Find your why

Achieving financial independence is generally defined as the point in time when your passive income exceeds your ongoing living costs.

It’s the pinnacle of the FIRE journey, and it means so much to so many people.

But what will it mean for you?

If you don’t have a good answer, it’s incredibly important that you find one.

You need your why to make spending and saving decisions based on your values.

And your why is what inspires you to find creative ways to spend less and/or earn more, so you can reach your financial & lifestyle goals sooner.

Arguably, finding your why is the most important step in the FIRE journey.

Without it, what are you saving for?

But this first step is also the one that many budding FI-ers get so wrong. They have a cloudy vision of ‘endless holidays’ in their mind and that’s about it. Poorly-defined goals aren’t motivating. Clear, detailed goals are.

Unfortunately, this is one step you can’t afford to get wrong. Your why is your foundation. And a lack of foundation when times get tough is the main reason that those who’ve started their FI journey stray from their path.

There’s no rulebook for finding your why. Everyone’s why is different - only you can discover it. Also, your why won’t be a static thing either. As you go through life your motivations and goals will probably change… mine certainly have!

But, there are a number of methods out there that can help - ranging from professionally-taught courses on FI to people who have found their motivation for FI!

At the end of the day, if you simply take some time to reflect on what you would do when you hit FIRE, why that’s valuable to you, and WRITE IT DOWN, then that’s a great start.

Reflecting on how popular the FIRE movement has become over the last decade, it’s clear that FIRE does satisfy many “whys”.

No matter whether you’re a doctor or nurse, a tradie or teacher, an engineer or a designer or something entirely different, Financial Independence has something to offer everyone. You just simply need to find out what it has to offer you!

Fundamentally though, not having to rely on your paycheck to live and being ‘unshackled’ from a salary is an intoxicating idea for almost everyone I’ve met.

And while most people still don’t believe it’s possible, that’s starting to change.

In fact, as FIRE has become more and more popular, different ‘Types’ of FIRE have begun to emerge.

So, as you’re contemplating your why, I figure it’s probably worth introducing you to the many different Types of FIRE that are now out there so that you can get an idea of the options available to you, and ultimately, FIRE faster, or in a way that suits you better - and hopefully give you a little chuckle along the way too!

The 7 Types of FIRE

The FIRE movement has gained massive popularity over the last decade. So much so that there are now 7 Types of FIRE! They are:

We'll get into each of these types in detail in this article, plus we've put together a Detailed Resources List for each type of FIRE, if you want to dive deeper!

But first, how did we get to 7 Types of FIRE?!

