This article shares some information to help you decide which platform is right for you. Keep reading for the details, starting with the below summary comparing the two platforms.

Comparing Pearler vs CommSec investing ethos

Pearler is an investing platform designed for passive, long term investing. The platform is aimed at everyday investors who want to invest regularly to slowly build wealth across a diversified portfolio. Pearler’s features and tools attract investors who are looking for a simple, accessible and rewarding investing experience that also provides sufficient long term ROIs.

Pearler offers investors exchange-traded funds (ETFs) and listed investment companies (LICs) as the main investment vehicles available on the platform. Investors can also own shares in individual companies. However, the Pearler community tends to only invest a small portion of their funds into direct shares, in comparison to LICs and ETFs. Pearler caters to investors with lengthy investment goals - generally 5 to 20+ years - who aim to grow their wealth with minimal research and management, rather than active trading.

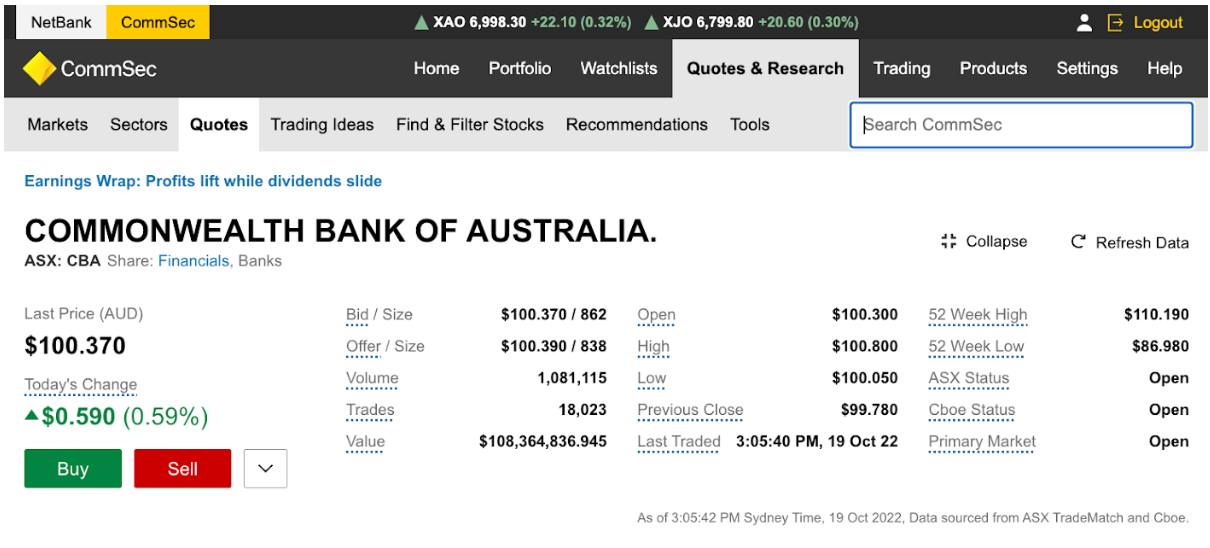

CommSec is an active investing platform for both short and long term investors who want to proactively manage their investments. The platform focuses on giving investors access to information and tools to research, compare, and select shares with the goal of outperforming the market. These investors aim to achieve this through regular research based on detailed company information, which is made available by CommSec.

CommSec is purpose-built for investors who want to specifically invest in individual companies, and frequently research, monitor, and manage each of their investments. CommSec encourages investors to actively manage their portfolios, helping them research and learn about individual companies, their operations, finances and investment ratings. Like Pearler, CommSec also enables investors to own shares in ETFs & LICs. Compared to individual companies, though, these typically account for a small percentage of each portfolio. CommSec is designed for investors with a mix of short- and long-term investment horizons - from as short as one day up to 20+ years - who like to spend hours each week researching, evaluating, and trading shares.

Unique features

To support their investing philosophy, the Pearler and CommSec platforms both have distinct features. Three key features for Pearler are Automate, Pearler Micro, and Goal-Tracking. In conjunction, these features enable passive investing, where daily share price movements are not actively monitored and consistent investing over the long term is most important.

