October is like the Thursday morning in your work week. It marks that point at which you think: "Where did all the time go?".

At this stage, some people look at their list of unfinished goals, give a shrug, and decide to wait until January. Luckily for all of us, the Pearler Community aren't "some people". There's a LOT you can achieve in 10 weeks – and our investors are already hustling.

This week, our friend @tashinvests launched a competition with us that encourages people to set a goal for NYE. In return, one lucky goal-setter will win $500 to invest. Since it kicked off on Tuesday, we've been blown away by how many of our investors have shared their end-of-year goals.

Now, not all of your end-of-year goals are going to relate to investing. Yes, we're long-term investing nerds – but we get that there's a world beyond portfolios. Even so, we believe that Automate can help you reach any number of targets.

In short, we want to help you clock a final win before the year is out. That's why we're providing a short walkthrough which details how you can use Automate to reach your goals.

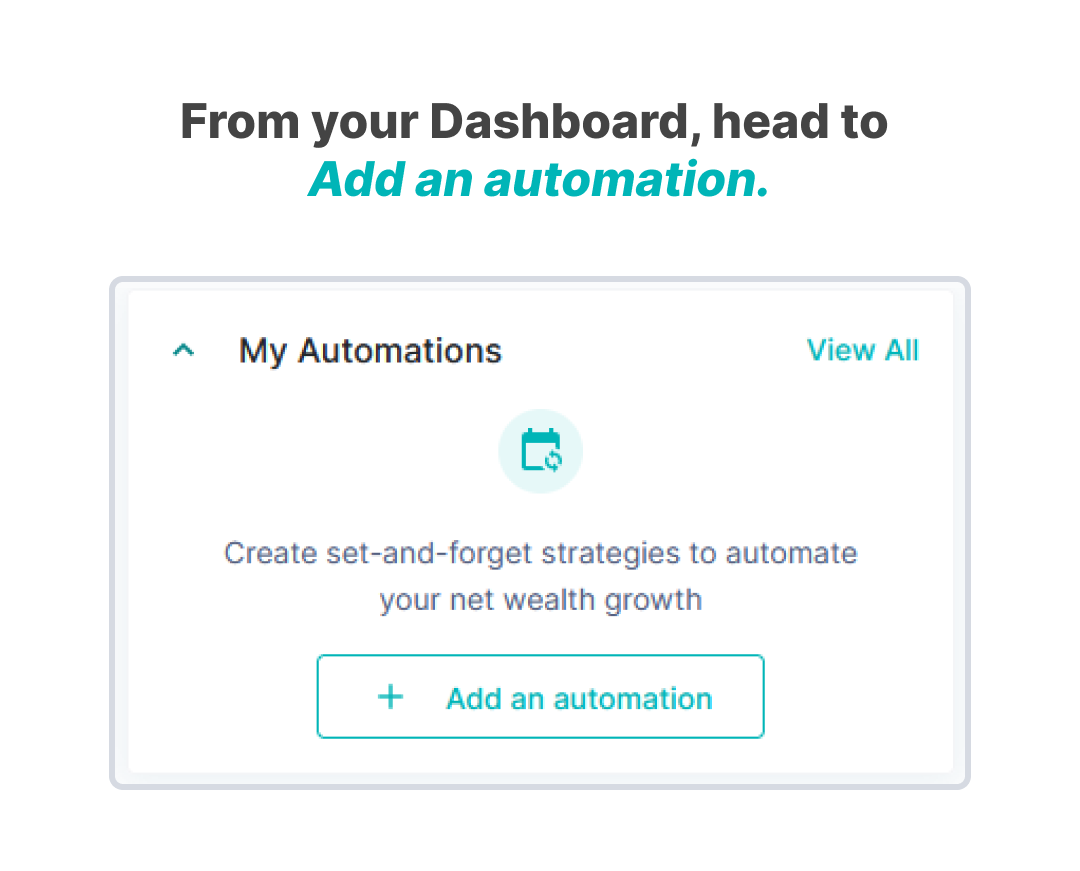

Here's an example of how you can set up Automate to achieve a goal

Here, you can set up one automation, or a range – from automated deposits, to roundups from everyday purchases.

Here, you can set up one automation, or a range – from automated deposits, to roundups from everyday purchases.

