We have a new Autoinvest experience!

We know that Autoinvest is a feature that most Pearler users love. So, we have taken it upon ourselves to make it bigger and better, helping you automate your investing with simplicity and ease.

More options to personalise your investing needs

With Autoinvest, you choose the amount, frequency, and shares you want to invest in, and set your Autoinvest strategy to suit your needs. It’s the easiest set-and-forget strategy for both beginners and experienced investors.

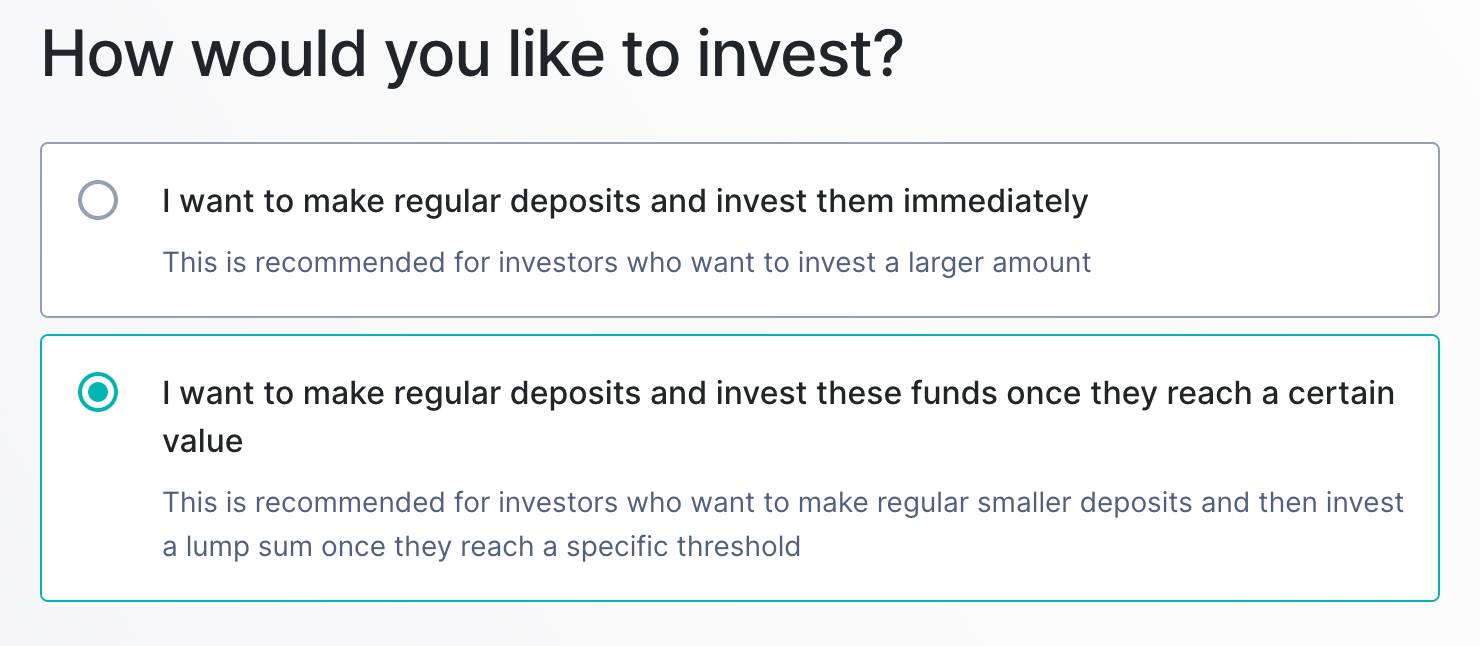

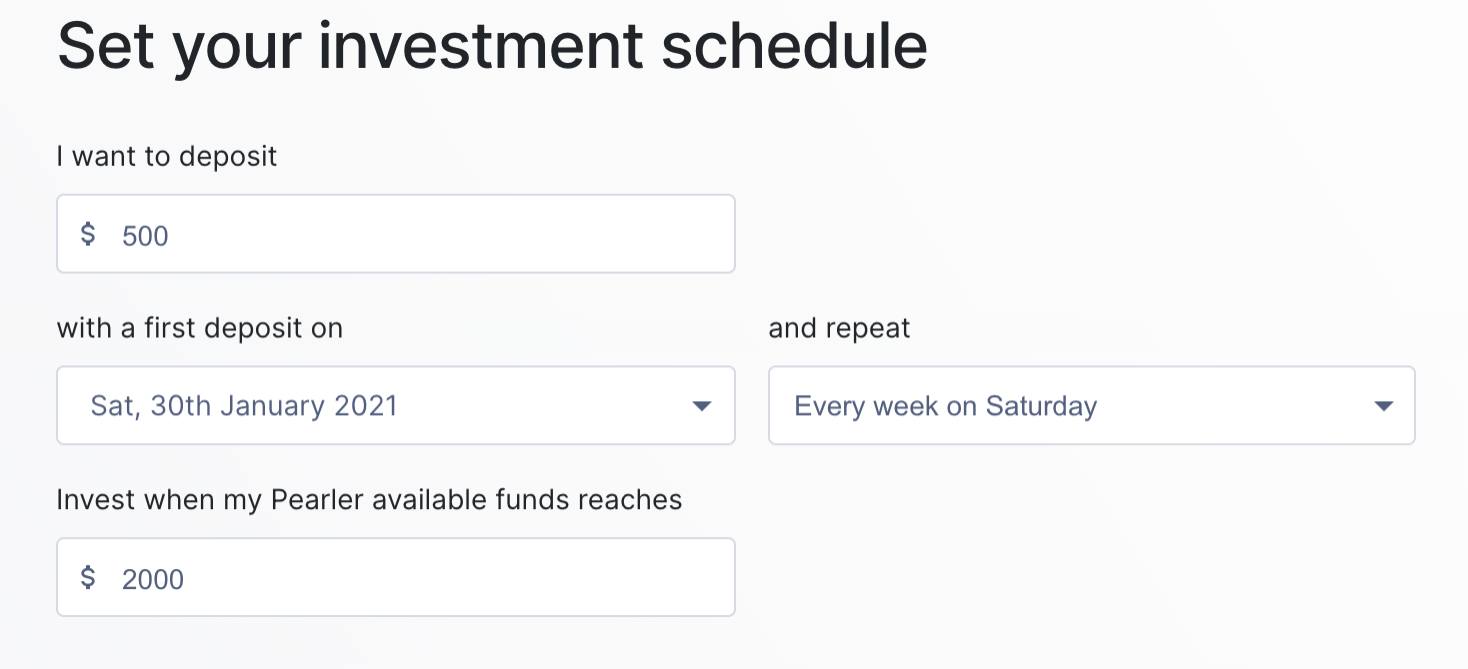

This new revamped version allows you to decide if you want to do one of the following: With Deposit and invest immediately or invest once your deposits reach a certain value.

That way, if you feel comfortable depositing immediately, you can. And if your style is to make regular smaller deposits and then invest a invest a lump sum once they reach a specific threshold, we’ve got you covered.