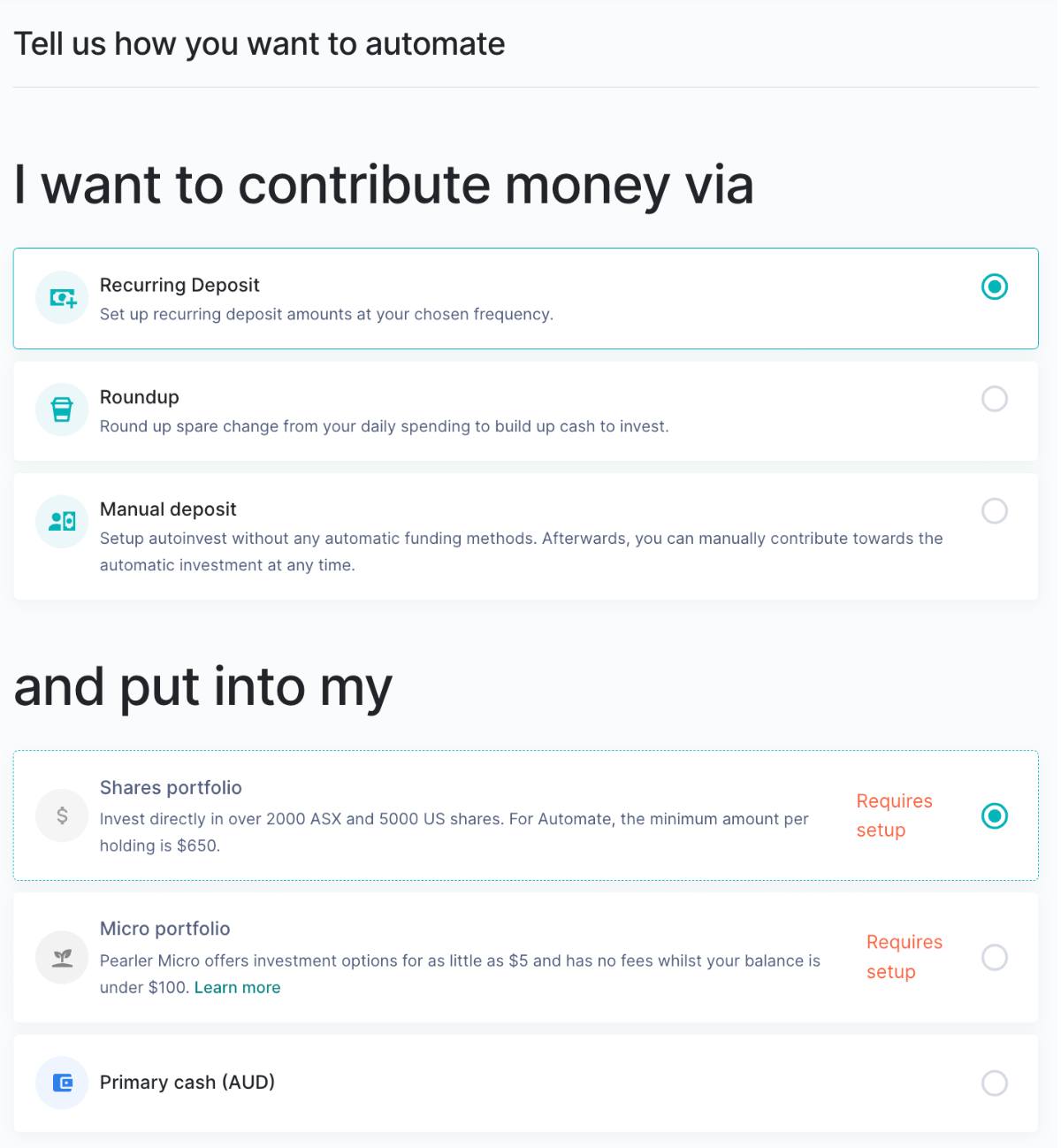

With Pearler's Automate, investors can put their investing schedule on autopilot. This enables them to meet their long term goals without the fuss. Automate allows investors to spread automatic deposits across Shares, Cash, and Micro; roundup spare change; and seamlessly connect multiple external bank accounts.

