) across Shares, Micro and Cash; roundup into either Shares or Micro; and connect multiple external bank accounts to power automation goals.

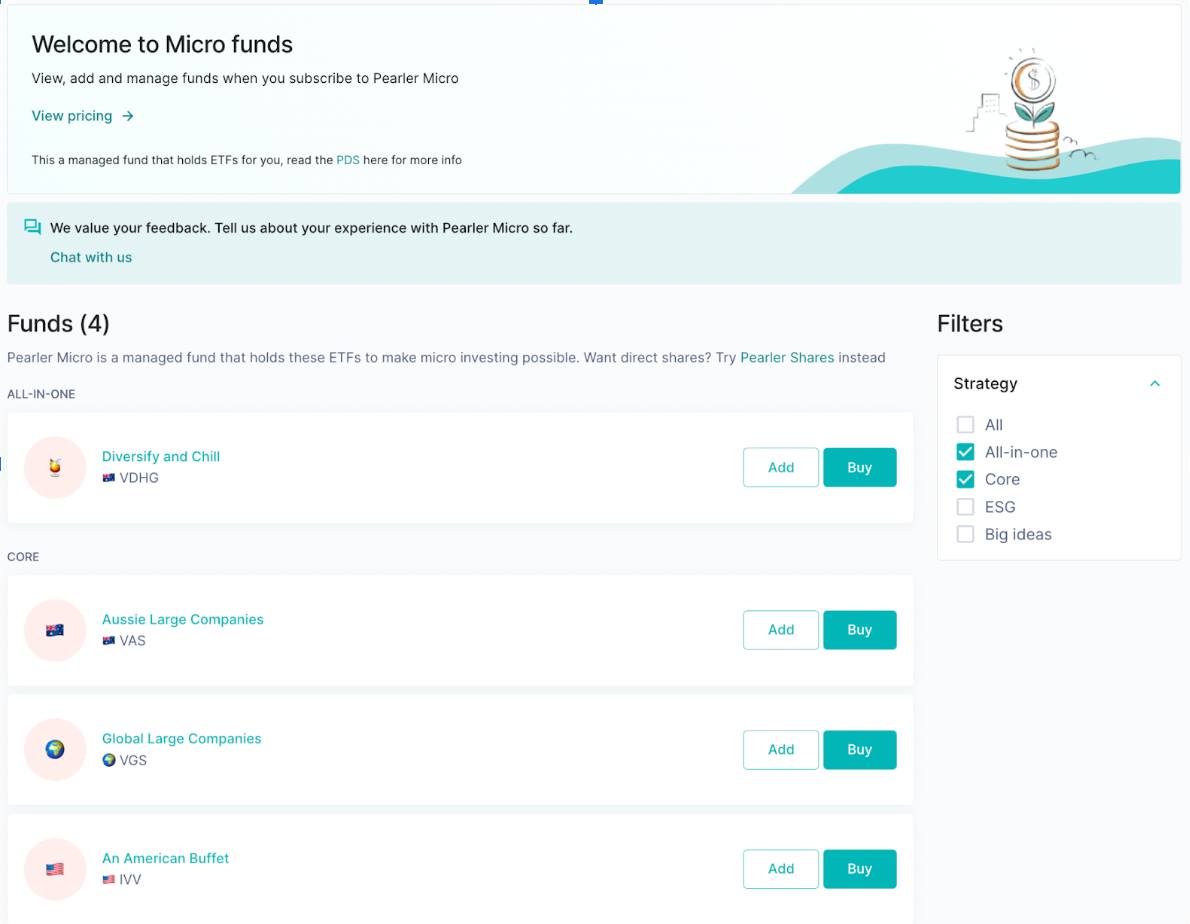

Pearler Micro allows investors to automatically invest small amounts easily. This is ideal for new investors looking to get started, or seasoned investors who want to round up transactions and invest them (often used for a secondary investing goal such as charity donations, or kids’ schooling).

Pearler’s Goal-Tracking enables investors to track how far they’ve progressed to an investment goal. This provides long term investors with the ability to see how far they’ve come, and how far they’ve got to go. It’s emotionally satisfying and reinforces a long term investing approach to investing.

