From our user data, wage gap aside, we have seen mainly similarities when it comes to shares investing behaviour; Pearler reports that both women and men are holding an average 2.5 assets, investing once a month and allocating ~70% of their portfolio to ETFs.

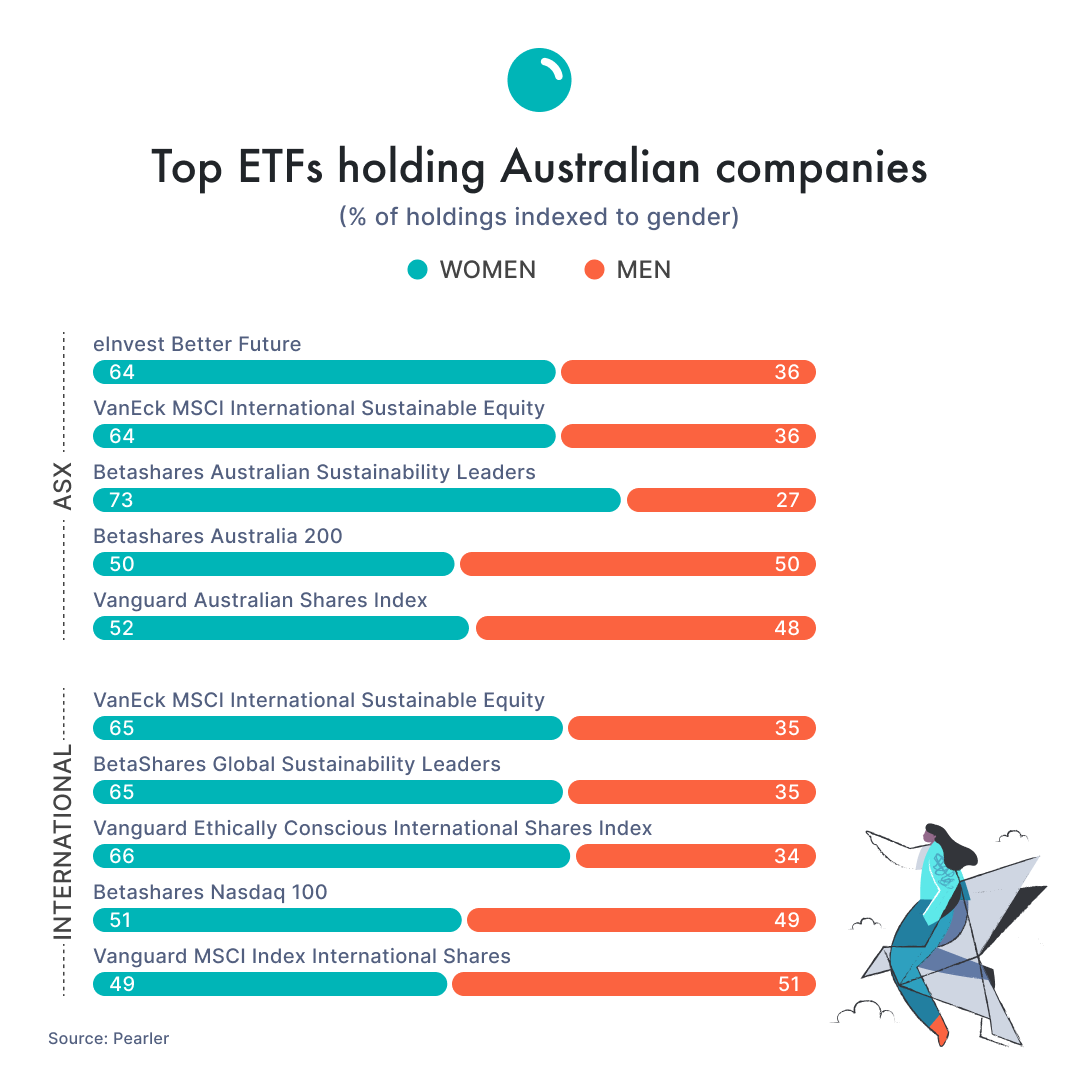

What stands out, however, is that women are investing in ESG ETFs at a rate of greater than 2x that of their male counterparts.

Address the wage gap

At Pearler, we have positioned ourselves as a passive investing platform, with a focus on ETFs and financial goals. Our data indicates that 53% of our account holders are women. Of those, 50% are the age of 26-35, and 30% are 18-25.

Pearler is seeing women investing on average 12% of their post-tax income. This is slightly higher than its male investors, who invest 10% of their relatively higher incomes.

"We’ve seen financial independence blow up as a theme for young people, particularly women, who are becoming more proactive in dealing with historical hurdles like lower wages, minimum cheque sizes, access to education and support,” said Ana Kresina, Head of Product at Pearler.

To introduce investors into our brand of investing earlier, Pearler launched a managed funds product alongside CHESS-sponsored trading which enables investors with just a few dollars to build their own ETF portfolios.

“We saw that people wanted to be investing more regularly and simply, then when we looked at earnings for our key cohorts, adding a micro managed fund product was a no-brainer” added Kresina.

Sustainability is front of mind when it comes to investing for women

Whether climate change is front of mind, or the future of their children, women are the forefront investors in Pearler’s top ESG funds.

“What we are hearing and then seeing in the data is that younger investors, especially women, want to make more ethical investment choices when considering their future - it's something certain investors feel very strongly about,” said Kresina

Claire H is an investor on Pearler who noted: “I think about how my son will be in his early 30s in 2050, when the climate will be much more difficult to live and thrive in.

“I want to support industries that are doing the right thing for future generations and investing in decarbonisation and the circular economy - I will be able to enjoy retirement knowing I did right by him”

Other investors have taken a more granular approach, forming their own views on what companies represent ESG to them.

“To me, that is supporting those making a positive impact in ways such as socially, climate and sustainability leaders, companies with greater representation of women in senior leadership roles and on boards, clean technology and corporate governance.” said Kelly Foreman, who invests on Pearler.

Foreman added: “You don’t need to compromise financial returns when considering the ESG criteria; there doesn’t need to be a performance sacrifice. It’s been really interesting to take a deep dive into companies that align with my values and meet the ESG criteria.”

The largest market is the most diverse

At Pearler, we track the diversity of our team by gender and languages spoken publicly via the Pearler website.

“We are a small startup, but that doesn’t mean we are immune to bias in growing the team. We‘ve focused on this since Day One and are at a good balance right now, but know it will remain a challenge as we scale,” said Nick Nicolaides, Co-Founder of Pearler.

The Pearler team is nearing 20 and the gender split is largely consistent with its investor base. The company expects to have 30 employees by 2023.

Nicolaides added: “As we continue to grow the business and team, we know we need to remain inclusive through our product, services and marketing. If we build the right culture, the product and our investors will benefit.

“That's why we share our community data publicly, and internally, we have open pay transparency to help facilitate open conversations about wage, roles, and opportunity.”