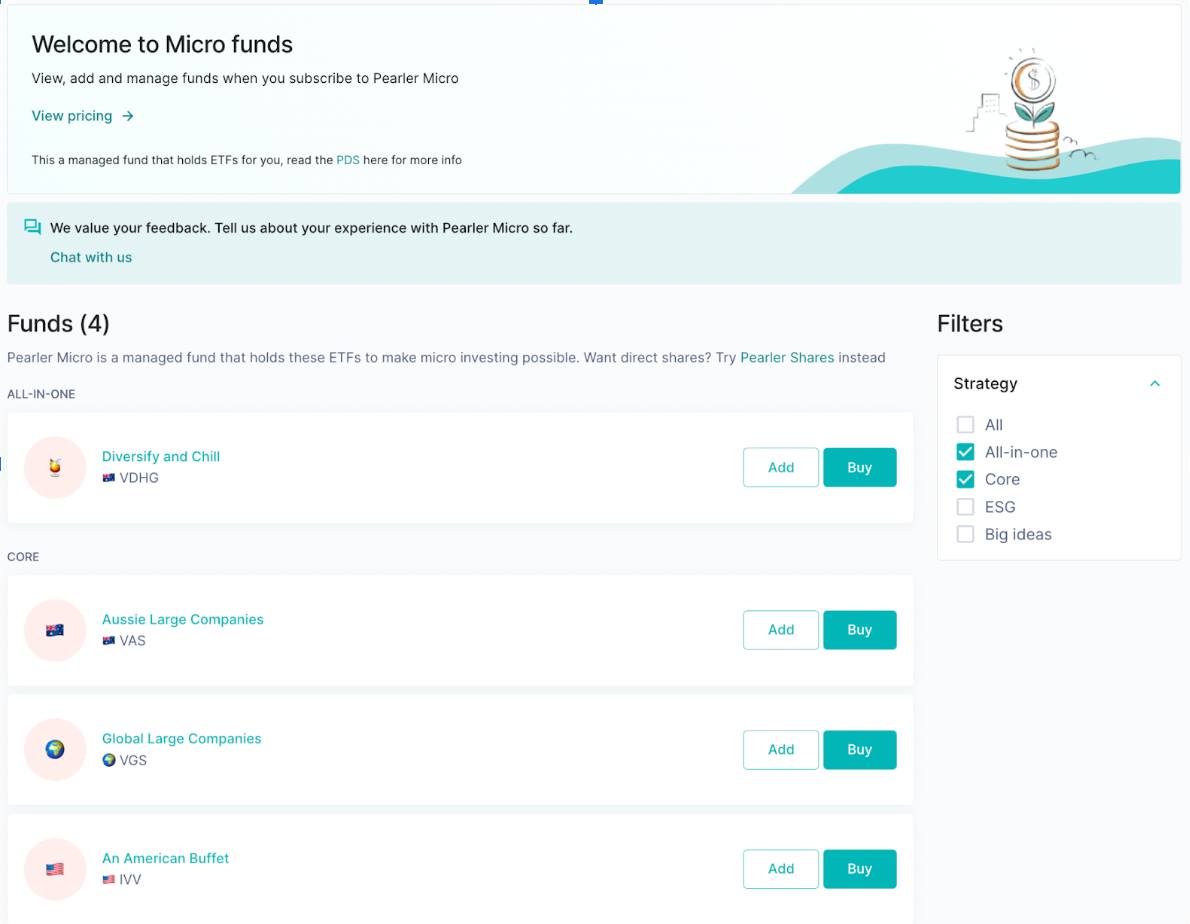

Pearler Micro empowers investors to passively invest small amounts by rounding up spare change. This is suitable for first-time investors who want to enter the market and more experienced investors who want to round up transactions to invest towards an ancilliary investing goal such as a holiday, charity contributions, or their children’s education.

