The world of ETFs can feel like stepping into a playground. A place buzzing with opportunities, but also packed with choices that can make your head spin. Among others, we have emerging market ETFs that allow you to get a piece of the action in other geographies. Then, there are also thematic ETFs, which make it easier to broadly invest in specific industries.

It's understandable to feel a tad lost, trying to pick the best adventure. But we’re here to clear the fog and walk you through each path. This way, you can explore the sights and sounds of both emerging market ETFs and thematic ETFs.

By the end of the article, you'll have the right information to know the lay of the land. You may also discover which trail is the best fit for your unique investing journey.

What are emerging market ETFs?

One thing ETFs (Exchange-Traded Funds) are known for is their diversity. They are investment baskets that hold different types of assets, and you can buy or sell them like regular stocks.

Let's first look at emerging market (sometimes called emerging markets) ETFs.

Emerging markets ETFs baskets are packed with companies from developing markets. These countries are becoming more involved in global markets. Such countries are like the new kids on the block, and they're growing fast. We're talking about nations like Brazil, India, and China.

These countries are flooded with new businesses, providing a lot of growth opportunities (and also potential risks) for investors. By investing in an emerging market ETF, you get to be part of this action. You can own various emerging markets equities from different countries within a single ETF investment.

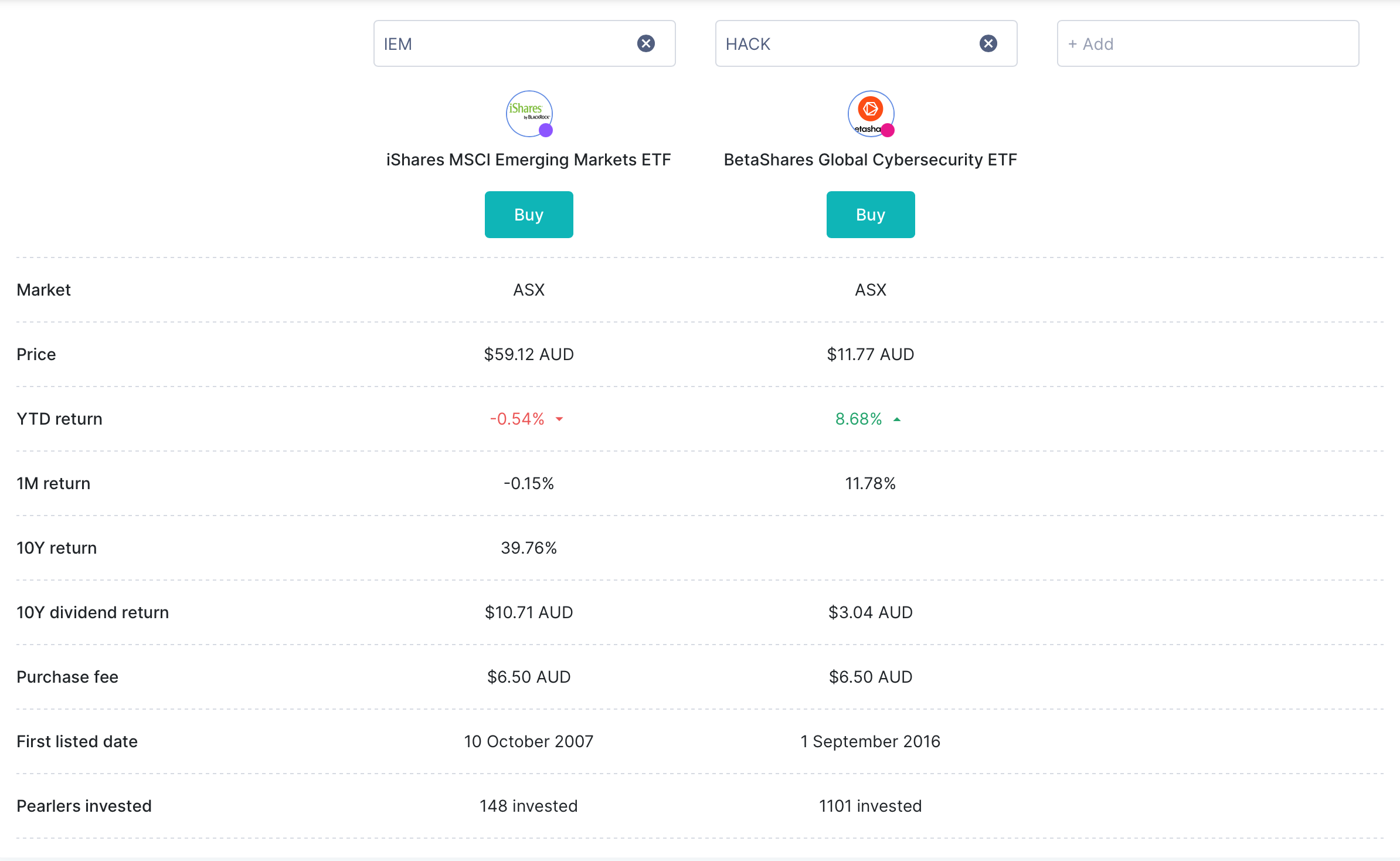

Now, let’s look at a couple of emerging market ETFs:

- Vanguard FTSE Emerging Markets ETF (VGE) : This is a popular ETF that gives you a slice of over 1,000 companies in these fast-growing countries.

- iShares MSCI Emerging Markets ETF (IEM) : This ETF is similar but with its own mix, including companies from countries on the rise like India and South Africa. It's another way to invest in companies from parts of the world experiencing a lot of growth.

Emerging markets ETFs are a way to spread your bets across many companies and countries. This can potentially make it less risky than choosing a single country or company to invest in. You get to join in on the exciting growth happening in other parts of the world, all from the comfort of your own home.

What are thematic ETFs?

When we talk about thematic ETFs, they're as the name suggests – built around a specific theme. For example, if you're passionate about sustainability and the environment, you might invest in a thematic ETF that's for clean energy. This means your money goes into companies dedicated to environmental projects like solar panels or wind turbines.

