NOTE: we do our best to share general resources so you can do your own research but keep in mind this information doesn’t consider your personal circumstances, objectives of needs. When it comes to investing in your super, you should consider if it’s appropriate, read PDS and TMDs and reach out to a financial advisor and tax accountant. When investing, there may be tax implications and you should get advice from a licensed tax adviser and financial advisor.

Why consolidating your super matters

Have you ever looked at your super statements and thought: "Why do I have so many of these?" You're not alone. Many Aussies have multiple super accounts floating around, silently eating away at their retirement savings through duplicate fees.

Let's fix that today.

This guide will walk you through bringing your super accounts together in one place, with pictures to help you along the way.

Not sure if consolidation is right for you? Some funds offer unique benefits that might be worth keeping separate. Check out our previous article on when to consolidate or switch super funds before making your decision.

Before you begin

- Your MyGov login details

- Your 9-digit tax file number

- A clear idea of which fund you want to keep (make sure it’s the one receiving your employer contributions)

Using myGov for consolidation

myGov is run by the Australian Government. It’s a simple and secure way to access government services online with one login and one password.

You can link many online services to your myGov account, including your Australian Taxation Office (ATO) account, which is where you go to consolidate your super.

Some funds offer their own super consolidation tools but we’re keeping it neutral and using the government’s independent tool for this process. Let’s get started.

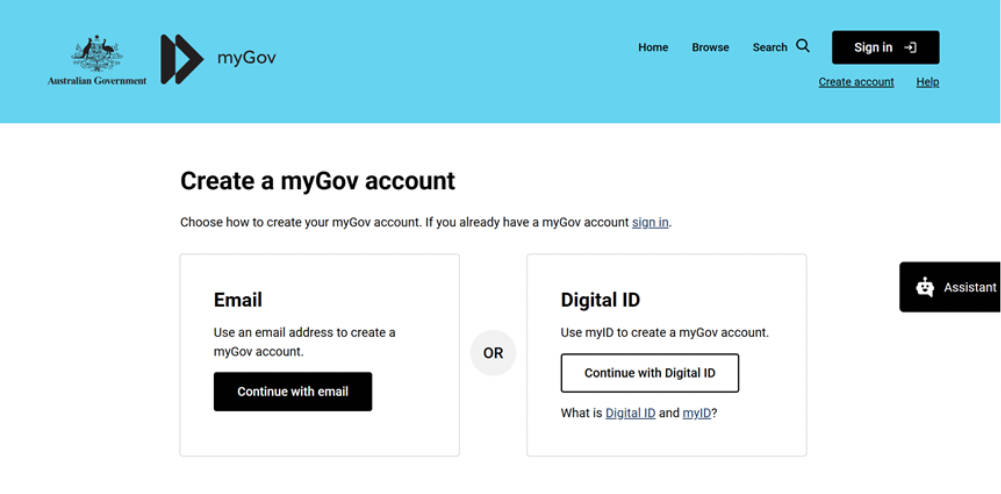

Step 1: Log in to myGov

First, head to the myGov website and sign in to your account using your preferred approach.

Don't have a myGov account? You'll need to create one first and then link it to the ATO.

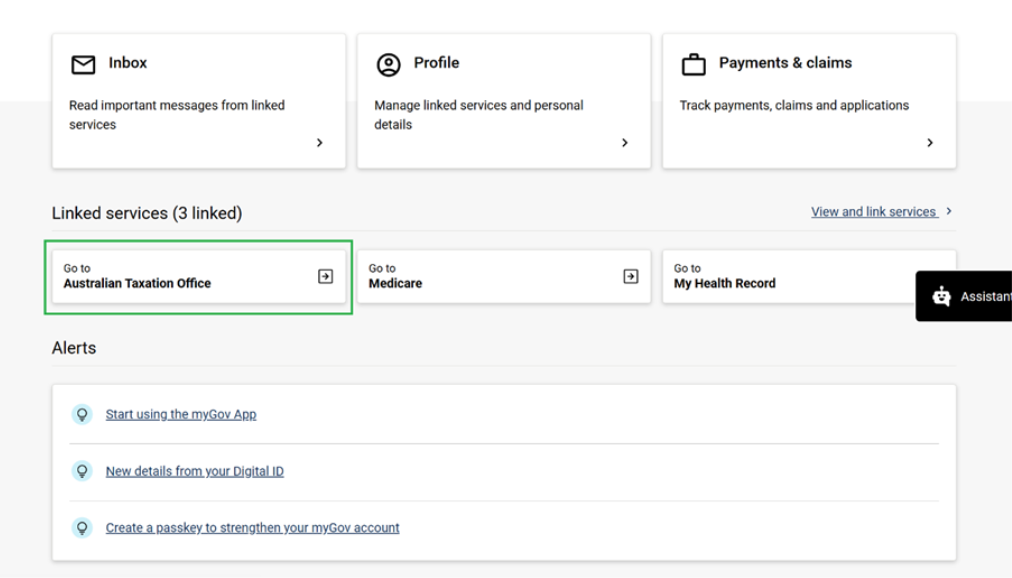

Step 2: Access the ATO section

Once you're in, find and click on the ATO service.

Haven't linked your ATO account yet? Click ‘View and link services’ on the right side of the screen. Then scroll down to find the Australian Taxation Office under ‘Link a service’.

You'll need to confirm your personal details, including your TFN, and answer two questions about your tax record. You can select two of the following relevant information:

- Bank account details – for an account where you receive your income tax refund or have earned interest in the last two years.

- Gross income – from a pay as you go (PAYG) payment summary issued by your employer in the last two years.

