Many investors right now are feeling nervous. After all, most of the time the share market goes up, right? What’s the deal?

And it’s true: shares deliver a positive annual return in 75-80% of all years. So what about those other years? Are we in one of the ‘down years’ now? And if so, what are we supposed to do about it?

In this article, we’ll discuss how to invest during a downturn, what to be aware of, and how to navigate the bumpy environment we find ourselves in.

If you’re going to invest during a downturn, begin by forgetting forecasts

There are two sides to investing through a downturn. There’s the market, and then there’s you. We’ll discuss both in this post. But it’s important to recognise we only have control over one of these things.

The market may go down for the next few weeks, few months, or few years. Nobody knows. If you find someone who claims (or even implies) they know, these jokers are lying to you, and to themselves. This means they’re either being dishonest, or are completely oblivious to this fact. Either way, they aren’t someone you should listen to. So you won’t find any ‘finger-in-the-air’ forecasts in this article. Instead, we’ll look at market history and what personal actions we can take to come out the other side stronger and, hopefully, wealthier than before. You know, stuff that’s actually useful!

Alright, let’s start with how to keep ourselves out of trouble.

Also forget performance for a while

Our main job in this type of environment is to simply stay calm and keep cool. Just because your shares might be going down, this doesn't mean you've done anything wrong.

Sure, it hurts that our portfolios are down instead of up. But that’s just part of the deal when investing in long term growth assets. No investment goes up every year (not even Sydney property, clearly!).

We need to accept things might be more volatile for a while. So it’s in the best interest of our mental health to check our portfolio less often, and ignore the media for a while.

I know, they’re going to tell you all these things you supposedly need to listen to. But in case you were under any illusions, here’s the brutal truth: they don’t care about you and your goals.

What the media cares about is making you tap on their click-bait article, or keep watching their addictively negative news. Please, do yourself a favour and spend your time and attention on other things.