Pearler’s Goal-Tracking allows Pearler’s community members to measure their progress towards a financial goal. This allows investors to see where they are on the journey, celebrate how far they’ve progressed, and continue to invest to achieve their goal. Goal-tracking can be an effective motivator, whilst further developing a long term wealth-building mindset.

Three features that stand out for CommSec are Trading Tools, Research, and Live Pricing. Together, these features enable active investors to more easily research, monitor, and manage each of their investments regularly. Fundamentally, they make life easier for active investors.

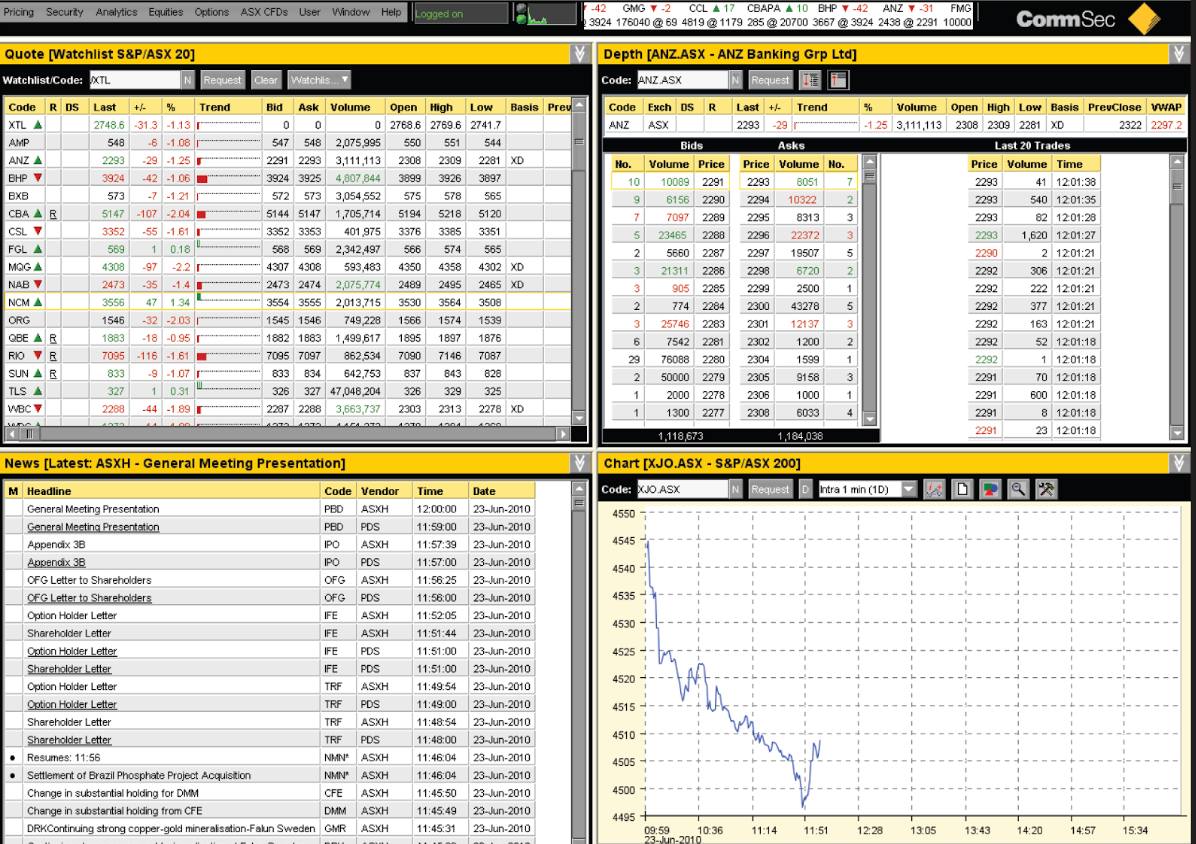

CommSec’s Trading Tools allow investors to analyse, compare, and monitor stocks on a near-instant basis. For example, CommSec offers CommSecIRESS Viewpoint (for $82.50/month) which is a highly customisable interface for active traders to analyse stocks, set alerts and place orders faster. With this tool, and others like it, active investors are able to create and implement complicated trading strategies with greater ease.