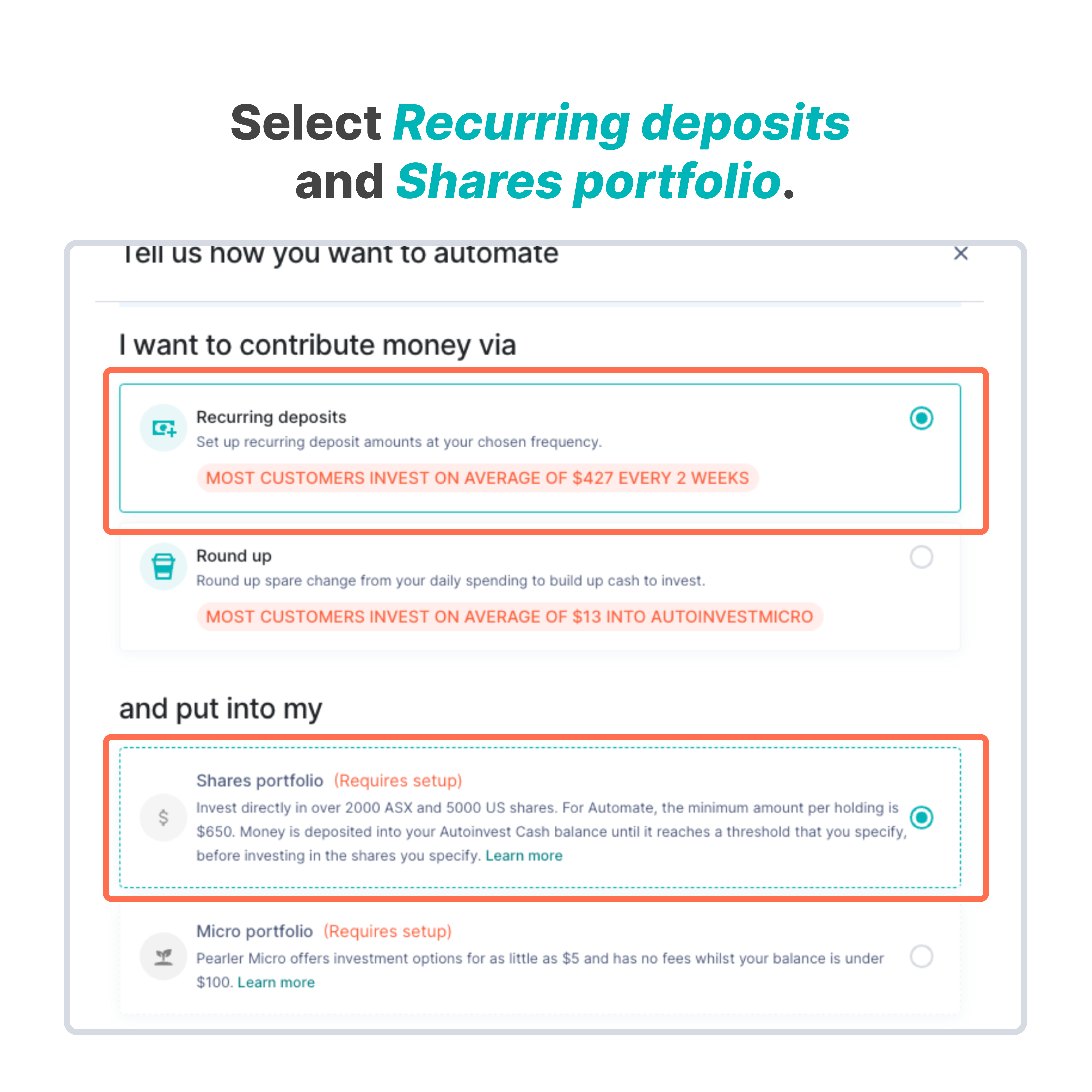

For this example, we're keeping it OG, and focusing on Shares investments via regular deposits. However, you can choose whichever Automate setup best aligns with your goal. For instance, if you want to quietly squirrel away small amounts of cash, you might choose

Round up

.

For this example, we're keeping it OG, and focusing on Shares investments via regular deposits. However, you can choose whichever Automate setup best aligns with your goal. For instance, if you want to quietly squirrel away small amounts of cash, you might choose

Round up

.