Put downturns in perspective

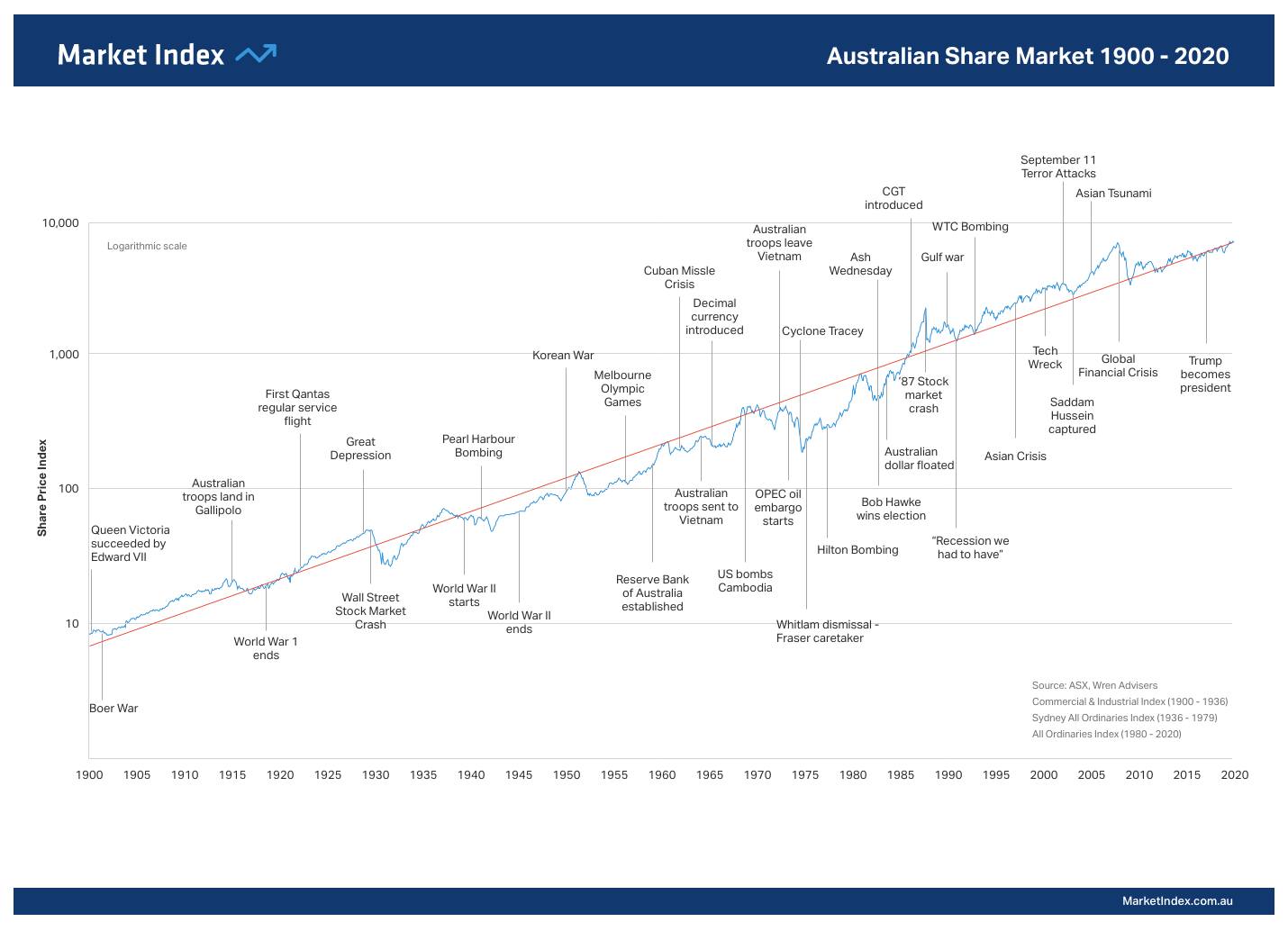

The current news and market movements always feel like a big deal. But when we zoom out, even large downturns don’t seem all that important when viewed with a long term lens. Take a look at this excellent graphic of the Aussie share market since 1900:

Note all the enormous disruptions and events we’ve experienced over the years. Looking back now, many of them barely even register on the chart.

Now, let’s be clear: at the time, many of these historic events would’ve been scary. But in the fullness of time, each downturn looks like a great buying opportunity. At least, that’s my takeaway.

Here’s a question for you: looking at the chart, when do you wish you could have bought shares? My answer is: “as early as possible, and as much as possible.”

Now, the future doesn’t have to look like the past. But this is a very long and very impressive trend.

There’s a simple and fundamental reason the stock market goes up over time, which we’ll get to in a minute. But our long term success as investors is not built on avoiding recessions and escaping downturns. It’s built on our ability to focus on the long term and invest consistently into a sensible portfolio of assets.

What if it gets worse?

Look, the truth is, the market could fall further. In fact, it could fall much further. But we’ll only know this after it’s happened. We can’t know in real time if it’s going to keep falling or start recovering. So what can you actually do about it?

Sure, you could wait on the sidelines until things get better. But guess what? If you do that, by definition, you’ve waited until the recovery has already happened. And that means you’ve missed out on those returns too.

We’re now getting into a behaviour called ‘market timing’, which we’ll cover in a future article. For now, just understand: this is a game which comes with many costs, and in which you have a very low chance of winning. Play it at your own risk.

One thing that can help investors stay the course - myself included - is to remember what the share market is all about (and no, it’s not share prices!).

What really drives the share market

Because the share market is simply a big basket of businesses, we need to understand what drives those businesses over time. In other words, why do share prices go up in the long run?

Here’s a very simple table explaining how the fundamentals of a business works.

Let’s break down what’s happening here…

A company makes $10 in profit, reinvests some of this back into the business, while paying shareholders a dividend. This should result in more profit next year, and so on.

Over time the company grows in size, continually reinvests to grow its earnings, all while keeping shareholders happy with an increasing dividend.

This ‘reinvestment’ of company earnings can include anything from research and development, buying new technology or equipment, sales and marketing, expanding a factory, or opening a new shop.

Because the company is more profitable, it's more valuable, so the share price goes up. And this is precisely what happens broadly with the overall market indexes (which simply reflect the underlying companies).

See? It makes perfect sense why company earnings grow, dividends increase and the market goes up over the long run. Now that we’ve got a good understanding of the market and put downturns into proper perspective, let’s run through some practical steps we can take during a downturn.

Action steps for how to invest during a downturn

Firstly, keep investing. Come on, you knew that was coming!

It’s a fundamental truth that the best way to keep making progress towards our wealth goals is to keep taking action. And we can’t do that by watching and waiting. We only make progress if we stick with our plan and continue to invest.

It’s also worth investing more if we can afford to, because of the lower prices on offer. If you’d like to do this but are finding the market movements make you nervous, consider automating your investments. This can ensure ‘Future You’ gets closer to their goals while taking some pressure off your current self.

Having said that, a downturn can be nerve-wracking because it could turn into a recessionary environment where jobs are lost. For that reason, you want to make sure your personal finances are in good shape.

How? Keep a cash cushion, AKA emergency fund. Maintain a healthy savings rate. Reduce some of your optional expenses. You may even consider earning more income while the market is down. This gives you more cash to either invest or simply strengthen your finances.

Of course, this whole plan only works if you can stay focused on the right things, which we spoke about here: what to focus on as a long term investor.

Final thoughts

The scariest times to invest will usually turn out to be the most profitable.

Why? Because that’s when prices are lower and pessimism is everywhere. And from those lower prices, we earn higher returns. As Warren Buffett is fond of saying: “in the stock market you pay a high price for a cheery consensus.”

Here’s an example: some of my highest returns came from the purchases I made during the worst (and scariest) period during the Covid Crash of 2020, when the market fell more than 30% in a single month. So there’s a definite upside to downturns.

Hopefully this post has helped you think about the current downturn from another angle. In fact, there’s so much to say about this topic we may need to follow up with a second or third instalment!

In the meantime, keep saving, stick with your plan, and let the magic of time do the rest.

Until next time, happy long term investing.