Now, let's say you're also a tech whiz and love everything about computers. There's a thematic ETF for that too, focused on cloud computing. This ETF would invest in companies that store data and run applications on the internet. When you browse ETFs on the Pearler platform, you might also come across an ETF database category like "ESG" (environmental, social, and governance), this is another type of thematic ETF.

Here are a couple of specific examples:

- Global X Lithium & Battery Tech ETF (ACDC) : This ETF is about the future of energy, focusing on companies that make lithium batteries, which power everything from smartphones to electric cars. It allows you to be part of the energy revolution, supporting cleaner, greener ways to power up our world.

- BetaShares Asia Technology Tigers ETF (ASIA): This ETF includes the biggest and brightest tech companies in Asia (like Alibaba and Samsung), excluding Japan. Investors holding this ETF get exposure to both a high-growth sector and diverse geographies.

Thematic ETFs allow you to be part of something bigger and aligned with your interests, all while you continue your investing journey.

How do I choose between emerging market ETFs and thematic ETFs?

Both emerging market ETFs and thematic ETFs bring something unique to the table. The best choice for you and your investment portfolio hinges on a few personal factors.

So, how do you choose? It's about knowing yourself as an investor. Consider what you're aiming for in the long run. Ask yourself how much risk you're comfortable with, and what kinds of stories or trends you want to be a part of.

Dive into the ETF database, browse the categories, and get a feel for what's out there. Look at the emerging market ETFs and thematic ETFs listed and identify what resonates with you and aligns with your goals.

And there's nothing wrong with mixing and matching. Combining emerging market ETFs with thematic ETFs can give your portfolio diversification. You can balance the thrill of high-growth potential with investments that speak to your personal values.

To that end, there's no one-size-fits-all answer. Simply arm yourself with knowledge and consider your investing style and journey as you choose.

How can I compare emerging market ETFs and thematic ETFs?

Now, comparing emerging market ETFs and thematic ETFs might sound like a lot of homework. But there are some great tools to help you out.

At Pearler, our Comparison Feature can help you line up the details for each investment side by side. By using it, you can see which ETF ticks the right boxes for you. It's like having all the information laid out in front of you, making it easier to decide without getting lost in the investment jungle.