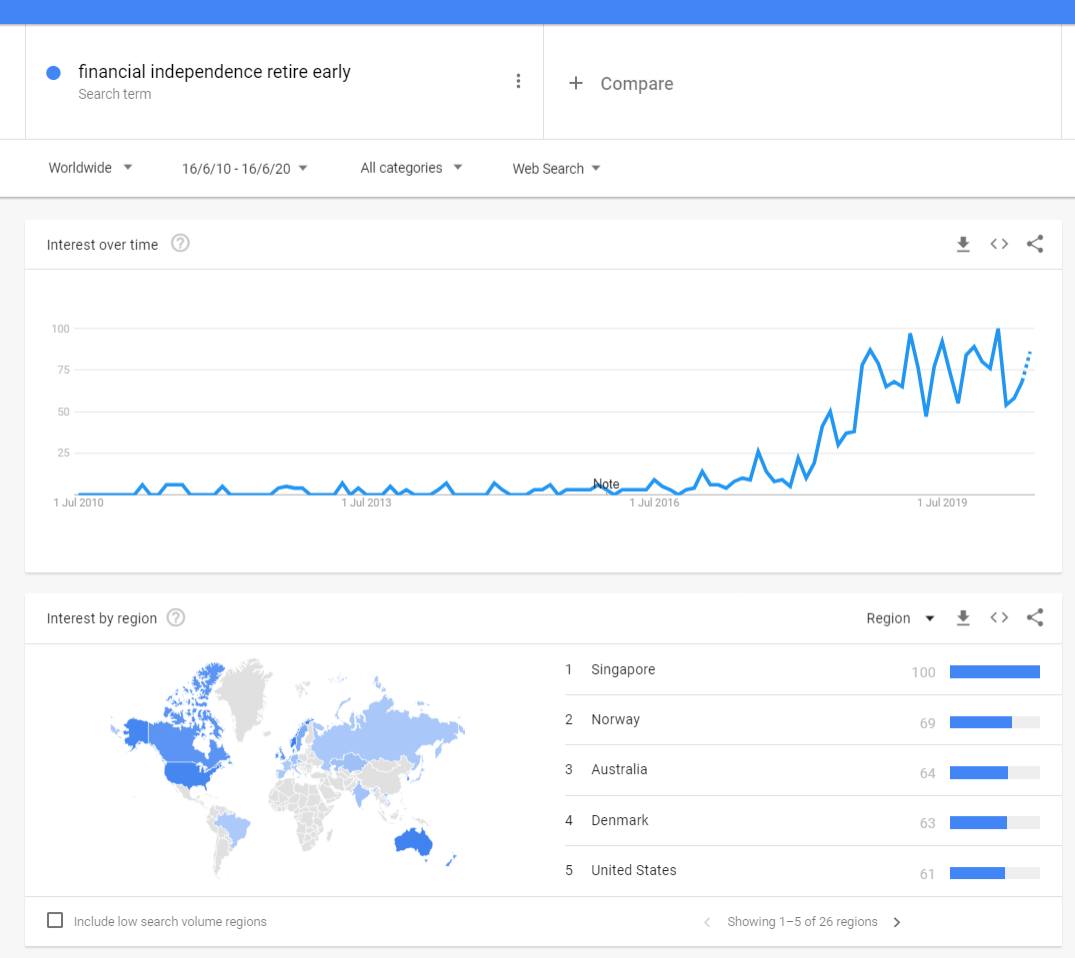

I think Google Trends tells the story pretty well. The graph below shows how interest in FIRE, or more specifically the “Financial Independence Retire Early” search term has grown over the past 10 years.

Astonishing, right? Just from late 2017 to now, interest has grown over three times. And not only that but “Financial Independence Retire Early” is a ranking search term in 26 countries - many of whom don’t even have English as a first language!

It’s undeniable - the FIRE is spreading!

With so many people interested and engaged, FIRE has evolved to have a few different sub-types based on simple but important questions such as:

- What kind of lifestyle do I want to live on my journey?

- How do I plan to reach my end goal?

- What am I willing to do or not do to save money?

Some people want to retire ASAP because they hate their job. Others love their job and aren’t in a rush at all - they just want that intoxicating feeling of independence!

Similarly, some people want to maintain their current lifestyle, while others want to cut back and bring their FIRE date forward as fast as possible.

And the list goes on…

While everybody’s answers to these questions are different, common patterns have emerged that have led to the creation of 7 distinct types of FIRE (so far!).

I’ve summarised each of the 7 types and have also provided links to the best resources I’ve found on each type - my aim is to provide one place to explore every type, not to be comprehensive about every type.

Please remember: the beauty of FIRE is that it can be achieved in many different ways. The only right way to FIRE is your way, which needs to be based on your unique goals and your own research - which, hopefully, this helps you to do!

With that out of the way, let's explore the 7 types!

TraditionalFIRE

You’re probably already familiar with TraditionalFIRE - or just “FIRE”.

It is the foundation for all of the other types.

The aim is to be able to retire from traditional work and not rely on a paycheck.

This is typically achieved by accumulating income-generating assets - with the goal being to accumulate enough money to cover your current living expenses.

Basically, people who fall into TraditionalFIRE want to retire living the same lifestyle as they do today.

If this is you, then you typically…

- Have average to above-average income

- Are diligent about not spending money on things you don’t value

- Aren’t counting every dollar you spend, but do track some spends

- Have simplified your lifestyle

- Save money aggressively & invest most it

- Enjoy working, but want flexibility & choice

The big distinctions between FIRE & the sub-types only really become apparent after understanding the other types - so read on!

LeanFIRE

LeanFIRE is FIRE on a tight budget - $40,000 a year is the commonly-quoted number for LeanFIRE.

The aim of this type is usually to retire ASAP.

When it comes to saving money, people in LeanFIRE are creative (some may even say ‘relentless’! 😂).

If this is you, then you are happy with living a simple and minimalistic lifestyle in retirement.

On top of saving money, simplifying their lifestyle and investing - LeanFIRE’ers are experts at managing their expenses and being frugal, but they do so without completely compromising comfort.