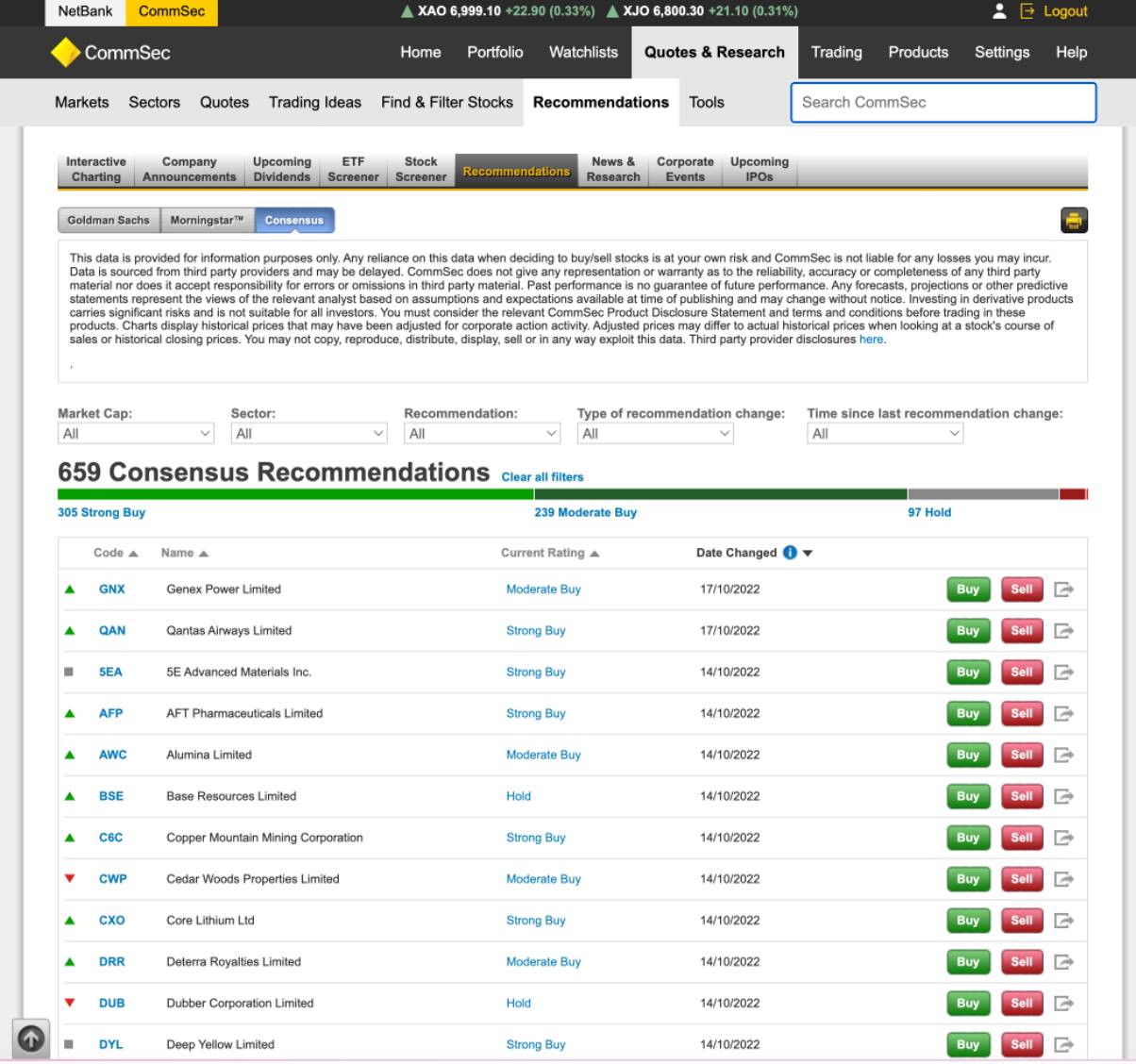

CommSec’s Research showcases investment themes and individual companies that their research partners surmise are undervalued. CommSec has partnered with Goldman Sachs and Morningstar to provide this research. This lets investors discover possibly high-yield investments.

