Investing in ETFs (exchange-traded funds) can be a convenient way to grow your wealth over the long term. It offers the potential for diversification, passive income and access to different sectors with just a single purchase. However, deciding whether an ETF is right for you requires more than a hasty decision.

Research is key. Whether you're a beginner or you've been investing for years, understanding the strategy, management team, and underlying assets of an ETF is important. Thorough research helps you align your investment choices with your long-term goals, so the ETF fits well within your portfolio.

In this article, we'll guide you through what to consider and how to research ETFs to find the right one for you. Let’s explore how to dig deeper into ETFs and discover the information you need.

Is ETF investing right for me at all?

Investing in ETFs can potentially provide a smoother, more predictable ride. However, there are always surprises with investing, regardless of the investment.

Many investors choose ETFs to adopt a passive investing approach. What does that mean? When you invest in ETFs, you're generally not trying to beat the market. Instead, you're going along with it. A lot of ETFs track an index, like the ASX 300 . These are known as passively managed ETFs . When you buy into this type of ETF, you're essentially buying a slice of the overall market.

Now, consider long-term investing with ETFs . If you're looking to invest your money and not stress about it every day, ETFs can be a good fit. They offer a way to build wealth over the long haul. The idea is to invest steadily, leave your money to grow, and let time do its magic.

But not everyone wants a passive approach. Some investors are more conservative, preferring safer options like gold , bonds , or even cash . These assets can offer more stability but might not grow as much over time.

Some investors seek more thrill and higher potential with value investing or active investing . These strategies involve more risk and require more time and effort but could potentially lead to higher rewards.

So, what's your style? Understanding your preferences and risk tolerance is key to figuring out if ETFs are right for you.

How can I learn more about an ETF?

If you decide ETFs are right for you, the next step is to educate yourself. There are many ways you can research ETFs to learn more about them:

ETF performance history

When considering an ETF, looking into its past performance can provide valuable insights. It helps you understand how the ETF has performed over time, especially during different market conditions. You can find annual returns, historical price changes, and volatility.

To start, check the fund's website. Most fund managers offer comprehensive performance data. Look at periods of both growth and decline to get a balanced view.

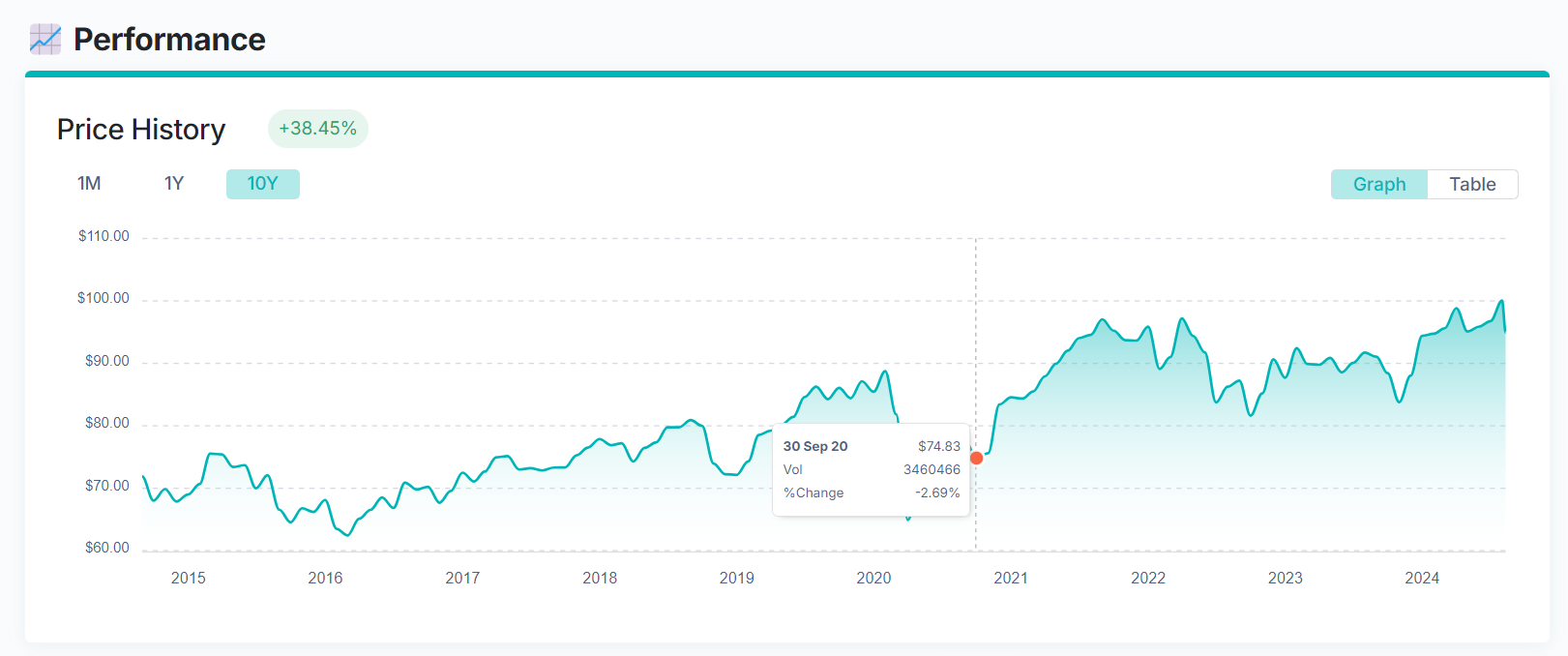

Additionally, brokers like Pearler make this information easily accessible. On the Pearler platform, you can find performance histories of various ETFs. For example, the table below shows the Vanguard Australian Shares Index ETF performance over 10 years.

