NOTE from Pearler: we do our best to share general resources so you can do your own research. When it comes to tax, this is personal to your investing and financial position. We are not a tax advisor, and don't have any information about your personal situation. When investing, there may be tax implications and you should get advice from a licensed tax adviser.

The world of finance and investing is a fascinating place.

As soon as we’ve figured out one thing, two more unanswered questions come into our mind. It’s that old line about knowledge: the more you learn, the more you realise how little you actually know.

In this article, we’ll tackle five interesting questions that you might've wondered about yourself at some point…

- How do I balance saving for a house deposit with investing?

- If I’m fully invested, how do I take advantage of a downturn?

- Is gold a good investment?

- My margin loan just got expensive, should I shut it down?

- Why do people invest in VDHG when other funds have cheaper fees and better performance?

Some juicy topics there, so let’s get started!

“How do I balance saving a house deposit with investing?”

This is a tricky question. Usually having two competing goals at the same time doesn’t tend to work well.

Firstly, it depends how quickly you want to get your own place. If the answer is “sooner rather than later”, then it’s probably better to focus on your deposit first.

In fact, I think it's more powerful to zone in on one thing versus trying to do both. Why? Because progress is faster focusing on one thing instead of two, making it even more motivating.

The desire to do both at the same time is likely to satisfy feelings of not wanting to miss out. But imagine spending a few years trying to do both, only for home prices to go up much more than you thought they might. The home may end up costing you much more because you'd been trying to invest too.

You'd probably be pretty annoyed about that. Of course, the opposite can happen too! But after buying a home, its price doesn’t really matter and we can then focus fully on building investments. It’s worth mentioning, though, that as long as you’re putting aside a good chunk of savings each month, the end result will likely be good either way.

Of course, if you expect to spend a decade saving your home deposit, then investing can make sense. Just be prepared to be flexible with your timeframe if the market has a wobble.

Now, five years is a decent timeframe, but it certainly doesn’t guarantee a decent result. For any money you need in five years’ time, there’s a case for not putting that money into the market. Instead, you could stick with lower risk options like a term deposit or high interest savings account.

It also depends on how flexible that timeframe is, though. What If you did happen to choose investing over a savings account? Well, it could turn out great. But if the market took a tumble towards the end of your timeframe, could you wait until it recovered? Or would you prefer your goal to not be disrupted by the market?

It’s really important to think about the possible downside and what’s more important: trying to get higher returns, or getting your home when you want it.

“If I’m fully invested, how do I take advantage of a downturn?”

Because the market goes up more often than down, many suggest investing whenever we can.

But then we also hear ideas like “be greedy when others are fearful” and “buy the dip” and “keep cash for opportunities.” So what gives? How are we supposed to do all these things at once?

Here’s something that’s often missed: just because you’re fully invested, it doesn’t mean you can't take advantage of the opportunity when shares fall.

The truth is, shares don’t just have a big fall on one specific day, or even one week. If the market falls, it typically happens over a period of many weeks and months. So, for those working towards financial independence who save regularly, there’ll be ample time to buy shares when prices fall.

Each month that prices lower is another opportunity to invest your surplus cash at cheaper prices than before. All the more reason to make sure your finances are sharp and you have surplus cash to invest with monthly.

For those more advanced, there’s also the option of tapping into your emergency fund (then building it back up), or using low-cost debt to invest with. But those options are probably more suitable for a larger market fall and only for those with more experience and greater wealth behind them.

“Is gold a good investment? I’ve heard experts say it’s a great way to diversify”

Some people are fascinated with gold as an investment, while others aren’t so keen. I fall into the latter camp, not really being a fan of gold at all.

I feel this way for a few reasons:

- It’s not a productive asset (it’s a lump of metal).

- It doesn’t provide income or an earnings stream.

- Its value is largely based on popularity (the demand for gold products and as an investment) because of the two previous points.

What about returns? Well, over the long term (50-100 years) the returns are quite different to the stock market.