Investment strategies that work for you

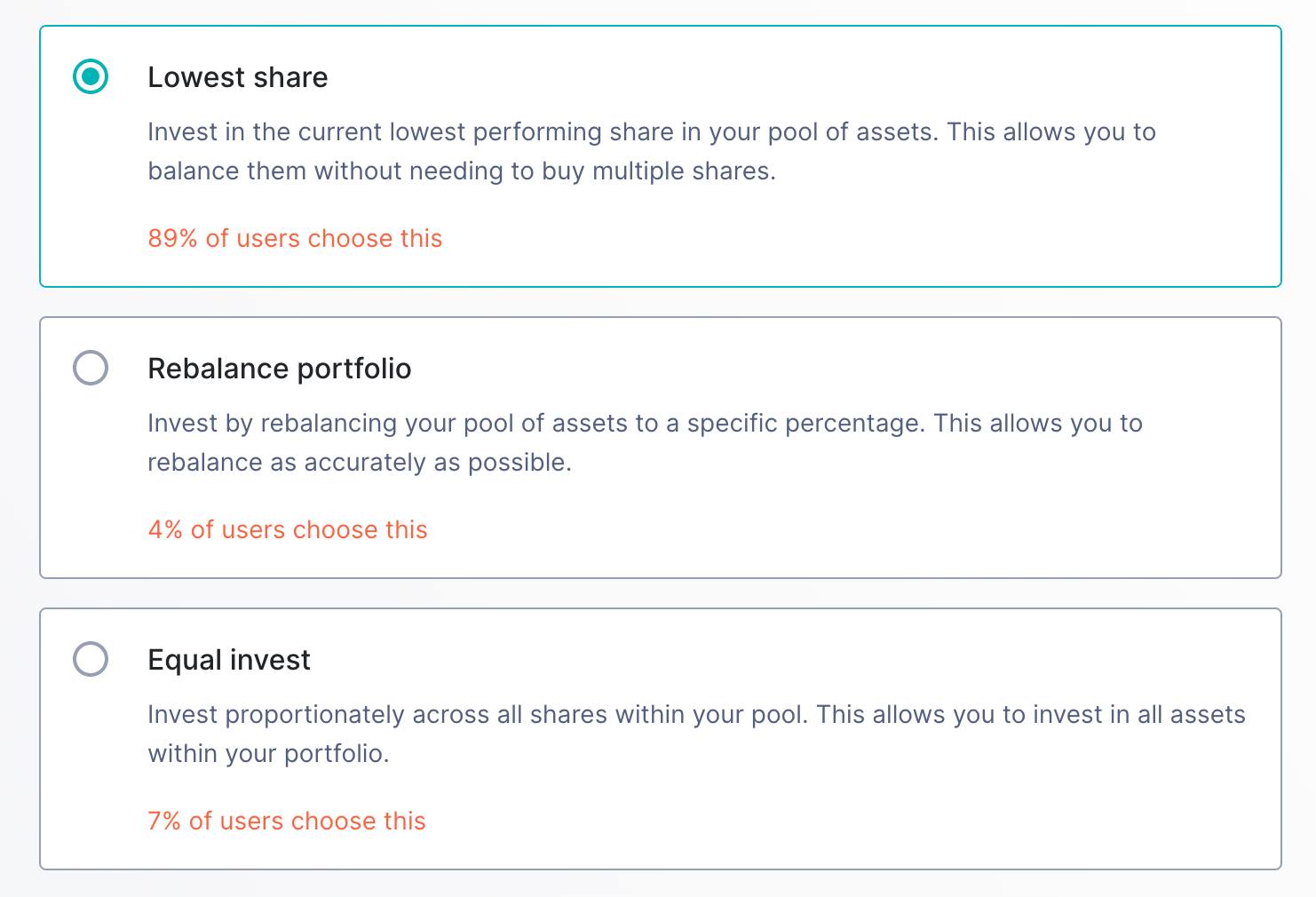

Have specific assets you want to use within your Autoinvest strategy? We’ve got you covered. There are three investment strategies to choose from: Lowest share, Rebalance portfolio, Equal invest.

Lowest share invests in the current lowest performing share in your pool of assets. This allows you to balance your portfolio without need to buy multiple shares. This is recommended for most users.

Rebalance portfolio invests by rebalancing your pool of assets to a specific percentage that you determined in your target portfolio. This allows you to rebalance as accurately as possible without selling shares. This option is recommended for larger investment amounts and may incur additional brokerage fees.

Equal invest invests equally across all shares within your pool. This allows you to invest in all assets within your portfolio equally. This option is recommended for advanced investors and may incur additional brokerage fees.

Now that you can personalise your investing, what are you waiting for?

At Pearler, we pride ourselves on the quality of the general financial advice we give. Please note though, that this advice has not been tailored for you. You have unique financial goals, circumstances and needs which may make this advice inappropriate, and it is important that you know whether it applies to you. If you are unsure we urge you to speak to someone you trust who is competent with money and understands your individual needs, whether they be a trusted friend or accredited professional.