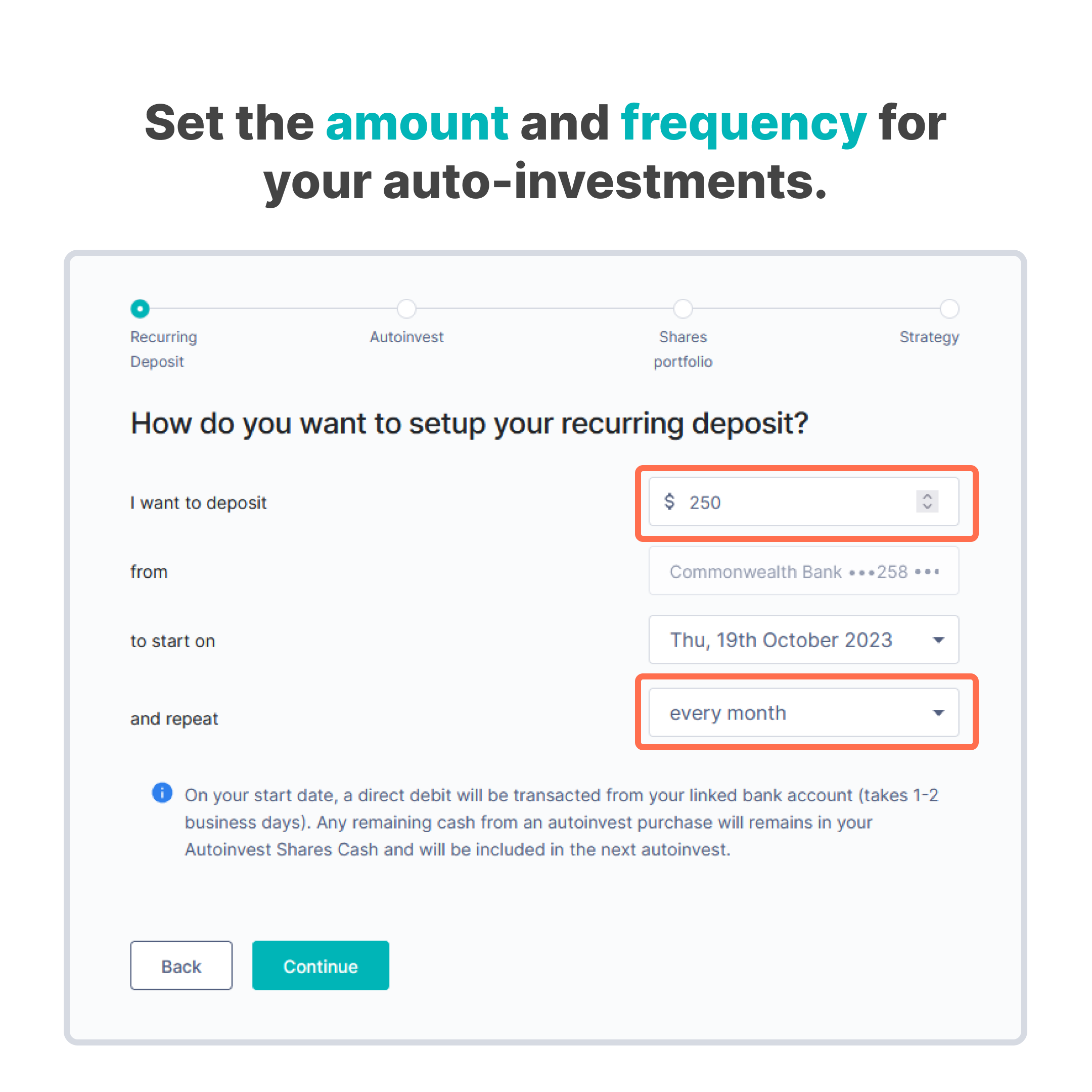

$250 a month between now and NYE means you'd have invested $750 by the year's end. If your goal is "invest before 2024", this would set you off to a cracking start.

$250 a month between now and NYE means you'd have invested $750 by the year's end. If your goal is "invest before 2024", this would set you off to a cracking start.