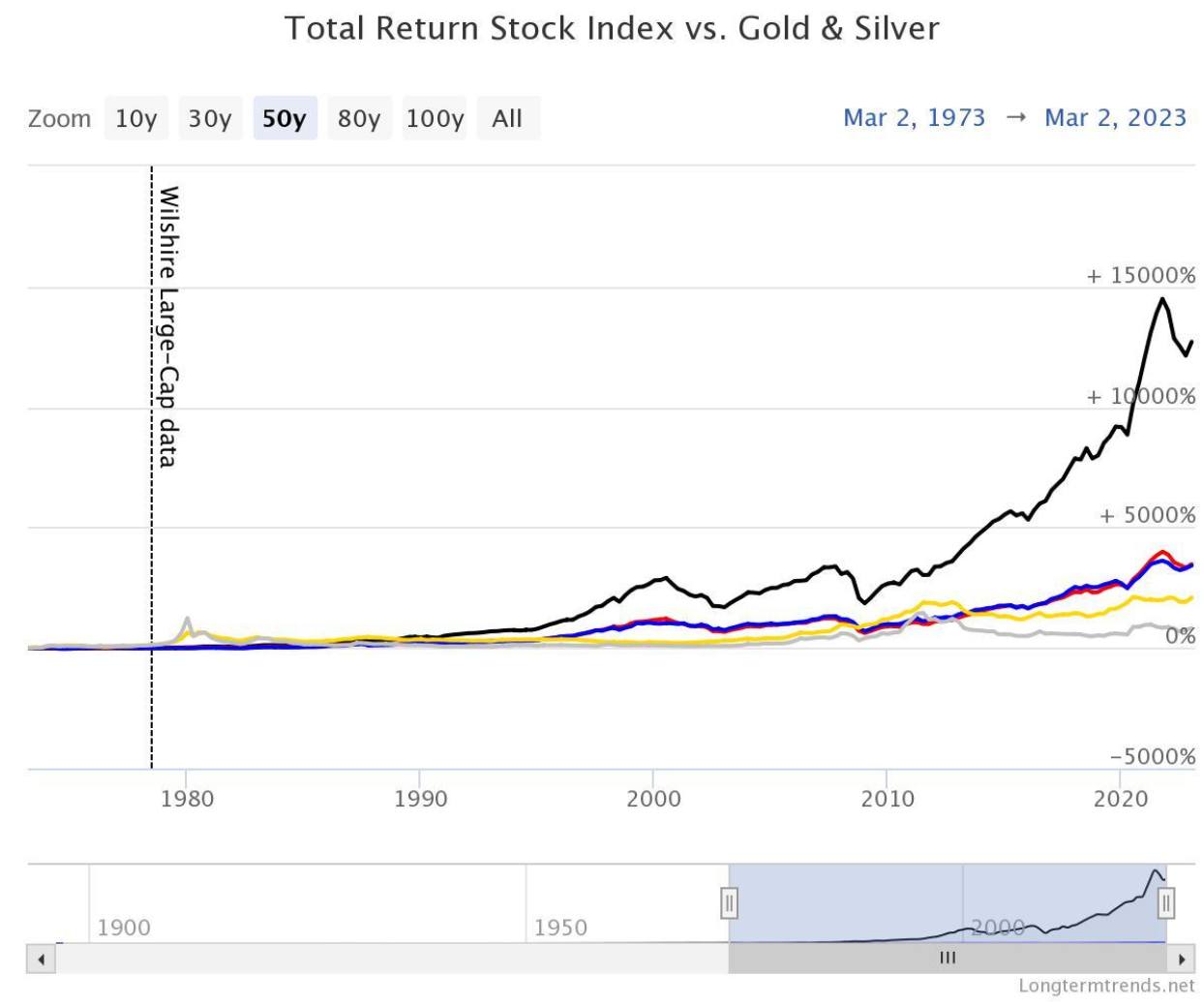

The below comparison from website Longtermtrends shows the difference between gold and stocks over the last 50 years. By the way, comparisons over all meaningful timeframes tell roughly the same story.

The total return of US stocks (the black bar) over the 50 years to March 2023 was 12,520%. Gold (the yellow bar) returned 2,030%. Still impressive, but blown away by the compounding power of stocks.