How to use Pearler’s Comparison Feature

Step 1: Visit Pearler's Comparison page. First, head over to Pearler's comparison feature,

Step 2: Pick your investments to compare. Now, you want to compare a couple of investments. Pick two (or even three) investments you're curious about. In this case, maybe it's an emerging market ETF and a thematic ETF.

Step 3: Review the comparison. The feature lays out the key information side by side. You can see what each ETF offers, like price, performance over time, and fees.

Step 4: Dive peeper if you want. If you're the type of investor who likes to know exactly what you're getting, you can dig deeper into each ETF by clicking on their respective names. You’ll be redirected to a page that holds more information, such as companies they invest in, dividend history, industry exposure, country exposure, and how popular it is among the Pearler community.

Using Pearler's Comparison feature is a straightforward way to see how different investments stack up against each other. But how can long-term investors make sense of this information to inform their investment decisions?

Using asset information to shape your investment decision

For a long-term investor, digging into asset details and exploring the info can help you figure out which ETFs align with your goals. Here's what's included in the comparison:

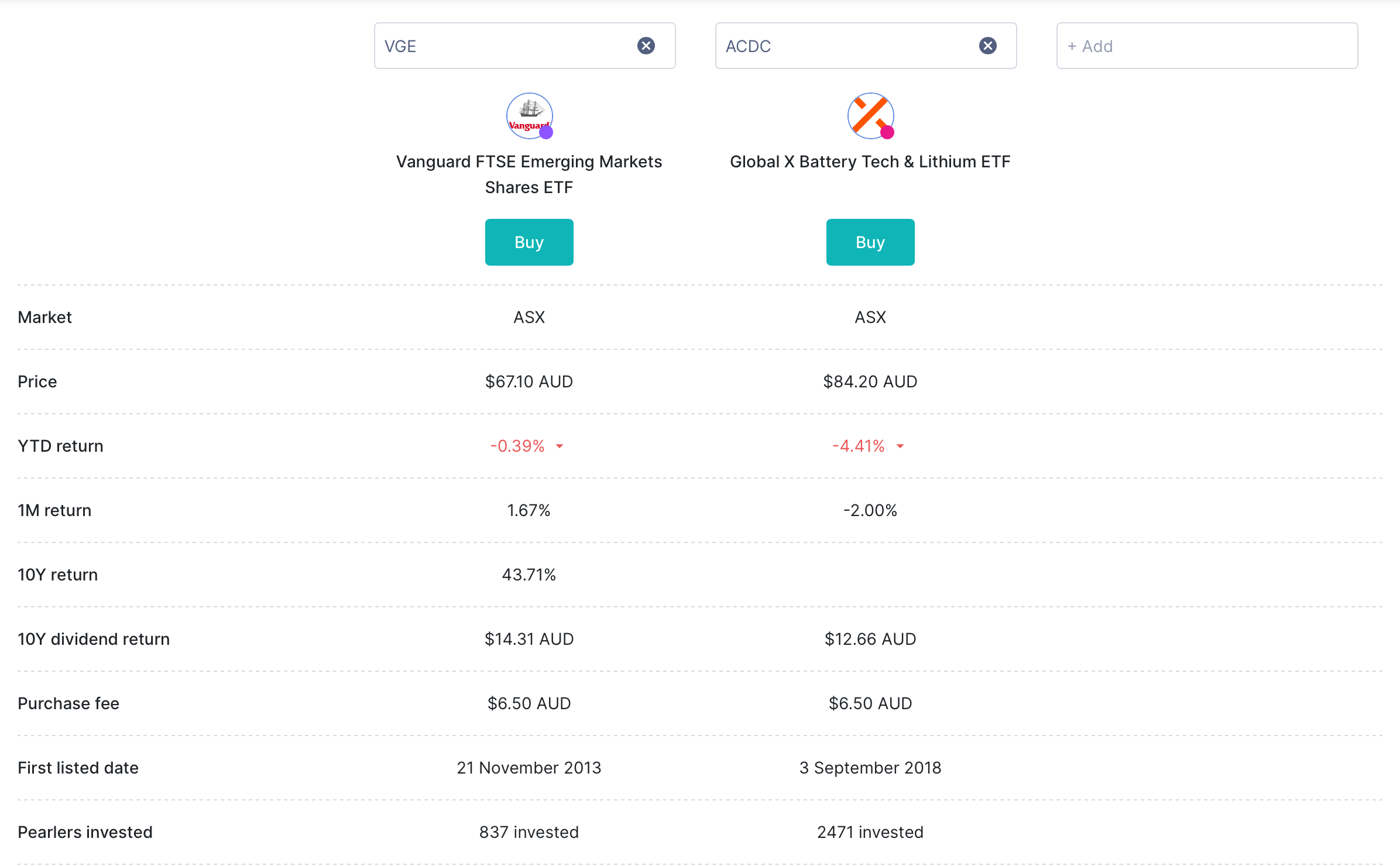

- Market : This tells you the market where you can buy and sell the ETF. In the example above, both Vanguard FTSE Emerging Markets Shares ETF (VGE) and Global X Battery Tech & Lithium ETF (ACDC) are available on the Australian Stock Exchange (ASX) .

- Price : This is how much it costs to buy one ETF share. As you can see, at the time of the image, it costs more to invest in ACDC compared to VGE. This might be important for an investor with less cash to invest.