While past performance doesn’t guarantee future results, it can help guide your decisions. Consider how the ETF fits within your broader investment strategy and long-term goals.

ETF factsheets

Factsheets can be your go-to for understanding an ETF. They’re a snapshot of all the essential info you need. Here’s what to look for:

- Key info at a glance: Start with the basics. The factsheet will give you the ETF’s name, ticker, and provider. This is your basic ID for the ETF.

- Objective and strategy: Next, read the investment objective. This tells you what the ETF aims to achieve. Is it growth? Income? Maybe a bit of both? Knowing this helps you see if it aligns with your investment goals.

- Performance data: Check how the ETF has performed over different periods. As we’ve said before, past performance isn’t a prediction of future results, but it gives you an idea of how the ETF has fared in various market environments.

- Fees and costs: Factsheets typically list the management fee or total expense ratio. Lower fees can mean more of your money stays invested. But it also depends on your investing approach – actively managed ETFs typically have higher fees because of the active management of the fund. Try not to let fees be the sole driver of your decision.

- Top holdings and sectors: Look at the top holdings. Factsheets often list the largest stocks or bonds the ETF holds. This gives you an idea of what you're investing in. Also, check the sector breakdown to see whether the ETF leans towards tech, finance, or other industries.

- Risks: Every investment comes with risks. The factsheet will outline these. Look out for this to ensure you understand what you’re getting into.

- Contact and further info: There are usually details on how to get more information or where to find detailed documents. Use these resources if you have more questions.

By looking out for these elements in the factsheet, you can better equip yourself to understand the essentials of any ETF. Have your eye on an ETF available on the Pearler platform? You can also view the relevant factsheet on the ETF page – you’ll find it in the ‘Overview’ section.

Product disclosure statements and target market determinations

When you're eyeing an ETF, one of your first stops should be the product disclosure statement (PDS) . This document breaks down the nitty-gritty details you need to know. It covers the fund's investment objectives, how it plans to get there, and the risks involved.

And don't skip the target market determination (TMD). This document tells you who the ETF is designed for. It outlines the types of investors the fund is best suited for, based on factors like financial situation and risk tolerance .

Compare with other ETFs

When choosing between ETFs , it helps to compare them directly on several aspects. Here’s what you can look for:

- Understand the strategy: Look at what each ETF aims to achieve. Some focus on a specific sector while others track a broader market index. Knowing the investment strategy can help you see which aligns best with yours.

- Dive into the costs: Compare the management fees, transaction costs, and any other fees. Even small differences can add up over time.

- Look into the performance: History isn't everything, but performance can tell you how well an ETF has done before. Look at how it performed over different periods and in various market conditions. But remember, past performance isn’t a guarantee of future results.

- Check the holdings: See what you’re actually investing in. Compare the top holdings and the overall diversity of each ETF.

- Measure the liquidity: Liquidity is about how easily you can buy or sell the ETF. Higher liquidity can make it easier to buy and sell the ETF. It might also mean lower costs when you trade. Compare trading volumes to get an idea of each ETF’s liquidity.

- Assess the risk profile: Every investment has its risks. Compare the risk levels of each ETF to see which fits your comfort zone. Look at factors like volatility and standard deviation.

- Read reviews and ratings: Check out what other investors and experts are saying. Reliable reviews and ratings can offer insights you might not find elsewhere – b ut take them with a grain of salt.

Making a well-informed decision involves looking at various factors and seeing the whole picture.

Speak to a financial adviser

Chatting with a financial adviser can be a helpful way to learn more about ETFs. They can provide insights tailored to your personal financial goals and risk preferences. Here’s why this step can be beneficial:

- Personalised advice: A financial adviser can help you understand how different ETFs fit into your unique investment strategy. They can highlight the benefits and potential drawbacks based on your circumstances.

- Expertise: Advisers have access to detailed market information and analysis that might not be readily available to individual investors.

- Clarifying doubts: ETFs can sometimes be confusing. Having a seasoned professional explain the nuances can clear up any uncertainties you might have. From understanding fees to knowing the different types of ETFs, an adviser can make complex aspects easier to grasp.

- Ongoing support: Investment landscapes change. An adviser can provide ongoing support and advice, helping you adapt your portfolio as needed.

If you decide to engage a financial adviser, don’t hesitate to ask questions and make sure their advice aligns with your investment strategy.

Keep learning about ETFs

Determining whether an ETF is right for you involves comprehensive research and reflecting on your investment goals and risk tolerance. The essential step is to keep learning. Financial markets are always evolving and keeping up with market trends can help you adapt your strategy. The only shortcut to building wealth is thorough and continuous education.

Armed with knowledge, you can be well on your way to adding the right ETFs to your investment portfolio.