The blue and red bars are two other versions of US stock indices. The outperformance is nowhere near as impressive. Why? Because the black bar is the total return of US stocks, including dividends.

See, when we account for the income from stocks, this makes an enormous difference to the long term outcome. Only suckers disregard the power of dividends in long term investing.

Why the difference? Stocks reflect the productivity and innovation of the human race.

All this makes sense when you think about it. One is owning a large collection of productive and dynamic businesses which make lots of money and grow over time. The other is a lump of metal which doesn’t actually do anything by itself. Sure, we can turn it into stuff. But the value is largely based on popularity.

Now, someone might point out that gold often moves in different cycles to stocks. For this reason, some people favour it as a way to diversify a portfolio. But at what cost? Like insurance, holding other assets that have a lower expected return is likely to be, on average, a losing bet.

There’s a case to be made for diversifying a portfolio through assets with solid long term fundamentals built on cashflows. An example of that would be real estate.

Gold also isn’t as ‘defensive’ as some suggest. It can be volatile and prone to swings in value. For example, it fell almost 20% from March to October last year. So we do need to be careful how we use the term ‘defensive’.

None of this is to say that gold is bad. But it’s important to understand that the two assets are fundamentally very different. So think carefully before adding (or removing) something in your portfolio because an ‘expert’ says it's a good idea.

“My margin loan just got expensive, should I close it?”

Interest rates have been super low for a few years until very recently. Many investors took advantage of the low rates by taking on debt such as a home equity loan or margin loan to build their portfolio at a faster rate.

But we’re now in a different environment, where those juicy rates have become very expensive. In fact, current margin loan rates as I write this are an eye-watering 7% to 10%.

This is causing investors to wonder if it’s better to pay off debt rather than continue investing. It's also a tricky equation, because as interest rates rise, shares often go down (as happened in 2022). So this actually means future returns should be a bit better from those lower prices.

Not only that, but a larger cashflow loss means a bigger tax return from a negatively geared share portfolio. While that might not be ideal, it does make the debt cheaper on an after-tax basis.

But let’s be honest. At current rates, margin loans (and even some home loans) start becoming a painful cost. It’s hard to believe how quickly the interest rate environment has changed.

So, opting to pay down debt with ongoing savings is not a bad move. Especially since paying off debt is a guaranteed return, which also makes your personal cashflow more stable and predictable.

And it also depends on the person’s situation. For instance, think of someone in the highest tax bracket, investing in low yielding funds, with plenty of spare income and a long time horizon. They may wish to keep their margin loan open and continue investing as is. But for many people, margin loan rates are now at a level where they will probably prefer the guaranteed return and certainty of knocking that loan down.

“Why do people choose VDHG when other funds have lower fees and better performance?”

Most readers will be aware that VDHG is one of the most popular investments in the community. It’s true: VDHG is certainly not the cheapest feed fund around - not even close!

In fact, IVV and VTS have much lower fees and have also provided higher long term returns. Some investors often point to these as attractive alternatives. But there’s a few important points to note here.

IVV and VTS are both index funds which invest in US stocks only. In contrast, VDHG provides exposure to Aussie shares, the US and all developed countries, as well as emerging markets, and a bit of bonds. It's a whole portfolio of many funds in one, which is the reason for the higher fee.

As for performance, the reason funds like IVV and VTS have performed better is simply because US shares have outperformed the rest of the world for the last 15 years. Can we be sure that will continue? Well, no. There are arguments for why that will and won’t continue into the future.

If you want to bet on that trend continuing, then maybe you prefer to only own us shares. But what if it doesn’t? It’s worth thinking about.

So, the main reasons people choose a fund like VDHG over others (even though they may be cheaper or look better on the surface) is because it’s an easy and simple option that’s diversified across many markets all in one package.

Final thoughts

I hope you enjoyed this Q&A session.

If you have a question yourself, feel free to post it on the Pearler Exchange. They’ll be answered by fellow investors in the community - like myself, someone more knowledgeable, or one of the Pearler team.

You can also post a question down in the comments selection and we’ll cover it next time.

Until next time, happy long term investing!

Dave