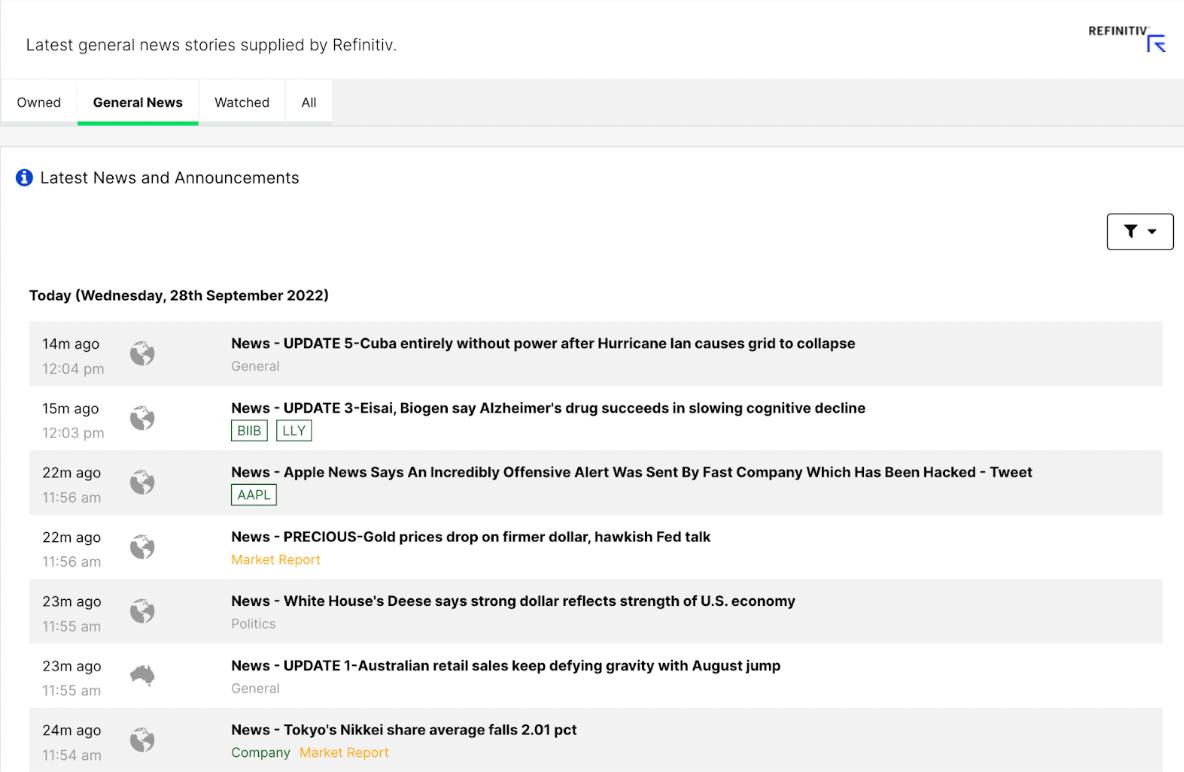

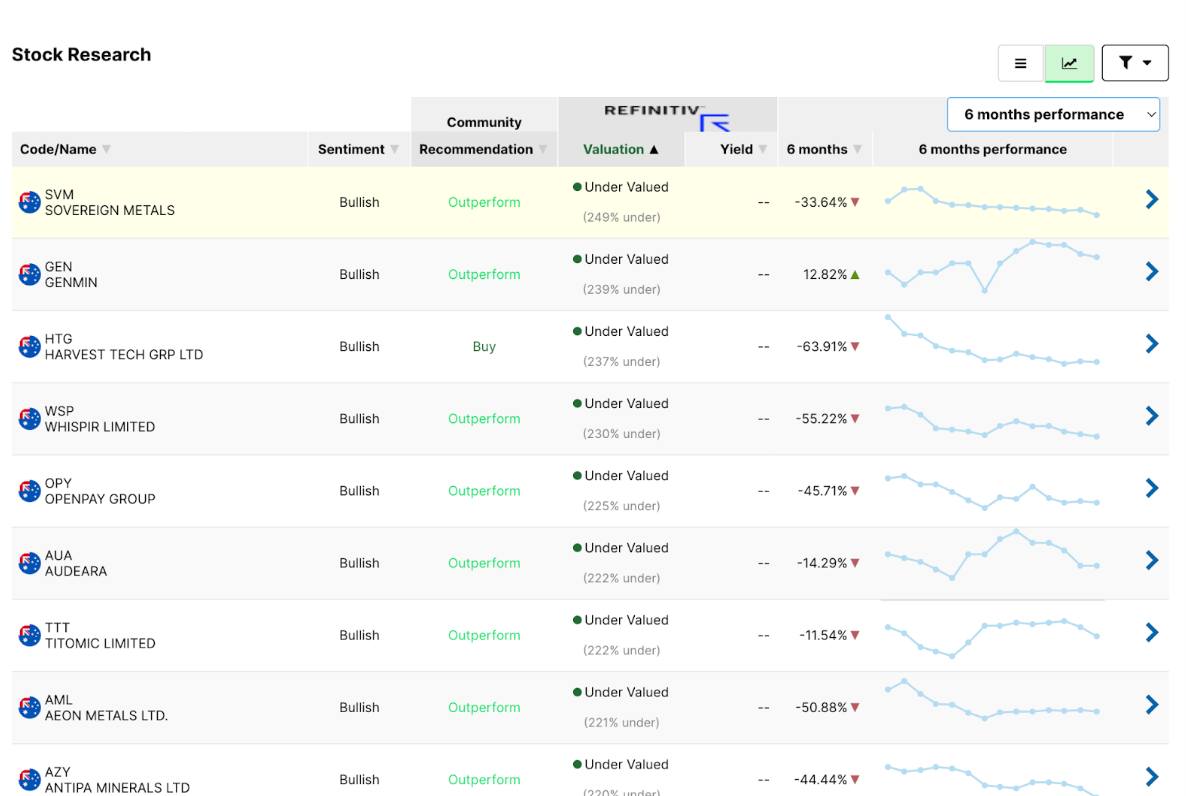

Three features of note for Selfwealth are News, Research and Live Pricing. These features encapsulate an active investment strategy, enabling active investors to more easily research, monitor and manage each of their investments on a regular basis.