If this is you then you typically…

- Have below-average to average income

- Are extremely conscious of your spending

- Are an expert at tracking and cutting your expenses

- Have a frugal lifestyle

- Save money aggressively & invest most it

- Want to retire from your current job ASAP

- Don’t want kids and/or live in a LCOL area

FatFIRE

FatFIRE is FIRE on a large budget - $100,000 a year is the commonly-quoted number for FatFIRE.

The aim of FatFIRE is to reach financial independence in style. Retiring isn’t enough!

Those pursuing FatFIRE have ambitious goals in mind & want to ‘live the high life’ in retirement - at least in comparison to the other types of FIRE.

Most people who pursue FatFIRE are high-income earners - high disposable incomes allow them to save greater amounts of money on which they will live once they FIRE.

If this is you, you might be spending more money than the average person - but your high income means you can still save significant amounts - perhaps even proportionately more.

If this is you then you typically…

- Have above-average income

- Spend more, but still in a values-based way

- Are not tracking your expenses

- Have a more expensive lifestyle

- Save money aggressively & invest most it

- Enjoy working and are not in a rush to retire

- Want kids and/or live in a HCOL area

BaristaFIRE

BaristaFIRE is FIRE without the RE - at least not in the literal sense…

Those who BaristaFIRE choose to work part-time jobs or in the gig economy after they wrap up their 9 to 5.

Typical “Barista” jobs include:

- Barista (surprise surprise)

- Fruit-picking

- Uber driving

- Airbnb hosting

- Sports coaching

- Freelancing

- And the list goes on…

The drivers behind choosing to BaristaFIRE are diverse - some people just want to be social, others struggle with having too much free time and others want to FIRE from their 9 to 5 ASAP and this is the quickest way to get there.

Those who pursue BaristaFIRE are aiming to save at least enough to only have to work a fraction of each year to maintain their lifestyle.

Others don’t necessarily pursue BaristaFIRE, but end up working a casual job once they FIRE anyway.

Reasons for the retro-active Barista’ing are very diverse, but common ones include needing to supplement income after financial circumstance change (such as a market crash!), finding a new social outlet, and becoming bored in full-blown retirement.

The key difference between BaristaFIRE and SemiFIRE (next section) is that those who BaristaFIRE usually work in part-time occupations that aren’t related to their previous professional careers. They are also typically not professional jobs.

Whatever the reason, and whether planned or not, these people are not fully FIRE’d, but they have hung up the boots of their previous profession for good.

Many in FIRE use the option of BaristaFIRE as a back-up or last resort if their projections turn out to be too optimistic. Please remember - it’s always better to be conservative than optimistic when it comes to financial projections!

Imagine having enough money saved that you only need to earn $5000 or $8000 a year. That isn’t impossible to achieve! No more 40+ hour work weeks.

If this is you then you typically…

- Have the same traits as TraditionalFIRE

- Except you’re happy to work a fraction of the year for a few years if that means you can FIRE from your 9 to 5 earlier

- You probably also live in or intend to move to a LCOL area

- You might be considering coupling this strategy with LeanFIRE

SemiFIRE

SemiFIRE is the other type of “part-time FIRE.”

Those who pursue it typically enjoy their current jobs and don’t want to fully retire, though they would like to take things a little easier.

Essentially, they’d like to work part-time towards the end of their professional careers.

Keyword: professional.

Unlike BaristaFIRE, these people don’t intend to participate in the gig economy.

Typically, if you pursue SemiFIRE your part-time work covers your day-to-day expenses and lets your nest egg continue to compound when you take a step back from full-time.

You also typically enjoy your profession & find it very fulfilling - but you’d just like a bit more time to do other things. Unsurprisingly, it is often paired with a FatFIRE strategy.

The life of a SemiFIRE person is: work little, play hard. Goodbye 40+ hour work weeks!

If this is you then you typically…

- Have the same traits as TraditionalFIRE

- Except you enjoy your profession and don’t feel any need to “retire early”

- Instead, you’d like to move into a part-time role towards the end of your career

- You might be considering coupling this strategy with FatFIRE

GeoFIRE

GeoFIRE is FIRE with geoarbitrage.

What is geoarbitrage? It’s moving to a relatively low cost of living (LCOL) area to reduce annual expenses once FIRE’d. It doesn’t matter where, all that matters is that living expenses are lower!