- Taxable income – from a Centrelink payment summary issued in the last two years.

- Notice of assessment (NOA) date of issue and reference number – for an NOA issued in the last five years.

- Super account member number and super fund Australian business number (ABN) – from a super account statement (received by email or letter) from the last five years or a membership card. Can’t find the fund ABN? Try the ATO’s Super Fund Lookup.

- Investment reference number – on a dividend statement from the last two years.

If you don't have the required information to link, contact the ATO for a unique linking code. They’ll ask questions to verify your identity and protect your account privacy.

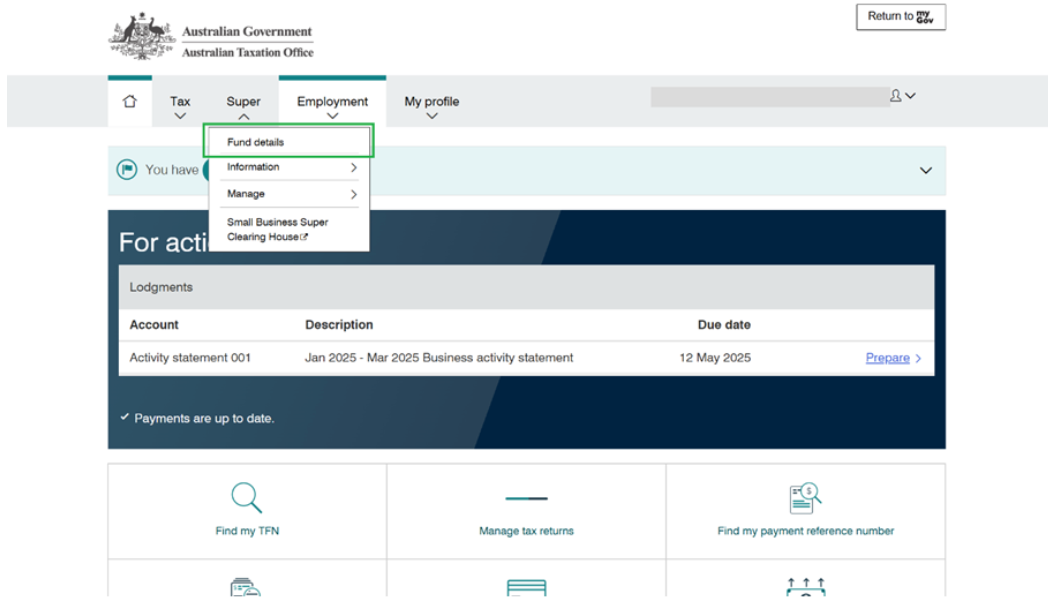

Step 3: View your super accounts

Once you’re in the ATO portal, navigate to the 'Super' section. You’ll see this in the main menu.

Then click ‘Fund details’ in the dropdown menu.

This will take you to a list of all your superannuation accounts. The ATO keeps track of these based on your TFN.

Step 4: Select accounts to consolidate

From your list of super accounts, click on 'Transfer super'. You’ll only see this option if you have more than one super account.

Don’t see it? Then your super is already consolidated – nice work.

You'll see options for selecting which accounts to transfer and where to transfer them to. Choose the fund you want to keep as your main super account (the receiving fund). Or, consider finding a new fund, like Pearler Super, to transfer all your account balances to.

As mentioned earlier, using myGov isn’t the only way to consolidate your super. You can also transfer your balance to your preferred fund by contacting them directly or using an ATO rollover form.

Step 5: Confirm your choice

Double-check everything before you confirm and authorise the transfer:

- Is the receiving fund correct?

- Does the transfer amount look right?

- Are your personal details accurate?

Step 6: Submit your request

Once you're satisfied everything is correct, submit your consolidation request.

The ATO will process your request and notify all super funds. This typically takes 3-5 business days but it can sometimes take longer.

After consolidation

Keep an eye on things after you submit. Wait a few days then track progress through the ATO portal. Also check your receiving fund to make sure the balance jumps up to the right amount.

Remember to:

- Let your employer know about your chosen super fund

- Update your beneficiaries

- Check your insurance coverage in your consolidated fund

Troubleshooting common issues

What if some super doesn't appear in myGov?

If you think you have other super accounts that aren't showing up:

- Check if you've used different names or TFNs in the past

- Contact the ATO directly on 13 28 65

- Try using the super fund's search tools

How to handle funds that can't be transferred online

Some funds, particularly older or more specialised ones, might not allow online transfers. In these cases:

- Contact your chosen fund directly

- Ask for a paper transfer form

- Complete and return it as instructed

What if I encounter errors during the process?

If you run into technical issues:

- Take note of any error messages

- Try again after clearing your browser cache

- Contact the ATO helpline for assistance

One fund, less stress

Bringing your super together cuts down on paperwork and can potentially save you thousands in fees. What seems like a small difference now compounds significantly over decades.

Super consolidation is like spring cleaning for your finances. It's a quick job that leaves everything tidier and working better. Your future self will thank you for taking this small step today!

Not sure what fund to transfer your super balance to? Check out Pearler Super, the newest addition to our all-in-one wealth platform.

At Pearler, we pride ourselves on the quality of the general material we provide. Please note, though, that this information is general in nature and has not been tailored for you. It does not consider your personal circumstances, objectives, financial situation or needs. Before acting on the information, you should consider its appropriateness. Before you make a decision about Pearler Super, you should also consider the Pearler Super product disclosure statement (PDS) and target market determination (TMD). You may also wish to consider consulting a financial adviser.