- YTD return : This number shows how the ETF has performed since the start of the year. VGE is slightly down, while ACDC has dropped a bit more – both have decreased in value. As a long term investor, you likely won't sweat these short-term moves too much, but it's good to keep an eye on them.

- 1M return : This is the recent month's performance. VGE had a small uptick, and ACDC dipped. Monthly numbers can be choppy. So, it’s best to weigh this against longer term performance to get the real story.

- 10Y return : Now we're talking long-term! Over ten years, VGE has gone up over 40%, a solid showing. ACDC hasn't been around that long. But if it's a sector you believe in for the next decade, you may choose to invest.

- 10Y dividend return : This is the average cash dividend (in dollar terms) investors have received for each ETF they held over the last 10 years. VGE's distributed a higher value of dividends over 10 years; this could be because it's been around for longer.

- Purchase fee: Both VGE and ACDC charge the same fee to buy in. Knowing this information helps you figure out the initial cost of your investment. As someone looking to invest for the long haul, this one-time cost might be worth it if the ETF fits your strategy.

- First listed date : VGE has been around since 2013, giving it a longer track record. ACDC started in 2018, so it's newer to the scene. History can give clues about how an ETF behaves over time, but newer ETFs like ACDC can be exciting if they're in a growing industry.

- Pearlers invested : It looks like ACDC has more Pearler investors at the time of this image. While popularity isn't everything, it shows that a lot of people are interested in the tech and lithium sector.