People who are pursuing GeoFIRE either have relocated or plan to relocate once they FIRE to bring forward their FIRE date.

This American couple estimates they saved $80,000 per year by moving 10 miles (16km) and reduced their time-to-FIRE by 9 years. And that’s just domestic relocation. The savings really start to ramp up if you’re willing to relocate internationally!

Imagine this scenario:

- Age: 30

- Net worth: $50k

- City: Sydney, Australia

- Monthly income: $3000

- Monthly spending: $1500

The cost-of-living in Sydney is $2774/mo which means it would take this person 30 years to reach FIRE. They will retire when they are ~60 years old.

Meanwhile the cost-of-living in Ankara, Turkey is $750/mo. This means that this person could retire in ~8 years at the age of 38 if they move to Ankara.

FIRE’d cost-of-living makes a massive difference to your FIRE date.

For those who have remote work as an option, you wouldn’t even have to wait until you FIRE to move - and that would ramp up your savings rate enormously too.

Imagine working for a big tech company but living on a beach in Sri Lanka. These days, that’s possible. In a post-COVID world, it’ll fast become possible for more and more people too…

That said, moving is definitely not for everybody! Family, friends, healthcare are all huge considerations that together means GeoFIRE is not an option for most. But if it is for you - awesome!

If this is you then you typically…

- Have the same traits as TraditionalFIRE

- Except you also wouldn’t mind relocating if it dramatically reduces your time-to-FIRE

- You might be thinking of coupling this strategy with FatFIRE or LeanFIRE too - both become much easier to achieve if your living expenses are significantly less!

NomadFIRE

NomadFIRE is the extreme version of GeoFIRE.

People who are pursuing NomadFIRE have been bitten by the travel bug hard.

They plan to travel full-time either after they’ve FIRE’d or in the lead-up to FIRE (also known as “digital nomading”).

If this is you, you would enjoy moving from place to place every couple of months or so - or already do!

I.e. You wouldn’t just stop at Ankara, after a couple of months you might move to Santiago, Chile and the year after that might be Tangalle, Sri Lanka (these examples are impractically expensive to fly between, but you get the point! 😅)

Travelling through LCOL countries allows you to increase your savings rate in the lead-up to FIRE, and reduce your overall FIRE number. The key to accelerating FIRE this way is to live frugally in places where your money goes far.

The lifestyle can be too adventurous and less stable so it is not for everybody. Take this into consideration before deciding on any big move!

If this is you then you typically…

- Have the same traits as TraditionalFIRE

- Except you also love to travel & want to travel HEAPS when you FIRE, or in the lead-up to FIRE

- And you also probably don’t want kids - at least, not while you’re travelling!

Wrapping up

As the FIRE has spread, the community has become more and more creative.

Nothing is taken for granted, and as you’ve seen, there’s a type of FIRE for everyone - or at least a mix of them!