Selfwealth’s News enables investors to keep abreast of what’s happening in the market on a minute-by-minute basis. Using this, investors are able to stay very up-to-date on what’s happening in the market, and for specific companies they are evaluating/invested in.

Selfwealth’s Research highlights individual companies that their research partner, Refinitiv, believes are undervalued. This enables investors to discover companies that could potentially high-return investments that they may not otherwise have.

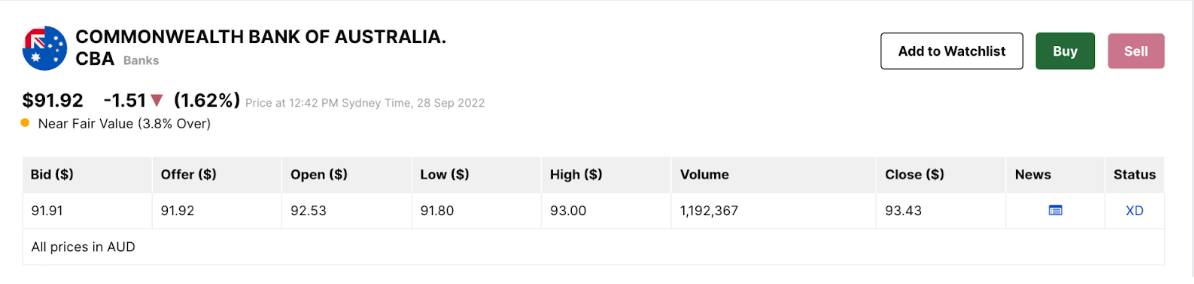

Selfwealth’s Live Pricing enables investors to view the real-time price of shares on their platform. This enables day traders to make more accurate decisions on when to buy and sell, and is used by active investors when making advanced orders such as limit and stop-loss orders.

Share ownership

Pearler and Selfwealth have the same share ownership structure for direct ASX share investing. They both use the CHESS-sponsored model, which means ASX investors own their shares directly. This means shares held with either platform are as safe as safe as the other - and also as safe as shares held with Commsec, NABtrade, or any other big Australian broker.

Read more on Pearler, or on Selfwealth.

For US shares, both Pearler and Selfwealth use the custodial model. This means that shares are indirectly owned by the investor. This ownership model is the only widely available option for retail investors who want to own US shares.

Australian (ASX) brokerage fees

Pearler and Selfwealth both charge low, flat brokerage fees for ASX share trades.

Pearler’s standard ASX brokerage fee is $6.50 for all buy and sell transactions, and $5.50 if you prepay. Pearler also offers brokerage-free ETFs when you invest in some ETFs for longer than one year.

Selfwealth’s ASX brokerage fee is $9.50 for all buy and sell transactions.

American (NASDAQ & NYSE) brokerage fees

Pearler and Selfwealth both charge a flat brokerage fee plus a foreign exchange fee for US investments. Pearler’s US brokerage is AU$6.50 (the same as Pearler’s AU brokerage) or about US$4.50 (* at a US/AU exchange rate of 67c) , while Selfwealth’s brokerage is US$9.50 .

Pearler’s FX fee is 0.5% AU$ which is approximately 32Bps* (you will see most share-trading apps quote FX in Bps), while Selfwealth’s is 60bps. For an AU$10,000 transfer into USD, Selfwealth is approximately $40 more expensive.

Support available

Pearler offers comprehensive investor support - Phone, Live Chat and Email.

Selfwealth also offers investor support - Live Chat and Email - but does not provide phone support.

Both Pearler and Selfwealth also have Help Centres that do a good job of explaining the features within each platform and other commonly asked investor questions.

Pearler vs Selfwealth - which should I choose?

In the end, both Pearler and Selfwealth can serve your investing goals. The best platform for you, then, will come down to which features you prefer.

Again, here's the summary.

If you’re still trying to figure out whether you want to focus on Active or Passive investing, I’d strongly recommend reading this article: How to SimpliFi your investing strategy. It compares the performance of professional investors over the last 15 years and shows that even for professionals, passive investing outperformed active.

I hope that helps! If you have any questions let us know, or drop a question in our community - it’s a safe space for all those interested in learning more about long term investing.

Happy investing!