CommSec’s Live Pricing allows its users to see the real-time price of shares listed on CommSec. This enables active traders to make more precise decisions on when to trade.

Share ownership

For direct ASX share investing, CommSec and Pearler maintain the same ownership structure.

Both use the CHESS-sponsored model - in other words, the ASX records investors as directly owning their shares. As a result, share ownership through both platforms are equally safe.

Learn more about Pearler's, or CommSec's, share ownership structure.

For investing in US shares, both CommSec and Pearler implement a custodial model. Through this structure, a custodian holds the shares on behalf of the investor and shares are indirectly owned. Though not without its faults, this ownership model is the only commonly available choice for Australian retail investors who wish to hold US shares.

Australian (ASX) brokerage fees

Pearler’s standard ASX brokerage fee is $6.50 for all buy and sell transactions, regardless of transaction size. For those investors who prepay, the fee can lower to $5.50. Pearler also provides brokerage-free ETFs once you’ve held certain ETFs for more than 12 months.

CommSec’s ASX brokerage fee is $5.00 for amounts up to and including $1,000; $10.00 for amounts between $1,000 and $3,000; $19.95 for amounts between $3,000 and $10,000; and $29.95 for amounts between $10,000 and $25,000. For amounts greater than $25,000, CommSec charges 0.12% of the investment amount (e.g. for a $100,000 trade CommSec charges $120.00).

American (NASDAQ & NYSE) brokerage & FX fees

Pearler’s US brokerage is AUD$6.50 (the same as Pearler’s AU brokerage) for all buy and sell transactions, regardless of transaction size. As with AU Shares, investors can prepay to reduce the amount to $5.50.

CommSec offers two options for US investing: International Shares and International Shares Plus. For International Shares accounts, US brokerage is USD$5.00 (currently ~AUD$7.80) or 0.12% of the investment amount - whichever is biggest. For International Shares Plus, US brokerage sits at USD$9.95 (currently ~AUD$15.50) or 0.20% of the investment amount.

Additionally, Pearler’s foreign exchange (FX) fee is 50bps, while CommSec’s is 0.55%.

All in all, for an AU $1,000 investment, in US shares CommSec is ~$25 more expensive. For an AU $10,000 investment, CommSec is ~$50 more costly (using late 2022 exchange rates).

Customer support

Pearler and CommSec both offer a level of support for investors.

Pearler provides holistic support to investors by Email, Phone & Live Chat.

CommSec provides standard support to investors by Phone and Email. However, it does not currently offer live chat support.

Both also maintain Help Centres where investors can search for specific topics to understand the features within each platform and also address FAQs.

Pearler vs CommSec - which is better?

Though Pearler is ultimately cheaper, this doesn’t mean it’s the best platform for you. You need to first consider how you want to invest.

Are you, or do you want to be, an active investor who spends hours each week researching, evaluating and trading shares? If so, CommSec is a far better platform than Pearler.

Or, are you a passive investor who wants to maximise the amount of wealth you passively invest (i.e. focus on the amount invested, not how it's invested, and minimise the time spent managing your investments)? If so, Pearler is a far better platform than CommSec. Once more, here’s the summary for you to compare the two platforms.

Should you still be yet to decide whether to pursue a passive or active investing strategy, I suggest looking over this piece: How to SimpliFi your investing strategy. The article shows how the two compare in terms of returns, based on the portfolios of professional investors over the last 15 years. You’ll see that, even for professionals, passive investing outperformed active.

I hope this article has helped you determine how Pearler compares to CommSec. If you have any queries, please reach out, or share a question on the Pearler Exchange; it’s a supportive environment for anyone who wants to share their experience in long term investing.

Happy investing!