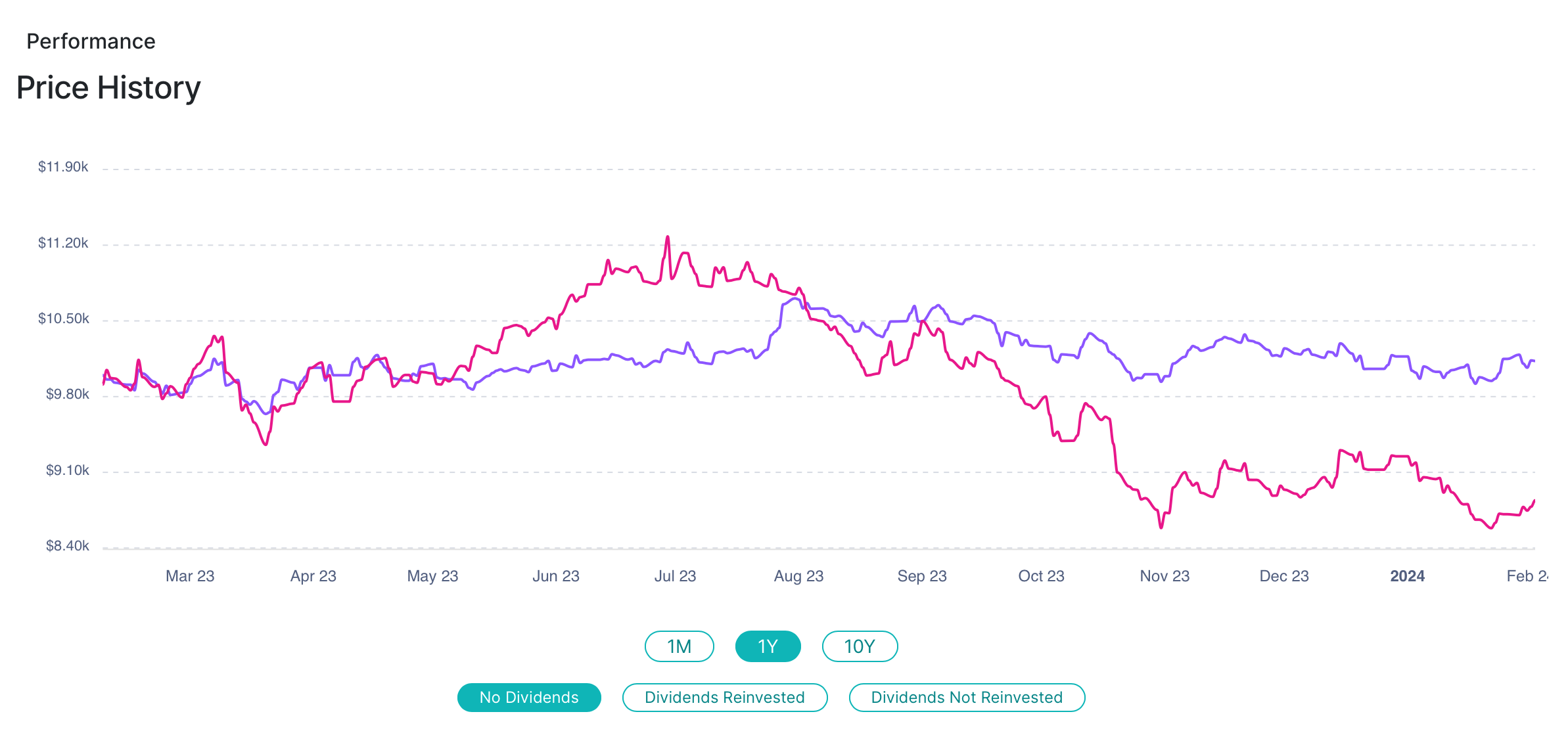

Imagine the graph as a storybook timeline, showing the journey of these two ETFs over time. Each point on the graph represents how well (or not so well) the ETFs have performed at moments in time.

When you look at the graph, check out:

- The starting point : This shows you where each ETF began. It's like the starting line of a race.

- The ups and downs : Each rise and dip in the line shows you how the ETF's value has changed over time. A big up might mean good news in that area, and a down could mean there were some challenges.

- The ending point : This is where each ETF is right now. It shows you how much it has grown or changed from the start.

From the graph, VGE (the purple line) has seen some minor ups and downs. But overall, it's had fairly steady performance. This stability might appeal to you if you prefer a more predictable investment with fewer surprises.

On the other hand, ACDC (the pink line) has seen more dramatic shifts. This could be exciting if you don't mind the rollercoaster ride that is the tech and lithium market.

Remember, what's happened in the past with these ETFs doesn't guarantee the future. Just like weather forecasts, financial forecasts can't promise the same patterns will continue. Consider this info as part of the big picture when deciding what assets to include in your portfolio.

As a long-term investor, use this information to weigh up the options. If you’re keen on tapping into the growth of emerging markets, you might lean towards the Vanguard ETF. But if you’re for the future of energy and tech, the Global X ETF could be more your style.

Armed with all this info, you're ready to pick the ETF that best matches your investment style and goals. Treat the examples above as just starting points for your own research.

Navigating your ETF choices: emerging markets vs thematic focus

Choosing between emerging market ETFs and thematic ETFs comes down to what works for you and your investing style. Do you get excited about the possibilities of emerging markets? Or are you more into specific themes like clean energy or tech? Whatever floats your boat, staying true to what you're into is key.

And when you include ETFs in your investing portfolio, don't feel like you have to stick to only one type. Having both can also bring diversification benefits and help spread the risk.

Before jumping in, take the Pearler Comparison tool for a spin to compare ETFs you're interested in. This and other tools can help you sift through the options, and make an informed choice that resonates with your long term vision.

The world of ETFs is vast and varied, inviting you to explore, learn, and grow as an investor.

Happy investing!