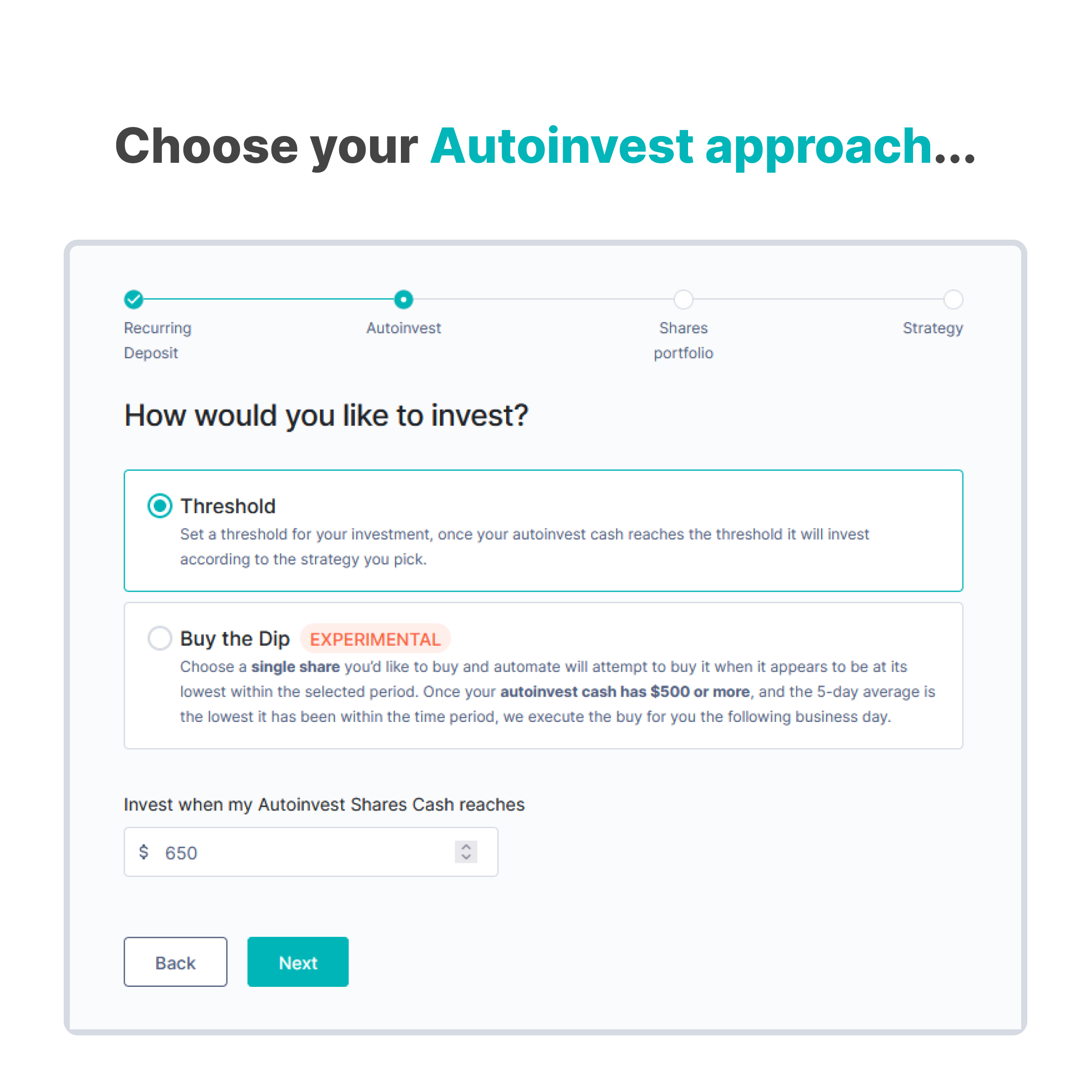

This section determines how and when you invest the money in your Pearler account. In this example, we'd autoinvest once there's $650 in our account.

This section determines how and when you invest the money in your Pearler account. In this example, we'd autoinvest once there's $650 in our account.

Are you only looking to add to your Pearler Cash for now, and don't want to think about investing it yet? Simply set a threshold that you won't reach, and your cash will remain in your Pearler account.

Here's where you get to decide what you'd like to invest in (if your plan is to invest at all right now). You can choose one investment, or mix and match.

Here's where you get to decide what you'd like to invest in (if your plan is to invest at all right now). You can choose one investment, or mix and match.

Congratulations! You've set up Automate. Now, you can work towards an end-of-year goal without needing to think about it.

Congratulations! You've set up Automate. Now, you can work towards an end-of-year goal without needing to think about it.

Of course, not everyone will want to set a financial goal between now and NYE. Maybe you just want to chill out and enjoy the rest of the year – and that's completely fine. But if you would like to tick a money goal off your 2023 list, we hope this article has helped.

All figures and data in this article were accurate at the time it was published. That said, financial markets, economic conditions and government policies can change quickly, so it's a good idea to double-check the latest info before making any decisions.