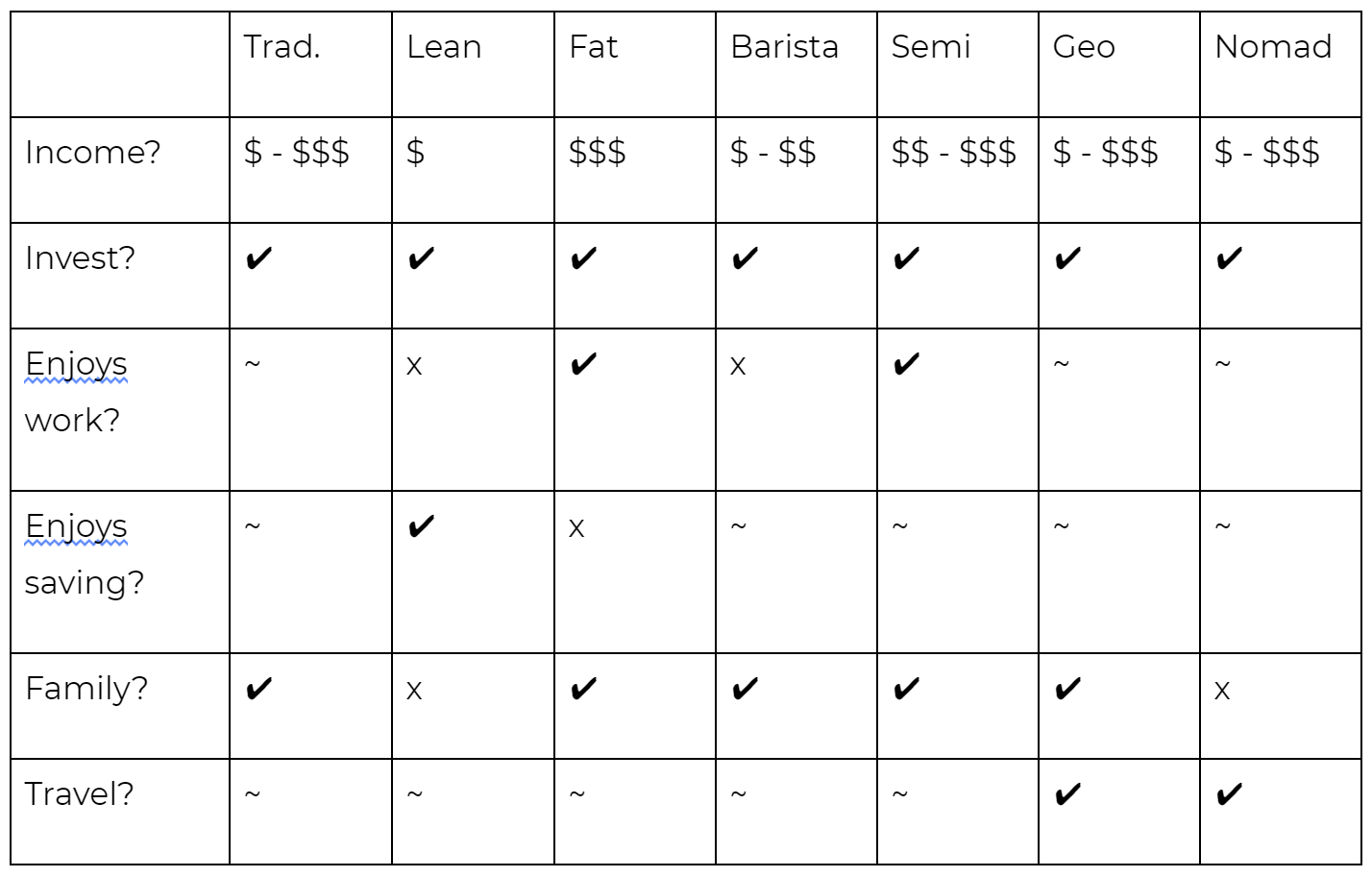

Here’s a general summary of the types of FIRE today:

Personally, I see myself going down the SemiFIRE/FatFIRE route. I’m tempted to go down the NomadFIRE route too, but I do love Australia. Maybe I could Nomad for a couple of years though…? Not in this COVID climate, I guess!

If you’d like to explore the Types of FIRE further, you’re in luck! Here is a shortlist of the best resources we’ve found when it comes to each type.

Resources: The 7 Types of FIRE

TraditionalFIRE

- Learn about the basics of FIRE

- FIRE Reddit Community

- FI Australia Reddit Community

- Pearler’s FI Resources

LeanFIRE

FatFIRE

BaristaFire

SemiFIRE

GeoFIRE

NomadFIRE

- Learn more about NomadFIRE

- A NomadFIRE approach

- NomadFIRE calculator (also useful for GeoFIRE)

About Kurt from Pearler | pearler.com

Kurt is one of Pearler's co-founders. After reading the Barefoot Investor at the age of 14, Kurt got started on his Financial Independence journey early. He invested his $15,000 in "life savings" in 3 stocks based on a stockbroker's recommendation – right before the Global Financial Crisis. Seeing his share portfolio plummet in value (and never bounce back), Kurt resolved to learn all he could about investing, and why retail investment advice gets it so wrong, so often. In 2018, Kurt co-founded Pearler with his two friends, Hayden and Nick, to make it easier for everyday Aussies to invest in shares the right way - incremental amounts in diversified portfolios, for the long-term.

NOTE: Aussie FIRE is a free educational resource prepared by Pearler, with permission from the co-authors. At Pearler, we strive to make investing for your long term goals easier and fun, but we only provide general information and/or general advice. We don’t present you any options based on your personal objectives, circumstances, or financial needs. Any advice is of a general nature only. All investments carry risk. Before making any investment decision, please consider if it’s right for you and seek appropriate taxation and legal advice. Please view our Financial Services Guide before deciding to use or invest on Pearler.